What puts the Mc- in McMansion? McMansion Hell hit the Internets recently hoping to answer that question, bringing along slews of illustrative photo examples covered with detailed (if at times bitingly sarcastic) annotations. The author notes that not all large post-1980 houses are McMansions — that’s a matter of factors like these. And not recognizing one isn’t necessarily a matter of having bad taste — it’s a matter of familiarity with basic design principles, which the site attempts to provide.

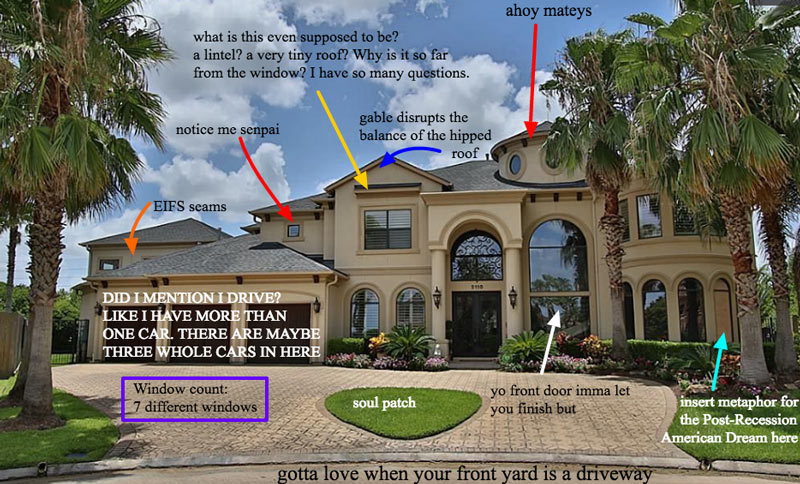

Starting with a McMansions 101 introductory primer on basic layouts and proportions, most of the site’s posts so far take on specific design aspects (last week’s called out useless and disproportionate column deployment). Other posts take readers on a Zillow-photo walkthrough of a single home — this afternoon’s critique dives into a Houston-area house (shown above), text block by aggravated text block:

“Downturn or not, Houston was so lacking in new development, ALL of what is getting built needed to be built . . . we were sooooooo far behind. The building boom allowed Houston to catch up to where it should have been — so these other delays/cancels are good for now. The pent-up demand will fill up what’s already in the works, and the delays/cancels can get after it at another time. What Houston has developed in the last several years has transformed the city, for the better. During the slowdown, we can catch our breathe and savor/enjoy the successes of the recent boom, and regroup and prepare for the next great haul.” [

“Downturn or not, Houston was so lacking in new development, ALL of what is getting built needed to be built . . . we were sooooooo far behind. The building boom allowed Houston to catch up to where it should have been — so these other delays/cancels are good for now. The pent-up demand will fill up what’s already in the works, and the delays/cancels can get after it at another time. What Houston has developed in the last several years has transformed the city, for the better. During the slowdown, we can catch our breathe and savor/enjoy the successes of the recent boom, and regroup and prepare for the next great haul.” [ Deeply embedded Houston real estate reporter Catie Dixon comes back from a panel event sponsored by her employer with a clickworthy account

Deeply embedded Houston real estate reporter Catie Dixon comes back from a panel event sponsored by her employer with a clickworthy account  So it may be bouncing back a little, but the precipitous drop in the price of oil since last summer has been responsible for the axing or delay of a considerable number of large-scale residential projects in Houston. How many new apartment buildings would we have had available to gawk at or choose from if it weren’t for the freefall? Ralph Bivins reports: “

So it may be bouncing back a little, but the precipitous drop in the price of oil since last summer has been responsible for the axing or delay of a considerable number of large-scale residential projects in Houston. How many new apartment buildings would we have had available to gawk at or choose from if it weren’t for the freefall? Ralph Bivins reports: “ “Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [

“Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [ “The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [

“The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [ “Houston: the wonder city that showed the country how laissez-faire economics, conservative values, and lax planning lead to growth and prosperity.

It turns out Houston was just benefiting from another bubble and a siphoning of wealth from the rest of the country via higher gasoline prices.

The shale boom was supposedly proof that peak oil was dead and we can keep building car-dependent cities. Houston was riding into the future in its new Mercedes.

It turns out that shale was only accessible at prices too high to pay to maintain strong economies around the world. When consumers cut oil demand, the shale, deepwater, and tar sands dry up.

We’re on the slope downward, folks. Oil prices will likely spike again when demand returns, Houston may boom temporarily, but consumers aren’t going to be able to pay for it forever. After the spike, demand slackens, prices drop, and expensive new oil projects are cancelled. Production drops, demand outstrips supply, and we hit another price spike. Over and over it goes until we one day wonder why we can’t afford to open the oil taps as wide as we could in the 2000-2010s. The thriving economies will be the ones that depend least on oil.” [

“Houston: the wonder city that showed the country how laissez-faire economics, conservative values, and lax planning lead to growth and prosperity.

It turns out Houston was just benefiting from another bubble and a siphoning of wealth from the rest of the country via higher gasoline prices.

The shale boom was supposedly proof that peak oil was dead and we can keep building car-dependent cities. Houston was riding into the future in its new Mercedes.

It turns out that shale was only accessible at prices too high to pay to maintain strong economies around the world. When consumers cut oil demand, the shale, deepwater, and tar sands dry up.

We’re on the slope downward, folks. Oil prices will likely spike again when demand returns, Houston may boom temporarily, but consumers aren’t going to be able to pay for it forever. After the spike, demand slackens, prices drop, and expensive new oil projects are cancelled. Production drops, demand outstrips supply, and we hit another price spike. Over and over it goes until we one day wonder why we can’t afford to open the oil taps as wide as we could in the 2000-2010s. The thriving economies will be the ones that depend least on oil.” [ Houston real estate reporter Ralph Bivins has been watching all those tanking oil prices: “

Houston real estate reporter Ralph Bivins has been watching all those tanking oil prices: “ “I’d like to see newer articles start noting that the jobs boom is already over and at this point it’s just the construction industry finishing off contractual commitments before we wrap it up and call the show over. past this it’s only retail & service sectors jobs growing which have a negligible impact on the overall economy anyhow due to the large supply of non-workers in the population and readily available labor. i’m not calling a downturn or anything here, but with drilling activity in the gulf starting to ease up (see hercules note [yesterday] morning about cutting personnel) and falling oil prices barring new onshore fields from starting up i’m not seeing any way for current growth trends to continue. fed pulling out of buying bonds will start hitting mortgage rates and drying up the cash closings that have helped stoked the fire as well so will be interesting to see if any slack appears in the market in the coming year.” [

“I’d like to see newer articles start noting that the jobs boom is already over and at this point it’s just the construction industry finishing off contractual commitments before we wrap it up and call the show over. past this it’s only retail & service sectors jobs growing which have a negligible impact on the overall economy anyhow due to the large supply of non-workers in the population and readily available labor. i’m not calling a downturn or anything here, but with drilling activity in the gulf starting to ease up (see hercules note [yesterday] morning about cutting personnel) and falling oil prices barring new onshore fields from starting up i’m not seeing any way for current growth trends to continue. fed pulling out of buying bonds will start hitting mortgage rates and drying up the cash closings that have helped stoked the fire as well so will be interesting to see if any slack appears in the market in the coming year.” [ Houston has some

Houston has some