COMMENT OF THE DAY: AT THE EDGE OF EXEMPTION “Churches and private education getting a pass on property taxes is just wrong wrong wrong. it opens up too many loopholes. things become clouded, like when 2nd baptist buys the adjacent shopping center. they own it, they operate a portion of it for church activities, does that take the entire property off the tax roles? That’s easily a $20MM property now not part of COH taxes, and yet using an unusually high pro-rata portion of traffic control, road maintenance since the remaining businesses there are high traffic. another example — i want to buy a piece of real estate. i start a ‘church’ and then buy it. i now have a free hold on a piece of dirt forever, don’t I? . . . private schools and universities are no different. st agnes now has taken a 4 corners hard corner off the tax roll @ bellaire/fondren so they can have athletic fields, and theoretically could continue to take in the same manner forever. who is to say a board member there wouldn’t buy/BTS a building for them, then pass on the effective tax savings through a long-term cheap rent deal??? HBU – same thing. the list goes on and on.” [HTX REZ, commenting on There Was a Church, and There Went the Steeple]

Taxes

COMMENT OF THE DAY: WHAT’S WORTH THE EFFORT “The system IS biased against low-value properties. There’s not a great deal of incentive to even file protest on a $40k mobile home, but there’s plenty of incentive to litigate the value of a downtown highrise in district court; and by that time, the highrise has had three bites at the apple. I’m not sure that there’s an easy solution to the inequity, though. Mass appraisal is a blunt tool by its very design. The right of protest allows for some of the rough edges to be smoothed out.” [TheNiche, commenting on The Office Building Appraisal Discount]

THE OFFICE BUILDING APPRAISAL DISCOUNT  “Across the city, prime office buildings are selling for far more than their tax values, leaving billions in potential tax revenue on the table at a time when city and county budgets are stretched,” writes business columnist Loren Steffy. “It’s almost as if there’s two sets of books: one for the buyers and sellers, and one for the tax man. A random sample of more than 40 office buildings that sold in the past five years found 2011 appraisals trailing market value by about 40 percent, or more than $1.6 billion in unrecognized taxable value.” A state law prohibits county appraisers from taking into account certain “intangibles” — including leases and occupancy rates — in valuing commercial property. [Houston Chronicle, via Off the Kuff] Photo of Heritage Plaza: Waymarking

“Across the city, prime office buildings are selling for far more than their tax values, leaving billions in potential tax revenue on the table at a time when city and county budgets are stretched,” writes business columnist Loren Steffy. “It’s almost as if there’s two sets of books: one for the buyers and sellers, and one for the tax man. A random sample of more than 40 office buildings that sold in the past five years found 2011 appraisals trailing market value by about 40 percent, or more than $1.6 billion in unrecognized taxable value.” A state law prohibits county appraisers from taking into account certain “intangibles” — including leases and occupancy rates — in valuing commercial property. [Houston Chronicle, via Off the Kuff] Photo of Heritage Plaza: Waymarking

STUDEMONT KROGER AIMS FOR A CITY TAX DEAL A couple of news bits about the new grocery store Kroger is planning for an 8.5-acre site it purchased in February at 1400 Studemont, just south of I-10 and just north of the Arne’s Warehouse and Party Store: It’ll measure 79,000 sq. ft., and will have a gas station. Plus, Chris Moran reports, Houston’s city council will consider sales and property tax reimbursements to the company of as much as $2.5 million. The proposed deal would require the company to create 170 jobs at the location for 13 years and donate $40,000 for improvements to Olivewood Cemetery across the street. [Houston Politics; previously on Swamplot]

DEATH, ABANDONED FEEDER ROAD STRIP MALLS, AND TAXES IN SHERWOOD OAKS  Craig Malisow tries to unravel the ownership mystery behind the abandoned strip center that serves as a rather dilapidated Katy Freeway-facing welcome sign for 2010 Swamplot Award runner-up Sherwood Oaks: “The owner listed on the Harris County Appraisal District is J.E. Eisemann III, who died in 1981. Interestingly, he seems to have purchased the property in 1988. Apparently, HCAD inherited this information from the Harris County Tax Assessor’s Office, which never had any problem with a dead owner, because the dude, while dead, was paying his taxes. But in 2010, death caught up with Eisemann, and he missed some payments to a few taxing districts, including Spring Branch ISD. When that district sued, it listed Eisemann’s kin as defendants. . . . The estate promptly paid more than $20,000 in back taxes, and now appears to be current.” [Hair Balls; original MyFox Houston story; previously on Swamplot] Photo: MyFox Houston

Craig Malisow tries to unravel the ownership mystery behind the abandoned strip center that serves as a rather dilapidated Katy Freeway-facing welcome sign for 2010 Swamplot Award runner-up Sherwood Oaks: “The owner listed on the Harris County Appraisal District is J.E. Eisemann III, who died in 1981. Interestingly, he seems to have purchased the property in 1988. Apparently, HCAD inherited this information from the Harris County Tax Assessor’s Office, which never had any problem with a dead owner, because the dude, while dead, was paying his taxes. But in 2010, death caught up with Eisemann, and he missed some payments to a few taxing districts, including Spring Branch ISD. When that district sued, it listed Eisemann’s kin as defendants. . . . The estate promptly paid more than $20,000 in back taxes, and now appears to be current.” [Hair Balls; original MyFox Houston story; previously on Swamplot] Photo: MyFox Houston

