INDICTMENTS BRING LE MERIDIEN HOTEL RENNOVATOR’S INTERSTATE KICKBACK SCHEME TO LIGHT  A construction boss who oversaw work to turn the Melrose Building on the corner of Walker and San Jacinto into the new-ish Le Meridien Hotel has been indicted for his role in a scam to embezzle $3.4 million from his employer — The Beck Group — during its renovation of the structure. “[Moses] Said was picked to manage construction at the Le Meridien Hotel from 2016 to 2017,” reports the Chronicle‘s Gabrielle Banks. “Prosecutors say he turned in fake invoices he had signed off on asking the Beck Group to pay for services that were never provided. After the fake contractors received money from Said, they kicked back some of the illegal proceeds to Said, according to court documents.” Also named in the indictment: 8 co-conspirators across multiple states who worked with Said as part of the scheme. The 225-room hotel opened in late 2017 after roughly 2 years of work. [Houston Chronicle; previously on Swamplot] Photo of Le Meridien Hotel: apvossos

A construction boss who oversaw work to turn the Melrose Building on the corner of Walker and San Jacinto into the new-ish Le Meridien Hotel has been indicted for his role in a scam to embezzle $3.4 million from his employer — The Beck Group — during its renovation of the structure. “[Moses] Said was picked to manage construction at the Le Meridien Hotel from 2016 to 2017,” reports the Chronicle‘s Gabrielle Banks. “Prosecutors say he turned in fake invoices he had signed off on asking the Beck Group to pay for services that were never provided. After the fake contractors received money from Said, they kicked back some of the illegal proceeds to Said, according to court documents.” Also named in the indictment: 8 co-conspirators across multiple states who worked with Said as part of the scheme. The 225-room hotel opened in late 2017 after roughly 2 years of work. [Houston Chronicle; previously on Swamplot] Photo of Le Meridien Hotel: apvossos

Fraud

Back in January of this year, the bankruptcy trustee assigned to colorful imploded homebuilder Royce Homes obtained a $9.3 settlement from Amegy Bank for the bank’s role in what attorneys called a $39 million conspiracy — to swindle creditors by draining the collapsed builder’s bank accounts shortly before Royce shut down and was declared bankrupt, in 2008. A separate settlement with Royce Builders’ founder, Michael Manners, was reached in March. And earlier this month, a jury in federal court returned a $27 million verdict against Royce’s former CEO, John Speer, for his role in the escapade. (Back in March, an earlier jury had ended up deadlocked on a number of charges.)

Back in January of this year, the bankruptcy trustee assigned to colorful imploded homebuilder Royce Homes obtained a $9.3 settlement from Amegy Bank for the bank’s role in what attorneys called a $39 million conspiracy — to swindle creditors by draining the collapsed builder’s bank accounts shortly before Royce shut down and was declared bankrupt, in 2008. A separate settlement with Royce Builders’ founder, Michael Manners, was reached in March. And earlier this month, a jury in federal court returned a $27 million verdict against Royce’s former CEO, John Speer, for his role in the escapade. (Back in March, an earlier jury had ended up deadlocked on a number of charges.)

According to reporting by Law360’s Jeremy Heallen, the charges stemmed from what the attorneys claimed amounted to an off-the-books leveraged buyout of Royce Homes. In 2006, Speer bought Manner’s 50 percent stake in the Royce Homes for $33 million, to give himself complete ownership of the homebuilder. Though the funds used to finance the purchase (including a $20 million personal loan from Amegy Bank) were borrowed in Speer’s own name, Speers, Manners, and Amegy came to an understanding that Royce Homes would ultimately be responsible for paying them off, the suit claimed. The purpose of the scheme, according to the claims, was to keep the loans off of Royce Homes’s financial statements, because doing so would have “wiped out most of the homebuilder’s equity and caused lenders to shut down vital credit lines,” Heallen reports.

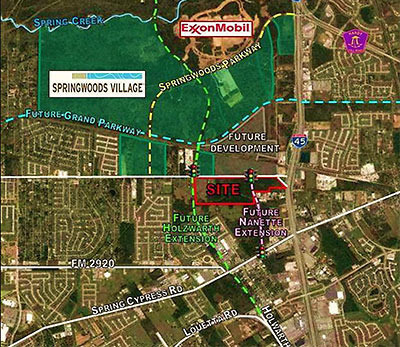

Doug Britton thought he had the deal of a lifetime: a contract to buy 101 acres of land (in red on the map) just south of the spot in Spring where — it was rumored at the time — ExxonMobil planned to develop a new corporate campus. And it was available for cheap: just $5 million. Britton contacted two brokers at Bandier Partners to help him move on it.

