MONTROSE DISTRICT APPEALING JUDGE’S ORDER TO RETURN $6.6 MILLION IT COLLECTED FROM LOCAL BUSINESSES  The new judge now in charge of the 5-year-old lawsuit against the 6-year-old Montrose Management District earlier this week affirmed the decision announced by his predecessor late last year — that the taxes the group imposed on the West Montrose Management District were not validly assessed, and that all $6.6 million should be returned to its payers — and parceled off a dispute about attorneys’ fees into a separate case. The final judgment clears the way for the district to appeal the ruling in state court, which it did yesterday. “The district stands by its position that it is operating within its legal charter granted by the State of Texas,” a statement put out by the organization reads. “No refunds for assessments collected in the West Montrose Management District (the only portion of the district under dispute in this legal action) will be made, pending the outcome of the current appeal.” [Houston Chronicle; previously on Swamplot] Photo: Montrose Management District

The new judge now in charge of the 5-year-old lawsuit against the 6-year-old Montrose Management District earlier this week affirmed the decision announced by his predecessor late last year — that the taxes the group imposed on the West Montrose Management District were not validly assessed, and that all $6.6 million should be returned to its payers — and parceled off a dispute about attorneys’ fees into a separate case. The final judgment clears the way for the district to appeal the ruling in state court, which it did yesterday. “The district stands by its position that it is operating within its legal charter granted by the State of Texas,” a statement put out by the organization reads. “No refunds for assessments collected in the West Montrose Management District (the only portion of the district under dispute in this legal action) will be made, pending the outcome of the current appeal.” [Houston Chronicle; previously on Swamplot] Photo: Montrose Management District

Tag: Taxes

COMMENT OF THE DAY: A WATERSHED APPROACH TO PAYING FOR FLOOD CONTROL  “. . . I think that if we are going to be realistic about the way that we finance flood control, that the core of such a plan needs to take a page from how flood insurance gets underwritten. Everybody pays a property tax to a watershed-specific flood control entity, but that tax is adjusted based on the elevation of their first-floor living area relative to the Base Flood Elevation. If you’re more than a few feet above it, your tax is very low. If you live more than a few feet below it . . . you’re probably going to pay so much in taxes that it’ll become immediately economic to raise your structure or demolish it. Right away, the inventory and value of property subject to flood risk is reduced; and what’s left that is tolerably at-risk pays for its own reduced need for risk mitigation. And . . . if we’re too gun shy to pull the trigger on a plan like this, which would totally wipe out a lot of people’s equity in vast swaths of real estate, okay well that’s where people not at very much risk should be expected to pay more taxes even without receiving very much in the way of benefits. Yeah, I’m basically proposing Obamacare for flood control in Houston, but only as a humane alternative which reveals a startling truth: that the big money for this sort of thing is unlikely to come from up on high, from the feds or the state government (and it shouldn’t IMO). Financing this stuff locally is going to hurt. One thing is very very clear: whatever kinds of administrative bodies are created or re-jiggered to deal with this issue have got to address legacy development first and foremost. We need a plan to cope with what is already on the ground. This is not something that we can just build ourselves out of, going forward, with stricter rules for new development, feel the catharsis, hold hands and sing Kumbaya, and call it a day.” [TheNiche, commenting on An 8th Wonder Distillery; New Bridges for Brays Bayou; How Apartment Buildings Get On Your Nerves]

