HOW A CANADIAN PENSION FUND FOUND ITS WAY TO SWALLOWING A BUNCH OF HOUSTON OFFICE BUILDINGS  Ralph Bivins explains how it came to pass that the Canada Pension Plan Investment Board, with its now-completed purchase of REIT Parkway, became the owner of 8.7 million sq. ft. of office space in Houston, including Greenway Plaza, CityWest Place, San Felipe Plaza, the Phoenix Tower, and Post Oak Central: “At one time Cousins and Parkway were separate companies with sizable holdings in Houston. The Houston office market tanked when oil fell from a high of $107 a barrel in June 2014 to less than $30 a barrel in early 2016. Houston energy firms laid off thousands of employees and vacated huge chunks of office space. Publicly traded firms with significant portfolios of Houston office space were under pressure. Security analysts criticized them. So Cousins and Parkway merged, all of the Houston properties were stripped out and placed into a new company, Parkway Inc. Now, the oil markets have stabilized. Houston’s office market is still soft and vacancies are high, but it appears to be on the road to recovery.” [Realty News Report] Photo of Greenway Plaza: Brent Oldbury, via Swamplot Flickr pool

Ralph Bivins explains how it came to pass that the Canada Pension Plan Investment Board, with its now-completed purchase of REIT Parkway, became the owner of 8.7 million sq. ft. of office space in Houston, including Greenway Plaza, CityWest Place, San Felipe Plaza, the Phoenix Tower, and Post Oak Central: “At one time Cousins and Parkway were separate companies with sizable holdings in Houston. The Houston office market tanked when oil fell from a high of $107 a barrel in June 2014 to less than $30 a barrel in early 2016. Houston energy firms laid off thousands of employees and vacated huge chunks of office space. Publicly traded firms with significant portfolios of Houston office space were under pressure. Security analysts criticized them. So Cousins and Parkway merged, all of the Houston properties were stripped out and placed into a new company, Parkway Inc. Now, the oil markets have stabilized. Houston’s office market is still soft and vacancies are high, but it appears to be on the road to recovery.” [Realty News Report] Photo of Greenway Plaza: Brent Oldbury, via Swamplot Flickr pool

Commercial Real Estate

A sign of possible second chances for anyone looking to make a play for the former Wabash Feed & Garden Store building at 5701 Washington Ave: the leasing notice now up out front, shown here as spotted by a reader yesterday. Onion Creek owner Gary Mosley bought the land early this year and announced plans to turn the building into a restaurant and bar called Driftwood once the garden store headed out to its new spot. At that time, the moveout was planned for June; Wabash owner Betty Heacker tells Landan Kuhlman this month that the new location in the former Mechanical Plumbing, Inc. warehouse at 4537 N. Shepherd should finally be ready to go by late October.

The last of the footwear kicking around at the Texas Junk Company’s curiosity-filled warehouse at 215 Welch St. could be packed up and shipped out as soon as September 30. Per owner Bob Novotney’s telling on social media, the company was told last week to be out of the space by the end of the next month, though he’s hoping to get that deadline pushed back to April; Novotney has already started moving goods to a new space planned at 121 N. Main St. in Moulton, TX (halfway between Shiner and Flatonia). The 1930s building that’s been hosting Texas Junk sits immediately north of the field of townhomes rising on the former site of Ecclesia’s since-reincarnated church-plus-coffee-shop.

The last of the footwear kicking around at the Texas Junk Company’s curiosity-filled warehouse at 215 Welch St. could be packed up and shipped out as soon as September 30. Per owner Bob Novotney’s telling on social media, the company was told last week to be out of the space by the end of the next month, though he’s hoping to get that deadline pushed back to April; Novotney has already started moving goods to a new space planned at 121 N. Main St. in Moulton, TX (halfway between Shiner and Flatonia). The 1930s building that’s been hosting Texas Junk sits immediately north of the field of townhomes rising on the former site of Ecclesia’s since-reincarnated church-plus-coffee-shop.

