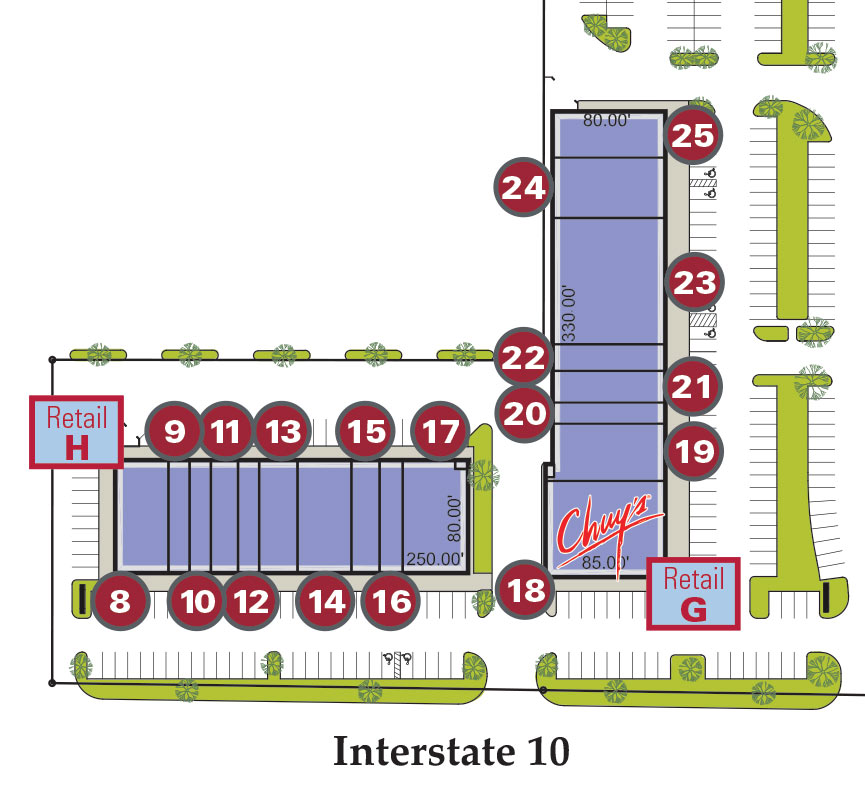

New city of Houston rules restricting the size, refinancing, and payment terms of auto-title and so-called payday loans went into effect on Tuesday. A total of 309 payday lenders had registered with the city by that date, somewhat shy of the total 361 such institutions the city had previously identified. And the Houston Chronicle has scooped up all the collected data to build the interactive map shown above, which shows the locations of the newly registered cash outlets. Unfortunately, the map does not directly indicate which locations are in strip centers or adjacent to nail salons.

Mike Morris’s accompanying report on the new rules includes this nugget demonstrating the valiant efforts of the payday-loan industry to reduce traffic in the area, by removing the overfinanced vehicles of its customers from already taxed streets: “In the 10-county Houston region, home to a fourth of the state’s 3,240 such lenders,” Morris writes, “data show borrowers refinance more and pay on time less than state averages, and that more than 100 title borrowers have their cars repossessed each week.“

- City awaits complaints as payday loan rules go into effect [Houston Chronicle ($)]

Map: Houston Chronicle

I’m surprised these places are allowed to exist, they break every know usury law (by technicalities). They are not a service to the poor, they’re a huge disservice, they make a bad financial situation a lot worse by putting people in perpetual high interest debt and a chance to lose their transportation which is required to earn income in Houston.

So, to people who rip these business off via never paying or scamming them with fake documents … more power to ya!

For once I completely agree with commonsense. These cesspools serve no purpose other than rent seeking off the poor. Just look at that solid red line down 45.

Commonsense should be nominated for comment of the day—agreed with everything except the encouragement to defraud these businesses. Two wrongs don’t make a something-something. :) To your excellent comment I’d add only that the fringe-banking industry is allowed to exist because it “serves” customers not otherwise able to get a line of credit (or even a bank account) at a traditional institution: it’s a symptom and not the disease.

.

Unfortunately, with our federal government’s generational war on the middle class—burned at both ends by high taxes to support war and welfare and shipping their jobs overseas thus robbing them of purchasing power—we’ll only see a rise in such institutions preying on the growing class of weak.

.

Happy Fourth of July? : /

As deplorable as I find these places to be, they do serve a function in the banking world. For those who do have access to lending through typical avenues, these places exist. While the APR’s are horrendous, they’re really just managing the risk that comes from making such loans.

If these places didn’t exist, then poor people that need loans would either have to do without or go see a loanshark that’ll break your knees for non-payment.

The article at the Chron states it may drive them out of the city, well let’s hope so, they are all around my office in a very poor part of the county, a new one sprung up two weeks ago. This is loan sharking at its worst.

When will people learn that being poor is a really bad life strategy?

For once I agree with Commonsense. Payday Lenders like to think they provide a service but he bad far outweighs the good. People who make plenty of money aren’t going to Payday Lenders for quick $300 loans that they’ll pay back right away. They’re carrying that $300 on their credit cards. People who take payday loans often find themselves in an endless cycle of debt. It’s an awful thing.

.

Now don’t get me wrong: poor people have financial needs, and they sometimes need loans. That’s why we have Credit Unions. The anti-payday loan store. I got a debt consolidation with a Credit Union after some nasty medical bills, and it was a great experience. I shudder to think the nightmare had I used a payday loan place for that.