HOW A CANADIAN PENSION FUND FOUND ITS WAY TO SWALLOWING A BUNCH OF HOUSTON OFFICE BUILDINGS  Ralph Bivins explains how it came to pass that the Canada Pension Plan Investment Board, with its now-completed purchase of REIT Parkway, became the owner of 8.7 million sq. ft. of office space in Houston, including Greenway Plaza, CityWest Place, San Felipe Plaza, the Phoenix Tower, and Post Oak Central: “At one time Cousins and Parkway were separate companies with sizable holdings in Houston. The Houston office market tanked when oil fell from a high of $107 a barrel in June 2014 to less than $30 a barrel in early 2016. Houston energy firms laid off thousands of employees and vacated huge chunks of office space. Publicly traded firms with significant portfolios of Houston office space were under pressure. Security analysts criticized them. So Cousins and Parkway merged, all of the Houston properties were stripped out and placed into a new company, Parkway Inc. Now, the oil markets have stabilized. Houston’s office market is still soft and vacancies are high, but it appears to be on the road to recovery.” [Realty News Report] Photo of Greenway Plaza: Brent Oldbury, via Swamplot Flickr pool

Ralph Bivins explains how it came to pass that the Canada Pension Plan Investment Board, with its now-completed purchase of REIT Parkway, became the owner of 8.7 million sq. ft. of office space in Houston, including Greenway Plaza, CityWest Place, San Felipe Plaza, the Phoenix Tower, and Post Oak Central: “At one time Cousins and Parkway were separate companies with sizable holdings in Houston. The Houston office market tanked when oil fell from a high of $107 a barrel in June 2014 to less than $30 a barrel in early 2016. Houston energy firms laid off thousands of employees and vacated huge chunks of office space. Publicly traded firms with significant portfolios of Houston office space were under pressure. Security analysts criticized them. So Cousins and Parkway merged, all of the Houston properties were stripped out and placed into a new company, Parkway Inc. Now, the oil markets have stabilized. Houston’s office market is still soft and vacancies are high, but it appears to be on the road to recovery.” [Realty News Report] Photo of Greenway Plaza: Brent Oldbury, via Swamplot Flickr pool

Tag: REITs

COUSINS AND PARKWAY MERGER BETTING ALL AND NOTHING ON HOUSTON’S OFFICE SPACE MARKET  Last week’s merger between real estate investment trusts Cousins Properties and Parkway Properties still resulted in 2 companies, notes Ralph Bivins this morning: the freshly combined firms, keeping the Cousins name, have now moved all of their Houston office holdings (along with nothing else) into a separate trust. The sequestered Houston investments are inheriting the Parkway name (that’s New Parkway, to head off any confusion), as opposed to the originally announced HoustonCo. New Parkway’s properties add up to about 8.7 million sq. ft., including Greenway Plaza (which Cousins bought back in 2013) and 4 other properties in Upper Kirby, Uptown, Tanglewood, and Westchase. Here’s a chance to buy in, Bivins writes, “whether you believe the Houston office market has reached the bottom or not” — noting also that there’s “about 3 million sq. ft. of new buildings still under construction.” [Realty News Report; previously on Swamplot] Photo of 3555 Timmons Ln.: Unilev

Last week’s merger between real estate investment trusts Cousins Properties and Parkway Properties still resulted in 2 companies, notes Ralph Bivins this morning: the freshly combined firms, keeping the Cousins name, have now moved all of their Houston office holdings (along with nothing else) into a separate trust. The sequestered Houston investments are inheriting the Parkway name (that’s New Parkway, to head off any confusion), as opposed to the originally announced HoustonCo. New Parkway’s properties add up to about 8.7 million sq. ft., including Greenway Plaza (which Cousins bought back in 2013) and 4 other properties in Upper Kirby, Uptown, Tanglewood, and Westchase. Here’s a chance to buy in, Bivins writes, “whether you believe the Houston office market has reached the bottom or not” — noting also that there’s “about 3 million sq. ft. of new buildings still under construction.” [Realty News Report; previously on Swamplot] Photo of 3555 Timmons Ln.: Unilev

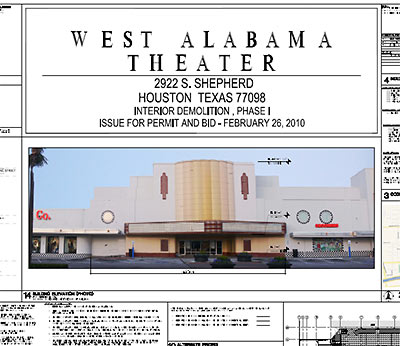

A TRADER JOE’S IN THE ALABAMA THEATER?  3 months ago, Trader Joe’s announced plans to build 10 stores in Texas. But where? A little bird tells Nancy Sarnoff that the California-born grocer is exploring the possibility of taking the vacant Bookstop space in the former Alabama Theater on South Shepherd Dr. No official comment from Weingarten Realty or Trader Joe’s, but Sarnoff notes the theater space’s listed 14,000-or-so sq. ft. is right in the target range for a Trader Joe’s store. The space has been vacant for almost 2 years. [Prime Property; previously on Swamplot] Photo: Chris Adams

