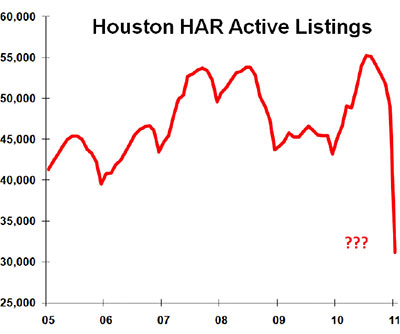

One of the more surprising stats in the latest residential home-sales data released yesterday by the Houston Association of Realtors, Swamplot’s numbers expert is kind enough to point out, is a whopping almost 40 percent drop in the number of listings that were active last January. Whazzat mean? That there were 40 percent fewer active listings this January than in January 2010? No, it’s screwier than that: The latest HAR report says that there were almost 40 percent fewer active listings in January 2010 than their own reports told us a year ago. Revising last year’s numbers down so dramatically, of course, makes it a whole lot easier for the local real-estate organization to announce at least one piece of news in this month’s press release: Listings are up 13.7 percent over this time last year!

But the new report doesn’t mention any adjustments. And it makes similar — though less dramatic — changes to last year’s data in several other categories.

***

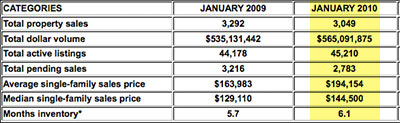

Here’s a snapshot of the numbers from last year’s report. Keep your eye on that January 2010 column:

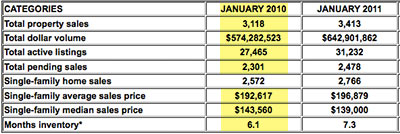

And presto change-o! Here’s the data from HAR’s latest press release. Yeah, in retrospect, 2010 didn’t start off quite so well as we all thought it had:

All of which makes it a bit difficult to . . . uh, follow some of the organization’s other claims about the market. For example, this statement:

Despite the increase in sales volume, growth in available housing pushed the January inventory of single-family homes to 7.3 months compared to 6.1 months one year earlier.

Is the 6.1 months figure — one of the few numbers not to have changed from one report to the next — based on the 45,210 active listings reported at the time, or the newly revised figure of 27,465? “It does not look good from a statistical integrity perspective,” our contributor deadpans. And notes the changes also in last year’s median and average sales prices:

They moved lower! This makes the yearly % gain look better. I have never in the 3 years of [following this data] seen a prior number move. It could be updated or better data. I certainly could have missed something.

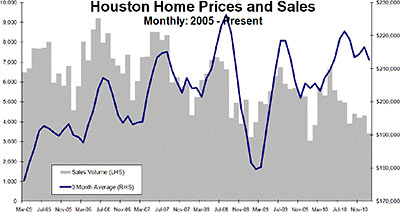

Here is the kicker –and January is always a weak pricing month, so you can’t read too much into it…. but WOW. The Chronicle should run with a headline: Houston Home Prices, Sales Nosedive!

Median Home Sales Price Dives 11.7% in one month! Average Sales Price 11.2% lower in only one month!

Well, okay, the value of any individual home did not plummet 10% in a month. The numbers were skewed by a gusher of sales in the under $80,000 category that brings down the average and the median. And it is not all bad news. Luxury homes sales (above $500,000) are up 17.6%

Here’s our contributor’s 3-month-average chart tracking movement in home prices and sales volume:

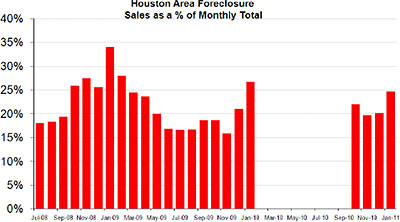

And, after a year long hiatus…… they started reporting foreclosure activity again. So we can spend 9 months trying to fill this graph in again!!! January is a peak time for foreclosure activity . . .

- MLS Report for January 2011 and MLS Report for January 2010 [HAR]

- Houston-area home sales climb out of the cellar [Houston Chronicle]

- Houston home sales make first gains in 7 months [Houston Business Journal]

- Previously on Swamplot: Houston Real Estate Sales Volume: Off the Charts!

HAR’s figures are just about as spin worthy as the Obabma budget figures.

Another reason not to trust Realtors.

The Arthur Anderson losers landed at HAR?

Why does the word “scam” come to mind?

Cross, HAR’s #s smell like goat poop or is it the smell of the Republican budget options being hailed as sweet smelling roses by Republican leadership. Its all so confusing. I can’t remember which half are liars/BS’ers and which ones are saints.

@Brad,

Kind of like choosing between month old shrimp or fresh dog poo. O’s failure to include interest on the debt is simply lying or omitting the truth, you decide

That’s the thing about numbers – you can usually manipulate them to say anything you want.

Hmm so the houses they were intentionally keeping off the market to prevent price collapse suddenly re-appeared? Sorry millennials/Gen-Y, looks like you’ve been thrown under the bus yet again.

Has anybody from HAR commented on why the numbers are so screwy?

I don’t like or trust most agents. On top of that, most I deal with seem downright stupid.

**

So I became an agent. Of course I see the irony, but by becoming an agent I drastically cut down on how much I need to deal with them (I can Supra myself into showings, post my own property, get access to TREC forms, etc.)

**

If anyone here has even a small interest in real estate, get your license. It’s cheap and easy

From HAR guy:

I don’t like or trust most agents. On top of that, most I deal with seem downright stupid.

_____________________________

Some of the brokers aren’t the brightest light bulbs either. It really doesn’t take much to succeed in real estate since success in real estate in great part is determined by what is called the scruples principle. The less scruples someone has, the more money someone will make.

HAR and real estate brokers never ever say or write anything negative about the Houston real estate market. The skies are always sunny and butterflies are free. Lots of winky-winks between seller’s agents and buyer’s agents. “Just do the deal, it’s good for everybody” nudge nudge. They claim properties sell “right away” or “less than 30 days” or my favorite, “sold at over offering price”. Why by golly, this must be the hottest real estate market in the world – just ask any Realtor, there’s one on every corner. So, buy now or else. “Har” rhymes with “car” and auto dealers have been doing the same goofy song-and-dance routine for 75 years – and har isn’t far behind.