COMMENT OF THE DAY SECOND RUNNER-UP: HOUSTON’S BIG BOUNDARY ADVANTAGE  “. . . One of the reasons that Houston manages to buck trends affecting other central cities is that Houston is orders of magnitude larger than many central cities. Within its incorporated city limits, Houston could contain all of Manhattan, Chicago, San Francisco, Washington DC, Boston, and then have room enough left over for Santa Barbara. That means that Houston contains its first-ring suburbs, most of its second-ring, and even some some third-ring; and then it also does this funky “limited-purpose annexation†scheme in the northwest suburbs and has a special non-annexation deal with The Woodlands to keep those areas as an unincorporated buffer zone from which they are still somewhat able to tap commercial property tax revenues from those areas. And as demographic pressures push and pull people across different regions, Houston has to adapt to all of those trends simultaneously, but it also has a diversified-enough tax base to be able to do so — you know, presuming that its elected officials never do anything especially stupid like capping revenues and also underfunding pensions for decades.” [TheNiche, commenting on North Houston Amazon Fulfillment Center Opens; Qui Now Taking Reservations; Ending the ‘Dry Heights’] Illustration: Lulu

“. . . One of the reasons that Houston manages to buck trends affecting other central cities is that Houston is orders of magnitude larger than many central cities. Within its incorporated city limits, Houston could contain all of Manhattan, Chicago, San Francisco, Washington DC, Boston, and then have room enough left over for Santa Barbara. That means that Houston contains its first-ring suburbs, most of its second-ring, and even some some third-ring; and then it also does this funky “limited-purpose annexation†scheme in the northwest suburbs and has a special non-annexation deal with The Woodlands to keep those areas as an unincorporated buffer zone from which they are still somewhat able to tap commercial property tax revenues from those areas. And as demographic pressures push and pull people across different regions, Houston has to adapt to all of those trends simultaneously, but it also has a diversified-enough tax base to be able to do so — you know, presuming that its elected officials never do anything especially stupid like capping revenues and also underfunding pensions for decades.” [TheNiche, commenting on North Houston Amazon Fulfillment Center Opens; Qui Now Taking Reservations; Ending the ‘Dry Heights’] Illustration: Lulu

Tag: Property Taxes

TREE RULE REVENGE AND OTHER LOCAL REAL ESTATE TARGETS ON JULY’S STATE SPECIAL SESSION HIT LIST  So what all’s on governor Greg Abbott’s to-do list for July’s special legislative session, following the variously dramatic finales to House and Senate business during the normal session last month? Some 19 topics are included in the governor’s shortlist after the maybe-killed-on-purpose sunset legislation (which Abbott has said has to pass before anything else can be done); the extensive extra credit list, he says, is meant to “make [the extra session] count.“ Plopped in the middle of property tax reform, caps on local spending, changes to local permitting processes, and changes to how cities deal with construction project rules: a ban on local tree ordinances — at least, the ones that impact tree-decisions on private property. (Why the sudden focus on what the governor calls “socialistic” plant regulations, which is placed even higher up the list than taking another go at a bathroom bill? The leafy beef seems to stem from Abbott’s own run-in with an Austin tree regulation back in 2012, which didn’t ultimately prevent him from getting rid of a couple of large pecans he wanted to remove, but did slow things down.) [Office of the Texas Governor; previously on Swamplot] Photo: Swamplot inbox

So what all’s on governor Greg Abbott’s to-do list for July’s special legislative session, following the variously dramatic finales to House and Senate business during the normal session last month? Some 19 topics are included in the governor’s shortlist after the maybe-killed-on-purpose sunset legislation (which Abbott has said has to pass before anything else can be done); the extensive extra credit list, he says, is meant to “make [the extra session] count.“ Plopped in the middle of property tax reform, caps on local spending, changes to local permitting processes, and changes to how cities deal with construction project rules: a ban on local tree ordinances — at least, the ones that impact tree-decisions on private property. (Why the sudden focus on what the governor calls “socialistic” plant regulations, which is placed even higher up the list than taking another go at a bathroom bill? The leafy beef seems to stem from Abbott’s own run-in with an Austin tree regulation back in 2012, which didn’t ultimately prevent him from getting rid of a couple of large pecans he wanted to remove, but did slow things down.) [Office of the Texas Governor; previously on Swamplot] Photo: Swamplot inbox