3 months ago, Trader Joe’s announced plans to build 10 stores in Texas. But where? A little bird tells Nancy Sarnoff that the California-born grocer is exploring the possibility of taking the vacant Bookstop space in the former Alabama Theater on South Shepherd Dr. No official comment from Weingarten Realty or Trader Joe’s, but Sarnoff notes the theater space’s listed 14,000-or-so sq. ft. is right in the target range for a Trader Joe’s store. The space has been vacant for almost 2 years. [Prime Property; previously on Swamplot] Photo: Chris Adams

Atlanta’s Post Properties has announced that it’s ready to get started with a third phase of its Midtown Square mixed use development, notes Houston’s InnerLooped blog. A rendering of the project on the front cover of a recent company financial report (above) may not be the latest, though — that looks like a 2005 date scribbled in the bottom right corner. The $21.8 million development will include 124 apartments and 10,864 sq. ft. of street-level retail and should begin opening mid-to-late next year, the company says. The apartment units should run a little smaller on average than those in the existing Post Midtown Square complex at 302 Gray St. Post Properties hasn’t responded to our request for details about the development’s exact location, but the rendering appears to show the view looking east from the narrow corner of West Gray and Webster in the Fourth Ward, a few blocks west of Post’s existing outpost of street activity.

- Post Properties Announces First Quarter 2011 Earnings and Development of Post Midtown Square(R) – Phase III in Houston, Texas [Post Properties]

- Post Midtown Phase III [InnerLooped]

- Post Midtown Phase III [HAIF]

Rendering: Post Properties

COMMENT OF THE DAY: CHIN UP, WEINGARTEN! “I don’t totally understand Weingarten’s defensiveness here. After all, they totally earned the wrath of people in the community who would like to see older, architecturally significant buildings preserved in some fashion when they tore down the north side of the shopping center at Shepherd and Gray. They made a calculation then that peoples’ upset feelings would not outweigh the financial benefit. Given this, why do they care what people think now? Did the negative publicity before actually hurt them in any material way? (I’ve made a point of not shopping at the new B&N even though I am a compulsive book-buyer, but I have no illusions that me and people like me have any impact on their bottom line.)” [RWB, commenting on Weingarten Exec Blames Those Alabama Theater Demolition Drawings on Staples]

In a letter published in today’s Chronicle, the PR director for Staples goes beyond her previous “we do not have a lease” statement and says the national office-supply chain is done with the idea of putting one of its stores in the vacant former Alabama Theater on South Shepherd at West Alabama — for now, at least:

. . . we are not currently considering a store at this site. We typically don’t comment about sites unless and until leases are signed, but we understand that this property represents a unique situation of local concern.

So what prompted theater owner Weingarten Realty to have a local architecture firm draw up plans for a complete interior scraping of the 1939 Art Deco theater — and arrange for at least one local construction firm solicit demolition bids based on it?

The new owners of the Alamo Drafthouse Cinema franchises in Katy and at the West Oaks Mall tell the Chronicle‘s Nancy Sarnoff they’ve begun new talks with Weingarten Realty about turning the former Alabama Theater into the first Inside-the-Loop location for the dinner-drinks-and-movie chain.

Triple Tap Ventures partner Neil Michaelsen tells Sarnoff his group had held discussions with Weingarten about the former Alabama Bookstop location at 2922 South Shepherd more than 6 months ago — but “couldn’t come to an agreement” about leasing the space. Triple Tap announced its purchase of the two Houston Alamo Drafthouse locations — and plans to construct new cinema locations in Amarillo, Corpus Christi, Lubbock, the Midland-Odessa area, San Marcos, and Houston — just last October.

Sarnoff explains that the Alabama Theater building isn’t exactly Triple Tap’s ideal location:

COMMENT OF THE DAY: WHAT MAKES THE ALABAMA THEATER SO EASY TO LEASE “Sigh. I’ve been told in the past that Weingarten would like to have a restaurant in this location, but with a rent that is probably in the low-mid 30’s/sf, that puts the monthly rent at around $35,000 a month, which is out of the price range of many retailers and restaurateurs. Also, 14,000 sf would be a huge restaurant. One of the other little discussed obstacles in this building is the balcony, and the low headroom that it provides at the lobby entrance. Most of the building is concrete but I’ve been told that the balcony is in fact a steel structure. I would not be surprised if the balcony does not survive. Regarding the sloped floor, it is extremely difficult to rent sloping space like that in the age of ADA. Bookstop was constructed prior (1984) to the implementation of ADA. . . .” [mt, commenting on Weingarten Realty: We Won’t Demolish the Interior of the Alabama Theater Until a Lease Is Signed]

What’s the latest on those plans to demolish the interior of the Alabama Theater at West Alabama and Shepherd — you know, the plans already put out to bid to subcontractors but that owner Weingarten Realty can’t quite seem to verify are its own?