- Is This the End for Texas Junk Company? [Houstonia]

- Previously on Swamplot: On Taft St. Near Welch, Where a Utility Pole Can’t Get Out of the Way Fast Enough

Photos: Texas Junk Company

A reader notes that the 1938 house at 2244 Welch St. — just 60 ft. east of the new 17-story office tower neighbor at 2229 San Felipe (peeking in from the right in the frame above) — is up for sale. Renting residents of the house made the news during early construction of the “boutique” San Felipe Place highrise in 2014; the occupants complained of diesel fumes, noise, and structural damage to the property from equipment operating feet from the fenceline (including the giant crane planted in the lot next door). Hines’s efforts to patch up the neighborly dispute escalated from the hasty installation of “hobo-penthouse” plastic sheeting to an eventual payoff arrangement that helped the renting family move to Pearland around April of 2014.

The house went on the market for $789,000 last November, not long after the 2-time lawsuit-defying completion of the tower in September and the pickup of a handful of tenants. The Kinder Foundation announced in October that it would be leasing the top floor of the highrise, which can be seen peering in through the shutters in a few of the house’s listing shots:Â

BUYER OF CHRONICLE COMPLEX DOWNTOWN NOT EXPECTED TO CRUSH IT JUST YET  The deal could still fall through, cautions Ralph Bivins, but real estate development firm Hines is in the middle of negotiating a purchase of the Houston Chronicle’s complex and parking garage at 801 Texas Ave. downtown. Expected sale price: “more than $50 million, perhaps as much as $55 million.” But Bivins doesn’t think Hines is ready to knock down the structures and build another of its downtown office developments on the 99,184 sq. ft. of land on 2 blocks right away. Instead, he writes, the company “appears to be seeking to lock up a prime skyscraper development site for future years.” [Realty News Report; previously on Swamplot] Photo: Walter P Moore

The deal could still fall through, cautions Ralph Bivins, but real estate development firm Hines is in the middle of negotiating a purchase of the Houston Chronicle’s complex and parking garage at 801 Texas Ave. downtown. Expected sale price: “more than $50 million, perhaps as much as $55 million.” But Bivins doesn’t think Hines is ready to knock down the structures and build another of its downtown office developments on the 99,184 sq. ft. of land on 2 blocks right away. Instead, he writes, the company “appears to be seeking to lock up a prime skyscraper development site for future years.” [Realty News Report; previously on Swamplot] Photo: Walter P Moore

This was the scene over the weekend at 2499 Ella Blvd., at the corner of 25th St. in Shady Acres — as photographed by a Swamplot reader. The vacant former Ella Family Medicine clinic building, known also more recently as the home of the Fulton Pharmacy, is no more.

Photos: Veronica Jones

The asking price for the Heights Theater on bustling 19th St. in Houston Heights in today’s live-or-work listing is $1.9 million. The owners last toe-tested the reel deal in 2008, at $1.3 million. In the interim, surrounding neighborhoods have tipped even more hip. Though the future of the historic (but not protected) property is up for grabs, its past scrolls like an old film roll, with scenes of early prosperity, seedy decline, suspected arson, and restoration.

The exterior’s revamp earned the current owners a Good Brick Award 20-ish years ago. The interior, a shell space since its near destruction by fire in 1969, has been used for live theater, retail, events, and galleries. In the former lobby’s crossroads sits an original projector (top), a sculpture standing as both a testament and witness to passing eras.

WHY HOUSTON COMMERCIAL REAL ESTATE THINKS IT’LL DO JUST FINE, THANK YOU  Deeply embedded Houston real estate reporter Catie Dixon comes back from a panel event sponsored by her employer with a clickworthy account of 5 reasons Houston (commercial real estate) will survive the latest oil bust. Included in the list: attractiveness to foreign investors whether prices fall or not; this boom wasn’t as big as the one before the last big bust; the industry doesn’t rely on short-term gains; industrial real estate is still healthy; and — yes — data centers! (But things will be tough for developers for a year to a year and a half, maybe.) [Real Estate Bisnow] Photo: Russell Hancock

