The longtime owners of the now-shuttered original Otto’s Bar B Que and Hamburgers on Memorial Dr. filed suit on Tuesday against their former broker, Cushman & Wakefield executive director David Cook, claiming that he failed to let them know about several offers to buy their property. As a result, the lawsuit claims, the owners ended up selling their real-estate holdings for — and settling into retirement with — only a third of the money they might have otherwise received. Marcus and June Sofka originally listed their restaurant at 5502 Memorial Dr. and some adjacent property with Cook in August 2007. Two months later, according to the suit, the Ponderosa Land Development Co. submitted a written offer for the land to Cook for $105 a sq. ft. But the Sofkas claim they didn’t hear about that offer until much later. Why wouldn’t Cook have given them such good news?

***

The legal filing, prepared by the offices of Jerry Eversole‘s attorney, Rusty Hardin, hints that Cook didn’t let his clients know about the Ponderosa offer — or others — because he was waiting for a different offer to come in, from a friend of his: apartment developer Marvy Finger. It claims that Cook told the Sofkas that Finger said he was going to make an offer for the 58,000-sq.-ft. property, and that he was working on it with him.

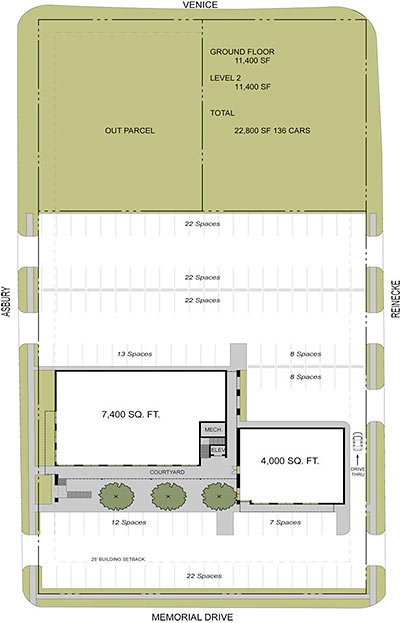

But an offer from Finger to buy the Sofkas’ property never came. Instead, the next year the market tanked. The Sofkas terminated their sales agreement with Cook in April 2009. Last May, using Moody Rambin as their broker, they ended up selling their property to Ponderosa — yes, the same company that had offered to pay more than $6 million for the property a few years earlier — for $38 a sq. ft., or $2,204,000. Ponderosa has since demolished the restaurant, an adjacent strip center, and Bibas Greek Pizza next door. In their place the company is currently putting up this 2-story, 22,800-sq.-ft. mixed-use strip center with a drive-thru, designed by Kirksey:

- Memorial Drive Mixed Use Development [The Retail Connection]

- Previously on Swamplot: Comment of the Day: A Demolition That Really Hits You in the Gut, Memorial Drive Scrape: The End of Otto’s and Bibas Greek Pizza, Otto’s Bar B Que Really Closing for Good This Time, Except of Course for the Hamburgers, The Finger, the Gun, and Other Secrets of the Park Memorial Sale, They’re Otto Here

Photo: Flickr users Bob & Lorraine Kelly. Rendering and site plan: The Retail Connection

So, Ben, Adam, Hoss, and Little Joe fessed up they were willing to pay an extra $4 mil to the Sofkas and couldn’t believe their luck? I can easily believe the Sofkas were conned, duped, or just counting on a prime payout until everything imploded, but this should be an interesting story to follow.

I wouldn’t be surprised, the realtor industry is plagued with conflict of interest and disincentives. It’s to their benefit to LIE about the state of the market driving up prices, it’s to their benefit NOT TO NEGOTIATE a lower price on your behalf to keep price per sq. ft. statistics high and to yield them a higher commission. It’s to their benefit to sell you a property from their OWN INVENTORY even thought it might not be the best fit to double dip in the commission. In Carlton Woods, the sales staff was pushing empty lots 10 times harder than finished homes because the developer paid them 10% commission vs. 3% standard share as seller’s agent.

139 parking spaces for 11,400 sqft of retails and restaurants?!?! Holy crap that seems high.

Lost_In_Translation, can you read? It’s twice the size at 22,800 square feet.

