FINDING CHEAP HOMES AT THE 20 MILE COMMUTER SWEET SPOT  Data type Scott Davis tells Paul Takahashi this week that the average commute distance among Houstonians with a $265,000 home is 30.5 miles, according to his company’s real-estate database. The middle 2 thirds of that price group makes a slog of anywhere between 15 and 47 miles to get to work; Davis says some folks in that range drive as far as 60 miles. He does note to Takahashi, however, that the homes closer in — say, within 15 or 20 miles of a major employment hub — tend to sell much faster; HAR even rolled out a tool last year to allow searches for housing by commute time. [HBJ] Photo: Russell Hancock via Swamplot Flickr Pool

Data type Scott Davis tells Paul Takahashi this week that the average commute distance among Houstonians with a $265,000 home is 30.5 miles, according to his company’s real-estate database. The middle 2 thirds of that price group makes a slog of anywhere between 15 and 47 miles to get to work; Davis says some folks in that range drive as far as 60 miles. He does note to Takahashi, however, that the homes closer in — say, within 15 or 20 miles of a major employment hub — tend to sell much faster; HAR even rolled out a tool last year to allow searches for housing by commute time. [HBJ] Photo: Russell Hancock via Swamplot Flickr Pool

Tag: Home Prices

COMMENT OF THE DAY RUNNER-UP: WHAT DIFFERENCE DOES THE PRICE OF OIL MAKE TO HOUSTON REAL ESTATE?  “Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [c.l., commenting on Houston Housing Market Reaches All-Time Highs — Before It Crashes, Dips a Little, Remains Steady, or Climbs Further] Illustration: Lulu

“Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA (5M or so). Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and a blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.” [c.l., commenting on Houston Housing Market Reaches All-Time Highs — Before It Crashes, Dips a Little, Remains Steady, or Climbs Further] Illustration: Lulu

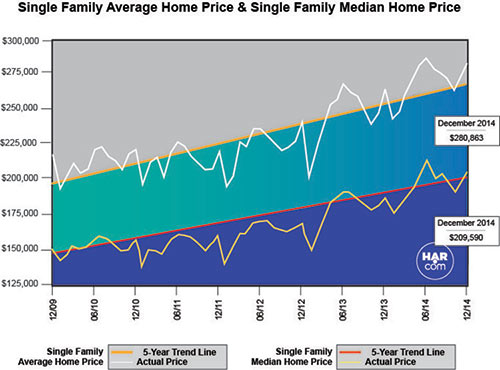

Is this Houston real estate’s Wile E. Coyote off-the-cliff-but-hasn’t-realized-he’s-gonna-fall-yet moment? Or is a new era dawning, in which out-of-state investors new to this whole “Houston is booming” thing swoop in to buy up everything and save the day? A fresh serving of home-sales data from real estate agents is available this morning . . . to support either notion. This past December was a record-breaking month for home sales, the Houston Association of Realtors claims in its latest report. Total property sales were up 11 percent over last December, and the current 2.5-months supply of inventory (a comforting term to those who regularly consider a home to be an off-the-shelf item) is scored as “the lowest level of all time.” Total dollar volume of housing sales for this past month was up a whopping 18.1 percent over December of last year. Both average and median sales prices for single-family homes reached “historic highs for a December in Houston.”

Separately, using her own calculations from MLS data, buyers’ agent Judy Thompson has updated her hand-carved regular roundup of appreciation rates and market conditions for the 21 well-known (and mostly Inner Loop) neighborhoods she’s been tracking on her West U Real Estate website for the past decade. (“In some areas I have had to make value judgments about which sales might have been lot value sales that were not listed that way,” she explains.) Of note: Of the tracked neighborhoods, little old Westbury led the increase in average sales price per sq. ft., rising 22 percent in the last year; the combined average for 2014 was an 11 percent uptick.

- The Houston Real Estate Market Breaks Records in 2014 [HAR]

- Appreciation [West U Real Estate]

Chart: HAR

COMMENT OF THE DAY: HOUSTON REAL ESTATE PROBLEMS, WITH OR WITHOUT CHEAP OIL  “The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