COMMENT OF THE DAY: HOW LONG UNTIL HOUSTON’S FLOODWATERS WASH AWAY THE OIL MONEY?  “But hey, why bother [with impermeable ground cover]? I’m sure this city will continue to grow and prosper and the taxes will still come pouring in, years after it exacerbates its reputation as a flooded-out mess far behind the tipping point. It will make our elected leaders look so smart when the pension system fails anyway because energy companies choose to move to Austin, OKC, DFW and Denver, because they can’t in good conscience relocate people to the flooded mess of our city. Oh wait — you say energy companies would never leave Houston? Remember, the oil companies fled New York decades ago. Recently BP has moved its onshore group to Denver. Exxon is gone to the Woodlands (and lets not pretend that didn’t have anything to do with escaping the hot mess of city hall mismanagement.)” [Tired of flooding, commenting on Where 2 New Buildings and 542 New Surface Parking Spots Could Fit North of Washington Ave.] Illustration: Lulu

“But hey, why bother [with impermeable ground cover]? I’m sure this city will continue to grow and prosper and the taxes will still come pouring in, years after it exacerbates its reputation as a flooded-out mess far behind the tipping point. It will make our elected leaders look so smart when the pension system fails anyway because energy companies choose to move to Austin, OKC, DFW and Denver, because they can’t in good conscience relocate people to the flooded mess of our city. Oh wait — you say energy companies would never leave Houston? Remember, the oil companies fled New York decades ago. Recently BP has moved its onshore group to Denver. Exxon is gone to the Woodlands (and lets not pretend that didn’t have anything to do with escaping the hot mess of city hall mismanagement.)” [Tired of flooding, commenting on Where 2 New Buildings and 542 New Surface Parking Spots Could Fit North of Washington Ave.] Illustration: Lulu

RESIDENTS NEAR SMART FINANCIAL CENTRE: DON’T WANNA LIVE WITH ‘EM, MAYBE CAN’T LIVE WITHOUT ‘EM  Mike Snyder reports from a dead empty plaza at the new Smart Financial Centre in Sugar Land for the Chronicle this week — utilizing the deserted backdrop for some quiet contemplation and speculation regarding the development’s likely ability to draw long-term business. So-called “destination center” projects like Smart Centre and Town Square are “a big part of [Sugar Land’s] long-term financial strategy to broaden our economic base and keep our property taxes low,” city business director Jennifer Mays tells Snyder — but Snyder and others suggest that a lack of nearby residential development may make it harder for Smart Centre to take off the way Town Square has. Snyder also notes that 900 new apartments were originally planned near Smart Centre, but were nixed on account of objections from “residents concerned that renters would increase traffic, crowd schools and damage their suburban lifestyle.” [Houston Chronicle; previously on Swamplot] Photo: Smart Financial Centre

Mike Snyder reports from a dead empty plaza at the new Smart Financial Centre in Sugar Land for the Chronicle this week — utilizing the deserted backdrop for some quiet contemplation and speculation regarding the development’s likely ability to draw long-term business. So-called “destination center” projects like Smart Centre and Town Square are “a big part of [Sugar Land’s] long-term financial strategy to broaden our economic base and keep our property taxes low,” city business director Jennifer Mays tells Snyder — but Snyder and others suggest that a lack of nearby residential development may make it harder for Smart Centre to take off the way Town Square has. Snyder also notes that 900 new apartments were originally planned near Smart Centre, but were nixed on account of objections from “residents concerned that renters would increase traffic, crowd schools and damage their suburban lifestyle.” [Houston Chronicle; previously on Swamplot] Photo: Smart Financial Centre

