The May home numbers are in and they’re . . . not so bad, says Swamplot’s chart-wielding commentator:

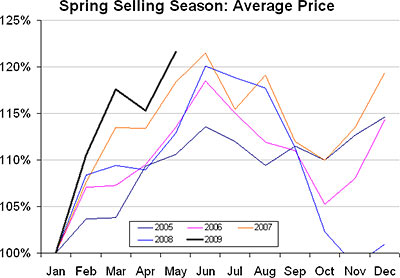

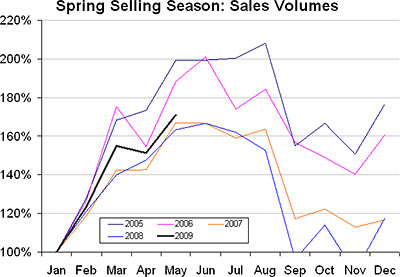

The “spring selling season†is going well as average home prices are up 21.6% since the beginning of the year. Errrr…ummm….that is a big move and it underscores that there is a strong seasonal trend at work. The big bounce brought us up to slightly above May of last year on a median basis. Positives included record low interest rates and foreclosures were “only†20% of the total.

Fewer foreclosures is better, right?

A reduction in foreclosure sales is a change in “product mix†and doesn’t reflect on the price of a given home. In prior reports we were encouraged to ignore them, now the lower # of foreclosures is embraced and is cited as “price gains.†The strong seasonal trend is powerful enough to keep the housing “bears†like me silent for a few months. May also featured some of the lowest interest rates in a long time, so buyers were poised to move and lock in lower rates.

***

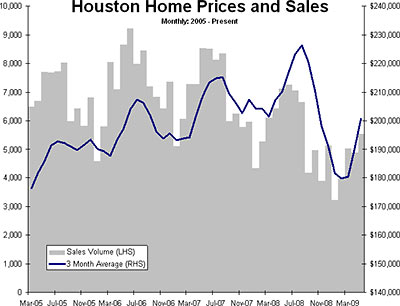

It is the 3rd year in a row of sharply declining sales volumes. The sales pace is a bit over half of the 2005 peak. . . .

Overall, it is a good report for Houston. The last 3 years my chart peaked in [June,] July, . . . and August, so prices will turn down again at some point in the next 4 reports and then we will see how bad or good the market is. This [season] is always the best time to sell a home.

- MLS Report for May 2009 [HAR]

- Houston home prices inch upward, but sales down again [Houston Chronicle]

Charts: Swamplot inbox

“strong seasonal trend”

“overall…a good report for Houston”

“big bounce (now) “slightly above (last) May on a median basis”

Another self-proclaimed “bear” grudgingly sticking his/her nose out into the sunlight…bitten by a prosperity bee!

Gotta love it!

Bears were mistaken about Q2, folks, and there will be more good news to follow over the next year. Checked gas prices recently, Smokey, or is it Boo-Boo? (Just kidding).

Outside of “liar-loan-land”, Houston is poised to pop by mid ’10 – pent-up projects, available credit, and a relatively shallow dip into the recession pool. All that international cash, just waiting for less-risky “parking”: Think

“ourtown” is on a few lists?

An increase in prices with a decrease in sales does not equate to an increase in value but some will believe what they want to believe. Particularly HCAD. And of course HAR.

An increase in prices with a decrease in listings equates to an increase in value.

It is wonderful having a market where those in charge of the stats are those with the biggest interest in spinning them.

Devans: WTF are you talking about?

Very simple Drew. This May analysis is a mild “whoops!” from a BEAR who expected far worse news for our area. I’m happy he/she was somewhat mistaken.

I’m not a bear about Houston except in “liar-loan zones” and strongly believe Big H will emerge from the current recession far faster than the housing “bears”. I’m entitled to my opinion.

I find this data heartening, because it coulda/shoulda been far worse (and, yes, I’m well-versed in “seasonal trends”.)

“Overall, it is a good report for Houston”. That’s what I’m talking about.

To use your vernacular, “what the f” did you not understand? I saw something that reinforces my bias, and I pointed it out.

It runs counter to the bias of the “chart-wielding commentator” whose post I’m responding to, so WTF, ace?

devans–you may want to consider laying off the caffeine . . . .

Devans is probably right only in that our property values were not as overvalued as everyone else’s. The real problem now is in the HCAD/HAR appraisals versus the lender appraisals in a growing number of areas and suffice it to say “ne’er the twain shall meet” and good luck trying to find a happy medium. HCAD is not about to let its tax base erode very easily. But the problem is homes are not selling for the HCAD appraisal value or the HAR appraised value based on “MLS” comparables that are still being manipulated in order to make the market look better than it is. If I were a buyer, I would be very careful and it truly is “buyer beware” at this point. HCAD hasn’t learned that what goes up sometimes goes down. But they might after a lawsuit or two. Which no doubt is coming. The realtors here might learn from the realtors in other cities where they have had to accept reality and pass it on to sellers. The markets in New York and Los Angeles are seeing increases in sales. At much lower prices. Taking a loss and/or taking a 1099 is much better than being foreclosed on. And much better than just watching your home just sit there.

ACTUALLY matt an increase in prices DOES equate to an increase in value. I don’t know what world you are living in where receiving more money for something makes it less valuable. And what does 1+1 equal again?

We all are hoping for better home sales in June and July. Maybe the tax credit will help. I am staying positive. Our Home Inspection business is up 25%. Many of the guys that didn’t have the customer base we do have fallen off the radar.

I am going to place your link on Twitter so others can follow your blog.

David Founder of

HomeInspectionsServices.org

WTF, Jay?