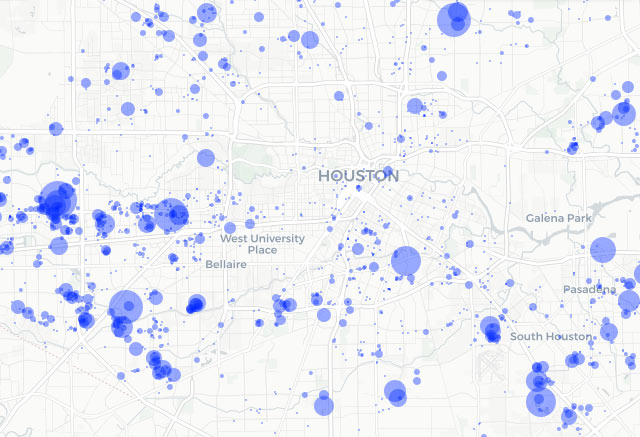

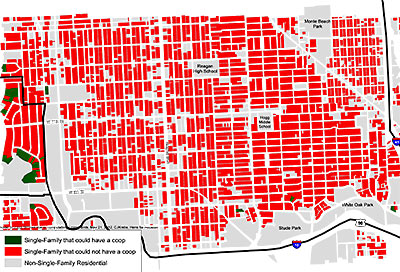

WHAT LANDLORDS HAVE OUSTED THE MOST TENANTS AFTER HARVEY, AND OTHER POST-DILUVIAN EVICTION FACTS  Since Harvey, the odds of tenants beating their eviction lawsuits have doubled. But their chances are still pretty slim: landlords win 94% of the time (down 3.73% since August), notes Houston data analyst Jeff Reichman. His recent report on citywide eviction trends after the storm features a ranking of which landlords have kicked out the most tenants. (Although that accounting also includes owners of storage rental facilities.) Also in the report: a map (a preview of which is included above) showing post-storm eviction density by address, an analysis of the time it takes for evictions to get through Houston’s court system (an average of 20 days), and the months during which the most evictions have historically occurred (January, with subsequent high volume between June and August). [January Advisors] Map of evictions after Harvey: January Advisors

Since Harvey, the odds of tenants beating their eviction lawsuits have doubled. But their chances are still pretty slim: landlords win 94% of the time (down 3.73% since August), notes Houston data analyst Jeff Reichman. His recent report on citywide eviction trends after the storm features a ranking of which landlords have kicked out the most tenants. (Although that accounting also includes owners of storage rental facilities.) Also in the report: a map (a preview of which is included above) showing post-storm eviction density by address, an analysis of the time it takes for evictions to get through Houston’s court system (an average of 20 days), and the months during which the most evictions have historically occurred (January, with subsequent high volume between June and August). [January Advisors] Map of evictions after Harvey: January Advisors

Housing Data

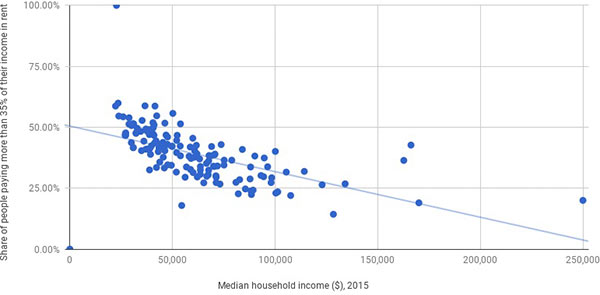

THE RENT IS TOO DAMN HIGH WHERE THE INCOME IS TOO DAMN LOW  Inspired by a report from Harvard’s Joint Center on Housing Studies that compares household income to the percentage of income used to pay rent for various income levels, Chronicle biz reporter Lydia DePillis charts similar stats for Harris County. “Houston is slightly less cost burdened than the national average,” she concludes, “with 46.7 percent of its renter households paying more than a third of their income on rent.” According to her analysis of Harris County data from the Census Bureau’s American Community Survey, “the disparity between high and low-income areas is still present: In the third of ZIP codes with the highest median household incomes, 31 percent of renters pay more than 35 percent of their income on housing. In the bottom third of ZIP codes, the share is 49 percent.” Her graph, shown above, plots median household income (on the X-axis) against the percentage of people paying more than 35 percent of their incomes on rent — for every Harris County Zip Code. [Houston Chronicle] Image: Houston Chronicle/Lydia DePillis

