- First-Time Buyers Priced Out of New-Home Market in Houston, Finds Metrostudy Report [Culturemap]

- Spurred by ExxonMobil Move, 5 Corporations Looking Into Office Space in The Woodlands [Houston Chronicle]

- Average Citywide Retail Vacancy Rate Falls to 6.3% from 6.8% a Year Ago, Finds Colliers [Prime Property]

- Energy Corridor, The Woodlands and Northwest Houston Submarkets Will Favor Landlords Until At Least 2017 [Houston Business Journal]

- Belle Vintage Park Apartments for 55 and Older Opening This Week Already 80% Leased [Prime Property]

- Katy ISD Considering $750M Bond That Includes Scaled-Back Version of Controversial Football Stadium Proposal [Houston Chronicle]

- Webster El Tiempo Opening Delayed Until Likely Later This Fall [Galveston County Daily News ($)]

- How Rebranding Airline Dr. and Adding a Fleet of Community-Service Trucks Would Strengthen the Neighborhood [OffCite]

- How Houston Can Do Better Than The One-Bin-For-All Program [CityLab; previously on Swamplot]

- Homebuilders Waiting Months for Timber Pilings Amid Severe Shortage [Galveston County Daily News]

- Pothole Problems Cost Houston Drivers $1,900 a Year, Finds Report [Click2Houston]

- Hundreds of Residents Attend Hearing To Show Opposition to Waller County Landfill [Houston Public Media; previously on Swamplot]

- Book Excerpt: When Flies Were Dropping Like Flies in the Astrodome [Houston Chronicle]

- TV Episode Ends on Cliffhanger for Montrose Rollerblader Dancer Juan Carlos Restrepo [Houston Chronicle]

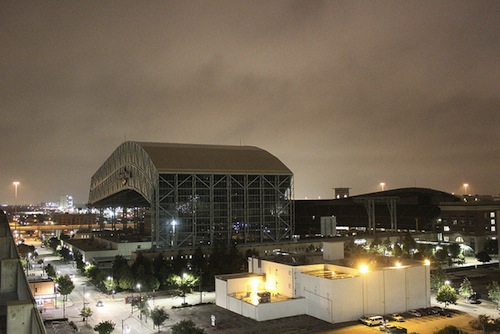

Photo of Minute Maid Park: Russell Hancock via Swamplot Flickr Pool

Headlines

Two points on the new-home article: 1. there are plenty of older homes that are great for first-time buyers, 2. what you can get a new home for in Houston is far, far below what you can get one for elsewhere. In my county in Pennsylvania Centex (!) builds new homes for a minimum of $255,900.

That blurb on the cost of potholes is not at all surprising. I have a 10-year old Nissan, and nearly every dollar I’ve spent on repairs has been related to suspension issues caused by driving on these pothole-ridden streets.

Re: timber pilings

Holy crap I was reading that article out of casual interest, but was blown away by how well it read and how informative it was. I have not read a real piece of “journalism” in Houston in several years, especially not in the Chron. This reporter did research, fact checked, wrote from all sides, and provided a sufficient level of detail to inform the reader. I thought journalism was dead – now I have hope again. Kudos to the reporter and the Galveston paper.

I find it interesting that the rebranding images for Airline are so blatantly stereotypical. Low riders and taco trucks.

@ Spoonman: Yeah, older homes are fine except that there are only so many of them in a growing city and they were transacting just fine to begin with. If you remove new supply at the lower price points and the prospective new homebuyer at that price point switches over to used housing, then the used housing won’t stay at that price point for very long.

I suspect that there are other factors at play too, such as an inadequate availability of consumer credit or that this generation of entry-level homebuyers isn’t as financially stable as the previous generation due to the lingering effects of the ‘Great Recession’.

MH005- Looks spot on. Been to Airline Drive lately?

no surprise about the roads causing troubles for houston drivers wallets. access to transportation and education continue to dog a large percentage of houston’s population holding back growth and productivity that could be much better leveraged with a system of transportation funding distributed more evenly as a percentage of residents incomes rather than impacting the lower incomes much more severely.