Deeply embedded Houston real estate reporter Catie Dixon comes back from a panel event sponsored by her employer with a clickworthy account of 5 reasons Houston (commercial real estate) will survive the latest oil bust. Included in the list: attractiveness to foreign investors whether prices fall or not; this boom wasn’t as big as the one before the last big bust; the industry doesn’t rely on short-term gains; industrial real estate is still healthy; and — yes — data centers! (But things will be tough for developers for a year to a year and a half, maybe.) [Real Estate Bisnow] Photo: Russell Hancock

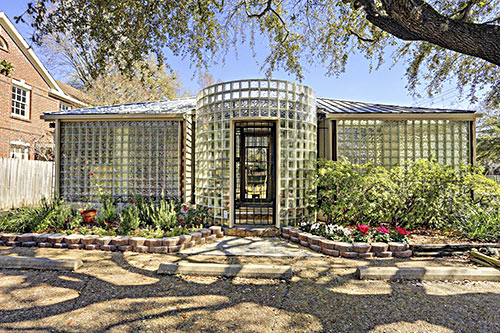

It’s a different kind of ice house on this corner: A sparkle finish fittingly fashions a gem-like setting for the Quenton Elliott custom jewelry store in Upper Kirby’s Ferndale neighborhood. Stacks of glass block encapsulate the property, which anchors the furnishings end of a semi-retail block. Raze or remodel, shouts the listing posted earlier this week, noting a $799K asking price. It carries no details on the 1945 building’s interior other than to note that it’s livable as a residence but likely heading toward land ho.

Rice U.’s real estate appetite for Rice Village property just picked up another choice tidbit: 2445 Times Blvd. That’s the 1955 flat-topped 7,500-sq.-ft. retail property on the southeast corner of Times Blvd. and Kelvin Dr. that’s spooned by mega-neighbor Village Arcade (which Rice also owns). In its listing by Davis Commercial, seller Rinkoff Rice Village LP’s asking price for the “trophy” corner was $3.995 million, though it initially sought $4.2 million. Who’s currently on display behind all the storefront windows?

OIL PRICE PLUNGE LEADS TO STOCK DOWNGRADE FOR NEW GREENWAY PLAZA OWNERS  Last year Atlanta-based Cousins Properties splashed out big in the Houston office market, purchasing all 4.4 million sq.-ft. of Greenway Plaza for $950m in October, 8 months after they snapped up the $233m Post Oak Central complex, making Houston the dominant market in the CUZ portfolio. Which might have seemed a great idea in October 2013, when crude was going for about $100 a barrel, but now? A security analyst from Bank of America and Stifel have both downgraded Cousins Properties shares from “buy” to “hold,” citing falling oil prices and the company’s exposure to Houston. [Realty News Report] Photo of lightning over Greenway Plaza: Russell Hancock via Swamplot Flickr Pool

Last year Atlanta-based Cousins Properties splashed out big in the Houston office market, purchasing all 4.4 million sq.-ft. of Greenway Plaza for $950m in October, 8 months after they snapped up the $233m Post Oak Central complex, making Houston the dominant market in the CUZ portfolio. Which might have seemed a great idea in October 2013, when crude was going for about $100 a barrel, but now? A security analyst from Bank of America and Stifel have both downgraded Cousins Properties shares from “buy” to “hold,” citing falling oil prices and the company’s exposure to Houston. [Realty News Report] Photo of lightning over Greenway Plaza: Russell Hancock via Swamplot Flickr Pool

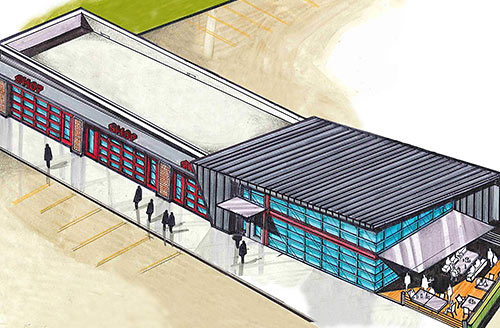

Houston Alternator’s West Heights location is getting a tuneup. Owners of the 6,000-sq.-ft. auto center, located on the busy N. Shepherd–W. 19th St. intersection’s southwest corner, are remodeling the 1960 vintage building for restaurant and retail use. But remixing N. Shepherd’s former auto care zone of used car dealerships and repair shops won’t stop there.