Inspired by a report from Harvard’s Joint Center on Housing Studies that compares household income to the percentage of income used to pay rent for various income levels, Chronicle biz reporter Lydia DePillis charts similar stats for Harris County. “Houston is slightly less cost burdened than the national average,” she concludes, “with 46.7 percent of its renter households paying more than a third of their income on rent.” According to her analysis of Harris County data from the Census Bureau’s American Community Survey, “the disparity between high and low-income areas is still present: In the third of ZIP codes with the highest median household incomes, 31 percent of renters pay more than 35 percent of their income on housing. In the bottom third of ZIP codes, the share is 49 percent.” Her graph, shown above, plots median household income (on the X-axis) against the percentage of people paying more than 35 percent of their incomes on rent — for every Harris County Zip Code. [Houston Chronicle] Image: Houston Chronicle/Lydia DePillis

THE HOUSTON ZIP CODE WHERE THE KIDS DON’T LEAVE HOME  New number crunching from the Pew Research Center suggests that around 57 percent of the folks between 18 and 34 in the 77045 Zip Code may be living with their parents. (77045 includes both residential areas and the salt-dome-adjacent industrial hodgepodge between Holmes and Almeda roads, southwest of that recycling plant that smoked out the Med Center last year). That figure compares to a 28.2 percent boomerang rate across most of Houston, which falls below the current-ish 32 percent national average, writes Maggie Gordon (who notes that the “new” numbers are based on the organization’s 2014 data). What’s responsible for the anomalously high numbers in South Main, which shoots well past even the Great Depression’s 35 percent? The difference, Gordon writes, may be rooted not only in the area’s low average wages, but also in the lower rate of folks actively pursuing college (which Gordon says is connected to low wages); the study also notes that some of the difference might reflect the smaller proportion of the Zip Code’s Millennals living with a romantic partner (which, Gordon notes, might be easier to meet in college these days). [Houston Chronicle] Photo of 3414 Ebbtide Dr., 77045: HAR

New number crunching from the Pew Research Center suggests that around 57 percent of the folks between 18 and 34 in the 77045 Zip Code may be living with their parents. (77045 includes both residential areas and the salt-dome-adjacent industrial hodgepodge between Holmes and Almeda roads, southwest of that recycling plant that smoked out the Med Center last year). That figure compares to a 28.2 percent boomerang rate across most of Houston, which falls below the current-ish 32 percent national average, writes Maggie Gordon (who notes that the “new” numbers are based on the organization’s 2014 data). What’s responsible for the anomalously high numbers in South Main, which shoots well past even the Great Depression’s 35 percent? The difference, Gordon writes, may be rooted not only in the area’s low average wages, but also in the lower rate of folks actively pursuing college (which Gordon says is connected to low wages); the study also notes that some of the difference might reflect the smaller proportion of the Zip Code’s Millennals living with a romantic partner (which, Gordon notes, might be easier to meet in college these days). [Houston Chronicle] Photo of 3414 Ebbtide Dr., 77045: HAR

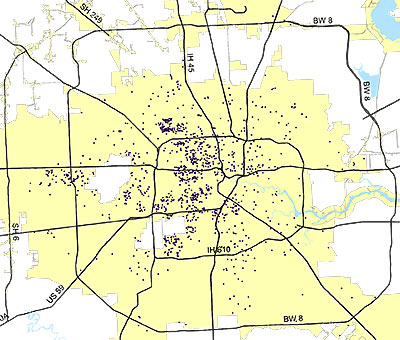

Following up on last month’s Supreme Court decision highlighting the segregation effects of Texas’s low-income housing programs, Chronicle reporter Jayme Fraser has a few observations about how the Housing Tax Credit program has been administered around here — after studying the above map, which she assembled to show the location and details of every Houston-area property involved in the program from its start in 1987 through 2013. Using federal funds, the Texas Dept. of Housing and Community Affairs offers tax incentives to private apartment developers in exchange for guarantees to keep rents on new or rehabbed complexes below the market rate.