***

TheNiche, i’d also note that the great recession was not the game changer we necessarily attribute it to be. average incomes have been falling ever since the late 70’s and these recessions just make a larger hit to incomes that would’ve already been coming around the corner anyhow.

True, Niche, but as long as new housing comes on the market at any price point – there will be old housing put on the market. I might buy one of the $300,000 “move up” houses and put my old house on the market at $150,000. Actually we have our old house on the market at just north of $150,000 right now….

.

I agree with Spoonman. There are plenty of older houses that are affordable to first time buyers. In many cases they’re better built than he new starter homes developers put up. The problem is that many of these houses are in neighborhoods that young home buyers think are beneath them. At some base level, they would rather kvetch about how they can’t afford a house, than move to Sharpstown or a neighborhood like it, where they could afford a house. It makes me want to sigh and shake my head. In fact I think I’ll do that now.

One hopes that if new housing is being built only at a higher price point than the median, that means that the overall quality of housing is increasing.

@ Spoonman: Here’s the constant-quality housing construction price index, made available by the Census Bureau. Prices are rising independent of quality. And the prices cited here exclude lot prices, which the article is attributing to some of the increase in home prices generally. Also, given the limited amount of new subdivision development since the recession, that means that quality probably has not greatly changed.

http://www.census.gov/construction/cpi/pdf/price_uc.pdf

@ZAW: Yeah, it’s no problem at all if you’re hoity-toity landed gentry and you’re in a position to sell. Lucky you.

If you’re buying as young folk and newcomers are wont to do and you’re competing with other frustrated buyers over a finite and wasting inventory of used houses, then no matter what, you’re worse off than you might have been if you had entered the market sooner. It means that housing in our region is less affordable; when people have to pay more for housing (and it’s not even the housing that they’d otherwise prefer), that means that they have less money to spend on other things that would bring them enjoyment. It means that they’ve become poorer. It sucks to be them; and if your job is dependent upon their having disposable income, then it might suck for you too, a little bit.

As for Sharpstown, yeah the sort of person that was going to buy a $150k house in North Katy probably isn’t going to ever be your market. They’d sooner rent an apartment zoned to what they perceive as being good schools, I’ll bet. Sharpstown is where a whole different segment of the market goes when they get priced out of Westbury.

@ Joel: For younger folks and especially the college grads that have historically been able to accumulate savings and buy a starter house in their early- or mid- 30’s, yes it really has been bad. Incomes have been flat since the recession; workforce participation continues to fall; of those in the labor force, the unemployment rate has been reduced but remains elevated; consumer credit availability to them is more constrained; meanwhile, they cope with a record high level of student debt. Not everybody was impacted so severely, its true, but many were and it is quantifiable. It is a generation that will effectively had a late start at wealth accumulation, and they’ll be challenged again later in life as their parents age and require more intensive care-taking even though those same parents have raised fewer children.

http://www.zerohedge.com/news/2014-07-22/college-worth-it-here-feds-answer-one-chart

Spoonman, it’s getting difficult to find older starter homes. A young couple looking to put 20% down on a property in the Westchase or Spring Branch 50s/60s buildout cannot compete against cash offers from investors looking to flip or rent. The houses come back on the market decked out in granite/wood/appliances/beige paint, and carry price tags that are 2x, 3x, or even 4x the 2013 appraisal value. It’s hard to justify spending upwards of $250k on a 50-year-old starter home that will be require more maintenance than a new-build. The inherently smaller floorplans and shorter driving distances will make some of that money back, but the financial case against the older house grows weaker and weaker with every blow of the bubble.

ZAW said it: the houses are out there. Many of them are in Southwest Houston, which unfortunately doesn’t have the curb appeal to make up for its reputation (the Heights evidently has that covered in spades); how could it, considering the comical numbers of aging apartment buildings that line the main thoroughfares, and the lingering sense of a wild ride gone horribly wrong that seems to pervade the area. However, in spite of all that, properties that used to go for <$100k just a year ago have migrated to the upper side, and the inventory seems to be moving; the demand is there. I doubt it'll become the next GO/OF anytime soon, though; the S-word is still a dealbreaker for veteran Houstonians and new arrivals alike.