A spokesperson under contract to Weingarten tells Swamplot that the company won’t act on them before a lease agreement with a new tenant is signed:

I now have the okay to post based on your last blog entry to reassure your readers that WRI has no intention undertaking any pre-buildout of the interior prior to any lease agreement. And, there is no agreement currently and no buildout plan.

“Buildout,” of course, is the correct term for the interior demolition here. Because the demolition plans out to bid show that Weingarten intends to permanently encase the theater’s extensive sloped floor in concrete, like this:

Last night, a spokesperson under contract to Weingarten Realty writing on behalf of the company reported to Swamplot and its readers that the shopping-center owner “can’t verify the authenticity of the drawings” we reported on yesterday.

The drawings referred to are bid documents that Heights Venture Architects prepared for Weingarten detailing an extensive interior demolition of the 70-year-old Art Deco Alabama Theater at South Shepherd and West Alabama — more commonly known until its closing last September as the Alabama Bookstop bookstore.

Well, gee. Today, “an official” of Weingarten’s architecture firm isn’t having such a hard time with the verification process:

An official at Heights Venture Architects told CultureMap this morning that the company did submit plans detailing a near total interior demolition of the Alabama at the specific request of Weingarten (the company that owns the vacant building).

The official at Heights asked not to be named and said he had no speaking authority, but confirmed that the company had been asked to submit the plans, which Swamplot first published.

What a fun game! Now that this round is over, let’s jump to the next one: Okay, so maybe Weingarten did ask its architects to prepare demolition drawings. Maybe Weingarten is exploring all its options! Just pricing a complete demo for . . . say, comparison.

Here’s the same Weingarten spokesperson feeding this ruse:

WEINGARTEN’S SELLOFF CONTINUES The 283,841-sq.-ft. Central Park Northwest off Dacoma St. and the 100,600-sq.-ft. Jester Plaza near Oak Forest are the latest industrial properties to leave the Weingarten Realty fold. And there’s more to jettison: “The company’s vice president/director — industrial properties Kelly Landwermeyer told GlobeSt.com the disposition of the industrial service center on 3500-3582 W. T.C. Jester Blvd. is part of Weingarten’s overall disposition strategy of non-core industrial asset, which includes service centers and flex properties. He says another asset is under contract and scheduled to close within the next few weeks. ‘There are another half-dozen on various pre-contract stages in the pipeline,’ he explains, adding that there are no set deadlines for closings by the end of 2009.” [Globe St.; previously on Swamplot]

A financial blogger going by the overused name of Tyler Durden points to some fishy behavior on the part of banks promoting a new stock offering by troubled Weingarten Realty. Writes the reader who alerted Swamplot to the story:

This may be a bit too finance-y for you, but apparently a recent Weingarten equity offering is being used to pay down debt to banks, which the author of this post (and me) find a bit suspicious. Further shenanigans? Analyst recommendations changing for the better just before the tender.

Is this too finance-y for Swamplot? Let’s find out!

AND WHAT ABOUT THE RIVER OAKS SHOPPING CENTER? His company’s stock down more than 70 percent since last year and the 2009 calendar wiped clean of all new development projects, Weingarten Realty president and CEO Drew Alexander tells analysts and investors the REIT is gonna survive. “The key to the survival? An increase in cash on the balance sheet and a continued ‘focus on tenants that sell basic goods and services,’ Alexander commented. Those tenants include grocery stores, dry cleaners, quick-serve restaurants and value chains such as Ross, Marshall’s and TJ Maxx.” [Globe St.]

Morgan Stanley, having swallowed Crescent Real Estate Equities near the peak of the market last year, is having a little trouble digesting the REIT.

The Wall St. Journal reports that one of the Crescent properties Morgan Stanley is ready to spit out is . . . Greenway Plaza. An article by reporters Lingling Wei and Aaron Lucchetti finds a July estimate of $826 million for the 10-building complex.

- Morgan Stanley’s Waning Crescent [Wall St. Journal, via Swamplot Inbox]

Photo: Flickr user ShinyCrazyDiamond

Worried that all those big-money real-estate investors have turned the Texas landscape into an unending sprawl of soulless shopping centers populated by the same boring chain stores?

Well, worry no longer! That’s right: Now even small investors can get in on the act!

As of this month, a new company called Nexregen will let even grumpy, middle-income sprawl curmudgeons put their money where their mouth is—by investing in shopping centers, strip malls, and other commercial real estate with as little as $2500.

For now, the options are limited: Nexregen is for Texas investors only, and there’s only one property available so far: the 14.5-acre, 148,870-square-foot Firewheel Village Shopping Center in the sprawling Dallas satellite of Garland, Texas, pictured above.

Yes, it’s a REIT, but you’re investing in a single property at a time. And that’s a pretty small minimum investment. If you think Houstonians aren’t proud enough of their commercial strips—or that there aren’t enough of them—just wait until Nexregen sells property here!

- For Ray Wirta, Thinking Small May Be Next Big Thing [CoStar Group]

- Nexregen