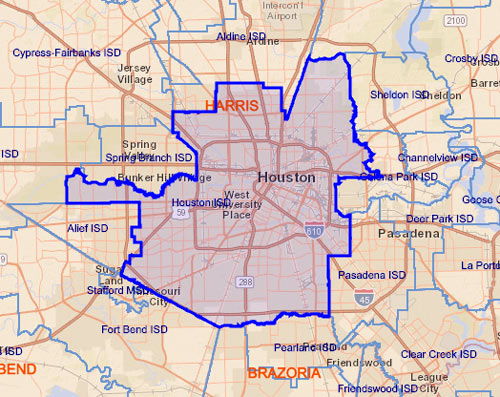

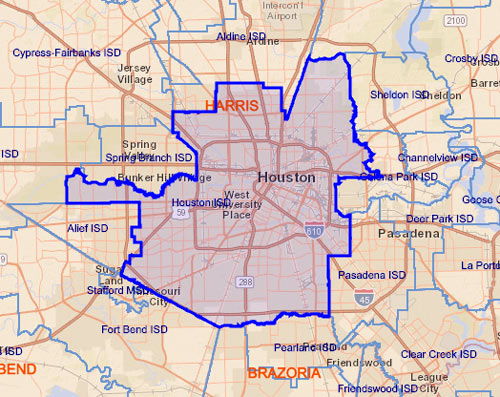

EARLY VOTING OPEN NOW FOR HISD’S SPECIAL MAY 6TH ‘YOU SURE YOU WANNA DO THAT?’ ELECTION  Early voting opened this past Monday and goes through next Tuesday, May 2nd, if you don’t wanna wait for the official May 6th election day to weigh in a second time on HISD Prop. 1. The ballot question, as Andrew Schneider notes this week for Houston Public Media, addresses the same funding recapture proposition that didn’t pass in November (meaning HISD voters opted not to send the state of Texas some $160-ish million in property tax money, as required under the current state education funding system.) The state responded in the spring with a list of $8 billion worth of skyscrapers, malls, refineries, and other properties it could pluck from HISD’s boundaries if the district doesn’t pay up; it also dropped the amount potentially owed this year down to $77.5 million as a nod to potential HISD revenue lost to the city’s homestead exemption. [Houston Public Media; previously on Swamplot] Map of HISD and surrounding school districts: Texas Education Agency District Locator

Early voting opened this past Monday and goes through next Tuesday, May 2nd, if you don’t wanna wait for the official May 6th election day to weigh in a second time on HISD Prop. 1. The ballot question, as Andrew Schneider notes this week for Houston Public Media, addresses the same funding recapture proposition that didn’t pass in November (meaning HISD voters opted not to send the state of Texas some $160-ish million in property tax money, as required under the current state education funding system.) The state responded in the spring with a list of $8 billion worth of skyscrapers, malls, refineries, and other properties it could pluck from HISD’s boundaries if the district doesn’t pay up; it also dropped the amount potentially owed this year down to $77.5 million as a nod to potential HISD revenue lost to the city’s homestead exemption. [Houston Public Media; previously on Swamplot] Map of HISD and surrounding school districts: Texas Education Agency District Locator

A letter up on the website of the Texas Education Agency — addressed to the HISD Board of Trustees and dated to last Thursday — provides what the state organization says is a preliminary list of the high-value Houston properties that might be detached from the district and tacked onto Aldine ISD. The transfer is the proposed response to last fall’s election by HISD residents not to authorize that payment of over-the-per-student-cap property tax revenue to the state for redistribution to other districts. Campaigners had hoped the “no” vote on the resolution would cause the Legislature to look at reforming the state’s education funding scheme (which the state high court raised an eyebrow at last year, but left in place).

