TANKING OIL PRICES PLACE HOUSTON SECOND ON FITCH’S OVERVALUED HOUSING MARKET LIST  With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses / lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.

I’m stunned…not. I’m sure they’ll be all the Swamploters going on and on about all those 100000 dollar a year 21 year olds they seem to think Houston is over flowing with. With these millions of highly successful recent grads I’m sure the high end real estate industry in Houston will be great. I’m thinking of getting John Daugherty to list my little bungalow for 2.2 million, I’m sure all these kids with all their oil money will be beating down my door and then I can retire to Santa Barbara. These industry people don’t know what they’re talkin’ bout, we have billions of dollars flowing to all these wealthy 21 year olds according to so many on Swamplot…we’ll be fine. Pardon me Mr Daugherty is calling, I need to get this.

** after 20 minutes of laughing, he politely declined the listing.

Oh my gosh, that sign is the best… generic piece o’ crap McMansions. Yes, this is no surprise. I watch the town homes go up and up and look at the house prices and wonder how so many people are pulling this off. It’s all got to catch up at some point. I remember when people used to talk about how cheap it was to live in Houston…surely, that’s no longer the case

Shannon — no need to worry. People won’t pay top dollar for sub par elementary, middle, and high schools.

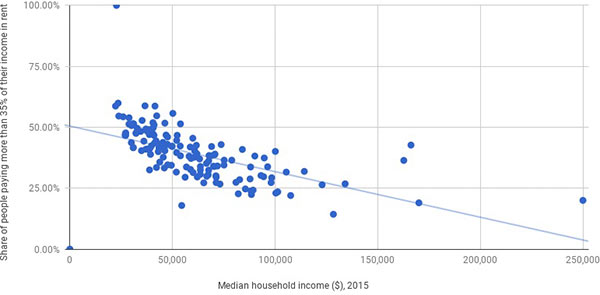

Discussions of housing affordability as of late have not been very nuanced. You can’t go by the regional averages; they have become skewed by tremendous increases in transactional volume at the higher end of the market — which is about what you’d expect that there should be through a boom cycle. You have to look at each segment in that market and each part of town and determine whether housing prices have risen for certain types of households and what the root cause has been and to gauge the degree of potential oversupply.

The whole situation is pretty confusing. Yes, the housing market is probably a bit overvalued with the expected slowing of job growth. And yes, the fear of a local reversal is probably going to seriously stunt speculative demand, which is great. On the other hand people may be over-estimating the damage to the big companies that the low oil prices will have. Exxon is still highly valued on the stock market, it’s down a hair, but recovered most of the losses it felt in mid December. And it’s not like the recent oil prices are going to change their human capital investment in the new campus all that significantly, they’re in this for the long haul. That trigger has been pulled and the bullet has left the barrel.

.

Similar things can be seen in the less stable O&G companies as well. Dow chemical is down but it also has seen gains since mid December. Even Apache, a real dog this year, has seen growth in the last month. These are all companies that will feel the pain of low oil prices.

.

The point is that while there is clear reason to believe that there will be some losses at O&G in the next year, the stock market seems to (for now at least) be indicating that this is not the beginning of some free-fall for these companies, and it is one of the most efficient market indicators out there. Not saying it might not be wrong, but right now even while JP Morgan is saying that Houston is headed for trouble they don’t seem to think that the companies that support it are.

.

In the end this could just be the perfect little storm we need to put the breaks on an unrealistic market and return some sanity to it, while not bringing enough of an impact to actually push us into a local recession.

Anyone who believes any of the rating services ,especially after their blatant conflicts of interest were exposed after the 2008 crash, is a fool . These “rating” services are NOT to be believed nor trusted. They only issue speculative opinions. NOT facts. Besides, the real estate market will self correct: most people WILL NOT pay over inflated prices in any area of the Houston metro area. And the ones that do, too bad. They’ll get their comeuppance when realistic property valuations hit them like a bag of bricks. They were desperate to be Inside the Loop and pay inflated prices for CRAPPY construction. That’s their fricking problem. I personally wouldn’t buy ANY NC anywhere in the Houston area, unless it IS Custom built by a REPUTABLE well known RELIABLE builder/contractor. Most of the builders today are fly by night crooks. And DO NOT buy anything with stucco exteriors. They all eventually have to be totally replaced!!!

Re: The VERY appropriate faux sign – I laughed so hard I almost spewed my coffee all over the monitor. All of these new apartment / loft projects are going to reach a point of over build. There will be quite a few semi-vacant buildings in a few years. Just watch. Then the owners will “adjust” /drop/lower the lease rates accordingly.

Let the hand-wringing begin, or not. Time will tell whether Fitch’s ham-fisted analysis (or Trulia’s for that matter) comports with market trends. Analysis pinned to the rubric that the trend is “out of character” just makes me yawn. Fitch did a bang up job after all, along with Moody’s and S&P’s, in its analysis of mortgage backed securities in the run-up to 2008.

@Htownproud, so it seems. It seems I was right all along. Thank you for validating this fact. It was almost worth finding out my house won’t sell for 2.2 million and learning that most 21 year olds in Houston work at Target and live with their parents, most educated at HISD schools. The irony.

Shannon, the timestamps on your posts clearly indicate that he only laughed for 4 minutes, not the 20, you state.

I think that Fitch is correct that Houston housing prices are 19% overvalued. I’m a native Houstonian and I grew up in a ranch style house on an acre lot in Memorial – Piney Point Village. Currently, the asking prices are for these lots is around $1.8 million or more. The realtor told us that we should sell the house for lot price b/c the house had not been updated (Carrara Marble counter tops, built in sound system, Jacuzzi baths). Even in homes built in the 1950’s in Briargrove and Bellaire are listed at $950K. These homes used to be in the 450K – 700K range. Even after someone purchases a home, they still have to pay property taxes. Who are these purchasers? Are they highly leveraged or are they paying mostly cash? It makes no sense. I agree that West Central Houston is in a housing bubble.