MONTROSE DISTRICT APPEALING JUDGE’S ORDER TO RETURN $6.6 MILLION IT COLLECTED FROM LOCAL BUSINESSES  The new judge now in charge of the 5-year-old lawsuit against the 6-year-old Montrose Management District earlier this week affirmed the decision announced by his predecessor late last year — that the taxes the group imposed on the West Montrose Management District were not validly assessed, and that all $6.6 million should be returned to its payers — and parceled off a dispute about attorneys’ fees into a separate case. The final judgment clears the way for the district to appeal the ruling in state court, which it did yesterday. “The district stands by its position that it is operating within its legal charter granted by the State of Texas,” a statement put out by the organization reads. “No refunds for assessments collected in the West Montrose Management District (the only portion of the district under dispute in this legal action) will be made, pending the outcome of the current appeal.” [Houston Chronicle; previously on Swamplot] Photo: Montrose Management District

The new judge now in charge of the 5-year-old lawsuit against the 6-year-old Montrose Management District earlier this week affirmed the decision announced by his predecessor late last year — that the taxes the group imposed on the West Montrose Management District were not validly assessed, and that all $6.6 million should be returned to its payers — and parceled off a dispute about attorneys’ fees into a separate case. The final judgment clears the way for the district to appeal the ruling in state court, which it did yesterday. “The district stands by its position that it is operating within its legal charter granted by the State of Texas,” a statement put out by the organization reads. “No refunds for assessments collected in the West Montrose Management District (the only portion of the district under dispute in this legal action) will be made, pending the outcome of the current appeal.” [Houston Chronicle; previously on Swamplot] Photo: Montrose Management District

Taxes

COMMENT OF THE DAY: A WATERSHED APPROACH TO PAYING FOR FLOOD CONTROL  “. . . I think that if we are going to be realistic about the way that we finance flood control, that the core of such a plan needs to take a page from how flood insurance gets underwritten. Everybody pays a property tax to a watershed-specific flood control entity, but that tax is adjusted based on the elevation of their first-floor living area relative to the Base Flood Elevation. If you’re more than a few feet above it, your tax is very low. If you live more than a few feet below it . . . you’re probably going to pay so much in taxes that it’ll become immediately economic to raise your structure or demolish it. Right away, the inventory and value of property subject to flood risk is reduced; and what’s left that is tolerably at-risk pays for its own reduced need for risk mitigation. And . . . if we’re too gun shy to pull the trigger on a plan like this, which would totally wipe out a lot of people’s equity in vast swaths of real estate, okay well that’s where people not at very much risk should be expected to pay more taxes even without receiving very much in the way of benefits. Yeah, I’m basically proposing Obamacare for flood control in Houston, but only as a humane alternative which reveals a startling truth: that the big money for this sort of thing is unlikely to come from up on high, from the feds or the state government (and it shouldn’t IMO). Financing this stuff locally is going to hurt. One thing is very very clear: whatever kinds of administrative bodies are created or re-jiggered to deal with this issue have got to address legacy development first and foremost. We need a plan to cope with what is already on the ground. This is not something that we can just build ourselves out of, going forward, with stricter rules for new development, feel the catharsis, hold hands and sing Kumbaya, and call it a day.” [TheNiche, commenting on An 8th Wonder Distillery; New Bridges for Brays Bayou; How Apartment Buildings Get On Your Nerves]

