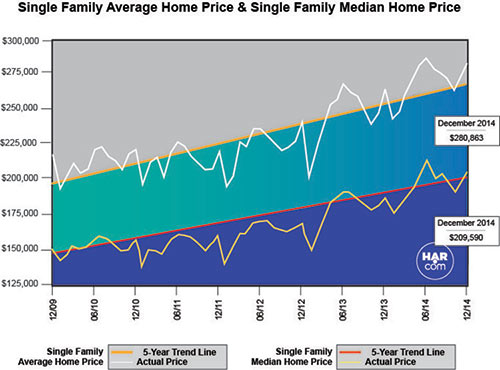

Is this Houston real estate’s Wile E. Coyote off-the-cliff-but-hasn’t-realized-he’s-gonna-fall-yet moment? Or is a new era dawning, in which out-of-state investors new to this whole “Houston is booming” thing swoop in to buy up everything and save the day? A fresh serving of home-sales data from real estate agents is available this morning . . . to support either notion. This past December was a record-breaking month for home sales, the Houston Association of Realtors claims in its latest report. Total property sales were up 11 percent over last December, and the current 2.5-months supply of inventory (a comforting term to those who regularly consider a home to be an off-the-shelf item) is scored as “the lowest level of all time.” Total dollar volume of housing sales for this past month was up a whopping 18.1 percent over December of last year. Both average and median sales prices for single-family homes reached “historic highs for a December in Houston.”

Separately, using her own calculations from MLS data, buyers’ agent Judy Thompson has updated her hand-carved regular roundup of appreciation rates and market conditions for the 21 well-known (and mostly Inner Loop) neighborhoods she’s been tracking on her West U Real Estate website for the past decade. (“In some areas I have had to make value judgments about which sales might have been lot value sales that were not listed that way,” she explains.) Of note: Of the tracked neighborhoods, little old Westbury led the increase in average sales price per sq. ft., rising 22 percent in the last year; the combined average for 2014 was an 11 percent uptick.

- The Houston Real Estate Market Breaks Records in 2014 [HAR]

- Appreciation [West U Real Estate]

Chart: HAR

Westbury has been the “next big thing”, but has been sort of a letdown. All this promise, but no execution.

Westbury would be a prime target of opportunity for developers hoping to make a quick dollar. All it needs is a Starbucks, Chipotle, and a grocery store specializing in organic, locally harvested goods…. well that and the complete redevelopment of Westbury Square.

A $280K median sales price, aye? What’s the split on this, just guessing here, but I’d figure that a good 80% of Houston’s homes are now below the median sales price. That is not a positive sign for momentum. And how does that relate to housing inventory? Are new builds / homes under contract ever considered in the area’s 2.5 month housing inventory before they’re closed on, or are these excluded from the inventory numbers? Anyhow, we know how this will end. The numbers from the past 2 years are way out of trend, can’t we get a chart that covers at least 10 years time to make better sense of it all?

ah, see now I was looking at the average home price. 209k makes much more sense.

@joel: I’m going to go out on a limb and say that exactly 50% of Houston’s homes are below the median price.

It was a relatively strong December in Houston, but the elephant in the room is collapsing oil prices. Oil spiked on absolutely no news today, but it looks like crude oil could be lower for longer than many had anticipated. Additional layoffs are baked in the cake if oil stays below $50 for an extended period.

I’ve seen some relatively crappy homes sold for nose-bleed prices during the last year, and this “recovery” story is getting long in the tooth. Record high debt, record low Treasury yields (see 30-Yr US Treasury Bond), and collapsing commodity prices are not indicative of an economic recovery. Houston is already overbuilt with multi-family based on current projections. Home builders could be sticking their necks out this year only to get their heads chopped off…

http://aaronlayman.com/2015/01/kb-home-reports-q4-2014-results-cuts-guidance-pulls-houston-land-deals/

Layman is 100 percent correct. Increasing government debt means that no recovery exists. Don’t you hippies know that!? In fact, I only know of one recession where government debt decreased during the recovery. 1854! I was a young whippersnapper back then. People had mustaches, ties, plad shirts, and top hats— and they werent hipsters! Its a sad day that we never recovered from the Panic of 1857. Debt, just kept increasing. Houston has never been the same since.

Multi-family is poised to be over-built here in Houston.

But then, those who can’t afford to buy can rent. And rents will adjust from the fat values we see today.

End result: New pockets of denser infill that can support mass transit and grocery stores. All good

memebag, I could certainly give you 50% of the homes sold, but not 50% of all of Houstons homes.

***

Aaron, my concern is that we actually did have a “recovery” but primarily for shareholders only which along with low interest rates has pushed up asset inflation in a period of income stagnation and a declining workforce.