Property-tax assessments dropped overall in Harris County this year, but a reader in Montgomery County writes in to brag about the remarkable rise in value her small neighborhood in The Woodlands experienced over the same period: Assessments for a group of 42 homes in the Village of Panther Creek went up by a minimum of 80 percent over last year’s values. To get a taste of the boom, our reader suggests, try a search for “Wedgewood Glen” on the MCAD website. The datasheets for any of the properties listed will show the appraisal history. “With increases like that, The Woodlands may be the hottest real estate market in the country,” she writes. And she says she’s ready to sell her 30-something-year-old home now — if she can get anyone to buy her home at the price the county assessor says it’s worth.

Property-tax assessments dropped overall in Harris County this year, but a reader in Montgomery County writes in to brag about the remarkable rise in value her small neighborhood in The Woodlands experienced over the same period: Assessments for a group of 42 homes in the Village of Panther Creek went up by a minimum of 80 percent over last year’s values. To get a taste of the boom, our reader suggests, try a search for “Wedgewood Glen” on the MCAD website. The datasheets for any of the properties listed will show the appraisal history. “With increases like that, The Woodlands may be the hottest real estate market in the country,” she writes. And she says she’s ready to sell her 30-something-year-old home now — if she can get anyone to buy her home at the price the county assessor says it’s worth.

COMMENT OF THE DAY: WHO’S PAYING FOR THIS SPREAD? “Ironically, it is GOVERNMENT rules and funding that promotes suburban, space-wasting development. If people had to pay every day for the cost of the roads they use, or for the government-required parking spaces (subsidized by non-car users in the prices they pay), they might think differently. Instead, the [cost] is hidden in catch-all taxes. And, after all, isn;t it a goverment regulation that these developers are trying to waive? . . . The city government, with the support of many Houstonians who see no value in an attractive city, and prefer to retreat indoors, actively makes urbanization difficult, and promotes far-flung developments with miles of expensive infrastructure at taxpayer cost.” [Marco Roberts, commenting on Apartment Building Replacing Tavern on Gray Won’t Have Any Retail, But Really Wants To Hug the Street Anyway]

HCAD TAX PROTEST SETTLEMENT PROTEST The largest property-tax consultant in the state agreed last November to an $800,000 settlement with the attorney general’s office that requires it to pay a penalty to the Texas Department of Licensing and Regulation, restricts some of the company’s business practices, and establishes a restitution fund for clients. But the agreed judgment doesn’t require O’Connor & Associates to admit any wrongdoing. A 2-year-old lawsuit alleged that the company routinely represented thousands of taxpayers in property-tax protests without their consent, failed to appear at some clients’ appraisal hearings, submitted documents that were “fraudulently notarized,” and failed to file more than 11,000 legally required client forms to the Harris County Appraisal District. Company president Patrick O’Connor denies the charges, and tells the HBJ‘s Jennifer Dawson his company was picked on by HCAD because it is big and aggressive: “The firm filed 150,000 to 160,000 protests in 2010, at least seven times the volume of its next closest competitor, O’Connor said. ‘Yes, we do make mistakes, but the percentage is a very low percentage. . . . It’s about four per 1,000 hearings that we did.’†[Houston Business Journal; consumer alert]

Got a question about something going on in your neighborhood you’d like Swamplot to answer? Sorry, we can’t help you. But if you ask real nice and include a photo or 2 with your request, maybe the Swamplot Street Sleuths can! Who are they? Other readers, just like you, ready to demonstrate their mad skillz in hunting down stuff like this:

Some answers to your questions!

- Riverside Terrace: Homeowner and eternal contractor Charlie Fondow told the Houston Press back in 2001 that his continually expanding house on Wichita St. just east of 288, where he’s lived since 1980, “is the love of my life. I don’t know how to live in a house that’s finished.” Clair de Lune comments on his towering and turreted Queen Anne show:

I wonder how Charlie is doing these days, and (since the story doesnt mention a family) what will happen to the house after he’s gone. I also wonder if the interior is as interesting as the exterior? It might be time for a follow-up.

Hey, all you local journalist types who use Swamplot as a tip sheet: How about it?

- Willowbend: Commenter Sihaya explains that the horses gently grazing under the high-voltage power lines in the easement west of Stella Link below the South Loop are the animal benefactors of agricultural-use leases set up by Houston’s power company in order to lower its property taxes:

Longtime Houston Heights resident Ivan Reyna tells Fox 26 reporter Isiah Carey that his family can no longer afford the 3-bedroom 1920 bungalow on Arlington St. his father bought for $18,000 — 37 years ago.

