- Briar Lake Village Retail Center in Westchase District Sold [Realty News Report]

- Florida-Based Ecclestone Organization Has Acquired Sheraton North Houston at George Bush Intercontinental Airport [Realty News Report]

- Luxury Residential Brokerage Carnan Properties Moves into New Galleria-Area Office Building [HBJ]

- Worship Facilities and Educational Market are Underserved in Houston, According to Architect Scott Ziegler [Realty News Report]

- Harvest Green in Fort Bend County Among Some 200 ‘Agrihoods’ Sprouting Up Across the Country [Houston Chronicle; previously on Swamplot]

- Harvest Moon Solar Farm Almost Dressed and Ready for Harvest [Houston Chronicle; previously on Swamplot]

- New Hermann Park Master Plan Expected by Year’s End as Old Master Plan Wraps Up [Houston Chronicle; previously on Swamplot]

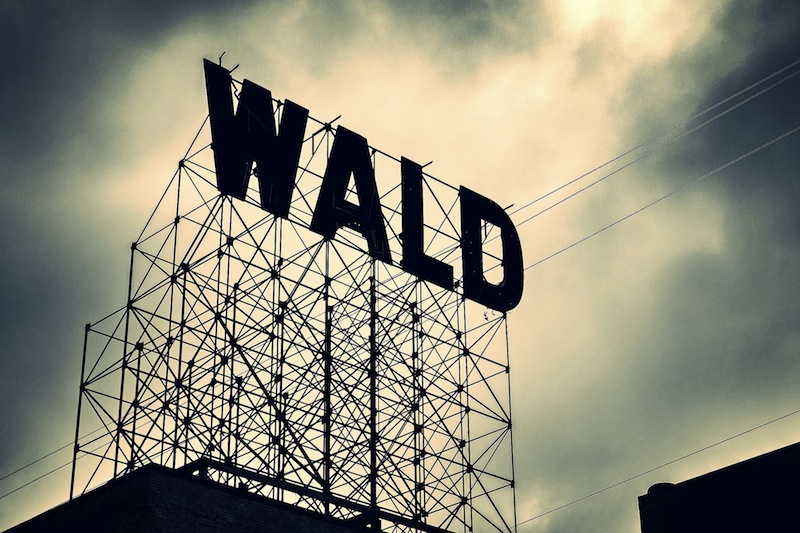

Photo: Bill Barfield via Swamplot Flickr Pool

Headlines

So, the government cannon outright ban religion (as irrational and ludicrous as it may be) and cannot advocate one religion over another due to the constitution and separation of church and state. But, under what laws or doctrine does the government exempt Worship Facilities from property taxes? As far as I know Non-Profits are income tax exempt but still have to pay Property Taxes. Discuss.

There seems to be some agreement among our stakeholders that you shouldn’t put the trails in until there’s money to put a HAWK at every street crossing. I disagree; I think you should put the trails in first and then figure out how to pay for more improved crossings. The Pinellas Trail (Tampa/St Pete) uses a lot of RRFBs ($15-25k/installation), while the Illinois Prairie Path (Chicago suburbs) has some entirely uncontrolled crossings at 40mph multilane thoroughfares.

.

Both Pinellas and the IPP also have extensive grade separations, which is as good as it gets. But if our agencies shell out $500k/mile to signalize every trail crossing there’ll be no money left over for bridges and underpasses. That would be a shame; one of the great strengths of Bayou Greenways is the way the trails often dip into the floodplain to go under major streets, making them sort of an expressway for bikes.

Commonsense: look at Section 11.20 of the Texas Tax Code. Generally speaking, it’s the way the property is used, not who owns it, that drive the exemptions.

@Dave, yes the property code does except religious institutions, but the bigger question is why? What reasoning is the exemption based on? What higher (pun intended) power is it derived from? Not the constitution, it says nothing about thou shan’t tax a very profitable business if it’s logo is a character from ancient fairy tales.

—

It also bring up lots of opportunities for abuse since religion is very poorly defined concept in law. One for instance can claim his multi-million dollar mansion in River Oaks is part of the church because it houses the clergy (guy that made up new age the religion like Scientology) and holds weekly worship service (dinner parties which end up with car keys in the punch bowl).