COMMENT OF THE DAY: EMPLOYEE OF THE MONTH? “In front of this building, to the right of the staircase, there used to be a sign that said ‘witch parking.’ Not sure why . . .” [Bill, commenting on The Feds Go After Houston’s Allied Home Mortgage]

A decade-long scheme of systemic fraud by Houston-based Allied Home Mortgage Capital Corp. cost taxpayers $834 million in insurance claims on defaulted loans and forced thousands of the company’s customers to lose their homes through mortgages that were “doomed to fail,” according to a lawsuit filed by a former branch manager of the company and which the U.S. government officially joined yesterday. Allied Home, which is based in offices at 6110 Pinemont Dr. (above) off the Northwest Fwy. not far from Houston’s new FBI HQ, claims to be the largest privately held mortgage company in the country (99 percent of the company is owned by founder Jim Hodge), with 200 branches, down from a high of 600. Separately, the company has now been suspended from issuing any FHA-backed loans or GNMA-backed mortgage securities.

Whatever happened to that Park 8 condo tower, hospital, and strip-mall development planned for Beltway 8 next to Arthur Storey Park, just south of Bellaire Blvd.? The Chronicle‘s Purva Patel surveys the wreckage of the self-styled “Land of Oz”: The highrise project has long been in bankruptcy, the contractor and lender are battling over ownership of the land in court, and 2 different groups of investors and condo buyers are suing developer David Wu for their investment losses (totaling more than $2 million), alleging he has or had no intention or ability to complete the project, and that he misled them about funding and leasing commitments. Neither Wu nor his attorney would respond to the reporter’s questions.

NO MONEY DOWN — YOUR GOOD NAME IS YOUR CREDIT! For 3 years in Houston, Claymon Trammell pitched “an investment where the straw borrowers would not need any money down, would not be responsible for the monthly payments and would get money for the use of their name and credit.” Any takers? Sure: enough to allow Trammell, his wife, and daughter to swing “purchases” of more than 70 Houston-area homes — 17 in the name of a single repeat customer. There were payment defaults on every home, and most of them wound up in foreclosure, according to the feds. On Tuesday, the family of mortgage-loan officers from Manvel and Katy pled guilty together to conspiracy to commit wire fraud. [FBI]

The longtime owners of the now-shuttered original Otto’s Bar B Que and Hamburgers on Memorial Dr. filed suit on Tuesday against their former broker, Cushman & Wakefield executive director David Cook, claiming that he failed to let them know about several offers to buy their property. As a result, the lawsuit claims, the owners ended up selling their real-estate holdings for — and settling into retirement with — only a third of the money they might have otherwise received. Marcus and June Sofka originally listed their restaurant at 5502 Memorial Dr. and some adjacent property with Cook in August 2007. Two months later, according to the suit, the Ponderosa Land Development Co. submitted a written offer for the land to Cook for $105 a sq. ft. But the Sofkas claim they didn’t hear about that offer until much later. Why wouldn’t Cook have given them such good news?

HARTS GOING, GOING, GOING . . . TO PRISON  Auctioneers and swindlers Jerry and Wynonne Hart will begin serving their 14-year prison sentences “within days,” after an appeals court reversed a decision that would have given the former owners of the Hart Galleries on South Voss a new trial. The Harts pled guilty to “misapplication of fiduciary property” 2 years ago, in return for prosecutors dropping theft and money-laundering charges against them. Prosecutors claim the Harts sold customers’ goods at auction but regularly underpaid or otherwise finagled their way out of distributing the proceeds. [Houston Chronicle; previously on Swamplot] Photo: Hart Galleries

Auctioneers and swindlers Jerry and Wynonne Hart will begin serving their 14-year prison sentences “within days,” after an appeals court reversed a decision that would have given the former owners of the Hart Galleries on South Voss a new trial. The Harts pled guilty to “misapplication of fiduciary property” 2 years ago, in return for prosecutors dropping theft and money-laundering charges against them. Prosecutors claim the Harts sold customers’ goods at auction but regularly underpaid or otherwise finagled their way out of distributing the proceeds. [Houston Chronicle; previously on Swamplot] Photo: Hart Galleries

Last Friday, a former St. Anne’s Catholic School P.E. teacher named Jonathan Barnes pled guilty to 4 counts of federal charges in connection with a multimillion-dollar oil-trading kickback scheme. What does the Bellaire resident have to do with the 360 Sports Lounge on Washington Ave? The plea agreement he signed last week spells it out: His investment in the bar was a kickback itself, one of many gifts given to him by his 2 alleged co-conspirators, to thank him for overcharging his employer, Houston Refining (now a part of LyondellBasell) by as much as $82 million for shipping contracts he arranged with their companies.