“. . . I think that if we are going to be realistic about the way that we finance flood control, that the core of such a plan needs to take a page from how flood insurance gets underwritten. Everybody pays a property tax to a watershed-specific flood control entity, but that tax is adjusted based on the elevation of their first-floor living area relative to the Base Flood Elevation. If you’re more than a few feet above it, your tax is very low. If you live more than a few feet below it . . . you’re probably going to pay so much in taxes that it’ll become immediately economic to raise your structure or demolish it. Right away, the inventory and value of property subject to flood risk is reduced; and what’s left that is tolerably at-risk pays for its own reduced need for risk mitigation. And . . . if we’re too gun shy to pull the trigger on a plan like this, which would totally wipe out a lot of people’s equity in vast swaths of real estate, okay well that’s where people not at very much risk should be expected to pay more taxes even without receiving very much in the way of benefits. Yeah, I’m basically proposing Obamacare for flood control in Houston, but only as a humane alternative which reveals a startling truth: that the big money for this sort of thing is unlikely to come from up on high, from the feds or the state government (and it shouldn’t IMO). Financing this stuff locally is going to hurt. One thing is very very clear: whatever kinds of administrative bodies are created or re-jiggered to deal with this issue have got to address legacy development first and foremost. We need a plan to cope with what is already on the ground. This is not something that we can just build ourselves out of, going forward, with stricter rules for new development, feel the catharsis, hold hands and sing Kumbaya, and call it a day.” [TheNiche, commenting on An 8th Wonder Distillery; New Bridges for Brays Bayou; How Apartment Buildings Get On Your Nerves]

COMMENT OF THE DAY SECOND RUNNER-UP: HOUSTON’S BIG BOUNDARY ADVANTAGE  “. . . One of the reasons that Houston manages to buck trends affecting other central cities is that Houston is orders of magnitude larger than many central cities. Within its incorporated city limits, Houston could contain all of Manhattan, Chicago, San Francisco, Washington DC, Boston, and then have room enough left over for Santa Barbara. That means that Houston contains its first-ring suburbs, most of its second-ring, and even some some third-ring; and then it also does this funky “limited-purpose annexation†scheme in the northwest suburbs and has a special non-annexation deal with The Woodlands to keep those areas as an unincorporated buffer zone from which they are still somewhat able to tap commercial property tax revenues from those areas. And as demographic pressures push and pull people across different regions, Houston has to adapt to all of those trends simultaneously, but it also has a diversified-enough tax base to be able to do so — you know, presuming that its elected officials never do anything especially stupid like capping revenues and also underfunding pensions for decades.” [TheNiche, commenting on North Houston Amazon Fulfillment Center Opens; Qui Now Taking Reservations; Ending the ‘Dry Heights’] Illustration: Lulu

“. . . One of the reasons that Houston manages to buck trends affecting other central cities is that Houston is orders of magnitude larger than many central cities. Within its incorporated city limits, Houston could contain all of Manhattan, Chicago, San Francisco, Washington DC, Boston, and then have room enough left over for Santa Barbara. That means that Houston contains its first-ring suburbs, most of its second-ring, and even some some third-ring; and then it also does this funky “limited-purpose annexation†scheme in the northwest suburbs and has a special non-annexation deal with The Woodlands to keep those areas as an unincorporated buffer zone from which they are still somewhat able to tap commercial property tax revenues from those areas. And as demographic pressures push and pull people across different regions, Houston has to adapt to all of those trends simultaneously, but it also has a diversified-enough tax base to be able to do so — you know, presuming that its elected officials never do anything especially stupid like capping revenues and also underfunding pensions for decades.” [TheNiche, commenting on North Houston Amazon Fulfillment Center Opens; Qui Now Taking Reservations; Ending the ‘Dry Heights’] Illustration: Lulu

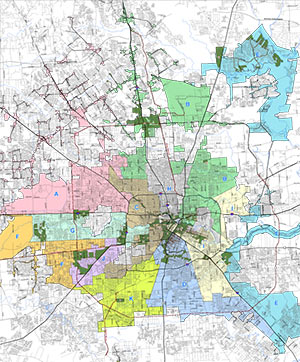

DISTRIBUTING DISASTER RELIEF FUNDS THROUGH TIRZ  A reader has a question about a particular Tax Increment Reinvestment Zone in Houston: “In this example scenario, the city of Houston is giving [Hurricane Ike] money to a developer for infrastructure improvements on their lot (located in a TIRZ) but the requirement is that the developer must build some affordable homes on that lot.

The twist to this is that the city would give the developer money, but only if it is given through the TIRZ. Speaking with the TIRZ board, they said that they plan to distribute that money around the entire TIRZ and not just to that single development. This of course has the neighboring residents and the developer worried about how the funds will be given.