Finding a seat in the latest round of musical chairs among Houston’s theater crowd is the Classical Theatre Company, which recently announced it is moving operations into the 175-seat Chelsea Market venue vacated by Main Street Theater earlier this year. For the previously nomadic CTC, the space means a more permanent home for its artists and audiences — as well as a single spot for its offices, storage, rehearsals, and performances.

Finding a seat in the latest round of musical chairs among Houston’s theater crowd is the Classical Theatre Company, which recently announced it is moving operations into the 175-seat Chelsea Market venue vacated by Main Street Theater earlier this year. For the previously nomadic CTC, the space means a more permanent home for its artists and audiences — as well as a single spot for its offices, storage, rehearsals, and performances.

Main Street Theater, which has a Rice Village venue on Times Blvd. readying for a long-awaited renovation, had rented the Chelsea Market space for its Theater for Youth and educational programming since 1996. Youth activities shifted recently to the Talento Bilingue de Houston center at 333 S. Jensen Dr. That move had been prompted by the kickoff of work on the recently re-christened 20-story apartment project fronting Chelsea Blvd. (The Carter, formerly known as Chelsea Montrose), which took a big bite out of a once-extensive parking area.

Hunkered down behind a tagged security curtain, a bunker-like commercial building in Midtown’s mid-section popped up on the market overnight with a $585K asking price in a “lot-priced” listing. The corner building of uncertain vintage fronting Fannin St. has a history with commercial printers (and insurance companies), and more recently, shoe repair. Adkins Printing struck an exterior inlay on the building’s forehead (above) that’s still visible behind current signage, as is some faint lettering from its days as the offices of Pound Printing and Stationery. More recent signage attached the building’s blank north side (at right) touts available “stationary,” a spelling more appropriate perhaps to Al’s Handmade Boots, the store now occupying half of the building, than to the location’s printing history.

2 CORNER BANK BUILDINGS BANISHED FROM BANKING FOREVER  This 3,848-sq.-ft. former WaMu at the intersection of Barker Cypress Rd. and FM 529 Rd. has been vacant and on the market for a good 5 years now. It’s surrounded by parking spaces on a 1.152-acre lot and features a spacious 5-lane drive-thru in back. Along with a twin structure at the intersection of Louetta Rd. and N. Eldridge Pkwy. (also for sale), the Cypress building has been forcibly retired from its banking career. Chase Bank, which bought up all the Washington Mutual corner-bank leftovers, spat out locations like these it considered too close to existing Chase banks — with restrictions to prevent another bank from moving in. A few more restrictions potential buyers of the structure at 7019 Barker Cypress Rd. will want to note: You can’t put a burger joint, a nail salon, a hair salon, or a dentist’s office in there either, because any of those (as well as a few other uses) would duplicate the offerings of establishments in the adjacent Signature Kroger shopping center from which the pad site was spun off. Still-asking price: $1.1 million. [The Weitzman Group]

This 3,848-sq.-ft. former WaMu at the intersection of Barker Cypress Rd. and FM 529 Rd. has been vacant and on the market for a good 5 years now. It’s surrounded by parking spaces on a 1.152-acre lot and features a spacious 5-lane drive-thru in back. Along with a twin structure at the intersection of Louetta Rd. and N. Eldridge Pkwy. (also for sale), the Cypress building has been forcibly retired from its banking career. Chase Bank, which bought up all the Washington Mutual corner-bank leftovers, spat out locations like these it considered too close to existing Chase banks — with restrictions to prevent another bank from moving in. A few more restrictions potential buyers of the structure at 7019 Barker Cypress Rd. will want to note: You can’t put a burger joint, a nail salon, a hair salon, or a dentist’s office in there either, because any of those (as well as a few other uses) would duplicate the offerings of establishments in the adjacent Signature Kroger shopping center from which the pad site was spun off. Still-asking price: $1.1 million. [The Weitzman Group]