On the same day the letter was issued, the HISD board voted to call a new election on the recapture/detachment question; the TEA has also set a lower figure for the district’s initial required payment to the state, in light of the fact that HISD doesn’t collect some potential property tax revenue because of homestead exemption rules. The letter tallies up the marked-for-snagging properties at more than $8.024 billion in total assessment value, and includes the Galleria, the Williams Tower, a slew of downtown office buildings, the CityWestPlace complex near Beltway 8, and 2 refineries. The list itself mentions only addresses and parcel numbers, connected mostly to the buildings below and a number of their associated parking garages:

HISD PROP 1 VOTERS TO STATE: COME AND TAKE IT OR MAYBE DO SOMETHING ELSE INSTEAD  While the Heights Dry Zone was dampened yesterday by a 63-to-36-percent moistening vote for City of Houston Prop. 1, HISD’s non-alcohol-related Prop. 1 was shot down yesterday by about the same margin (62-to-37-percent against). Laura Isensee writes that the measure was on the ballot this year because Houston’s rising property tax values have put it above a wealth threshold requiring it to share revenue into the state’s education funding system, “even if the majority of its students come from low-income households.” Crossing that threshold means the district was asked to send around $162 million this year to be distributed around; the ‘no’ vote however, denied the district permission to send the money the usual way (which no district has ever refused to do before). To get at the funds, the state could redraw the boundaries of HISD to move some higher-tax-value property into other nearby districts — or it could overhaul the education funding system during this year’s legislative session, as that Texas Supreme Court ruling in May strongly recommended (but did not order). Isensee writes that mayor Turner and others who campaigned against the proposition are hoping the vote will spur the Legislature to reform education funding in the upcoming session; lieutenant governor Dan Patrick has already said a special summer session could be called to tackle the issue, while governor Greg Abbott has already said that won’t be necessary. [Houston Public Media] Photo of HISD central office at 4400 West 18th St.: HISD

While the Heights Dry Zone was dampened yesterday by a 63-to-36-percent moistening vote for City of Houston Prop. 1, HISD’s non-alcohol-related Prop. 1 was shot down yesterday by about the same margin (62-to-37-percent against). Laura Isensee writes that the measure was on the ballot this year because Houston’s rising property tax values have put it above a wealth threshold requiring it to share revenue into the state’s education funding system, “even if the majority of its students come from low-income households.” Crossing that threshold means the district was asked to send around $162 million this year to be distributed around; the ‘no’ vote however, denied the district permission to send the money the usual way (which no district has ever refused to do before). To get at the funds, the state could redraw the boundaries of HISD to move some higher-tax-value property into other nearby districts — or it could overhaul the education funding system during this year’s legislative session, as that Texas Supreme Court ruling in May strongly recommended (but did not order). Isensee writes that mayor Turner and others who campaigned against the proposition are hoping the vote will spur the Legislature to reform education funding in the upcoming session; lieutenant governor Dan Patrick has already said a special summer session could be called to tackle the issue, while governor Greg Abbott has already said that won’t be necessary. [Houston Public Media] Photo of HISD central office at 4400 West 18th St.: HISD

COMMENT OF THE DAY: A PROPERTY TAX PROTESTOR’S GUIDE TO HCAD BUILDING GRADES  “There is no process to request that a home be considered an economic misimprovement. When a neighborhood has changed to the point that the original homes are no longer the norm, either by new construction or remodeling, HCAD can deem the remaining original homes as econ improvements.

On to grade — Grade is set when the home is constructed. There is usually a discussion between the builder and the appraisal district as to what level of customization is going into the property as it’s being built. Think of a typical Pulte starter-home as a C+. For every level of better materials or customization, the grade will be increased up to a maximum of X+. This is, for the most part, impossible to change on a permanent basis. Especially after the construction is complete. The key here is to get in either during construction or immediately after. It helps if your home is exactly the same as the rest on the block, but for some reason, your grade is higher. Bring in floor plans and show which houses are similar.