Is this the normal process for distributing Ike funding? And can a TIRZ take money away from the developing area?” Map of area Tax Increment Reinvestment Zones: City of Houston

A reader has a question about a particular Tax Increment Reinvestment Zone in Houston: “In this example scenario, the city of Houston is giving [Hurricane Ike] money to a developer for infrastructure improvements on their lot (located in a TIRZ) but the requirement is that the developer must build some affordable homes on that lot.

The twist to this is that the city would give the developer money, but only if it is given through the TIRZ. Speaking with the TIRZ board, they said that they plan to distribute that money around the entire TIRZ and not just to that single development. This of course has the neighboring residents and the developer worried about how the funds will be given.

Is this the normal process for distributing Ike funding? And can a TIRZ take money away from the developing area?” Map of area Tax Increment Reinvestment Zones: City of Houston

This baroque 8th-floor penthouse condo in the Campton at Post Oak building at 4950 Woodway Dr. north of the Galleria has been available for rent at $9,500 a month since last September (marked down from the whopping $11,500 it began with in August). But there a few things you might want to know about the 3,948-sq.-ft. pad before you sign any lease: First, the unit’s owner since 2010 is Minnesota Vikings running back Adrian Peterson — who (in case you’ve been on a news blackout for the last several months) last November pled no contest to charges of “recklessly assaulting” his 4-year-old son with a wooden switch, and was suspended from the NFL for the remainder of the season. Second: Peterson hasn’t been paying his taxes on the property; after court proceedings at which Peterson failed to appear, a tax auction was approved by a district court a few days before Christmas.

COMMENT OF THE DAY: A PROPERTY TAX PROTESTOR’S GUIDE TO HCAD BUILDING GRADES  “There is no process to request that a home be considered an economic misimprovement. When a neighborhood has changed to the point that the original homes are no longer the norm, either by new construction or remodeling, HCAD can deem the remaining original homes as econ improvements.

On to grade — Grade is set when the home is constructed. There is usually a discussion between the builder and the appraisal district as to what level of customization is going into the property as it’s being built. Think of a typical Pulte starter-home as a C+. For every level of better materials or customization, the grade will be increased up to a maximum of X+. This is, for the most part, impossible to change on a permanent basis. Especially after the construction is complete. The key here is to get in either during construction or immediately after. It helps if your home is exactly the same as the rest on the block, but for some reason, your grade is higher. Bring in floor plans and show which houses are similar.

On to Condition/Desirability/Utility (CDU) – This is the one you can play with. A home with a reasonable amount of un-repaired deferred maintenance should be in Average condition. In the old days, all new homes were put on at Excellent condition, but HCAD has since changed that policy and puts most new homes on in Average condition. This is the one you need to work on with signed written repair estimates and pictures. Every year. Big stuff — electric, plumbing, foundation, windows, storm damage, etc.

Finally, Level of Remodel — None, partial, extensive, total, new/rebuilt. This causes a great deal of angst to many people, because there is no real written explanation of what each one is, and how long a remodel actually lasts. There are homes from the early 90s in West U that are still being considered New/Rebuilt, and, as such, are being compared to brand new construction. Additionally, HCAD does not know about every remodel — they only started getting the building permits about 6 years ago. So, your neighbor with the spectacular new kitchen who did it under the table may still be listed as having no remodel. Unless you want to bring in pictures of their kitchen from the last BBQ, there’s not much you can do, other than show that yours is in worse shape than HCAD shows. Additionally, many ARB boards and appraisers have different ideas as to what makes a remodel — putting new cabinet doors up in the kitchen? I’ve seen that called a partial remodel. Replacing knob and tube wiring without increasing capacity to avert a possible fire? I’ve seen that called a repair, and not an improvement.” [BrewWench, commenting on How Do You Get on HCAD’s ‘Cheap’ List?] Illustration: Lulu

“There is no process to request that a home be considered an economic misimprovement. When a neighborhood has changed to the point that the original homes are no longer the norm, either by new construction or remodeling, HCAD can deem the remaining original homes as econ improvements.