I’m curious ZAW, is this new 300000 house for you and your partner in your beloved Sharpstown. It would be sad if you’re abandoning a neighborhood you’ve so tirelessly (and incessantly;) championed. Tell me it isn’t so.

Not being able to find a new, cheap house in the best school district is a different kind of problem from not being able to find a cheap house.

I’m on the MUD Board for a newer subdivision just outside City of Houston limits on the south-southwest side, inside the Beltway. The builder was the developer. It sold out within the last 12 months at prices very much in the starter home range. Sales were so strong at the end, the builder/developer wishes they had more land. Folks in that income range and of Black or Hispanic ethnicity – I believe this constituted nearly all buyers – can just barely afford a new home; new is probably preferable for them because they don’t have the economic resources to pay for an equivalently priced older home that needs additional $ put into it to bring it up to physical and aesthetic snuff.

Still, it’s wrong to say that affordable single family homes are in short supply in the closer-in parts of Houston, at least at present. It’s just that much of it needs additional investment to get it up to modern standards, or in some cases to make it functionally livable.

Housing is an unusual good in that American culture tends to emphasize buying the absolute maximum you can afford rather than being thrifty, as you might with other things. This is because housing is not just a physical shelter, it’s also a stream of services and amenities associated with its location, most notably the zoned public schools. This leads to pricing results that may have little to do with the commuting proximity or physical characteristics. Hence new housing on the south side of Houston inside the Beltway that should sell for much higher price based on commuting distance to the Medical Center, Greenway, and Downtown, plus the fact that it’s new construction – but basically has a ceiling of starter-home prices because anyone who can afford to will choose to buy a home (and commute farther) to Pearland or Fort Bend County.

I don’t have anything to add, but I want to encourage this kind of discussion. Very civilized and educational! Good jobSpoonman, Niche, ZAW, Joel, Rodrigo and Local Planner.

All the cheap land in the burbs is gone. Houston can no longer continue to have affordable housing just by sprawling out further. There is too much demand and too many people who can afford to spend $250k+ to count on the burbs to perpetually be able to spit out starter homes.

All things constant, the result will be an expansion of multifamily in the burbs. Katy has apartment complexes sprouting up all over. But this will just be sprawl on steroids. Road in the burbs are already overburdened. Commute times to the city will get worse and worse.

Houston needs to push redevelopment of all of the parts of town that are loaded with vacant lots, teardowns, and big tracts of undeveloped land. There are tons of super cheap lots on the southside between 90/45 and 610/Beltway 8. Same on the northside between 290 and 90 going out of town. But developers won’t touch these areas because they are, for a lack of a better term, the “bad” parts of town. The City pays developers $15k a unit to build luxury high end apartments downtown, pays millions to developers to build luxury town home developments and retail centers, but does almost nothing to incentivize redevelopment in the “bad” parts of town. If the city sweetened the deal for developers looking to redevelop these parts of town with affordable housing on the same scale that the city has sweetened deals with developers doing highrise apartments, strip malls and town homes, many of the city’s “bad” parts of town would see a swift turnaround.

I wonder if what’s really happening is that the new suburban starter homes have been supplanted in the market by apartments in more urban areas. I still think people are missing out if they don’t buy starter home when they’re in their 20s. It really helps to have some equity built up by the time you reach your 30s and start a family. It’s the easy way to get a down payment for a $300,000 “move up” house. People talk about how it’s a bad investment, but they’re missing an important fact. Namely: a house is an investment AND housing. You might get a better return on $150,000 in stocks than you would on a $150,000 house, but you can’t live in those stocks while they gain value. But so many people were scared away from homeownership when the bubble burst, that maybe the demand for new starter homes just isn’t there.

.

Local Planner brings up a good point about the schools. But if you don’t have kids, Schools shmools I would say – and I did when I bought my first house.