On to Condition/Desirability/Utility (CDU) – This is the one you can play with. A home with a reasonable amount of un-repaired deferred maintenance should be in Average condition. In the old days, all new homes were put on at Excellent condition, but HCAD has since changed that policy and puts most new homes on in Average condition. This is the one you need to work on with signed written repair estimates and pictures. Every year. Big stuff — electric, plumbing, foundation, windows, storm damage, etc.

Finally, Level of Remodel — None, partial, extensive, total, new/rebuilt. This causes a great deal of angst to many people, because there is no real written explanation of what each one is, and how long a remodel actually lasts. There are homes from the early 90s in West U that are still being considered New/Rebuilt, and, as such, are being compared to brand new construction. Additionally, HCAD does not know about every remodel — they only started getting the building permits about 6 years ago. So, your neighbor with the spectacular new kitchen who did it under the table may still be listed as having no remodel. Unless you want to bring in pictures of their kitchen from the last BBQ, there’s not much you can do, other than show that yours is in worse shape than HCAD shows. Additionally, many ARB boards and appraisers have different ideas as to what makes a remodel — putting new cabinet doors up in the kitchen? I’ve seen that called a partial remodel. Replacing knob and tube wiring without increasing capacity to avert a possible fire? I’ve seen that called a repair, and not an improvement.” [BrewWench, commenting on How Do You Get on HCAD’s ‘Cheap’ List?] Illustration: Lulu

“There is no process to request that a home be considered an economic misimprovement. When a neighborhood has changed to the point that the original homes are no longer the norm, either by new construction or remodeling, HCAD can deem the remaining original homes as econ improvements.

On to grade — Grade is set when the home is constructed. There is usually a discussion between the builder and the appraisal district as to what level of customization is going into the property as it’s being built. Think of a typical Pulte starter-home as a C+. For every level of better materials or customization, the grade will be increased up to a maximum of X+. This is, for the most part, impossible to change on a permanent basis. Especially after the construction is complete. The key here is to get in either during construction or immediately after. It helps if your home is exactly the same as the rest on the block, but for some reason, your grade is higher. Bring in floor plans and show which houses are similar.

On to Condition/Desirability/Utility (CDU) – This is the one you can play with. A home with a reasonable amount of un-repaired deferred maintenance should be in Average condition. In the old days, all new homes were put on at Excellent condition, but HCAD has since changed that policy and puts most new homes on in Average condition. This is the one you need to work on with signed written repair estimates and pictures. Every year. Big stuff — electric, plumbing, foundation, windows, storm damage, etc.

Finally, Level of Remodel — None, partial, extensive, total, new/rebuilt. This causes a great deal of angst to many people, because there is no real written explanation of what each one is, and how long a remodel actually lasts. There are homes from the early 90s in West U that are still being considered New/Rebuilt, and, as such, are being compared to brand new construction. Additionally, HCAD does not know about every remodel — they only started getting the building permits about 6 years ago. So, your neighbor with the spectacular new kitchen who did it under the table may still be listed as having no remodel. Unless you want to bring in pictures of their kitchen from the last BBQ, there’s not much you can do, other than show that yours is in worse shape than HCAD shows. Additionally, many ARB boards and appraisers have different ideas as to what makes a remodel — putting new cabinet doors up in the kitchen? I’ve seen that called a partial remodel. Replacing knob and tube wiring without increasing capacity to avert a possible fire? I’ve seen that called a repair, and not an improvement.” [BrewWench, commenting on How Do You Get on HCAD’s ‘Cheap’ List?] Illustration: Lulu

A reader whose new property tax assessment is feeling pressure from all the construction nearby in Brooke Smith writes in with questions about HCAD’s “economic misimprovement” classification. That’s the label HCAD often applies to older houses in neighborhoods where similar structures are being torn down and replaced with new construction. (It’s “an adjustment to the dwelling to limit the remaining building value as the land value increases.”) Writes the homeowner: “I was wondering if my fellow co-readers would have any information about filing your home as an economic misimprovement and how to do so with HCAD. Also, are there any disadvantages of doing so?”