On to grade — Grade is set when the home is constructed. There is usually a discussion between the builder and the appraisal district as to what level of customization is going into the property as it’s being built. Think of a typical Pulte starter-home as a C+. For every level of better materials or customization, the grade will be increased up to a maximum of X+. This is, for the most part, impossible to change on a permanent basis. Especially after the construction is complete. The key here is to get in either during construction or immediately after. It helps if your home is exactly the same as the rest on the block, but for some reason, your grade is higher. Bring in floor plans and show which houses are similar.

On to Condition/Desirability/Utility (CDU) – This is the one you can play with. A home with a reasonable amount of un-repaired deferred maintenance should be in Average condition. In the old days, all new homes were put on at Excellent condition, but HCAD has since changed that policy and puts most new homes on in Average condition. This is the one you need to work on with signed written repair estimates and pictures. Every year. Big stuff — electric, plumbing, foundation, windows, storm damage, etc.

Finally, Level of Remodel — None, partial, extensive, total, new/rebuilt. This causes a great deal of angst to many people, because there is no real written explanation of what each one is, and how long a remodel actually lasts. There are homes from the early 90s in West U that are still being considered New/Rebuilt, and, as such, are being compared to brand new construction. Additionally, HCAD does not know about every remodel — they only started getting the building permits about 6 years ago. So, your neighbor with the spectacular new kitchen who did it under the table may still be listed as having no remodel. Unless you want to bring in pictures of their kitchen from the last BBQ, there’s not much you can do, other than show that yours is in worse shape than HCAD shows. Additionally, many ARB boards and appraisers have different ideas as to what makes a remodel — putting new cabinet doors up in the kitchen? I’ve seen that called a partial remodel. Replacing knob and tube wiring without increasing capacity to avert a possible fire? I’ve seen that called a repair, and not an improvement.” [BrewWench, commenting on How Do You Get on HCAD’s ‘Cheap’ List?] Illustration: Lulu

A reader whose new property tax assessment is feeling pressure from all the construction nearby in Brooke Smith writes in with questions about HCAD’s “economic misimprovement” classification. That’s the label HCAD often applies to older houses in neighborhoods where similar structures are being torn down and replaced with new construction. (It’s “an adjustment to the dwelling to limit the remaining building value as the land value increases.”) Writes the homeowner: “I was wondering if my fellow co-readers would have any information about filing your home as an economic misimprovement and how to do so with HCAD. Also, are there any disadvantages of doing so?”

A reader whose new property tax assessment is feeling pressure from all the construction nearby in Brooke Smith writes in with questions about HCAD’s “economic misimprovement” classification. That’s the label HCAD often applies to older houses in neighborhoods where similar structures are being torn down and replaced with new construction. (It’s “an adjustment to the dwelling to limit the remaining building value as the land value increases.”) Writes the homeowner: “I was wondering if my fellow co-readers would have any information about filing your home as an economic misimprovement and how to do so with HCAD. Also, are there any disadvantages of doing so?”

Some background: “I bought my home in 2012; my property taxes from 2011–2012 increased by 40 percent. I prepared a thorough protest, but the ARB essentially denied my protest by comparing my home to the new homes/heavily remodeled homes in the neighborhood.”

More:

Yes, ExxonMobil has been constructing an enormous new 20-building corporate campus on 386 acres near the intersection of I-45 and the new Grand Parkway, where it plans to consolidate approximately 17,000 employees from several Houston-area and out-of-state locations. But the oil company is apparently planning a bit of a move in the opposite direction at the same time. It now has plans to lease more than 480,000 sq. ft. in 2 new office buildings in a new separate “satellite campus” 7 miles north. This won’t be a contrasting urban setting for workers seeking something similar to the company’s longtime Downtown Houston tower. It’ll be in Hughes Landing (pictured above), the new mixed-use development on the shores of Lake Woodlands in The Woodlands.

