- Zillow: Houston Homebuyers Break Even in Just Under 2 Years [Houston Chronicle; report]

- Houston’s Retail Sector Has Shown Little to No Ill Effect from the Energy Downturn, Finds Weitzman Report [Realty News Report]

- The Most Expensive Houston Rental on HomeAway for This Weekend Is $10,000 [Houstonia]

- Downtown Hotels Running on Average $650 a Night for the Super Bowl, Finds Orbitz [HBJ]

- Typical Super Bowl Booking in Houston on Airbnb Is $150 Per Night [Houston Chronicle]

- A Breakdown of the Houston-Dallas Bullet Train’s Economic Impact [HBJ]

- In Texas, Houston Dominates the Most-Congested Roads List [The Urban Edge]

- Drake Opening Pop-Up Houston Strip Club The Ballet for Super Bowl Weekend [Houston Chronicle]

- How the Super Bowl Served as a Peacemaker Between Uber and Houston [AP]

- Was It Really Super Bowl LI That Brought About All These Improvements to Houston’s Landscape? [Houston Public Media]

- Highlights from the Forthcoming ‘Handbook of Houston’ Featuring Historic Bayou City Dwellers and Events [Houstonia]

- Why the NFL’s Super Bowl Economic Impact Studies Are So ‘Blatantly Dishonest’ [Bisnow]

- The Home of Super Bowl 2017 Is Also a Haven for Refugees [SB Nation]

- More Ways To Pretend the Super Bowl Isn’t Happening [Texas Monthly; previously on Swamplot]

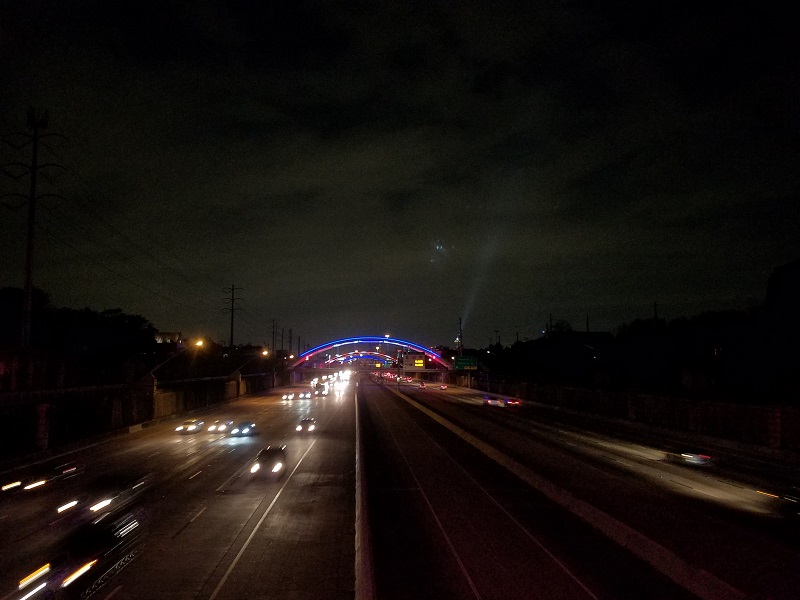

Photo of US-59 Bridges: Marc Longoria via Swamplot Flickr Pool

Headlines

Once again utterly useless numbers from Zillow, you can tell they’re in website ad revenue business, not real estate business. The ‘break even’ point has been hovering at 5 to 7 years, coincidentally the same amount of time people sell and move on average.

@commonsense Where are you getting those numbers? I don’t question them, but the term “breakeven” seems to have some variability in what it means. I’m wondering if your definition is different from theirs.

How do you cover a 6% realtor commission after less than 2 years and still come out ahead after moving costs and everything? would really love to see the spreadsheet they use for this junk.

From what I understand their description of “break even” in this sense is that you have an NPV equal to the cost of renting for the same period. It’s not “break even” in the sense that your NPV is zero (that is the 5-7 year mark commonsense is describing). So moving costs would not be included since they exist in both cases. That’s my guess.

@MrErection, what they seem to fail to account for is the huge cost of “getting out” of a house which could be roughly 10% of sales price including 6% Stealertor commissions, title policy, small negotiation discount, tax pro-ration, etc. I’m pretty sure they also fail to account for inevitable maintenance and break/fix costs on an owned property. Also on a mortgage the first couple of years roughly 80% of your payment is interest, as in money down the drain anyway.

The Texas city with the most people has moer traffic than other cities? You don’t say, Urban Edge! I guess they have to fill their fish wrap somehow.