A reader whose new property tax assessment is feeling pressure from all the construction nearby in Brooke Smith writes in with questions about HCAD’s “economic misimprovement” classification. That’s the label HCAD often applies to older houses in neighborhoods where similar structures are being torn down and replaced with new construction. (It’s “an adjustment to the dwelling to limit the remaining building value as the land value increases.”) Writes the homeowner: “I was wondering if my fellow co-readers would have any information about filing your home as an economic misimprovement and how to do so with HCAD. Also, are there any disadvantages of doing so?”

Some background: “I bought my home in 2012; my property taxes from 2011–2012 increased by 40 percent. I prepared a thorough protest, but the ARB essentially denied my protest by comparing my home to the new homes/heavily remodeled homes in the neighborhood.”

More:

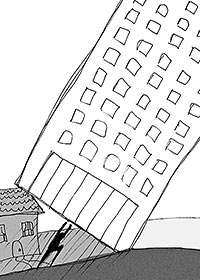

COMMENT OF THE DAY: HOLDING BACK THE ONSLAUGHT ON A GALLERIA MOD  “There’s not too much respect for older architecture in Houston. I own a three family near the Galleria. My building was designed by Neuhaus and Taylor and was featured in ‘Houston and the Mod House.’ The developers are sniffing around trying to make deals for the whole street. I may reach a point of diminishing returns soon and be forced to sell. One of the reasons is that the city keeps raising the property taxes so high in ‘hot’ areas by comparing old buildings to the new ratables and raising the old assessments by thousands at a time. At some point you can’t afford to pay the bills with a density of three units on the property. A developer will come in, buy the whole cul de sac, and put up a tower so he can make a lot more money per sq. ft. from the land than we can. When you protest taxes, HCAD listens and lowers the amount a tiny amount. Thus, the little guy is eventually forced out.” [Gary Andreasen, commenting on Comment of the Day: How Houston Tears Down and Sprawls] Illustration: Lulu

“There’s not too much respect for older architecture in Houston. I own a three family near the Galleria. My building was designed by Neuhaus and Taylor and was featured in ‘Houston and the Mod House.’ The developers are sniffing around trying to make deals for the whole street. I may reach a point of diminishing returns soon and be forced to sell. One of the reasons is that the city keeps raising the property taxes so high in ‘hot’ areas by comparing old buildings to the new ratables and raising the old assessments by thousands at a time. At some point you can’t afford to pay the bills with a density of three units on the property. A developer will come in, buy the whole cul de sac, and put up a tower so he can make a lot more money per sq. ft. from the land than we can. When you protest taxes, HCAD listens and lowers the amount a tiny amount. Thus, the little guy is eventually forced out.” [Gary Andreasen, commenting on Comment of the Day: How Houston Tears Down and Sprawls] Illustration: Lulu