CHEVRON GETS A CHEVRON-SIZED TAX ZONE DOWNTOWN  To further persuade Chevron to build that 50-story tower that it told everyone back in July that it was gonna go ahead and build, city council voted unanimously yesterday to create a tax abatement reinvestment zone for the 2 acres on which the tower would stand at 1600 Louisiana. The resulting cash should help Chevron replace a sewer line on the former Downtown YMCA property, the Houston Chronicle reports. And the Houston Business Journal’s Shaina Zucker adds up all the incentives that might be coming to help out the energy giant: “[The zone] could mean $2.7 million to $3 million for the company . . . . That money would be in addition to the $12 million it could receive from the Texas Enterprise Fund, which Gov. Rick Perry’s office announced in July.” [Houston Chronicle; Houston Business Journal; previously on Swamplot] Rendering: HOK

To further persuade Chevron to build that 50-story tower that it told everyone back in July that it was gonna go ahead and build, city council voted unanimously yesterday to create a tax abatement reinvestment zone for the 2 acres on which the tower would stand at 1600 Louisiana. The resulting cash should help Chevron replace a sewer line on the former Downtown YMCA property, the Houston Chronicle reports. And the Houston Business Journal’s Shaina Zucker adds up all the incentives that might be coming to help out the energy giant: “[The zone] could mean $2.7 million to $3 million for the company . . . . That money would be in addition to the $12 million it could receive from the Texas Enterprise Fund, which Gov. Rick Perry’s office announced in July.” [Houston Chronicle; Houston Business Journal; previously on Swamplot] Rendering: HOK

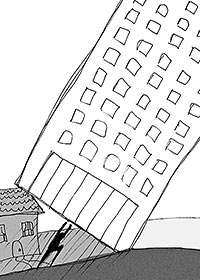

COMMENT OF THE DAY: HOLDING BACK THE ONSLAUGHT ON A GALLERIA MOD  “There’s not too much respect for older architecture in Houston. I own a three family near the Galleria. My building was designed by Neuhaus and Taylor and was featured in ‘Houston and the Mod House.’ The developers are sniffing around trying to make deals for the whole street. I may reach a point of diminishing returns soon and be forced to sell. One of the reasons is that the city keeps raising the property taxes so high in ‘hot’ areas by comparing old buildings to the new ratables and raising the old assessments by thousands at a time. At some point you can’t afford to pay the bills with a density of three units on the property. A developer will come in, buy the whole cul de sac, and put up a tower so he can make a lot more money per sq. ft. from the land than we can. When you protest taxes, HCAD listens and lowers the amount a tiny amount. Thus, the little guy is eventually forced out.” [Gary Andreasen, commenting on Comment of the Day: How Houston Tears Down and Sprawls] Illustration: Lulu

“There’s not too much respect for older architecture in Houston. I own a three family near the Galleria. My building was designed by Neuhaus and Taylor and was featured in ‘Houston and the Mod House.’ The developers are sniffing around trying to make deals for the whole street. I may reach a point of diminishing returns soon and be forced to sell. One of the reasons is that the city keeps raising the property taxes so high in ‘hot’ areas by comparing old buildings to the new ratables and raising the old assessments by thousands at a time. At some point you can’t afford to pay the bills with a density of three units on the property. A developer will come in, buy the whole cul de sac, and put up a tower so he can make a lot more money per sq. ft. from the land than we can. When you protest taxes, HCAD listens and lowers the amount a tiny amount. Thus, the little guy is eventually forced out.” [Gary Andreasen, commenting on Comment of the Day: How Houston Tears Down and Sprawls] Illustration: Lulu

