Okay, that guy with the lawnmower is just a little creepy, no?

Committed real-estate snoops, come out from behind your laptop screens. With Zillow’s new iPhone app, you can just pull out your device and lurk . . . in person! And . . . uh, it follows you!

- Zillow Launches iPhone Application [Geek Estate]

- Zillow Takes Zestimates to the Streets [Future of Real Estate Marketing]

- Zillow iPhone App [YouTube]

The info base for homes not on the market weirds me out a bit.

Possibly public tax records? That’s a mind-boggling amount of data.

I don’t know exactly what data Zillow uses, but I can tell you from experience that the data is NOT straight from tax roll records (at least for Harris County and Colorado’s Adams County).

For example, when my townhouse was appraised at about 340k last year, Zillow insisted my house was worth 400k, which was ridiculous since other townhouses in the same complex were also showing only $340k on Zillow.

In addition, I have a rental property in Colorado, which Adams County appraised at about $240k, but Zillow claims is worth about $210k.

The morale of the story: take Zillow’s data with a grain of salt (or rather, a salt shaker full :-) ) If you need to know the actual appraisal value, you have to head straight to the county’s property search if it has one.

Angeli-

Sounds like you are confusing tax assessed values with Zestimates. They are not the same thing. A zestimate is a number calculated by using a mathematical formula called an automated valuation model. You can learn more about Zestimates here.

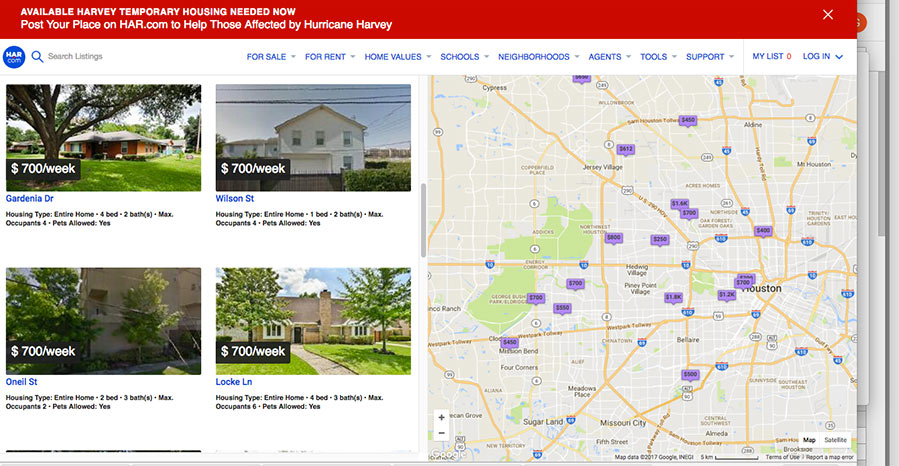

Zillow says the Zestimate is calculated using a proprietary formula; its main inputs seem to be public data. However, Texas is a non-disclosure state, so sales prices are not public data, and are not available to Zillow (unless they have a mole at HAR and the other local Realtor orgs). That means the only thing they have to go on is the county appraisal data, which is known to be bad. Possibly they can also get mortgage amounts, but that doesn’t really tell you about the sale price unless you know how much the downpayment was, how much else is rolled into the loan, etc.

In Houston, the older the neighborhood, the fewer are the “recent sales” and the more out-of-whack are the Zestimates.