“. . . I think that if we are going to be realistic about the way that we finance flood control, that the core of such a plan needs to take a page from how flood insurance gets underwritten. Everybody pays a property tax to a watershed-specific flood control entity, but that tax is adjusted based on the elevation of their first-floor living area relative to the Base Flood Elevation. If you’re more than a few feet above it, your tax is very low. If you live more than a few feet below it . . . you’re probably going to pay so much in taxes that it’ll become immediately economic to raise your structure or demolish it. Right away, the inventory and value of property subject to flood risk is reduced; and what’s left that is tolerably at-risk pays for its own reduced need for risk mitigation. And . . . if we’re too gun shy to pull the trigger on a plan like this, which would totally wipe out a lot of people’s equity in vast swaths of real estate, okay well that’s where people not at very much risk should be expected to pay more taxes even without receiving very much in the way of benefits. Yeah, I’m basically proposing Obamacare for flood control in Houston, but only as a humane alternative which reveals a startling truth: that the big money for this sort of thing is unlikely to come from up on high, from the feds or the state government (and it shouldn’t IMO). Financing this stuff locally is going to hurt. One thing is very very clear: whatever kinds of administrative bodies are created or re-jiggered to deal with this issue have got to address legacy development first and foremost. We need a plan to cope with what is already on the ground. This is not something that we can just build ourselves out of, going forward, with stricter rules for new development, feel the catharsis, hold hands and sing Kumbaya, and call it a day.” [TheNiche, commenting on An 8th Wonder Distillery; New Bridges for Brays Bayou; How Apartment Buildings Get On Your Nerves]

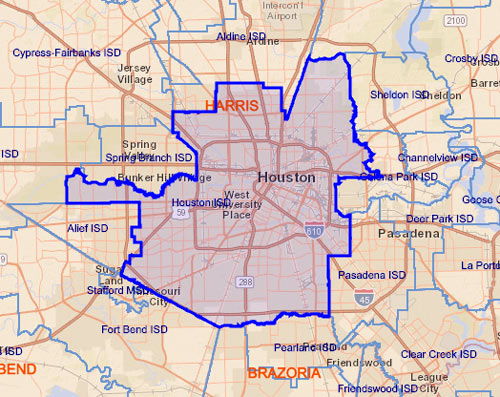

EARLY VOTING OPEN NOW FOR HISD’S SPECIAL MAY 6TH ‘YOU SURE YOU WANNA DO THAT?’ ELECTION  Early voting opened this past Monday and goes through next Tuesday, May 2nd, if you don’t wanna wait for the official May 6th election day to weigh in a second time on HISD Prop. 1. The ballot question, as Andrew Schneider notes this week for Houston Public Media, addresses the same funding recapture proposition that didn’t pass in November (meaning HISD voters opted not to send the state of Texas some $160-ish million in property tax money, as required under the current state education funding system.) The state responded in the spring with a list of $8 billion worth of skyscrapers, malls, refineries, and other properties it could pluck from HISD’s boundaries if the district doesn’t pay up; it also dropped the amount potentially owed this year down to $77.5 million as a nod to potential HISD revenue lost to the city’s homestead exemption. [Houston Public Media; previously on Swamplot] Map of HISD and surrounding school districts: Texas Education Agency District Locator

Early voting opened this past Monday and goes through next Tuesday, May 2nd, if you don’t wanna wait for the official May 6th election day to weigh in a second time on HISD Prop. 1. The ballot question, as Andrew Schneider notes this week for Houston Public Media, addresses the same funding recapture proposition that didn’t pass in November (meaning HISD voters opted not to send the state of Texas some $160-ish million in property tax money, as required under the current state education funding system.) The state responded in the spring with a list of $8 billion worth of skyscrapers, malls, refineries, and other properties it could pluck from HISD’s boundaries if the district doesn’t pay up; it also dropped the amount potentially owed this year down to $77.5 million as a nod to potential HISD revenue lost to the city’s homestead exemption. [Houston Public Media; previously on Swamplot] Map of HISD and surrounding school districts: Texas Education Agency District Locator