“The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

A DIRE WARNING FOR HOUSTON, 1965: IN CASE OF NUCLEAR ATTACK, PROPERTY VALUES MAY RISE  Nuclear historian Alex Wellerstein, creator of the online Nukemap nuclear-blast simulator, finds the following charming nugget in a September 1965 report issued by the nonprofit Institute for Defense Analyses, which wad been hired by the U.S. Army’s Office of Civil Defense to calculate the effects of the use of a nuclear weapon on an American city — using Houston as an example: “For single surface bursts of 3- and 10-Mt, about 64 percent and 46 percent of the property values survive, while only 32 and 18 percent of the unsheltered population survives. In a macabre sense, the surviving population would be individually ‘wealthier’ than before the attack. For a single 10-Mt weapon, surviving property value per capita nearly doubles from a preattack value of about $9,000 to slightly more than $16,000 and, as the weight of the attack increases, the greater the per capita gain in ‘wealth’ of the survivors. For a 100-Mt surface burst, the surviving population is nearly four times wealthier than pre-attack ($34,000). However, any joy among the surviving population may be quite shortlived; none of these gross estimates of the effects of nuclear attack indicate whether or not the immediate metropolitan area is viable, either by itself or with the assistance of the rest of the country.” [Lawyers, Guns, and Money; report (PDF)] Simulated image of 10-megaton mushroom cloud over Houston: Nukemap 3D

Nuclear historian Alex Wellerstein, creator of the online Nukemap nuclear-blast simulator, finds the following charming nugget in a September 1965 report issued by the nonprofit Institute for Defense Analyses, which wad been hired by the U.S. Army’s Office of Civil Defense to calculate the effects of the use of a nuclear weapon on an American city — using Houston as an example: “For single surface bursts of 3- and 10-Mt, about 64 percent and 46 percent of the property values survive, while only 32 and 18 percent of the unsheltered population survives. In a macabre sense, the surviving population would be individually ‘wealthier’ than before the attack. For a single 10-Mt weapon, surviving property value per capita nearly doubles from a preattack value of about $9,000 to slightly more than $16,000 and, as the weight of the attack increases, the greater the per capita gain in ‘wealth’ of the survivors. For a 100-Mt surface burst, the surviving population is nearly four times wealthier than pre-attack ($34,000). However, any joy among the surviving population may be quite shortlived; none of these gross estimates of the effects of nuclear attack indicate whether or not the immediate metropolitan area is viable, either by itself or with the assistance of the rest of the country.” [Lawyers, Guns, and Money; report (PDF)] Simulated image of 10-megaton mushroom cloud over Houston: Nukemap 3D

COMMENT OF THE DAY: GETTING THE MAXIMUM PRICE ON A MINIMUM LOT SIZE  “All things being equal, restricted property is worth less than un-restricted property. However, property for which NEIGHBORING properties are restricted can be MORE valuable. Property owners accept MLS [minimum lot size] restrictions on their own property in return for MLS restrictions on their neighbors’ property. If the value they give up by accepting the restriction on their own property is less than the value they gain by ensuring they won’t end up living next to a townhouse cluster, then it can be in their interest to accept the restriction.

If you own a tear-down, MLS restrictions will (probably) reduce the value of your home. If you own a valuable structure on a block with one or more tear-downs, MLS restrictions will probably INCREASE the value of your home.” [Angostura, commenting on Flyer Sent to Very Near Northside Warns of Dangers of Minimum Lot Size Designation] Illustration: Lulu

“All things being equal, restricted property is worth less than un-restricted property. However, property for which NEIGHBORING properties are restricted can be MORE valuable. Property owners accept MLS [minimum lot size] restrictions on their own property in return for MLS restrictions on their neighbors’ property. If the value they give up by accepting the restriction on their own property is less than the value they gain by ensuring they won’t end up living next to a townhouse cluster, then it can be in their interest to accept the restriction.

If you own a tear-down, MLS restrictions will (probably) reduce the value of your home. If you own a valuable structure on a block with one or more tear-downs, MLS restrictions will probably INCREASE the value of your home.” [Angostura, commenting on Flyer Sent to Very Near Northside Warns of Dangers of Minimum Lot Size Designation] Illustration: Lulu

HAVE HOME PRICES IN LINDALE PARK REALLY JUMPED THAT MUCH, THAT FAST?  “I’d be curious to know what your more knowledgeable readers think about the rising prices in Lindale Park,” a reader writes. “Just today I saw this listing — for north of $400k! Over the past couple of months there have been a number of homes listed, and quickly pending, for around $300k. Most (all?) of these appear to have been flipped.