COMMENT OF THE DAY: A LITTLE 411 ON THAT 2010 $6 MILLION 380 SOUTH OF I-10 “For the record, the Ainbinder 380 Agreement did not include drainage detention, they simply tied into existing storm sewer systems — there were no ‘improvements.’ The road was widened at the expense of a tree-lined sidewalk. The sidewalk was ‘abandoned,’ which means ‘is no longer in existence.’ There are no street tree wells and/or no ROW accounted for to plant shade-bearing street trees. The removal of $250K worth of mature Live Oaks resulted in a transfer of this public amenity to Walmart’s parking lot. Yes, that’s right. Public trees were allowed to be replanted on Walmart’s parking lot. And, oh yeah, the four-sided intersection has just two pedestrian signalized crossings. Yes, you can’t actually safely cross on two sides because there are no lights and markings. Why? Because PW&E missed it and the developer didn’t end up having to pay for it. The ‘bridge improvement’ is the biggest boondoggle of them all. Ainbinder wanted to pave it and area civic orgs fought them. Turns out, after coring was performed on the bridge, that the dead load was far greater than known AS A RESULT OF previous paving. That was the second load limit drop. So, Ainbinder window-dressed and spent 380 monies for cosmetic treatments — changing out balustrades and painting A BRIDGE THAT WILL BE TORN DOWN. That is an absurd waste of taxpayer money. Unlike other 380s, the Ainbinder 380 had next to no specifications that ensured deliverables. There were no clawback provisions to ensure public return on the investment. Once the money is awarded to the developer, they can strike or change line items and they still get full payment. The development doesn’t even have to perform to produce new taxes (not just poached taxes), it can be a miserable failure and they still get paid. The folks that were championing this development are now trying to pretend the public infrastructure results were worth $6,000,000 of public money. Guess what? You were wrong then and you’re still wrong now. The proof is right there for everyone to see. Own it.” [TexasSpiral, commenting on Headlines: Getting to the Washington Heights Walmart; Learning Lessons from Hurricane Ike]

HOW TO KEEP PROPERTY TAXES LOW — AT THE TOP  Using figures from a study put together by the Service Employees International Union last year in support of striking janitors, Steve Jansen’s cover story in this week’s Houston Press highlights some spectacular feats of Houston highrise taxcutting: “For the 2011 tax year, if the owners of a class A skyscraper or office complex protested HCAD’s appraised value in front of HCAD’s appraisal review board or district court, they were 77 percent likely to have the value cut (and Âalmost always by millions). By contrast, only 55 percent of owners of single-family homes won their appeals with HCAD.” Total resulting savings on those high-dollar tax bills: $58 million in 2011 alone. This year, HCAD is raising the market valuations on many of the city’s fanciest office buildings by more than 50 percent. But don’t expect those numbers to hold when the companies have lawyers at the ready. For 2012, 70 percent of large downtown commercial office property owners went ahead with property-tax lawsuits against HCAD. [Houston Press] Photo of Wells Fargo Plaza, which through lawsuits and negotiated settlements gained valuation reductions totaling $380 million between 2006 and 2011: Matthew Colvin de Valle [license]

Using figures from a study put together by the Service Employees International Union last year in support of striking janitors, Steve Jansen’s cover story in this week’s Houston Press highlights some spectacular feats of Houston highrise taxcutting: “For the 2011 tax year, if the owners of a class A skyscraper or office complex protested HCAD’s appraised value in front of HCAD’s appraisal review board or district court, they were 77 percent likely to have the value cut (and Âalmost always by millions). By contrast, only 55 percent of owners of single-family homes won their appeals with HCAD.” Total resulting savings on those high-dollar tax bills: $58 million in 2011 alone. This year, HCAD is raising the market valuations on many of the city’s fanciest office buildings by more than 50 percent. But don’t expect those numbers to hold when the companies have lawyers at the ready. For 2012, 70 percent of large downtown commercial office property owners went ahead with property-tax lawsuits against HCAD. [Houston Press] Photo of Wells Fargo Plaza, which through lawsuits and negotiated settlements gained valuation reductions totaling $380 million between 2006 and 2011: Matthew Colvin de Valle [license]