Also interesting in Thompson’s numbers is that Montrose is saturated with new million-plus dollar homes (currently a two year supply), and yet the builders keep building more.

Where is the financing coming from to build more of these monsters? There would have to be some precious commodity whose trade is the source of all riches.

It can only be… mattresses.

Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the energy industry. That’s a very high guesstimate, but let’s go with that. Now let’s assume one of four, or 25,000, are in danger of having their hours reduced or jobs eliminated. Again, a very high estimate. 25K folks in financial distress is less than one percent of the giant Houston SMA [5M or so]. Even if you tripled the number to 75K folks living in Houston that are instantaneously released from their employment ’cause oil dropped to $25/barrel, that’s still less than 2% of the city’s population, and blip on the ‘financial health of Houston’ radar. Home prices may dip a bit in Houston, but that may be more due to a massive number of shit houses being constructed and sold cheap than $1.95/gallon gas.

@joel: I was having a little fun with you. By the definition of “median”, half of all values of anything have to be below the median.

c.l.

How do you figure only 100,000 employees? 5-10x that is more accurate.

Take a look at all the companies headquartered in Houston:

http://en.wikipedia.org/wiki/List_of_companies_in_Houston

Almost all of them are directly involved in O&G. This list does not yet include the new Exxon Mobil campus designed to accommodate more than 10,000 employees alone.

There are over 5,000 separate energy companies in Houston, and close to 11,000 manufacturing establishments, many of them whose clients are these O&G companies.

The Houston Ship channel – responsible for over 250 million tons annually – again mostly petroleum related.

Houston’s economy is so intertwined with the Oil and Gas industry that a mass layoff (even 10%), unfortunately, is going to be much worse than you think on Houston and it’s economy.

> Let’s assume 100,000 people live and work in Houston and are employed, somehow, someway, by the

> energy industry. That’s a very high guesstimate…

Not high at all. Here are the 2014 numbers from http://www.houston.org/economy/

“In June 2014, according to the U.S. Bureau of Labor Statistics, the Houston MSA held:

o 29.3 percent of the nation’s jobs in oil and gas extraction (62,300 of 212,800); and

o 11.7 percent of jobs in support activities for mining (50,300 of 430,500). ”

So that is 112,600 at a minimum. However, it is not clear if “extraction” includes geophysical exploration. If it doesn’t, that’s another 20k jobs at least, and it certainly doesn’t include the fraction of the banking/investment industries that are tied to O&G. My guess would be 150,000 total.

In any case, the number of jobs is irrelevant, it is how much that activity represents as a % of GAP. Here are those numbers:

“Mining (e.g., oil and gas exploration and production) represented 19.3 percent, followed by manufacturing at 18.3 percent, and finance/insurance/real estate at 11.9 percent.

The Perryman Group estimates Houston MSA’s Nominal Gross Area Product for ‘13 at $533.0

billion.”

So I think it is safe to say that 25% of Houston’s GAP, or 133 billion dollars, is impacted by the downturn, and maybe 20% of will be lost, or a GAP decline of roughly 25 billion dollars a year.

That is very significant but probably not fatal. However… Texas is notorious for financial swindles and bubble implosions, so I would expect a run of local bank/S&L failures in 2015 from those over-leveraged in the fracking business.

c.l., you’re leaving out the most important part such as extrapolation though. it’s not how many jobs are lost, but the quality of the jobs that are lost. one six-figure salary probably supports a couple low-income & part time jobs so a loss of 25,000 full-time well paying jobs could lead to a total loss of 100,000 jobs for the area. no idea about these type of metrics myself so just throwing out completely unfounded stuff here. that’s how you can come up with the assumption that nearly half of the entire Houston area is supported solely by the energy industry. additionally, it doesn’t take a large number of houses to hit the market to quickly jack up the housing inventory numbers in a period of zero job growth and low sales.

Jonke is right. The big hangover in the Houston real estate market is going to be the million+ spec home. Demand for middle to upper middle class single family is still very strong and supply is still struggling to catch up. Even multifamily has a very strong occupancy rate that will be able to absorb a lot of the new construction. But the 1 mil+ spec homes are starting to quietly pile up. People at the top end of the market are usually the first to put on the brakes when there are economic problems. They will either hold off on buying, rent or buy something cheap if they cannot wait. The real estate market is set to come in for a soft landing, but the 1 mil spec houses may be the one casualty.

If the million-dollar spec homes are piling up, then why are they still buying half-million-dollar teardowns in Upper Kirby and tearing them down to build million-dollar spec homes (not townhomes)? I’m not disputing that the things are piling up; I can see that they are. Just honestly wondering why the builders don’t see that too, and just stop already! Is it a game of musical chairs? Last one out of the pool is a rotten egg?