COMMENT OF THE DAY: A LITTLE 411 ON THAT 2010 $6 MILLION 380 SOUTH OF I-10 “For the record, the Ainbinder 380 Agreement did not include drainage detention, they simply tied into existing storm sewer systems — there were no ‘improvements.’ The road was widened at the expense of a tree-lined sidewalk. The sidewalk was ‘abandoned,’ which means ‘is no longer in existence.’ There are no street tree wells and/or no ROW accounted for to plant shade-bearing street trees. The removal of $250K worth of mature Live Oaks resulted in a transfer of this public amenity to Walmart’s parking lot. Yes, that’s right. Public trees were allowed to be replanted on Walmart’s parking lot. And, oh yeah, the four-sided intersection has just two pedestrian signalized crossings. Yes, you can’t actually safely cross on two sides because there are no lights and markings. Why? Because PW&E missed it and the developer didn’t end up having to pay for it. The ‘bridge improvement’ is the biggest boondoggle of them all. Ainbinder wanted to pave it and area civic orgs fought them. Turns out, after coring was performed on the bridge, that the dead load was far greater than known AS A RESULT OF previous paving. That was the second load limit drop. So, Ainbinder window-dressed and spent 380 monies for cosmetic treatments — changing out balustrades and painting A BRIDGE THAT WILL BE TORN DOWN. That is an absurd waste of taxpayer money. Unlike other 380s, the Ainbinder 380 had next to no specifications that ensured deliverables. There were no clawback provisions to ensure public return on the investment. Once the money is awarded to the developer, they can strike or change line items and they still get full payment. The development doesn’t even have to perform to produce new taxes (not just poached taxes), it can be a miserable failure and they still get paid. The folks that were championing this development are now trying to pretend the public infrastructure results were worth $6,000,000 of public money. Guess what? You were wrong then and you’re still wrong now. The proof is right there for everyone to see. Own it.” [TexasSpiral, commenting on Headlines: Getting to the Washington Heights Walmart; Learning Lessons from Hurricane Ike]

HOW TO KEEP PROPERTY TAXES LOW — AT THE TOP  Using figures from a study put together by the Service Employees International Union last year in support of striking janitors, Steve Jansen’s cover story in this week’s Houston Press highlights some spectacular feats of Houston highrise taxcutting: “For the 2011 tax year, if the owners of a class A skyscraper or office complex protested HCAD’s appraised value in front of HCAD’s appraisal review board or district court, they were 77 percent likely to have the value cut (and Âalmost always by millions). By contrast, only 55 percent of owners of single-family homes won their appeals with HCAD.” Total resulting savings on those high-dollar tax bills: $58 million in 2011 alone. This year, HCAD is raising the market valuations on many of the city’s fanciest office buildings by more than 50 percent. But don’t expect those numbers to hold when the companies have lawyers at the ready. For 2012, 70 percent of large downtown commercial office property owners went ahead with property-tax lawsuits against HCAD. [Houston Press] Photo of Wells Fargo Plaza, which through lawsuits and negotiated settlements gained valuation reductions totaling $380 million between 2006 and 2011: Matthew Colvin de Valle [license]

Using figures from a study put together by the Service Employees International Union last year in support of striking janitors, Steve Jansen’s cover story in this week’s Houston Press highlights some spectacular feats of Houston highrise taxcutting: “For the 2011 tax year, if the owners of a class A skyscraper or office complex protested HCAD’s appraised value in front of HCAD’s appraisal review board or district court, they were 77 percent likely to have the value cut (and Âalmost always by millions). By contrast, only 55 percent of owners of single-family homes won their appeals with HCAD.” Total resulting savings on those high-dollar tax bills: $58 million in 2011 alone. This year, HCAD is raising the market valuations on many of the city’s fanciest office buildings by more than 50 percent. But don’t expect those numbers to hold when the companies have lawyers at the ready. For 2012, 70 percent of large downtown commercial office property owners went ahead with property-tax lawsuits against HCAD. [Houston Press] Photo of Wells Fargo Plaza, which through lawsuits and negotiated settlements gained valuation reductions totaling $380 million between 2006 and 2011: Matthew Colvin de Valle [license]