I think part of the problem for young families is the choice between schools and location. Anything that is a combination of the two is often beyond their reach.

the other issue is the vilification of commuting, i grew up in clear lake and it was just accepted that you commuted to town if you wanted to do something. it was not that big of a deal to drive 50 minutes to westheimer or to classes at U of H. the only intown that was nice was southside place, bellaire and west u.

people need to accept the way housing used to be for our parents. buy a home in the burbs, when your family got older and your income grew, then consider moving to a better location.

as far as housing stock being affordable and nice, i looked at my old zip code, 77062, in clear lake, there were at least 12 properties around 150k all zoned to CCISD. the problem is people want affordable and close to town. that just is not possible.

the issue is not that housing in houston is too expensive, but rather it is too expensive for certain locations.

not everyone can live in west u, bellaire, braeswood place or even meyerland, that’s just the way it is…

@ Spoonman: The market is segmented, it just is. Not every consumer has the same priorities, even among those with the same financial means. FWIW, I compared north(!) Katy with Sharpstown; my starter-home example hardly makes the case of somebody demanding the “best” schools, but Sharpstown is unacceptable to most people to the extent that school quality is a priority at all, and private alternatives are typically beyond their means.

@ Local Planner: I’m familiar with a few of the newer subdivisions in the area that you describe. Your characterizations of them strike me as accurate, and it got me to thinking that this conversation may serve as a sad reminder to all of us that land prices and therefore lot prices and therefore home prices (and the types of houses built) are to a large extent a function of the perceived desirability/undesirability of the neighbors and the neighbors’ kids. In many instances, it breaks down by race. In some places it seems to break down by the number and density of mobile homes…or of pine trees, I notice. However unfortunate that may be, as I just reminded Spoonman…the market is segmented. Like it or not, it just is. There are some people (a lot of people) that will never get over themselves and move into south-southwest Houston; from my observation, “they” seem quite concerned about “those people” going down to shop at the Pearland Wal-Mart even such as it is.

Consumers can be very masochistic with respect to housing, inflicting their prejudices on themselves at their own financial expense. You could even frame it as though there’s a discount available for people that are open-minded and tolerant of others.

ZAW—schools schmools? Schools effect resale and desire for an area–it’s obtuse to assume because you don’t have kids that you being zoned to shitty schools won’t matter to others–you’re just flat wrong. I’m sure you’re finding that those looking at your house in Sharpstown are asking about the schools. I don’t have kids but I damn sure care what schools my neighborhood is zoned to because it’s HUGE in resale –yeah yeah Robert Boyd great dull discussion reminds my of NPR, it’s 3 people burning up the thread rehashing the same issue over and over. Houston has tons!!! of affordable housing, it may not be where you want to live, you many get robbed or worse but there is affordable housing and I assure you Houston, even in the Loop, is still a HUGE bargain compared to other cities around the country…get real…now discuss ad nausium

Shannon,

Why would schools affect resale value and not current value?

or

If the price is going to be 10% lower ten years from now because of bad schools, why isn’t 10% lower today?

@ Old School: If you think that the City’s incentivizing housing development in the “bad” parts of town will somehow lure middle class and affluent residents there just because it exists, you’re being very very naive. There are few areas – generally the ones right next to areas where gentrification has already been well underway – where that is possible, and given our strong economy the townhome developers are finding these areas anyway. Move on to the more suburban parts of the “bad” areas, or deeper into the inner-city “hoods”, and most folks who can afford to pay more than $160,000 for a house will just skip on out to a suburban area that matches their “preferred demographics.” Once you’re away from either the beach or the “urban trendy” neighborhoods in the core, the dominant force of the middle class and affluent residential market is the desire to have as little interaction with those of lower socioeconomic status as possible, especially within schools. This often correlates to ethnicity but not always – why else would north 59 past Kingwood lag in residential development except for the fact that educated parents don’t want their kids to go to school with “white trash”? Even for folks without kids, it still matters, for both the investment factors Shannon rather brusquely referred to and because most childless educated homebuyers still want to be able to be amongst their own at the local shopping center.

Only in the urban core are these factors able to be overcome, and once they are (see: the Heights, GOOF) prices go up really fast.