Interesting. $38 sq ft? Seems like a bit of a fire sale price for that prime piece of property. Things weren’t that bad last May. I wonder how they were able to find out about the $104 offer. Did someone from Ponderosa just gloat at closing and say “ha ha, we were going to give you $104 in 2007, but now were getting 438!!! Duh, winning!” While this certainly sounds like the kind of skullduggery that goes on in the high stakes real estate game, I suspect there may be more to the story.

If the broker didn’t present the original offer TREC should revoke the broker’s license. But of course TREC won’t.

Buyer Beware. Seller Beware. Welcome to Texas.

I talked to the listing agent in Jan 2010 because i needed this sale as a comp. He told me it traded for $60psf for the land…so I am really confused now…who would ever be a seller at $38psf for dirt on memorial: answer- no one. This does not add up and i doubt if $ 38 was the actual price the dirt sold for. Show us the contract!

Actually, a Chase Bank will be built on that site along with a restaurant. In law school, my real estate professor gave us the defintion of a real estate broker: “Someone who is too dishonest to be a used car salesman.” Over the years, I have come to learn that he was right. Brokers have a fiduciary duty to relay all offers. I have been able to acquire property in bidding wars just by waiving the buyer’s commission and allowing the seller’s broker to keep 100%.

Please AJPeter, while real estate brokers do have a reputation, is it not the the pot calling the kettle black to make mention of an “Attorney” while alluding to attorneys as being so noble. Please put down the self-righteous, sanctimonious attitude and recognize yourself as being a card carrying member of a bunch of scumbags. Besides, coming from a law school, real estate professor, that has to top them all.

To Kevpat64: Why so sensitive ? I get it: Brokers dont like lawyers. Maybe its because lawyers hold brokers accountable; something brokers dont like. I’ve had a number of cases against brokers; mostly for failure to disclose. I have also followed the recommendations of trusted brokers and acquired commercial real estate that has performed really well. Like anything else in this world: there is good and bad. In the meantime, grow up.

TO Commonsense-There are good and bad in every industry so please don’t lump us all together and then add your “Freakonomics” on us. You mention the sales people at Carlton Woods. They are just that “salepeople” not licensed and are there to sell. Sounds like you’ve really been burned by a bad experience but please don’t generalize us. The majority of us are honest and put the needs of their client above all else, I know I do…

I’ve been in the real estate industry for over 10 years and haven’t met a single Real Estate Agent that did not have some sort of alterior motive. The industry structure simply allows it and encourages it. How can one have the client’s best interest in mind where their paycheck directly depends on the Quickest and Most Expensive sale above all other considerations? I submit to you that Real Estate Agents have outlived their usefulness… All house listings are available online, it’s easy to research Comps and neighborhood information. Title company can take care of all of the pertinent paperwork. Why should one pay 6% extortion for a glorified Google searcher and appointment scheduler?

From AJPeter:

In law school, my real estate professor gave us the defintion of a real estate broker: “Someone who is too dishonest to be a used car salesman.â€

____________________________________

And an attorney is someone who is too dishonest to be a real estate broker.

And I should add that quite a few attorneys are now also real estate brokers. And wquite a few of them shouldn’t have been licensed as either. Sued any of them lately?

Maybe there will be a few minor fines or ethics violations, but there is way too many indemnification clauses in the purchase contracts that are large commercial transactions. Cook will lose his license, but that is the risk you take for trying to keep a Finger in your pocket.

This sounds like a case of seller’s remorse. Especially when you hire a high-profile attorney to a make a bigger splash- IMO. They got burned by the market and not their broker. $38 per sf in today’s market is a fair price considering demo cost, etc. I don’t know of any broker that wouldn’t submit a $6 million offer to their clients and if I know Mr. Cook, he’d use that offer as leverage to any other potential buyer.

From CLF – CRE:

This sounds like a case of seller’s remorse. Especially when you hire a high-profile attorney to a make a bigger splash- IMO. They got burned by the market and not their broker. $38 per sf in today’s market is a fair price considering demo cost, etc. I don’t know of any broker that wouldn’t submit a $6 million offer to their clients and if I know Mr. Cook, he’d use that offer as leverage to any other potential buyer.

____________________________

According to the sellers, he didn’t. But then we all know brokers are all on the up and up, don’t we?

It’s going to be difficult to prove.

I’m thinkin’ that with Mr. Hardin on the case, whatever happens, it’ll be in the news.