MAYOR PARKER’S PLAN FOR A BIGGER, FRIENDLIER UPTOWN TIRZ  Why not both? Yesterday, Mayor Parker announced a $556 million plan that, if approved by city council on April 24, would fund the seemingly unrelated instead-of-light rail Post Oak BRT and Memorial Park reforestation: Uptown would annex 1,768 acres of property into the TIRZ, and a gradual increase in tax revenue over the next 25 years would help to keep the BRT operational and implement a program of park improvements. Those would include, says Houston Parks and Rec director Joe Turner in a city press release, “erosion control, removal of invasive non-native plants, the reestablishment of native grasslands and forests and facility needs.” Still: Only 36 acres of the property roped in for annexation would be taxable. And does this plan mean that BRT — first thought to be up and running by 2017 — will be delayed? Don’t worry, says Uptown Management District president John Breeding. Besides what will be generated by the more environmentally friendly TIRZ, money for BRT will come from TxDOT and — if approved by a vote on April 26 — Transportation Improvement Program grants from the Houston-Galveston Area Council. [City of Houston; previously on Swamplot] Drawing of Post Oak BRT: Uptown Management District

Why not both? Yesterday, Mayor Parker announced a $556 million plan that, if approved by city council on April 24, would fund the seemingly unrelated instead-of-light rail Post Oak BRT and Memorial Park reforestation: Uptown would annex 1,768 acres of property into the TIRZ, and a gradual increase in tax revenue over the next 25 years would help to keep the BRT operational and implement a program of park improvements. Those would include, says Houston Parks and Rec director Joe Turner in a city press release, “erosion control, removal of invasive non-native plants, the reestablishment of native grasslands and forests and facility needs.” Still: Only 36 acres of the property roped in for annexation would be taxable. And does this plan mean that BRT — first thought to be up and running by 2017 — will be delayed? Don’t worry, says Uptown Management District president John Breeding. Besides what will be generated by the more environmentally friendly TIRZ, money for BRT will come from TxDOT and — if approved by a vote on April 26 — Transportation Improvement Program grants from the Houston-Galveston Area Council. [City of Houston; previously on Swamplot] Drawing of Post Oak BRT: Uptown Management District

COMMENT OF THE DAY: HOUSTON FIRST SKIPS THE BULLY SALES BLOCK “Instead of ‘hoping’ to get residential/retail development on the site, why not REQUIRE such development on the site via deed restrictions or other contractual agreements with the buyer? This is how HISD screwed themselves on the sale of their old administration building. They sold to the highest bidder and ‘hoped’ they would build something like the fancy mixed use rendering they were passing around. Instead we got a Costco and an LA Fitness. When you consider that HISD pockets more than 50 percent of every tax dollar paid by the property, they might have made more money in the long run by GIVING AWAY their land to someone who would have developed it more intensely.” [Bernard, commenting on Headlines: Downtown Block for Sale; Accessing Remote Hermann Park]

COMMENT OF THE DAY: WHAT YOU REALLY MADE ON YOUR HOUSE “. . . Most people say ‘I bought it for x and sold it for y, so I made an (y-x)/x return on my house’ which really isn’t the case. That formula can tell you your total appreciation in market value, but that is not the same as your ROI. To get closer to calculating an accurate nominal return, you need deduct the following from y: total in real estate taxes you paid while you owned the home, total expenses for repairs and maintenance, total amount of insurance premiums, the total interest and fees you paid to a lender before paying off your mortgage, and any commissions you paid to a realtor. You can then add back any income tax benefit you got for deducting your interest payments as well as any income you got from renting out all or part of your property. If you wanted to take things to the next level you could discount these cash flows and also convert nominal dollars to real, but I think even with just doing the above exercise most people will find that they didn’t really make as much money on their house as they think they did, and unless you manage to time your purchase, sale, and hold period just right, home values really have to appreciate significantly each year for the regular homeowner to just break even on it as a pure investment. That said, I think there are a lot of other very good arguments in favor of home ownership, including some financial ones. My point is just that if you bought a house for $100K and sold it 10 years later for $200K, you didn’t actually get a 10% annual return unless your property was tax exempt, you paid cash (and had a separate account set up to hedge inflation and compensate you for the cost of that capital being tied up for ten years), sold it yourself, didn’t buy homeowner’s or flood insurance, and never made any repairs.” [You Didn’t Earn That, commenting on Comment of the Day: What You Inner Loopers Got Wrong]