All that said, the city could work to incentivize “starter homes” under $160,000 in these areas, and they would have much better chances of success. The developments on the south side have sold fairly well, even if educated professional Anglos won’t touch them with a ten-foot pole.

@Old School & Planner: If the middle class (including educated middle class Anglos) are going to move back, there has to be a broad based effort to reinvest in the neighborhoods. Fixing up or demolishing existing, blighted housing. Improving the streets. Building or enhancing parks. Mitigating polluted brown fields and other nuisances. Addressing crime with more and better policing. Luring in the right kind of businesses….

.

To your point about incentivizing housing, Planner: My vision is that housing incentives should primarily be used to allow owners to bring older housing up to standard, without making the housing too expensive for the poor. As I’ve suggested elsewhere, there could be a 2% bonus to LIHTC for renovations to the “new projects” in places like Gulfton, Alief, and Greenspoint. A separate program, aimed at poor homeowners and small-time landlords, could be there to address ailing single family homes in Sunnyside, Acres Homes, and other impoverished neighborhoods.

.

@Shannon: the schools were built into the price of the house when you bought it, too – unless the schools were lousy when you bought the house and somehow turned around to be really good. I don’t understand why you would pay a premium to buy a house zoned to the right schools, if you don’t have kids going to those schools. Why not save some money and treat yourself to a shorter commute?

HISD’s level of open enrollment means, to me, that it’s surprising people get so worked up about the schools in Sharpstown and certainly in the enormous expanse of undeveloped land within Houston city limits between the South Belt and 610. (Swamplot linked to an article a while ago about how CoH is building a new sewer collector there to encourage more building.) I believe that’s the housing Local Planner was referring to above, which certainly makes the idea that the area is running out of land seem incorrect.

The best research suggests that school quality has little effect on a child’s achievement (within reason); the biggest driver of a child’s achievement is the parents.

All that said, a school should certainly be safe, and I am not suggesting moving to Kashmere if you have high-school-age kids.

@Local Planner: I am not talking about middle and upper class people moving into the “bad” parts of town. I am talking about the people looking for the $150k price point. That is a solidly working class price point. The supply of new homes in the burbs that meet the 150k price point are dwindling to nothing and getting pushed out so far that transportation costs negate the savings. People looking for the $150k price point would be willing to do some pioneering if there was a significant push to redevelop some of the “bad” areas. With a big enough push, the redeveloped “bad” areas would for all practical purposes become brand new neighborhoods. Schools would turn around quickly with an influx of new students and involved parents (already happening on the East Side). This kind of development doesn’t happen in Houston not because of lack of demand, but because the returns for developers are better in other areas (town homes, 3000 sq ft boxes in the burbs, etc.). If the City put enough tax incentives on the table, the profit potential would even out and attract investors.

Spoonman, even if the “best research suggests that school quality has little effect on a child’s achievement (within reason),” you fail to acknowledge that everybody has their own biases and many people will still disregard this notion and prefer a “good” school over a “bad” one.

As for inexpensive homes, it is all relative. What people think is expensive in Houston is actually fairly inexpensive for people moving in from the coasts. Having just spent some time back on the west coast, a lot of my friends paid $450K+ for short sales & foreclosures in the suburbs of LA/San Diego and now their homes are worth $650-$800K. Not that any of them wanted to pay that much, but it’s what the market demanded and they had to find a way to make it work. Nevertheless, perhaps to a native Houstonian that’s accustom to prices in the $100-200Ks, it may now seem expensive.

Lastly, I’ve often heard the remark that while you can buy a super cheap house in Houston, you don’t want to buy in the cheapest neighborhood because 1) it likely has a weak HOA (if at all) and 2) the people that buy into really inexpensive neighborhoods don’t necessarily have the financial means to keep up their properties. Yes, it’s sad to say that some people feel this way and discriminate against people of lower socio-economic means, but we’d be naïve to think that this feeling doesn’t exist out there.

Is it – can we allow it to be – evidence of progress that the bar for discrimination has, at least in this thread, been lowered to, not moving in next door to someone?

