Rice U.’s real estate appetite for Rice Village property just picked up another choice tidbit: 2445 Times Blvd. That’s the 1955 flat-topped 7,500-sq.-ft. retail property on the southeast corner of Times Blvd. and Kelvin Dr. that’s spooned by mega-neighbor Village Arcade (which Rice also owns). In its listing by Davis Commercial, seller Rinkoff Rice Village LP’s asking price for the “trophy” corner was $3.995 million, though it initially sought $4.2 million. Who’s currently on display behind all the storefront windows?

***

Longtime Village staple Miss Saigon and neighbors Grace Ann’s accessory shop, Joseph Keith Jewelry, Myth Hair Salon & Spa, and the Yum Yum Cha Cafe front the building’s sidewalks. Customers must vie for street parking, however, as the property has none of its own.

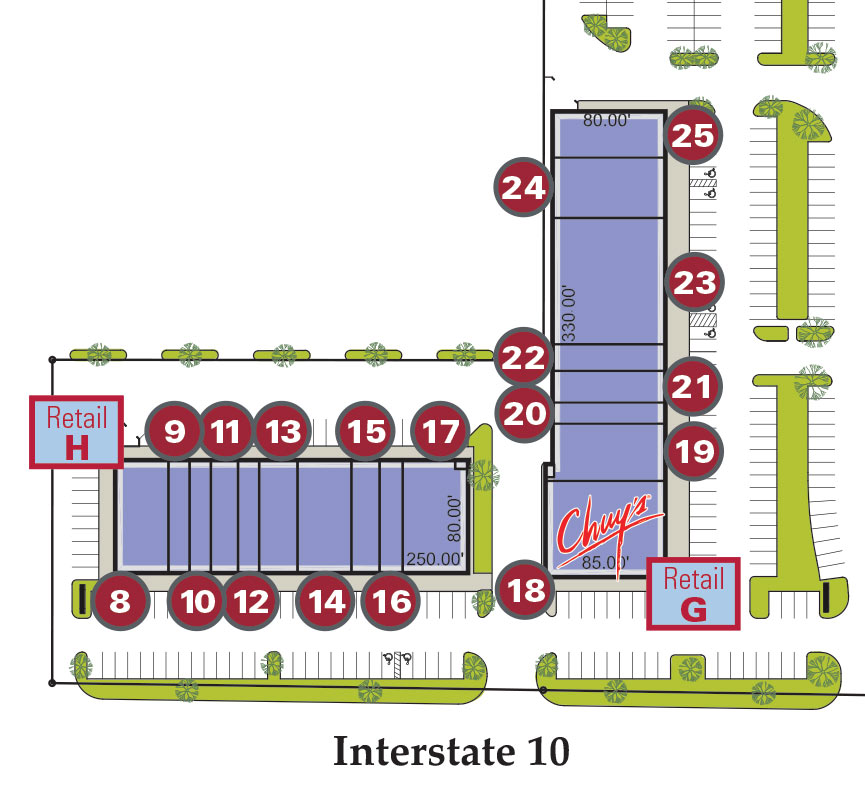

The recent deal (price undisclosed) joins Rice University’s other area holdings: Village Arcade, a 50-shop, 2-story complex with parking garage, and 2501 University Blvd., occupied by Urban Outfitters and smaller, specialty retailers. An aerial map included in an early flyer by Trademark Property Co., which Rice U. has hired to revamp and manage Village Arcade, shows how the most recently purchased corner property sort of squares off the footprint of the property outlined in red below: The corner of Times and Kelvin otherwise forms a notch in the northern border of the property:

- Previously on Swamplot: How Rice University Might Mix Up Its Rice Village Properties

As a real esate investor, I don’t get the concept of “trophy property”. To me a trophy property is one that brings us a lot of income relative to what we paid for it — with some upside from appreciation.

Who would buy that for $4m (other than, say, a Rice, who might want it to expand their land)? There is no way the income from that property would ever generate the cash flow needed to pay $4m. For $4m you could find an apartment complex that brings in $60k/month in rent. What does that corner store bring in?

.

Property desirability and income are inversely related. The more desirable, the less return. This property is a perfect example (if an investor bought it). Desirable location/corner? Sure, so buy it and enjoy your 0% return.

.

Props to David Commercial for getting the seller their $ (though Rice didn’t have to justify the NOI to a bank the way an investor would have)

Did Rice already own the ground for this building, and just now bought the building? They always owned the dirt for the Village Arcade – it was a ground lease to Weingarten until recently.

someone should make a map of the real estate holdings of all the inner loop private schools. would be interesting to see just how much cash these schools are sitting on and what they’re valuing the land at.

I assume Rice University feels it has a strong interest in what kinds of businesses and developments operate in the vicinity of their campus, and thus bought the property mainly for control and not for profit or status.

@Cody, I had first hand experience with Rice’s procurement/purchasing decision making process. It is ran by a handful of people who have absolutely no training, experience, or any qualifications to make such decisions. They make well over 100k a year and have an aura of Val Wilder, they ride around on golf carts and attend every single party without a clear purpose or job description. Worst of it all, they have absolutely no personal responsibility and almost no oversight, the only reason Rice has not gone broke is the huge endowment and annual donations by alumni.

No wonder the Annual Fund is so danged persistent with their calls…

@Cody: If you speak to Rice’s real estate management team they’ll tell you that they want all of these buildings back so that they can tear them down and “upgrade” Rice Village. It sounds like they want to turn it into a mix between Highland Village and City Center.

Hello, I would like to apply for the position of Rice University RE Procurement Agent please.

HCAD says it is worth $788,424. Why pay more?

Adolph: what does HCAD value have to do with sales price?

If memory serves, that piece of property was the lone holdout when the Arcade was built. Owner would not budge so the Arcade went right to the lot lines of that remaining building. I don’t know if the person who just banked the Rice $$ is that same seller or if the property changed hands in the intervening years.