- Hines Buys Underwood Distribution Center in LaPort, Rebrands It Independence Logistics Park [Houston Chronicle]

- Downtown’s Nearly Empty 500 Jefferson Office Building Trades Hands [HBJ ($)]

- Value of Houston Construction Starts Rose 17% Year-Over-Year in February, Finds Dodge Data & Analytics [Houston Chronicle]

- Castex Energy Leases Office Space at Downtown’s Three Allen Center [CoStar]

- You Can Rent That Alexan Heights House Where a Skeleton Was Found for $1,600 a Month [abc13; previously on Swamplot]

- What Could Houston Roads, Parks, And Buildings Look Like in the Future? [Houston Public Media]

- Safety of Drinking Water in Alief a Growing Concern [Click2Houston]

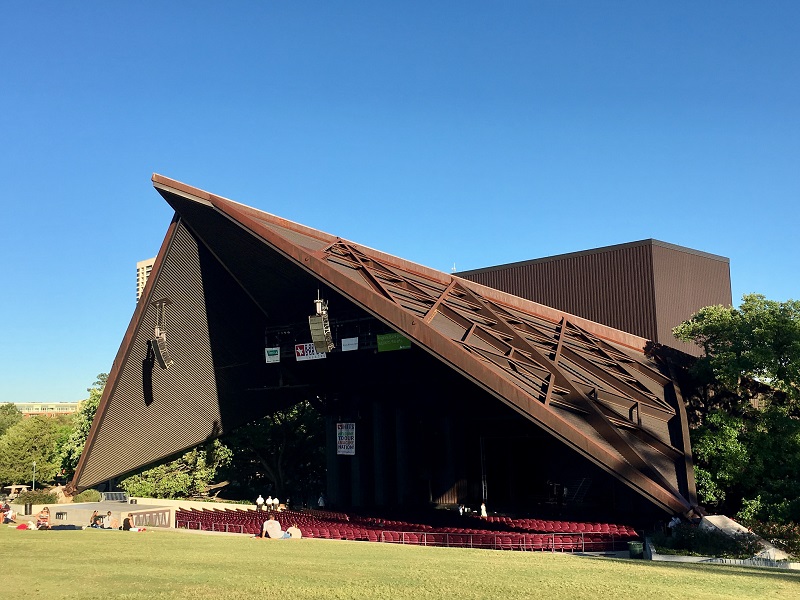

Photo of Miller Outdoor Theater: Russell Hancock via Swamplot Flickr Pool

Headlines

LOL at the owners of “skeleton house”. I made an offer to buy. They said it was too low because they are going to keep as rental. I can tell you my offer was pretty generous for a property that brings in $1,600 of income.

**

Now that place, as an investment property, would be ~$200k max. Unless they have 0 options to put the sales price of the property to work, they’re experiencing massive opportunity costs for little income.

Bob….200k in the bank brings in about $10 a month in interest.

The bungalow on Allston looks quite nice; it has good bones yuk yuk

But seriously, if the owner gets tired of land-lording, I’d imagine it would be a great coffee-shop or bar given the quantity of next-door neighbors.

@moveocelot agreed, perhaps they could call it “Calaveras Cafe”?

erhed: lol, I also tried to buy the place since I have a lot in that arae. And yes, if the owner has no other options but to put money into a near 0% savings account then they should hold onto the property. But if the owner is a real estate investor than I’d think (hope?) he could find something to buy for that sales price that would bring in more income than they’re getting now.

But… To each their own (PS: I get 1.25% on my bank money so it would be more like $210/month ;)