@ Old School: Yes, I agree that the $150K price point can work in those areas, and fixing up the neighborhoods will increase the odds of market capture for that income/wealth demographic. It’s worth noting that private developers have been building for this market already – in my MUD’s subdivision, other ones on the south side, in North Katy, and Spring. There’s a definite limit to the overall size of that market because a large share of potential buyers with the right income levels still don’t qualify for mortgages due to credit issues, which have become more relevant since 2008.

I have yet to see evidence that this will lead to a dramatic turnaround in school reputation, however. It took decades and gentrification way way beyond the $150,000 mark to turn around the reputation of elementary schools in the Heights. And schools on the south side of HISD, North Katy, and most notably Spring are still hardly considered desirable. For the market at large, from what I’ve seen, the school’s demographics have to be dominated by students from homes at least $175+ before educated professionals will feel comfortable. And non-selective zoned schools have to take whoever’s living there, so you’d need a majority share of students coming from the new active-parent households in the school (probably impossible for the middle and high schools) in order to really change things.

@ luciaphile: No, I wouldn’t say that the standard for ethnicity-based, race-based, or more accurately, class-based discrimination is as low as where an individual chooses to live. Housing preferences can be a multifaceted thing. However, when you look at patterns of socioeconomic segregation within society, yeah I would say that the evidence is damning…to society. (I do not have any policy prescriptions. I think that good intentions are too often and too easily co-opted by the powers that be.)

At the very least, at the barest minimum, a significant enough portion of homeowners anticipate that the market moves on the premise of socioeconomic segregation that their anticipation of demand for segregation is itself what makes the market segregated. This is the polite premise underlying white flight, and it was as true in Riverside 50 years ago as it was 10 years ago in Spring and Missouri City and as it is today in various places I prefer not to call out by name in order not to be part of the problem.

Zodiac Mindwarp talks about how it was “no big deal” back in the ’70’s and ’80’s to drive 50 minutes into town from Clear Lake. The difference these days is not just perception, but gas prices. Back then a gallon of gas cost around .98 to $1.19, and even in current dollars, that’s not too much. Also, metro Houston 30 years ago had only half the population that we do today, so the Gulf Freeway was much less crowded, and shortened the drive time.

.

Old School laments the large tracts of vacant land in the ring between 610 and Beltway 8 on the north and south sides. Trust me, that area will eventually fill up, but it will probably take another 20 to 25 years. It wasn’t that long ago that The Heights, Shady Acres, Stella Link, and EaDo were considered undesirable “hoods”. Change happens, just not as fast as some of us would like.

I’m basically against all tax abatements, subsidies etc. but the ordinance the City is basing the million-dollar handouts they’re giving to developers so that Cartier and Hermes can move from one luxury shopping center to another or so that someone can build downtown apartments that rent for $5,000 a month is supposed to help provide affordable housing.

I’ve noticed the house price / zoned school quality correlation thing, too, Planner. It’s weird how that works.

ShadyHeightster, I’m not expert on inflation, but per the Fed, your reference to 98c in the 70s being “not much money”, it translates to roughly $3.62 (see http://www.minneapolisfed.org) which is on par with gas prices right now. I do agree that Zodiac is a little unrealistic in expecting everybody to lives in the burbs and then move into the city when they have more money. You can live in the city with not a whole lot of money, but your options will be fewer. Personally, I’d love to see some more acreage communities b/t the south loop and south Sam (done better than Bender’s Landing, which has too narrow of streets and ditches all over the place).

@ ShadyHeightster: The Gulf Freeway, in addition too being a route that is notoriously in a state of ever-present construction, has rarely been without traffic congestion. The region may have more people, but the roads now are also vastly superior to the roads of yesteryear.

Adjusted for inflation using the Bureau of Labor Statistics’ CPI, a $1.00 for a gallon of gasoline in 1975 is the same as $4.43 in 2014.