A new home just went on market on our block – the investor (a realtor’s family member) purchased in spring 2013 for $239K, found out it had foundation issues and decided to do new build and cleared lot October 2013. They were advertising as new build for $975K, took it off listing for most of 2014 and now asking $1.35 million. I sure hope it doesn’t sit for months like the one next door is (and 2 more on the block will be on the market very soon).

The NAICS system for classifying industries does a notoriously poor job at identifying energy jobs because energy almost functions as a parallel economy all unto itself. The energy industry proper gets picked up under the headings of “oil and gas extraction” and “support activities for mining” as a subset of “mining and logging”. However, a huge number of directly energy-related jobs get picked up in the nooks and crannies of “manufacturing”, “construction”, “professional and business services”, and “trade, transportation and utilities”. Also, what those employment figures don’t reveal are bonuses, reimbursed business expenses, or anything of that nature that results in personal expenditure that will be curtailed as profit margins slide and slip away into red ink.

Jobs that are indirectly related to energy are also threatened. Everything from retail to home construction to hospitality — these are all threatened as an indirect consequence of an energy bust and will have ripple effects that bounce off of one another. Even state and local government jobs will become threatened if economic activity doesn’t bounce back quickly and if public revenue projections go south.

I’d be inclined to say that perhaps upwards of eighty percent of Houston’s employment is directly or indirectly justified by the existence of the energy industry. The tricky thing is figuring out the degree of exposure as a function of energy prices. Some of those jobs are very sensitive to oil prices, others are not; some sectors only become sensitive after several years of sustained low prices; and actually downstream may become a bright spot — although it probably won’t be if the USD remains strong.

“I’d be inclined to say that perhaps upwards of eighty percent of Houston’s employment is directly or indirectly justified by the existence of the energy industry.”

WTF ? 80% OK… let’s assume there are 3 millions folks employed in Houston, that’d mean 2.4M are directly or indirectly justified by the existence of X. That MAY be true if you boil it down to ‘the high school gal who works the window at McDonalds has, at some point, passed a bag of burgers to someone working for Schlumberger’…. as being ‘indirectly’ justified.

In full disclosure, I do not think the economic outlook is all too rosey for the short to medium term. I can’t help but think of TheNiche as Gandolf saying “Riddles in the dark… my precious… my precious’ as he concentrates on his doom and gloom predictions paralleled with hard lined Armageddon preppers trying to figure out when the bubble with actually pop.

c.l. – The economic concept you are railing against is called a “multiplier”, and yes, that woman who hands you a bag of burgers IS going to be affected when her boss loses customers. Multipliers are horribly abused because they are often tools of marketing, not economic analysis (“The Port of Houston accounts for 25% of all Houston area jobs!!!!”). However, if you were alive in Houston in the 70s, 80s, 90s, 00s, or 10s, then you’ve felt the good and/or bad effects of oil prices, no matter in which sector of the local economy you worked.

When oil is high, then not only do employment LEVELS go up, but the people who do have jobs get things like raises and bonuses. This gives them confidence to spend money. Conversely, if they are worried that they may face unemployment, then rational people cut back on discretionary items: burgers, lattes, cars, houses… The silver lining here is that American consumers have consistently proven to be fairly irrational when it comes to good economic decisionmaking. Your analysis plays straight into that short-sighted, polyanna-ish tendency: Please keep spending. You’re right. It’s all going to be good. Actual data and analysis be damned.

Lennar Homes (2nd largest home builder in the country) reported average prices In Houston that were $9,000 lower in Q4 2014. That should tell you how the collapse of oil prices is going to affect Houston real estate. Builders are already seeing a margin squeeze. If the layoffs continue the squeeze will get tighter…

http://aaronlayman.com/2015/01/margin-squeeze-lennar-homes-reports-higher-revenues-lower-prices-houston-tx/

Lennar is a low-end builder. The O&G engineers making six figures (and possibly getting laid off) are not living in Lennar homes.

Furthermore, Lennar builds developments en masse, in far-flung suburbs, and those developments are more susceptible to the whims of the employment figures than are the “custom” homebuilders creating their monstrosities one at a time inside the Loop. Wasn’t there a pay-to-read column in the Comical this weekend about a million-dollar spec builder who’s not slowing down?

I especially like it when in a large area like Houston, someone takes the trouble to do an analysis of particular neighborhoods. That can be very helpful to the prospective buy.er. Thank you.

@ cl

This sounds like someone who has no idea about the energy industry in Houston.