Across from the Reynas are two million dollar homes. Just down the block is another house that sold for $600,000. And that’s the problem. Reyna says as a result of the revitalization of the Heights he can’t afford his father’s dream any more. Ivan says, “the taxes have gone up 100% since they started building the mansions.”

HCAD records show the appraised value on the home has increased almost 40 percent over the last five years alone.

Ivan says they’re hoping to get at least $250,000 for their aging home as is. He knows potential buyers are not interested in the small structure to live in. Many of the newcomers want to shop around, buy the land, and tear down the structure.

Reyna says he’s alright with that. He, his sister, and older brother are hoping to make enough off the sale to move down to the Valley where Papa is. He says there they can get 5 acres of land for a cool $90,000.

Photo: Isiah Carey

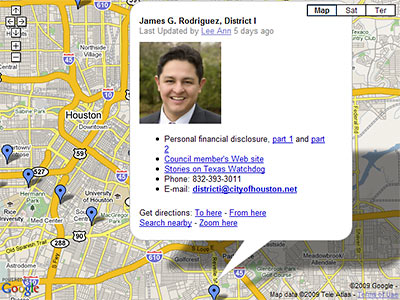

Texas Watchdog has released an interactive map that links to the financial disclosure statements of Houston’s city council members, including Mayor White. Each disclosure, which covers calendar year 2008, includes an accounting of real estate holdings by officials and their spouses — along with the usual stocks and bonds and mutual funds and business interests stuff.

Unfortunately, the map itself appears to note only the council members’ primary residences — not any strip centers, spec McMansions, apartment complexes, land grants, or tool sheds that might be lurking in their portfolios. For those goodies (if any), you’ll need to poke through the linked personal financial statements.

The statements, which state law requires council members to complete, are broken into 2 segments; real estate holdings are listed at the end of the first. Of course, for the more sophisticated investors in the City Council crowd, the more interesting properties are likely to be held under the name of some sort of business entity — like, say M/A Khan Holdings LP. You’ll find that sort of info in part 2.

COMMENT OF THE DAY: MINING THE TAX RECORDS “Here’s my method to determine medium-term appreciation rates: 1. Look up a given house in HCAD.org. Make note of the current year’s appraised value. 2. Click the View link for the Harris County Tax Records. 3. Click the “View 15 year tax/value history†link on the following page. 4. On the graph on the following page, hover your mouse over the year farthest back (e.g. 1993). 5. Find the percentage difference between the appraised value from the current year and the appraised value from the year farthest back, and there’s your medium-term appreciation rate. It’s a quick and dirty method, but it really opened my eyes to the areas that are the best investments from a financial standpoint.” [Alan, commenting on Baby Needs a New Pair of Schools]

COMMENT OF THE DAY: THE LOW PRICE OF HIGH PROPERTY TAXES “Houston is pretty affordable overall. However, people like to make statements about how affordable the city is and say ‘Prices are low because of __________.’ My point is, property prices are low for a lot of reasons. One of the reasons is that property taxes are high.” [Andrew Burleson, commenting on Houston Home Values: The Property Tax Effect]

HOUSTON HOME VALUES: THE PROPERTY TAX EFFECT A few of Andrew Burleson’s conclusions from a comparison of property taxes in Houston, Chicago, L.A., and New York: “When a person buys a $200,000 home in Houston they’re actually making payments worth $273,000 including taxes. When a person in Los Angeles buys a house for $200,000 they’re making payments worth $235,000. It costs the person in LA the equivalent of $37,000 less to obtain the same loan. . . . The greatest irony here is how this plays out at the high end of the market. Because our taxes are so high, the cost to own valuable property becomes significantly higher here. . . . What you can see in the chart is how the actual cost to own a property is much higher than the real value of the property, and how this gap becomes larger as a property increases in value. For instance, if you have enough cash flow to make payments worth $200,000, you can only actually afford about a $150,000 home in Houston. As you look up the scale the difference becomes more ridiculous. $750,000 worth of cash flow actually gets you $550,000 worth of property in Houston – that’s $200,000 in value lost to property taxes. Therefore, if you’re rich, and you’re planning on buying a mansion, you’re better off living in Los Angeles or New York.” [NeoHouston]

LETTING THE TIRZS FLOW Work on public improvements connected to the 4-million-sq.-ft. Regent Square project in North Montrose will begin by October, and work on the actual development will begin by a year later, according to an agreement approved by city council yesterday. GID Urban Development Group, the project’s developers, will be reimbursed for $10 million of its work on public streets and sidewalks through the Memorial Heights TIRZ. What’s next? “[Mayor] White said he generally has shied away from such public-private development efforts, but would continue to review opportunities on a case-by-case basis for distressed properties, such as Sharpstown Mall, and for other major projects already in the works that have been delayed or canceled amid the national economic crisis. . . . The mayor made note of a number of properties to which he hopes to attract developers, including in the Leland Woods TIRZ near Homestead Road and East Little York, the Near Northside TIRZ immediately north of downtown Houston, and in the Fifth Ward TIRZ. Other potential incentive packages may not be administered through a TIRZ, he added.” [Houston Chronicle; previously in Swamplot]