According to the NHTSA, passenger cars in 1975 averaged 15.9 miles per gallon on the highway (although actual fuel consumption was approximately 11 mpg) for 132 horsepower to move 4,114 pounds. As of 2013, fleet efficiency for passenger vehicles was 36.0 mpg (with actual consumption at about 22.5 mpg). Horsepower and weight stats seemed to peter out in 2004, but at the time the engines were creeping up to 200 hp and test weights were around 3,500 pounds.

The fact is, times have rarely been better for drivers. Fuel costs are volatile but not outrageously high. Consumers are buying more powerful lighter-weight more fuel-efficient vehicles and they have the option to purchase highly economical vehicles if they so desire.

Moreover, a majority of employment is not located in the urban core and an even larger proportion of new employment is outside of the urban core, so that living in the suburbs or exurbs is often more efficient and a better bargain compared to living in the city.

@ all re sharpstown

I am single with no children, and I just bought in this area (section 2) as a starter home. I am very satisfied with my purchase and I love the area…particularly because of its ease of access to uptown, Chinatown, and sugar land. My mortgage payment is less than what I was paying for a 1-bedroom apartment in the Heights.

I know housing isn’t something we should count on as an investment, but do any of you think this area will turn in the next few years? I do not think there is a lot of inventory on this side, and even for the houses that are for sale, the median price seems to be a lot higher than even just a few years ago.

@Newbie—err no. Too bad you didn’t study the history of Houston better–Sharpstown has a reputation for being dangerous, gang land turf. The crime numbers are off the chart. Get the SpotCrime app and look at how horrid crime is I your area. You’ve been lucky to have not been touched by crime in that area–hope your luck holds out –your resale will be Sh#t, just ask ZAW—sold your house yet, ZAW?

What I’m saying ZAW is that it’s not always wise to buy a house in an area with bad schools and make a large investment in fixing it up, you may not see that money back due to the schools. When I bought my house I knew the schools it was zoned to because I grew up here, but if I had not I would certainly have reserched and it would have played a part in my decision, certainly. To say buy a house in Sharpstown, then invest say 30000, I’m just not sure you’d see that due to the bad schools and even worse reputation of the area. HISD’s open enrollment is a joke. Take Lamar—at Lamar they try to keep a certain demographic, so it’s very hard for Anglo kids to get in of they’re not actually zoned to that school. I’m zoned to Poe, Lanier, and Lamar. Poe is pretty good, Lanier is excellent and Lamar is pretty good. Tho Lamar is getting more ghetto by the day, another blow back of open enrollment if you’re actually zoned to a school. HISD buses them in from everywhere to keep the 25 25 25 25.

So then, The Niche, if nobody “co-opted” them, you would in fact be in favor of policy prescriptions designed to arrange people in a way more pleasing to some assortment of bureaucrats, activists, lawyers, and academics?

Interesting. I’m sorry if I’m off, but you strike me as one of those “we’re leaving trillion-dollar bills on the sidewalk” guys, vis-Ã -vis open borders.

I find it hard to square, the idea that globally, people act with perfect rationality in migrating, and countries with perfect rationality in absorbing them, but that locally – where people might be expected to have still more information – they cannot be trusted to choose where to live.

Newbie: I am sure Sharpstown will turn within the next decade or so. There’s definitely a spike in property values in and around Sharpstown right now. We just got a favorable offer back on our house that was right at the $150k mark. Two years ago when we moved out, we’d have been lucky to get $100,000 for it. (So we rented it out for two years – best decision we ever made, but I digress). And they’re putting care into the renovations. You’re starting to see granite countertops, redone bathrooms, glass tile backsplashes…. two years ago that was very rare.

.

That said, there are some things holding it back. Namely: the apartments around it. I am still hoping that the Sharpstown Management District will get a handle on its apartments the way Brays Oaks has, and they’re starting to on the north end of their district, but not to the southwest (Westwood.). Also, the Gulfton Management District had got to get off the ground and functioning. When those two things happen, you’ll start to see Sharpstown really take off.