WE’VE REACHED CHAPTER 11 IN THE HUNKY DORY, BERNADINE’S STORY  Here’s an update to continuing reports on the financial health of the Treadsack restaurant group, the company behind Heights-area establishments Down House, D&T Drive Inn, Johnny’s Gold Brick, Hunky Dory, Bernadine’s, Foreign Correspondents, and Canard: Mothership Ventures, LLC, an entity owned by Treadsack partner Chris Cusack and — according to Houston Press reporter Craig Malisow, the business entity that operates as Bernadine’s and Hunky Dory — filed for Chapter 11 bankruptcy protection over this past weekend. Foreign Correspondents and its next-door-neighbor bar Canard closed for business in the shopping center at 4721 N. Main St. suddenly at the end of last year; in February, Malisow published a detailed saga of payroll and tax problems behind the shutdown, alleging Treadsack restaurants had become subject to IRS and state liens totaling more than $1.3 million, and that at one point the Texas Comptroller’s office had threatened a seizure of assets at Down House if taxes were not paid. Bernadine’s and Hunky Dory have been operating since late 2015 in a new building constructed for them at the corner of 18th St. and N. Shepherd. Update, 1:30 pm: An investor has filed suit against the owners of Treadsack, the Houston Press now reports. Craig Malisow also notes that the debtor in the bankruptcy filing has been granted funds to pay for the next employee paychecks. Photo: Hunky Dory

Here’s an update to continuing reports on the financial health of the Treadsack restaurant group, the company behind Heights-area establishments Down House, D&T Drive Inn, Johnny’s Gold Brick, Hunky Dory, Bernadine’s, Foreign Correspondents, and Canard: Mothership Ventures, LLC, an entity owned by Treadsack partner Chris Cusack and — according to Houston Press reporter Craig Malisow, the business entity that operates as Bernadine’s and Hunky Dory — filed for Chapter 11 bankruptcy protection over this past weekend. Foreign Correspondents and its next-door-neighbor bar Canard closed for business in the shopping center at 4721 N. Main St. suddenly at the end of last year; in February, Malisow published a detailed saga of payroll and tax problems behind the shutdown, alleging Treadsack restaurants had become subject to IRS and state liens totaling more than $1.3 million, and that at one point the Texas Comptroller’s office had threatened a seizure of assets at Down House if taxes were not paid. Bernadine’s and Hunky Dory have been operating since late 2015 in a new building constructed for them at the corner of 18th St. and N. Shepherd. Update, 1:30 pm: An investor has filed suit against the owners of Treadsack, the Houston Press now reports. Craig Malisow also notes that the debtor in the bankruptcy filing has been granted funds to pay for the next employee paychecks. Photo: Hunky Dory

COMMENT OF THE DAY: WHERE THE RUNOFF TAX FLOWS MATTERS LESS THAN COLLECTING IT  “Just collecting the tax on impermeable surfaces is valuable on its own. It makes landowners think twice about creating (or even keeping) flood-worsening pavement. Where the money goes sort of morally determines whether the fee is a form of legally-imposed direct responsibility for flood costs, or just pure financial disincentive that helps the city with flood costs or whatever else — it would be better with the spending restriction, but I’ll gladly take either one.” [Sid, commenting on City Loses Latest Appeal on 2010 Drainage Fee Election] Map of past, ongoing, and planned drainage and street projects: ReBuild Houston interactive map

“Just collecting the tax on impermeable surfaces is valuable on its own. It makes landowners think twice about creating (or even keeping) flood-worsening pavement. Where the money goes sort of morally determines whether the fee is a form of legally-imposed direct responsibility for flood costs, or just pure financial disincentive that helps the city with flood costs or whatever else — it would be better with the spending restriction, but I’ll gladly take either one.” [Sid, commenting on City Loses Latest Appeal on 2010 Drainage Fee Election] Map of past, ongoing, and planned drainage and street projects: ReBuild Houston interactive map

