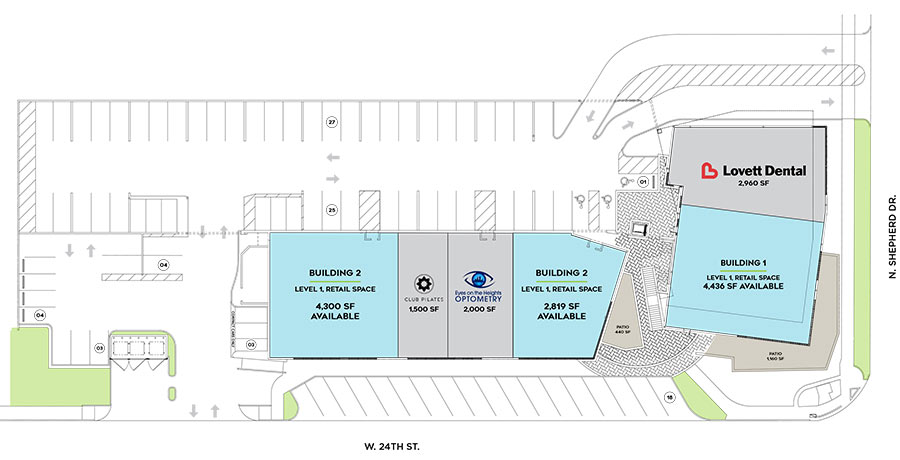

The teeth, eyes, and . . . uh, overall shape of the new shopping center Braun Enterprises is planning for N. Shepherd and 24th St. can be considered taken care of, now that Lovett Dental, Eyes on the Heights Optometry, and Club Pilates have each signed leases for space in the development. That leaves 11,555 sq. ft. still available in 3 separate end-cap spots for any nail salon, podiatrist, or dermatology clinic that wants to fill out the theming for the complex, which would go on the block catty-corner to the H-E-B Heights Market currently under construction.

This would fit in with N. Shepherd’s ongoing transformation: Braun plans to demolish the Miller’s Auto Body Repair Experts facility (as of now still open for business) as well a building formerly occupied by Auto Electric Service on the site in order to construct the 24,000-sq.-ft. shopping center, which includes structured parking as well as a parking lot on the roof of one of the 2 buildings.

A full human-body-part-focused buildout for this planned complex at 2401 N. Shepherd Dr. isn’t so far-fetched: the latest renderings released for the development include generic signage for both a nail salon and a fitness club:

Ralph Bivins explains how it came to pass that the Canada Pension Plan Investment Board, with its now-completed purchase of REIT Parkway, became the owner of 8.7 million sq. ft. of office space in Houston, including Greenway Plaza, CityWest Place, San Felipe Plaza, the Phoenix Tower, and Post Oak Central: “At one time Cousins and Parkway were separate companies with sizable holdings in Houston. The Houston office market tanked when oil fell from a high of $107 a barrel in June 2014 to less than $30 a barrel in early 2016. Houston energy firms laid off thousands of employees and vacated huge chunks of office space. Publicly traded firms with significant portfolios of Houston office space were under pressure. Security analysts criticized them.

Ralph Bivins explains how it came to pass that the Canada Pension Plan Investment Board, with its now-completed purchase of REIT Parkway, became the owner of 8.7 million sq. ft. of office space in Houston, including Greenway Plaza, CityWest Place, San Felipe Plaza, the Phoenix Tower, and Post Oak Central: “At one time Cousins and Parkway were separate companies with sizable holdings in Houston. The Houston office market tanked when oil fell from a high of $107 a barrel in June 2014 to less than $30 a barrel in early 2016. Houston energy firms laid off thousands of employees and vacated huge chunks of office space. Publicly traded firms with significant portfolios of Houston office space were under pressure. Security analysts criticized them.

“ . . . Worth mentioning that 50 percent [vacancy] in Greenspoint versus 26 percent in Houston as a whole tells me a much different story than the one

“ . . . Worth mentioning that 50 percent [vacancy] in Greenspoint versus 26 percent in Houston as a whole tells me a much different story than the one  The deal could still fall through, cautions Ralph Bivins, but real estate development firmÂ

The deal could still fall through, cautions Ralph Bivins, but real estate development firm

Is Michael Graves personally to blame for the

Is Michael Graves personally to blame for the  Deeply embedded Houston real estate reporter Catie Dixon comes back from a panel event sponsored by her employer with a clickworthy account

Deeply embedded Houston real estate reporter Catie Dixon comes back from a panel event sponsored by her employer with a clickworthy account

Billionaire Landry’s CEO Tilman FertittaÂ

Billionaire Landry’s CEO Tilman Fertitta

This 3,848-sq.-ft.

This 3,848-sq.-ft.