TANKING OIL PRICES PLACE HOUSTON SECOND ON FITCH’S OVERVALUED HOUSING MARKET LIST  With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

If the Greater Houston Partnership is eager to include some exhibits or animated GIFs to go along with the video footage of cars driving through imaginary barriers, shiny skyscrapers, and smiling people that pepper its new campaign celebrating Houston as The City of No Limits, it might want to look at the work of California computational biologist [and former Houstonian and longtime Swamplot reader] Ian Rees. Using data from the American Community Survey, Rees mapped structures in the region by the decade they were built, grading their concentration with varying shades of blue.  The result helps us visualize the decades-long march of Houston housing ever outward. His map, shown above, was featured in a series of articles on the Next City website on urban sprawl, a few of which compare Houston’s growth to those of other major U.S. cities.

Unfortunately, the data (and the dancing blue construction hotspots) stop in 2010, and we’re left to ourselves to wonder whether Houston is still on track to continue its now-officially-enshrined core mission. An earlier version of Rees’s map breaks out the last recent decade into 2 separate frames, helping to illustrate the scale and sequence of the more recent Inner Loop construction revival:

The number of homeless people living without shelter in Harris County and Fort Bend County dropped by more than 50 percent between 2011 and this year, according to the latest figures released yesterday by the nonprofit Coalition for the Homeless. The overall homeless population — which includes those housed in shelters — stands at 5,351, according to the organization’s latest count, which was conducted on January 30th. That’s down a similarly respectable 37 percent from the 2011 figure, and a 16 percent drop from the numbers found in 2013.

The number of homeless people living without shelter in Harris County and Fort Bend County dropped by more than 50 percent between 2011 and this year, according to the latest figures released yesterday by the nonprofit Coalition for the Homeless. The overall homeless population — which includes those housed in shelters — stands at 5,351, according to the organization’s latest count, which was conducted on January 30th. That’s down a similarly respectable 37 percent from the 2011 figure, and a 16 percent drop from the numbers found in 2013.

The report goes on to break down those numbers into subpopulations, as illustrated in this chart:

COMMENT OF THE DAY: BURSTING YOUR HOUSING BUBBLE BUBBLE  “Your fears of a bubble being caused in this manner are unfounded. The sales of older homes (by Houston standards at least — still less than 10 years) have shot up in just the last 9 months. Sure, we always need to guard against bubbles, but I don’t think an EaDo-specific bubble is occurring, and certainly not because there aren’t existing single-family homes.

Teardowns of existing, livable (leaving out the shotgun shacks) single-family homes have started (here, for instance). In the place of the teardowns are multiple townhomes.

There are some examples of irrational exuberance on the part of the developers, like the $500,000 asking price for the townhomes bounded by Nagle/Capitol/Delano/Rusk, but the recent high appreciation occurring is not out of line and has only been occurring for a few years, whereas places like the Heights and Rice Military have seen prices increases for many years, all without any neighborhood-specific bubble. Midtown, too, has avoided a bubble-then-crash and they have an even smaller stock of single-family homes yards than EaDo.” [eiioi, commenting on Comment of the Day: East Downtown, Brought to You by Montrose] Illustration: Lulu

“Your fears of a bubble being caused in this manner are unfounded. The sales of older homes (by Houston standards at least — still less than 10 years) have shot up in just the last 9 months. Sure, we always need to guard against bubbles, but I don’t think an EaDo-specific bubble is occurring, and certainly not because there aren’t existing single-family homes.

Teardowns of existing, livable (leaving out the shotgun shacks) single-family homes have started (here, for instance). In the place of the teardowns are multiple townhomes.