HISD PROP 1 VOTERS TO STATE: COME AND TAKE IT OR MAYBE DO SOMETHING ELSE INSTEAD  While the Heights Dry Zone was dampened yesterday by a 63-to-36-percent moistening vote for City of Houston Prop. 1, HISD’s non-alcohol-related Prop. 1 was shot down yesterday by about the same margin (62-to-37-percent against). Laura Isensee writes that the measure was on the ballot this year because Houston’s rising property tax values have put it above a wealth threshold requiring it to share revenue into the state’s education funding system, “even if the majority of its students come from low-income households.” Crossing that threshold means the district was asked to send around $162 million this year to be distributed around; the ‘no’ vote however, denied the district permission to send the money the usual way (which no district has ever refused to do before). To get at the funds, the state could redraw the boundaries of HISD to move some higher-tax-value property into other nearby districts — or it could overhaul the education funding system during this year’s legislative session, as that Texas Supreme Court ruling in May strongly recommended (but did not order). Isensee writes that mayor Turner and others who campaigned against the proposition are hoping the vote will spur the Legislature to reform education funding in the upcoming session; lieutenant governor Dan Patrick has already said a special summer session could be called to tackle the issue, while governor Greg Abbott has already said that won’t be necessary. [Houston Public Media] Photo of HISD central office at 4400 West 18th St.: HISD

While the Heights Dry Zone was dampened yesterday by a 63-to-36-percent moistening vote for City of Houston Prop. 1, HISD’s non-alcohol-related Prop. 1 was shot down yesterday by about the same margin (62-to-37-percent against). Laura Isensee writes that the measure was on the ballot this year because Houston’s rising property tax values have put it above a wealth threshold requiring it to share revenue into the state’s education funding system, “even if the majority of its students come from low-income households.” Crossing that threshold means the district was asked to send around $162 million this year to be distributed around; the ‘no’ vote however, denied the district permission to send the money the usual way (which no district has ever refused to do before). To get at the funds, the state could redraw the boundaries of HISD to move some higher-tax-value property into other nearby districts — or it could overhaul the education funding system during this year’s legislative session, as that Texas Supreme Court ruling in May strongly recommended (but did not order). Isensee writes that mayor Turner and others who campaigned against the proposition are hoping the vote will spur the Legislature to reform education funding in the upcoming session; lieutenant governor Dan Patrick has already said a special summer session could be called to tackle the issue, while governor Greg Abbott has already said that won’t be necessary. [Houston Public Media] Photo of HISD central office at 4400 West 18th St.: HISD

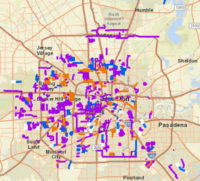

THE 82 SQUARE MILES OF TIRZS SPONGING UP SOME OF THAT REVENUE CAP SPILLOVER  A couple of state senators are mulling over potential reform options for Houston’s ballooning tax increment reinvestment zones, which have more than tripled in area in the past decade according to Mike Morris and Rebecca Elliot’s article in Friday’s Chronicle (which includes a peek-a-boo-style before-and-after slider map for reference).  The zones, shown here on the city’s own map, collected around $109 million dollars of woulda-been property tax money this year for use on development projects inside their boundaries, which (in theory) are supposed to encompass blighted areas in need of an additional redevelopment boost. Morris and Elliot also point out, however, that much of the tax money being collected by TIRZs would be lost altogether if the zones were disbanded at the moment, as the sudden influx would pass Houston’s revenue cap (which limits the amount of cash the city is allowed to collect each year to what was collected in the previous year, scaled up by 4.5% or by inflation and population increases, whichever is less). They also mention that Mayor Turner is pushing for a new vote on the revenue cap in 2017; Turner tells the duo that the city council has stuck with the TIRZ system to make up for some of the potential funds lost by the revenue cap, but notes that “you can only do that for so long without hurting the city as a whole.” [Houston Chronicle; previously on Swamplot] Map of Tax Increment Reinvestment Zones: City of Houston