That’s a lot of if’s ZAW. You’re completely correct about what it will take to make Sharpstown desirable, but do I want to make a mortgage commitment based on what areas around me might or might not do. You as always paint an optimistic view of Sharpstown and who wouldn’t you, you have property you’ve been trying to unload for 2 years. You were lucky on your renters, in that area it could have really been a nightmare for you. Did you accept this 150K offer or are you still gambling on your matrix for Sharpstown to become the next Briargrove.

@ luciaphile: Speaking from no small amount of personal experience and direct observation, people are often much better at finding income than they are at deciding how to spend money once they have accumulated some wealth and obtained access to credit. Indeed, they often do not know what is good for them; and yes that reasoning extends perhaps foremost to the impulse to own a home.

To that end, yes I am dubious about the underlying logic of a subsidy to encourage homeownership for people that may not be ready for it; but I also acknowledge that a low rate of homeownership in particular neighborhoods can give rise to a legitimate externality if renters do not wrap their ego around a financial asset in the same way as homeowners are wont to do, and therefore don’t maintain their homes or landscaping to the same standards. We could debate this, but I think it would be unproductive. My point though, was that no matter whether an affordable housing program has good intentions or is based from logically valid set of reasoning or not, it is difficult to point to policy successes and very easy to point to policy failures or to programs that were so poorly or deceptively administered that policy was clearly never a consideration in practice.

For the love of God, Shannon, do us all a favor and don’t ever become a landlord. Trying to sell a house while you have tenants in it is just shady. It exudes ghetto. I never would have done that, and I didn’t do that. The house was on the market as a rental in 2012. We had it rented out in 1 month to a couple of HISD music teachers. It would have rented quicker but I turned down the first tenants who expressed interest because of their background check.

.

The house went on the market again last Friday, listed for sale. We got an offer this past Monday; and the house will be under contract by next Monday — like I said, for $150k in a neighborhood just south of Sharpstown. Things ARE on an upswing in the Sharpstown area.

ZAW, I’m not sure which one of the houses that are up on HAR is yours, but there’s something to be said about the fact that just $150k gets you something that’s in such great shape, or even well updated. In searching for my first house, it’s your stories, commentary, and faith in the potential of the SW side that keep returning me to the area, in spite of the all of the dissenting voices. I hope I’ll be able to make it happen sooner rather than later.

@Shannon: Yes, NPR–good analogy. People discussing issues calmly and knowledgeably. It may indeed seem dull compared to some of the trollish and hysterical arguments often presented in the comments section. But I see you’ve already employed a tu quoque argument, which seems to be one of your favorite techniques for bringing the level of discussion down.

Just going to throw this out there. The school argument for resale is shit. Areas like midtown, the heights, the east end, and others all have “bad” schools but are booming. Nevertheless, I grew up in Sharpstown and I just graduated from UT with honors. I know it’s a fallacy to use correlation as causation but one of the common denominators at Sharpstown High was that most of the AP kids came from families with houses. Most of those kids graduated or about to graduate from UT, A&M, and UH. My point is that even if your high school is “statistically” bad, your child will still succeed if you instill upon them a drive to succeed.

Regardless, the neighborhood itself continues to boom. The baby boomers are beginning to pass so lots of remodels and even some tear downs are happening. The people moving in tend to be young minority families, yuppies, and gays. Quite an eclectic group.

RE: Red-hot Houston housing market shuts out first-time home buyers, new report says

I can’t say I’m surprised.

I work in multi-family construction and feel first-time apartment-RENTERS are priced out of Houston.

@Robert,

Dude, some of us baby boomers haven’t had our 50th birthdays yet.

This has probably been one of the most civilized and educated comment thread I’ve experience here. Though I had to chuckle at Robert’s and GoogleMaster’s baby bommer comments. @Robert, I agree with you. Drive is a major factor. My parents instilled in me the importance of an education. Others aren’t so fortunate. I’m a product of the East End, went to a “bad” public school, graduated from UH and landed a good job. Are you and I the exception? Maybe. But we won’t know until someone conducts a study on what happened to most of the students who graduated from HISD’s “bad” schools from 1990-2010. Maybe there is one somewhere. @ movocelot: I also read that article. Interesting, to say the least. I’m not surprised most first-time renters are priced-out in hot areas.