@ commonsense: State law provides an avenue for property tax exemptions for many nonprofits, although some are unaware of this and although many counties intentionally challenge exemption claims, lacking any evidence, in order to draw out further information from those organizations. Its screwy. To go down the rabbit hole, follow the link below and Find for “nonprofit”. But I agree in principle that nonprofits and religious organizations ought to pay taxes. Actually, I think that government entities ought to pay property taxes too; that could mitigate government over-investment in land (HCCS, Midtown Mgt. Dist.), facilities (ISD stadiums & HISD’s new HSPVA downtown), and ethically questionable deals to shield private parties from tax liabilities (METRO). Doing so would perhaps also cause those entities to protest the appraisal methodologies being used against them if they are the same as those methods used unjustly against private property owners, and that would be fun to watch.

http://www.statutes.legis.state.tx.us/Docs/TX/htm/TX.11.htm

Taxing churches is a terrible idea. When there is one official church, fine, go ahead (as in the UK). But adjudicating among dozens of sects while trying to appear impartial would be like opening a can of worms, and each worm is holding another can of worms. There’s a reason why the First Amendment is the first amendment.

@Gisgo, why would it be difficult to tax the churches? We’re not talking about income taxes, we’re talking about property taxes, it should be pretty easy to tax them all across the board just like any other commercial building. The First Amendment is also often interpreted that the government should not give any preferential or special treatment to religion, i.e. no tax breaks because that constitutes Making Laws Respecting an Establishment of Religion, which is explicitly forbidden by the First Amendment. In essence we are supporting religion though tax subsidies.

===

I think in the United States rational discussion of religion is still the only taboo subject because it brings out emotional and irrational (and often knee-jerk reaction violent) behavior in otherwise seemingly sane people.

Gisgo, would just note your explanation is actually in favor for taxing churches. The government should not be involved in having to label what is and isn’t an organized religion and our local civic land use policies should not be guided by federal taxation policies.

.

Private school taxation/donation policies have me much more worried though considering the huge swathes of land the schools in the inner city control and rent out to both residential/commercial entities. Something definitely doesn’t smell right.

.

Religion is an easy target, which means the real dirty work is going on elsewhere.

To weigh in on why the state cannot tax religious institutions: “The power to tax is the power to destroy.” This may be a paraphrase on one of the earliest Supreme Court cases but it holds true. The state can destroy a given religion by taxing it – and thus favor one religion or another – and thus establish a “state religion”, which is in violation of the Constitution’s freedom of religion clause.

.

So, this is why government cannot tax religious institutions. I’m no lawyer but it makes sense to me.

@Major Market, if the power to tax is the power to destroy then it also destroys businesses and private property etc. In either case, if they’re taxed all across the board evenly just like any other property, the law would not favor any one religion over another. We are giving billions every year in tax subsidies to organizations who’s opinions are not admissible in court because they cannot be defended by rational thought. There’s a huge disconnect here.

Every property should pay at least partial City and County taxes, unless there is no requirement for the City or County to provide the services, police, fire, etc, those taxes pay for.

@ commonsense: You’re really being a statesman on this issue. I couldn’t agree more.

@ joel: If a church or nonprofit leases space to a non-qualifying entity and the appraisal district is aware of that then their exemption will be challenged. And in fact what can happen is that the appraisal district can remove it for all of the previous five years and send a whopping property tax bill, forcing the property owner to protest and provide more information or else very likely go under! It can be a disruptive and existential threat to these entities when it happens, closings lots of doors in terms of financing their ongoing activities (if they are honest with their stakeholders). The same thing can happen on homestead exemptions and there is a similar process for if the appraisal district notices that they forgot to tax an outbuilding or swimming pool or some such thing — but some appraisal districts are strict, others are lax, and many are inconsistent — and meanwhile they can hide behind sovereign immunity and are mostly immune to class-action litigation from property owners. Its a recipe for mismanagement and provides some avenues for cronyism or for carrying on a grudge. This is an issue that requires some special legislative attention IMO.

@ Ross: Some exemptions of private and public property may make sense IMO. For example, exempting private amenities owned by the HOA of a subdivision may make sense because the high value of private property therein is predicated upon the existence of those other improvements. To tax them separately would be a kind of double-taxation. (On the other hand, if the appraisal district doesn’t do a good job at reconciling sales comps to its cost model then…my beautiful theory doesn’t hold up in practice.)

An alternative is to provide public services on a fee basis. Accordingly, things would be assessed sort of like the drainage fee, where impacts are measured and charged-for. That program is fairly inequitable and may not stand up to legal scrutiny so I hate to offer it as an example, but…that’s the basic idea. If you own a fire load on your property, you get charged on that or some other sort of risk-adjusted basis. Run a chemical warehouse, okay, you pay out the wazoo, run a dog grooming outfit, maybe not so much, have a house and pay basically a flat fee plus some factor that’s a function of its size. But in some ways, I prefer a property tax to all the screwball stuff that can come with a complex fee-based solution to local-area public finance.