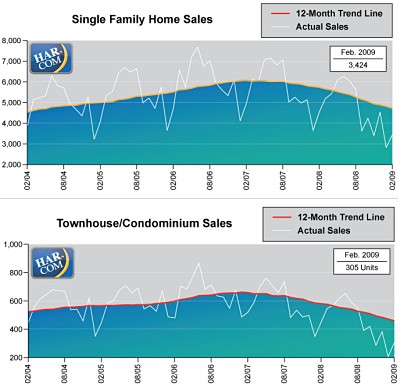

Looks like HAR has responded to some Swamplot reader criticism and added a bit of needed real estate to the bottom of the charts in its latest report — as well as a thin white line to indicate actual, non-adjusted values. The changes and the addition of the latest numbers show a market that doesn’t seem quite so steady as last month’s HAR report made it seem.

There were 25.9 percent fewer property sales this February than last, according to the report. But our reader’s 3-month-moving average chart doesn’t look any worse than last month:

***

The bright side?

Looking back over the years, we saw a price increase from every January to February and this month was no different. Actually the month was buoyant as prices jumped 10% instead of the average 7.5% increase. I am surprised the realtors didn’t seize on this fact. This will be a developing story over the next few months as prices may rise month to month, but it is only a seasonal trend.

Well, okay. But is Houston still doomed to follow the real-estate declines of other cities — just with that one-year lag?

Employment prospects here are better than most places, but unemployment is rising just as quickly in Houston as in the rest of the country. The slope of the line is no different:

Charts at top: HAR

To be sure, the real estate market is ‘challenging’ right now. And, I think most Realtors were surprised to see the price increase.

There are still a lot of opportunities for buyers, due in part to Houston’s relative stability, the $8000 credit for first-time buyers and buyers who haven’t owned a home for 3 years, and record-low mortgage rates.

Some neighborhoods that are desirable and priced fairly reasonably -below $350,000, have less inventory and those homes will sell more quickly and closer to list price. Norhill, Meyerland, Maplewood, and Knollwood come to mind.

Other neighborhoods are developing and there are terrific opportunities there!

Areas experiencing high foreclosure and short sale rates, of course, will take a longer time to recover.

Buyers who are prepared to spend the (longer) time it will take to fine the right home for their needs, will be very satisfied.

swamplot bloggers aren’t so powerful as to cause har to do anything. having said that the more data the better. the price of oil is going back up. i am sure the avid followers of dr doom on here will wear sack cloth with that bit of info. of course the houston metropolitan area has problems. no kidding.

i do think reality checks are important. and i would just as soon see builders simply build on contracts for awhile thereby giving us a chance to get rid of our forclosures. guess what houston has a less than 6 month inventory. chew on that for awhile. we have problems and 2009 will be a tough year. but i will leave my sack cloth and ashes in the closet.

rollo,

“swamplot bloggers aren’t so powerful as to cause har to do anything.”

hmmm… HAR had those graphs up for YEARS, then a sudden change?? the very next release, right after the blog’s criticism? doing EXACTLY what the Swamplot community asks for??

Scoreboard:

Swamplot…1

HAR………..0

That is a pretty direct response to criticsm and an argument to the power of Swamplot, isn’t it?

ah dreams of power abound i see. of course har jumps when a blogger on swamplot speaks. NOT!