MAYOR PARKER’S PLAN FOR A BIGGER, FRIENDLIER UPTOWN TIRZ  Why not both? Yesterday, Mayor Parker announced a $556 million plan that, if approved by city council on April 24, would fund the seemingly unrelated instead-of-light rail Post Oak BRT and Memorial Park reforestation: Uptown would annex 1,768 acres of property into the TIRZ, and a gradual increase in tax revenue over the next 25 years would help to keep the BRT operational and implement a program of park improvements. Those would include, says Houston Parks and Rec director Joe Turner in a city press release, “erosion control, removal of invasive non-native plants, the reestablishment of native grasslands and forests and facility needs.” Still: Only 36 acres of the property roped in for annexation would be taxable. And does this plan mean that BRT — first thought to be up and running by 2017 — will be delayed? Don’t worry, says Uptown Management District president John Breeding. Besides what will be generated by the more environmentally friendly TIRZ, money for BRT will come from TxDOT and — if approved by a vote on April 26 — Transportation Improvement Program grants from the Houston-Galveston Area Council. [City of Houston; previously on Swamplot] Drawing of Post Oak BRT: Uptown Management District

Why not both? Yesterday, Mayor Parker announced a $556 million plan that, if approved by city council on April 24, would fund the seemingly unrelated instead-of-light rail Post Oak BRT and Memorial Park reforestation: Uptown would annex 1,768 acres of property into the TIRZ, and a gradual increase in tax revenue over the next 25 years would help to keep the BRT operational and implement a program of park improvements. Those would include, says Houston Parks and Rec director Joe Turner in a city press release, “erosion control, removal of invasive non-native plants, the reestablishment of native grasslands and forests and facility needs.” Still: Only 36 acres of the property roped in for annexation would be taxable. And does this plan mean that BRT — first thought to be up and running by 2017 — will be delayed? Don’t worry, says Uptown Management District president John Breeding. Besides what will be generated by the more environmentally friendly TIRZ, money for BRT will come from TxDOT and — if approved by a vote on April 26 — Transportation Improvement Program grants from the Houston-Galveston Area Council. [City of Houston; previously on Swamplot] Drawing of Post Oak BRT: Uptown Management District

ENOUGH SQUARE FOOTAGE TO QUIBBLE OVER “We bought a fairly new house this year. We were all surprised when the appraiser’s square footage was 7 percent (200 square feet) smaller than what they had listed on HAR. Turns out the builder built the original owners a smaller house than they paid for. Some of their original closing documents showed the smaller square footage, but others had the larger number, so we understood why they were confused. We adjusted our offer price based on the revised square footage and called it good. . . . BUT as it turns out [the original owners] had been paying property taxes on the larger square footage. Now it’s our turn to pay the property taxes and I’d like to get the square footage corrected. Our estimate is that we’ll be overpaying by $600 this year if the error isn’t fixed. Unfortunately, I’m reading this information [PDF] from the HCAD website. I’m not sure whether this is a ‘clerical error’ or a ‘substantial error.’ For a substantial error, you apparently can’t protest unless the error causes the property to be over-appraised by more than one third (!). And for clerical errors, they say that inaccuracies in estimation such as estimating the square footage of a house, cannot be changed. I’m guessing I could push this as a clerical error (tell them they must have transposed some numbers when filling in their system). Has anyone done this with success? Or are we just screwed?” [Swamplot inbox; previously on Swamplot]

AMAZON.COM PURCHASES WILL NO LONGER BE TAX-FREE FOR TEXAS  Amazon.com and the State of Texas were able to work out a deal to cover that little $269 million bill for uncollected sales taxes the comptroller’s office sent the online retailer last September. And the result may benefit

Amazon.com and the State of Texas were able to work out a deal to cover that little $269 million bill for uncollected sales taxes the comptroller’s office sent the online retailer last September. And the result may benefit brick-and-mortar stucco-and-Styrofoam retailers throughout the state. Beginning July 1, Amazon will begin charging sales tax on all online purchases shipped to Texas. The company has also promised to invest at least $200 million in Texas, create at least 2,500 new jobs here over the next 4 years, and cough up an undisclosed payment. Early last year, Amazon had threatened to shut down its distribution center outside of Dallas. [Star-Telegram] Photo of Irving distribution center: Kati Drisc/Texas Tribune