A couple of state senators are mulling over potential reform options for Houston’s ballooning tax increment reinvestment zones, which have more than tripled in area in the past decade according to Mike Morris and Rebecca Elliot’s article in Friday’s Chronicle (which includes a peek-a-boo-style before-and-after slider map for reference).  The zones, shown here on the city’s own map, collected around $109 million dollars of woulda-been property tax money this year for use on development projects inside their boundaries, which (in theory) are supposed to encompass blighted areas in need of an additional redevelopment boost. Morris and Elliot also point out, however, that much of the tax money being collected by TIRZs would be lost altogether if the zones were disbanded at the moment, as the sudden influx would pass Houston’s revenue cap (which limits the amount of cash the city is allowed to collect each year to what was collected in the previous year, scaled up by 4.5% or by inflation and population increases, whichever is less). They also mention that Mayor Turner is pushing for a new vote on the revenue cap in 2017; Turner tells the duo that the city council has stuck with the TIRZ system to make up for some of the potential funds lost by the revenue cap, but notes that “you can only do that for so long without hurting the city as a whole.” [Houston Chronicle; previously on Swamplot] Map of Tax Increment Reinvestment Zones: City of Houston

This baroque 8th-floor penthouse condo in the Campton at Post Oak building at 4950 Woodway Dr. north of the Galleria has been available for rent at $9,500 a month since last September (marked down from the whopping $11,500 it began with in August). But there a few things you might want to know about the 3,948-sq.-ft. pad before you sign any lease: First, the unit’s owner since 2010 is Minnesota Vikings running back Adrian Peterson — who (in case you’ve been on a news blackout for the last several months) last November pled no contest to charges of “recklessly assaulting” his 4-year-old son with a wooden switch, and was suspended from the NFL for the remainder of the season. Second: Peterson hasn’t been paying his taxes on the property; after court proceedings at which Peterson failed to appear, a tax auction was approved by a district court a few days before Christmas.

COMMENT OF THE DAY: FIRST WE CROWD “. . . those folks thinking Houston would ever actually be capable of creating infrastructure to adequately manage increased density developments are living in a fool’s paradise. you live in a state where voters actively vote against such propositions by favoring no income taxes and keeping the pressure on no property tax increases to fund such transit initiatives. the density will have to come first, that’s a given.” [joel, commenting on Comment of the Day: Bring It On]

ENOUGH SQUARE FOOTAGE TO QUIBBLE OVER “We bought a fairly new house this year. We were all surprised when the appraiser’s square footage was 7 percent (200 square feet) smaller than what they had listed on HAR. Turns out the builder built the original owners a smaller house than they paid for. Some of their original closing documents showed the smaller square footage, but others had the larger number, so we understood why they were confused. We adjusted our offer price based on the revised square footage and called it good. . . . BUT as it turns out [the original owners] had been paying property taxes on the larger square footage. Now it’s our turn to pay the property taxes and I’d like to get the square footage corrected. Our estimate is that we’ll be overpaying by $600 this year if the error isn’t fixed. Unfortunately, I’m reading this information [PDF] from the HCAD website. I’m not sure whether this is a ‘clerical error’ or a ‘substantial error.’ For a substantial error, you apparently can’t protest unless the error causes the property to be over-appraised by more than one third (!). And for clerical errors, they say that inaccuracies in estimation such as estimating the square footage of a house, cannot be changed. I’m guessing I could push this as a clerical error (tell them they must have transposed some numbers when filling in their system). Has anyone done this with success? Or are we just screwed?” [Swamplot inbox; previously on Swamplot]

AMAZON.COM PURCHASES WILL NO LONGER BE TAX-FREE FOR TEXAS  Amazon.com and the State of Texas were able to work out a deal to cover that little $269 million bill for uncollected sales taxes the comptroller’s office sent the online retailer last September. And the result may benefit

