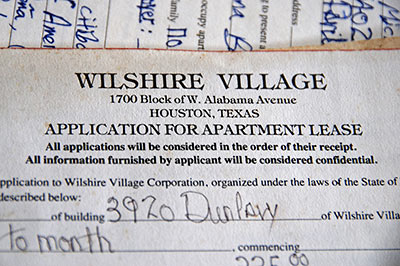

Did Matthew Dilick, managing partner of the partnership that owns the 7.68-acre site of the former Wilshire Village Apartments, really refer to the long-term tenants of the long-neglected property at the corner of West Alabama and Dunlavy — many of whom had lived in their apartments and paid rent for decades before they were evicted last year — as “squatters”?

In a February 1st affidavit he provided to the 133rd District Court in hopes it might help forestall Wedge Real Estate Finance from foreclosing on the property, Dilick states that “the Plaintiff [Alabama & Dunlavy Ltd., of which Dilick is the general partner] expended considerable time and expense in evicting squatters on the Property.” This just a page or so after declaring his qualifications: “The Plaintiff and/or limited partners of the Plaintiff have owned this Property for over 50 years.”

Gosh, maybe there’s a bit of confusion here? Maybe the “squatters” Dilick is referring to weren’t the actual long-term rent-paying Wilshire Village residents, but some other people he found hiding out in the complex who didn’t have authorization to be there from “the Plaintiff and/or limited partners of the Plaintiff”?

Uh . . . no. By “squatters,” Dilick clearly means Wilshire Village’s long-term residents. The ones he sent eviction notices to; the ones he addressed as “reported occupants” in the release forms he asked them to sign. Otherwise, why should it have taken “considerable time and expense” for Dilick to evict them? How about just . . . “shoo!”?

Neatly left out of the affidavit: The apparent ongoing conflicts Dilick had with Jay Cohen, the sole owner of the property for the bulk of those 50 years. Until they were evicted, the tenants paid their rent to him every month. What’s Cohen’s role?

A person familiar with the situation writes in:

CONTINUE READING THIS STORY