I bought my (not updated, in need of work, but a not-bad 3-2) house in Lindale Park for around $150k in 2010. There were a number of factors to picking Lindale Park, but the biggest was that we could get a decent-sized house in a close-in neighborhood that seemed to be on the up-and-up without breaking the bank. (The rail was a big reason too.) But when I saw this home — big and updated but right on 610 — for more than $400k . . . my jaw dropped.” [Swamplot inbox] Photo of 511 Kelley St.: HAR

“I’d be curious to know what your more knowledgeable readers think about the rising prices in Lindale Park,” a reader writes. “Just today I saw this listing — for north of $400k! Over the past couple of months there have been a number of homes listed, and quickly pending, for around $300k. Most (all?) of these appear to have been flipped.

I bought my (not updated, in need of work, but a not-bad 3-2) house in Lindale Park for around $150k in 2010. There were a number of factors to picking Lindale Park, but the biggest was that we could get a decent-sized house in a close-in neighborhood that seemed to be on the up-and-up without breaking the bank. (The rail was a big reason too.) But when I saw this home — big and updated but right on 610 — for more than $400k . . . my jaw dropped.” [Swamplot inbox] Photo of 511 Kelley St.: HAR

GAINING IN HOUSTON’S GAYBORHOODS  So home prices are rising in urban areas — no surprise there. But nowhere are those prices rising faster than in so-called “gayborhoods.” That’s according to Jed Kolko, crunching the numbers for Trulia: “Neighborhoods where same-sex male couples account for more than 1% of all households (that’s three times the national average) had price increases, on average, of 13.8%. In neighborhoods where same-sex female couples account for more than 1% of all households, prices increased by 16.5% –– more than one-and-a-half times the national increase.” Prime Property’s Nancy Sarnoff adds that in Houston in Rosedale prices are up 16 percent and 14 percent in Hyde Park, where the 1920s Jackson Blvd. bungalow shown here is for sale for $425,000. [Trulia Trends; Prime Property] Photo of 1223 Jackson: HAR

So home prices are rising in urban areas — no surprise there. But nowhere are those prices rising faster than in so-called “gayborhoods.” That’s according to Jed Kolko, crunching the numbers for Trulia: “Neighborhoods where same-sex male couples account for more than 1% of all households (that’s three times the national average) had price increases, on average, of 13.8%. In neighborhoods where same-sex female couples account for more than 1% of all households, prices increased by 16.5% –– more than one-and-a-half times the national increase.” Prime Property’s Nancy Sarnoff adds that in Houston in Rosedale prices are up 16 percent and 14 percent in Hyde Park, where the 1920s Jackson Blvd. bungalow shown here is for sale for $425,000. [Trulia Trends; Prime Property] Photo of 1223 Jackson: HAR

COMMENT OF THE DAY: WHAT DO I HEAR FOR AN ORIGINAL TANGLEWOOD RANCH? “serious question . . . as the number of 1 story ranch houses in tanglewood dwindles to what is now only about 20% of the market, does this type of product ever carry in ITSELF a premium for being a certain ‘historic’ structure? or is the value of these houses always going to be simply a function of their dirt value? and if they are renovated enough for entry level tanglewood families (like mine) to live in, is there a value to be established there? the answer is probably as suggested. i realize that ultimately these houses are saddled with 8′ ceilings and outdated wiring/plumbing, but it’s still a 1:4 coverage ratio housing product, where you want to be, surrounded by the schools you want to send your kids to, and spending $1.25 to buy it and $250,000 to renovate it (to the studs)” [HTX REZ, commenting on Daily Demolition Report: School of Hard Knocks]

Seem familiar? This 1952 mod appeared in the HBO boob-job exposé Breast Men, starring David Schwimmer as Houston’s early-’60s boob pioneer Dr. Kevin Saunders. Or maybe that two-faced fireplace sparks your memory: Last July, the 4-bedroom, 3,558-sq.-ft. home was listed for sale at $1.1 million. (It was the one with the bomb shelter underneath the patio?) Well, in December it was sold for an even $1 million. And it showed up in today’s Daily Demolition Report.

Why not take one last peek, before it goes?

Property-tax assessments dropped overall in Harris County this year, but a reader in Montgomery County writes in to brag about the remarkable rise in value her small neighborhood in The Woodlands experienced over the same period: Assessments for a group of 42 homes in the Village of Panther Creek went up by a minimum of 80 percent over last year’s values. To get a taste of the boom, our reader suggests, try a search for “Wedgewood Glen” on the MCAD website. The datasheets for any of the properties listed will show the appraisal history. “With increases like that, The Woodlands may be the hottest real estate market in the country,” she writes. And she says she’s ready to sell her 30-something-year-old home now — if she can get anyone to buy her home at the price the county assessor says it’s worth.