Amazon.com and the State of Texas were able to work out a deal to cover that little $269 million bill for uncollected sales taxes the comptroller’s office sent the online retailer last September. And the result may benefit brick-and-mortar stucco-and-Styrofoam retailers throughout the state. Beginning July 1, Amazon will begin charging sales tax on all online purchases shipped to Texas. The company has also promised to invest at least $200 million in Texas, create at least 2,500 new jobs here over the next 4 years, and cough up an undisclosed payment. Early last year, Amazon had threatened to shut down its distribution center outside of Dallas. [Star-Telegram] Photo of Irving distribution center: Kati Drisc/Texas Tribune

COMMENT OF THE DAY: WHO’S PAYING FOR THIS SPREAD? “Ironically, it is GOVERNMENT rules and funding that promotes suburban, space-wasting development. If people had to pay every day for the cost of the roads they use, or for the government-required parking spaces (subsidized by non-car users in the prices they pay), they might think differently. Instead, the [cost] is hidden in catch-all taxes. And, after all, isn;t it a goverment regulation that these developers are trying to waive? . . . The city government, with the support of many Houstonians who see no value in an attractive city, and prefer to retreat indoors, actively makes urbanization difficult, and promotes far-flung developments with miles of expensive infrastructure at taxpayer cost.” [Marco Roberts, commenting on Apartment Building Replacing Tavern on Gray Won’t Have Any Retail, But Really Wants To Hug the Street Anyway]

Galveston Mayor Joe Jaworski now says he will waive the $10 annual permit fees the city had planned on charging 3 homeowners whose dead-tree sculptures stand in the public right-of-way. Homeowner Donna Leibbert started a small local-media firestorm late last week after she received a permit renewal form in the mail for the sculpture of a Geisha that artist Jim Phillips had carved out of an oak tree outside Leibbert’s home at 1717 Ball St. After the Hurricane Ike storm surge killed an estimated 30,000 trees on the island, artists turned almost 2 dozen of them into sculptures. But Leibbert’s Geisha is one of only 3 of the works that sits on city property.

Galveston Mayor Joe Jaworski now says he will waive the $10 annual permit fees the city had planned on charging 3 homeowners whose dead-tree sculptures stand in the public right-of-way. Homeowner Donna Leibbert started a small local-media firestorm late last week after she received a permit renewal form in the mail for the sculpture of a Geisha that artist Jim Phillips had carved out of an oak tree outside Leibbert’s home at 1717 Ball St. After the Hurricane Ike storm surge killed an estimated 30,000 trees on the island, artists turned almost 2 dozen of them into sculptures. But Leibbert’s Geisha is one of only 3 of the works that sits on city property.

City spokesperson Alice Cahill, who has helped to publicize the sculpture program as a tourist attraction, tells Amanda Casanova of the Galveston County Daily News that the license-to-use fee is normally required for any designed object that occupies a portion of the right-of-way. “A carved tree is treated the same as a cafe table.” Leibbert tells Casanova she was aware of the permit requirement at the time the Geisha was carved — getting approval for the sculpture required a formal application with the city’s planning commission. But she notes that the tree had stood in the same position for about 100 years, and for free.

Over the summer, Swamplot photographer Candace Garcia tracked down 22 of the tree sculptures, including Leibbert’s Geisha. Here’s her photo tour:

A COME-FROM-BEHIND VICTORY FOR HOUSTON’S DRAINAGE FUND Surprise! A late flood of support turned the tide for the “Renew Houston” campaign. Proposition 1, the city charter amendment that sets up a separate pool of money for drainage improvements and establishes new taxpayer fees to pay for it, ended up passing by a very narrow margin: a little more than 7,000 votes. The amendment was supported heavily by engineering and construction firms. [Bay Area Citizen]

PROPERTY TAX PROTESTS: DIFFERENT COUNTIES, DIFFERENT RULES Bring up the number of foreclosures and the amount of time properties have been sitting on the market in your neighborhood when you protest your property taxes, and the Harris County Appraisal District will take that evidence into account. But the Fort Bend County Appraisal District won’t. [Houston Press]