Last Friday, a former St. Anne’s Catholic School P.E. teacher named Jonathan Barnes pled guilty to 4 counts of federal charges in connection with a multimillion-dollar oil-trading kickback scheme. What does the Bellaire resident have to do with the 360 Sports Lounge on Washington Ave? The plea agreement he signed last week spells it out: His investment in the bar was a kickback itself, one of many gifts given to him by his 2 alleged co-conspirators, to thank him for overcharging his employer, Houston Refining (now a part of LyondellBasell) by as much as $82 million for shipping contracts he arranged with their companies.

Why might Barnes have figured that a new Washington Ave sports bar would be a good investment? Well, his stint at Enron in the early 1990s had given him a solid business background.

HCAD TAX PROTEST SETTLEMENT PROTEST The largest property-tax consultant in the state agreed last November to an $800,000 settlement with the attorney general’s office that requires it to pay a penalty to the Texas Department of Licensing and Regulation, restricts some of the company’s business practices, and establishes a restitution fund for clients. But the agreed judgment doesn’t require O’Connor & Associates to admit any wrongdoing. A 2-year-old lawsuit alleged that the company routinely represented thousands of taxpayers in property-tax protests without their consent, failed to appear at some clients’ appraisal hearings, submitted documents that were “fraudulently notarized,” and failed to file more than 11,000 legally required client forms to the Harris County Appraisal District. Company president Patrick O’Connor denies the charges, and tells the HBJ‘s Jennifer Dawson his company was picked on by HCAD because it is big and aggressive: “The firm filed 150,000 to 160,000 protests in 2010, at least seven times the volume of its next closest competitor, O’Connor said. ‘Yes, we do make mistakes, but the percentage is a very low percentage. . . . It’s about four per 1,000 hearings that we did.’†[Houston Business Journal; consumer alert]

Will the rumored reality TV show featuring Leslie Tyler Fink ever reach the airwaves? Or are these listing pics the best view you’ll ever get of the house the “lifestyle expert” and her husband (pictured at left) own in a gated subdivision just west of Uptown Park, and which the U.S. Attorney’s office has identified as “property involved in, or traceable to, money laundering”? Leslie and Randy Fink bought the the 4,096-sq.-ft. home at 5 Wynden Oaks Dr. 2 years ago for $740,000 in cash, but the entire amount (plus an additional $8,980 to cover closing costs) was wired in for the closing courtesy of Leslie’s pal Jonathan Barnes — as a gift, the Chronicle‘s Tom Fowler reported last week. How generous! Sadly, Barnes — who worked as a marine chartering manager at Houston Refining (now part of LyondellBasell), was indicted late last year along with two oil traders for his involvement in a multi-million-dollar kickback scheme. According to the Feds, Barnes’s thoughtful house gift came from funds “traceable to . . . unlawful activity,” and the ill-gotten property, which is named as the plaintiff in a complaint filed by the U.S. Attorney’s office, is therefore subject to forfeiture if Barnes is convicted. Isn”t this exactly the kind of stuff great reality TV shows are built from?

Will the rumored reality TV show featuring Leslie Tyler Fink ever reach the airwaves? Or are these listing pics the best view you’ll ever get of the house the “lifestyle expert” and her husband (pictured at left) own in a gated subdivision just west of Uptown Park, and which the U.S. Attorney’s office has identified as “property involved in, or traceable to, money laundering”? Leslie and Randy Fink bought the the 4,096-sq.-ft. home at 5 Wynden Oaks Dr. 2 years ago for $740,000 in cash, but the entire amount (plus an additional $8,980 to cover closing costs) was wired in for the closing courtesy of Leslie’s pal Jonathan Barnes — as a gift, the Chronicle‘s Tom Fowler reported last week. How generous! Sadly, Barnes — who worked as a marine chartering manager at Houston Refining (now part of LyondellBasell), was indicted late last year along with two oil traders for his involvement in a multi-million-dollar kickback scheme. According to the Feds, Barnes’s thoughtful house gift came from funds “traceable to . . . unlawful activity,” and the ill-gotten property, which is named as the plaintiff in a complaint filed by the U.S. Attorney’s office, is therefore subject to forfeiture if Barnes is convicted. Isn”t this exactly the kind of stuff great reality TV shows are built from?