Property-tax assessments dropped overall in Harris County this year, but a reader in Montgomery County writes in to brag about the remarkable rise in value her small neighborhood in The Woodlands experienced over the same period: Assessments for a group of 42 homes in the Village of Panther Creek went up by a minimum of 80 percent over last year’s values. To get a taste of the boom, our reader suggests, try a search for “Wedgewood Glen” on the MCAD website. The datasheets for any of the properties listed will show the appraisal history. “With increases like that, The Woodlands may be the hottest real estate market in the country,” she writes. And she says she’s ready to sell her 30-something-year-old home now — if she can get anyone to buy her home at the price the county assessor says it’s worth.

OAK FOREST: NEW WEST U OR MINI BELLAIRE? The Chronicle is out with its annual survey of area home prices. Sadly, this year’s online version doesn’t allow easy cost-per-square-foot comparisons, leaving Houstonians who like to build and buy their residences in bulk without much to oooh and aah over. Consolation: The accompanying neighborhood profiles include a peek at the controversy that’s apparently been raging through Oak Forest: “‘I call it the new West University,’ said Jason Light, owner of the Light Group, a local real estate firm active in the Inner Loop area. . . . Marlene Casares and her husband, Jalin Casares, looked all over town before settling on Oak Forest, she said. A year ago they bought a new 4,300-square-foot home. . . . ‘It’s like a little mini Bellaire, but with better prices,’ she said.” [Houston Chronicle]

COMMENT OF THE DAY: ARE YOU ALL SHORT-TIMERS HERE? “I have often wondered… Why is there such a collective push towards “improving property valueâ€? I think it’s a terrible thing! My preference is for the value of my property to stabilize. I don’t want it to fall, because it would make the neighborhood as a whole lose value and therefore invite blight; but I don’t want it to rise either, because I will simply have to pay more taxes on it. The only reason for anyone to hope for their property value to rise is because they would prefer to sell it. In my opinion, that’s not a sustainable model, because the only ones that benefit from it are the ones that do not want to keep the house long-term. That’s how you end up with sub-par quality ‘houses’ built by seedy developers. Am I off base?” [Alex, commenting on Where Houston’s Lot-Size Restrictions Went, Year by Year]

PRICE DROPS ARE UP! Been noticing more local home sellers slashing prices? It’s not just that HAR listings now highlight them: Real estate website Trulia notes that one-quarter of all homes it tracks in the Houston market (mostly through MLS) dropped their asking prices over the last year. That’s 32 percent more price cuts than for the previous year-long period, and qualifies Houston as one of the top 5 cities Trulia follows where asking-price reductions have been on the upswing. The average price cut here: 9 percent. [Trulia, via Houston Business Journal]

COMMENT OF THE DAY: LOT SIZE AND THE ROAD TO DEMOLITION  “. . . The owners of the above pictured house realized a LONG time ago that the value of their 10,000 SF lot was the same with or without the existing structure. THAT is the point when maintaining the structure becomes uneconomical. THAT is when repairs stop. THAT is the starting point on the path to real decay and eventual demolition.

Interestingly, the economics of a townhouse give their owners MORE incentive to keep up with repairs. Their ratio of structure-value to land-value is higher meaning that going forward they should have MORE economic incentive to keep their structures maintained.

Even a $100,000 structural repair on a townhouse on a 1,800 SF lot isn’t likely to push it into teardown status. Making the repair is still economically rational. You’d be far less likely to affect a similar repair on a single family home on 5,000 SF lot in the same neighborood.” [Bernard, commenting on Up and Down in Hyde Park] Photo of former property at 1212 Hyde Park Blvd.: fortbendtomontrose

“. . . The owners of the above pictured house realized a LONG time ago that the value of their 10,000 SF lot was the same with or without the existing structure. THAT is the point when maintaining the structure becomes uneconomical. THAT is when repairs stop. THAT is the starting point on the path to real decay and eventual demolition.

Interestingly, the economics of a townhouse give their owners MORE incentive to keep up with repairs. Their ratio of structure-value to land-value is higher meaning that going forward they should have MORE economic incentive to keep their structures maintained.

Even a $100,000 structural repair on a townhouse on a 1,800 SF lot isn’t likely to push it into teardown status. Making the repair is still economically rational. You’d be far less likely to affect a similar repair on a single family home on 5,000 SF lot in the same neighborood.” [Bernard, commenting on Up and Down in Hyde Park] Photo of former property at 1212 Hyde Park Blvd.: fortbendtomontrose