There are some examples of irrational exuberance on the part of the developers, like the $500,000 asking price for the townhomes bounded by Nagle/Capitol/Delano/Rusk, but the recent high appreciation occurring is not out of line and has only been occurring for a few years, whereas places like the Heights and Rice Military have seen prices increases for many years, all without any neighborhood-specific bubble. Midtown, too, has avoided a bubble-then-crash and they have an even smaller stock of single-family homes yards than EaDo.” [eiioi, commenting on Comment of the Day: East Downtown, Brought to You by Montrose] Illustration: Lulu

Each of these purple specks — or black holes, depending on your perspective — represents a demolition permit issued by the city in 2012. The planning and development department has posted this and a few other maps online with an overview of demographic data.

After the jump, you can see in more detail the demos inside the Loop from 2012 and 2011, juxtaposed with other maps showing the permits for single- and multi-family construction. You know. For balance:

In Dallas, you have to keep at least 20 ft. between your chicken coop and your neighbor’s stuff. Here? It’s 100 ft. That’s why this map of the Greater Heights looks the way it does. Hens for Houston founder Claire Krebs, using GIS technology she learned as an engineering student at Rice, created a series of these maps (what she’s calling “policy-making tools”) out of HCAD data to show just how few Houstonians are allowed to keep hens — if they wanted, that is — because of a city ordinance requiring the 100-ft. setback.

COMMENT OF THE DAY: MAKING IT UP WITH QUANTITY “Using numbers to determine what is ‘cool’ is a waste of time. One of the criteria used in the article was the number of pro and college sports teams in the city. Ok, fine, but do you really think the Astros are as ‘cool’ as the Yankees, Cubs, or Red Sox? Yet quantity wise, they each count as 1 and are considered equal. The same goes for museums. Is the MFAH really as cool as the Met? This exercise could be done for any of the categories Forbes used to rank the cities and Houston would come up short on almost all of them. So while Houston may be the coolest when you count numbers, its certainly not the coolest when you’re looking for the coolest things around.” [Walt, commenting on Headlines: Houston as America’s ‘Coolest’ City; Predicting Traffic Jams]

A JUST-OPENED SOURCE FOR HOUSTON BUILDING DATA  A 3-month-old website that aims to collect and broadcast detailed information about existing buildings — including photos, square footage counts, ownership and management contacts, projects and renovations, and LEED certification levels — opened its catalog of Austin, Dallas, and Houston commercial and mixed-use structures this week. HonestBuildings.com claims to have detailed online profiles already available on a total of 95,000 buildings in those 3 Texas cities, and on a total of 475,000 nationwide. Many of the Houston listings contain only cursory info so far, but the company is hoping local building managers will provide details to fill out the extensive list of data categories. The New York and Seattle-based startup appears to focus on issues of energy efficiency, allowing companies that provide related services to showcase and target their work — and users to compare building data.

A 3-month-old website that aims to collect and broadcast detailed information about existing buildings — including photos, square footage counts, ownership and management contacts, projects and renovations, and LEED certification levels — opened its catalog of Austin, Dallas, and Houston commercial and mixed-use structures this week. HonestBuildings.com claims to have detailed online profiles already available on a total of 95,000 buildings in those 3 Texas cities, and on a total of 475,000 nationwide. Many of the Houston listings contain only cursory info so far, but the company is hoping local building managers will provide details to fill out the extensive list of data categories. The New York and Seattle-based startup appears to focus on issues of energy efficiency, allowing companies that provide related services to showcase and target their work — and users to compare building data.

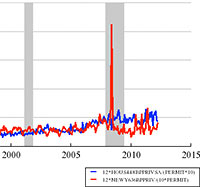

WE’RE BUILDING MORE HOUSES IN HOUSTON  “The New York Metro areas has more than 3 times as many workers as the Houston metro area,” notes UNC professor and Forbes economics blogger Karl Smith after looking at a bunch of graphs, “but can’t keep up with the pace at which Houston is permitting new housing.” One of the several charts Smith assembled from Federal Reserve data shows that the number of construction permits issued in the Houston metro area surged ahead of the number issued in the New York-New Jersey-Long Island area beginning toward the latter end of 2007, just as the recession hit, and has stayed ahead. (The pace of new permitting in both cities accelerated in 2005, but fell off in New York a couple years later, after a big spike.) Over the last couple of years the Houston area has accounted for between 3.5 and 6.5 percent of all newly issued U.S. housing units. [Forbes]