“Drama right?! . . . This is going to be one of the episodes for the show,” the apparently unflappable Fink — who identifies herself as “princess of the modern Houstonian socialites” on one of her websites — declared last week in an email she sent to CultureMap’s Shelby Hodge. Can’t wait to see footage of the parties!

Gosh, processing paperwork for foreclosures used to be so easy before the end of last month — when everyone started getting so picky, insisting that agents for the mortgage lenders actually read the documents they were signing. What do they expect? Have you ever tried to wade through all that legalese? And now look what’s come of it: On Friday, Bank of America became the next major lender to call for a time-out, announcing it would halt foreclosures and the sales of foreclosed homes in all 50 states — presumably until the company can figure out its best defense against lawsuits. Yes, that would include all B of A mortgages headed for foreclosure in Texas, where ordinarily courts don’t care whether an agent of the lender has any personal knowledge of the signed documents. Bank of America and its subsidiaries have accounted for 31 percent of all Harris County foreclosures so far this year, according to data dug up by Chronicle reporter Nancy Sarnoff.

Also getting in on the break: Litton Loan Processing Services, a division of Goldman Sachs. The Houston company announced Friday it would also stop pushing through foreclosure paperwork — though only in “certain cases.” Next to be held up in the paperwork traffic pile-up: title insurers. A statement released by the company tries to spin it in a different direction, but the AP reported Friday that an internal memo issued by Houston’s Stewart Title would “make it difficult” for the company’s agents to issue insurance policies for properties foreclosed on by Bank of America and other quick-signing lenders: JP Morgan Chase, OneWest Bank and the GMAC Mortgage unit of Ally Financial.

- Ally’s mortgage documentation problems could extend beyond 23 states [Washington Post]

- Bank of America puts sales on hold [Houston Chronicle]

Photo of Bank of America Center: Erin Ferguson

MICHAEL B. SMUCK IS GOING TO JAIL Longtime Louisiana and Texas real-estate investor Michael B. Smuck pled guilty this week to one count of mail fraud in connection with the sale of the Briar Meadows Apartments on Dairy Ashford, just north of Briar Forest Dr. An investment company controlled by Smuck purchased the complex in 2004. Smuck sold the property in 2007, according to federal prosecutors, but didn’t tell his investors. Instead, he used the almost $3.5 million in proceeds to pay debts owed by other business entities he controlled: “Smuck continued to send documentation to investors in Briar Meadows in order to give the fictitious appearance that the investment property was still active. Pursuant to the plea agreement entered into by the parties, Smuck faces a term of imprisonment of 30 months and a $250,000.00 fine. In an effort to make the victims of this crime whole, the United States has secured from the defendant an agreement to pay a minimum of $3,299,480 in restitution to investors in both Briar Meadows and Yellowstone Ranch, which are apartment communities in Houston, TX.” [U.S. Attorney’s Office; background; previously on Swamplot]

Converted from an office building to apartments in 2004 by NBC Holdings’ Tracy Suttles and The Randall Davis Company, the Kirby Lofts at 917 Main Downtown went condo a little later. How did that ball get rolling? The federal government’s Financial Fraud Enforcement Task Force suggests one answer: a few “sham sales” from January to October 2006. Indictments charging Veronica Frazier, Robert Veazie, and Felton Greer with several counts of conspiracy and wire fraud were unsealed Friday.

Converted from an office building to apartments in 2004 by NBC Holdings’ Tracy Suttles and The Randall Davis Company, the Kirby Lofts at 917 Main Downtown went condo a little later. How did that ball get rolling? The federal government’s Financial Fraud Enforcement Task Force suggests one answer: a few “sham sales” from January to October 2006. Indictments charging Veronica Frazier, Robert Veazie, and Felton Greer with several counts of conspiracy and wire fraud were unsealed Friday.

Frazier, 42, of Pearland, allegedly recruited buyers with good credit in 2006 to act as straw borrowers and use false information to apply for home loans, according to the U.S. attorney’s office. She and other unnamed co-conspirators then allegedly used the loan proceeds for themselves and to pay kickbacks to the fake borrowers.