“The New York Metro areas has more than 3 times as many workers as the Houston metro area,” notes UNC professor and Forbes economics blogger Karl Smith after looking at a bunch of graphs, “but can’t keep up with the pace at which Houston is permitting new housing.” One of the several charts Smith assembled from Federal Reserve data shows that the number of construction permits issued in the Houston metro area surged ahead of the number issued in the New York-New Jersey-Long Island area beginning toward the latter end of 2007, just as the recession hit, and has stayed ahead. (The pace of new permitting in both cities accelerated in 2005, but fell off in New York a couple years later, after a big spike.) Over the last couple of years the Houston area has accounted for between 3.5 and 6.5 percent of all newly issued U.S. housing units. [Forbes]

If y’all had come to Space Center Houston, they’d have built a home for a retired space shuttle there. Well, maybe. Today’s report of the NASA inspector general points out a few details in the story of how Houston lost out in the retired-space-shuttle home sweepstakes. At a presentation given to NASA administrator Charles Bolden in November 2009, 4 out of 5 options being considered at the time by the agency’s recommendation team would have given Houston a shuttle. And Bolden says Houston was a sentimental favorite for him, too. He told investigators

If y’all had come to Space Center Houston, they’d have built a home for a retired space shuttle there. Well, maybe. Today’s report of the NASA inspector general points out a few details in the story of how Houston lost out in the retired-space-shuttle home sweepstakes. At a presentation given to NASA administrator Charles Bolden in November 2009, 4 out of 5 options being considered at the time by the agency’s recommendation team would have given Houston a shuttle. And Bolden says Houston was a sentimental favorite for him, too. He told investigators

that if it had been strictly a personal decision, his preference would have been to place an Orbiter in Houston. He noted that “[a]s a resident of Texas and a person who . . . spent the middle of my Marine Corps career in Houston, I would have loved to have placed an Orbiter in Houston.â€

So what happened?

WHERE HOUSTONIANS HIDE FROM TOURISTS Writing in the travel section of the St. Louis Post-Dispatch, devoted Cardinal fan and reporter Diane Toroian Keaggy blows the lid off the great Houston population hoax: “Who am I to argue with the U.S. Census, Greater Houston Convention and Visitors Bureau and Post-Dispatch pal and Houston native Aisha Sultan? But no way is Houston the nation’s fourth largest city. Where are the people? Certainly not downtown, which cleared out immediately after the Astros win. The Museum District, easily reachable from downtown by rail and home to the Houston Zoo, Children’s Museum and Museum of Natural Science, also seemed strangely quiet. We wanted to visit the Contemporary Art Museum, the Byzantine Fresco Chapel, the Menil Collection, the Houston Center of Photography and the wacky folk-art mecca called the Orange Show. Each was closed on Tuesday. We could have visited the Space Center Houston, which includes the tram tour of NASA’s Johnson Space Center, but it’s 25 miles south of downtown and costs $21. That’s too much money and time for a short two-day trip. Instead we visited the Museum of Fine Arts, which features an impressive collection of Impressionism and the Weather Museum, which feels more like a seventh-grade science project than an actual attraction. Don’t bother. . . . We continued our search for life at the Galleria, one of the nation’s top malls. A-ha! So that’s where everyone was hiding. Home to Fendi, Dior, Chanel, Yves Saint Laurent, Versace, Tory Burch and other impossibly expensive boutiques not found in St. Louis, the Galleria boasts 375 shops spread across two large buildings. Bring comfy, but fashionable, shoes. The mall claims to attract 24 million shoppers each year, and only a few seemed to be buying Gucci glasses, Kate Spade earrings and Jimmy Choo pumps. The rest could be found skating on the indoor ice rink or slumming it in Banana Republic, Apple and Claire’s.” [STLToday]