Sales of single-family homes in the Houston area were 25.1 percent lower this July than last, according to HAR data released this week. Swamplot’s occasional home-sales correspondent writes in with a few illustrated comments:

Certainly 25% is an eye catching number but everyone saw it coming with the expiration of the tax credit. . . . This lower volume comes in the middle of a strong April-August selling season, and lower pending sales means we will have another weak month to report for August.

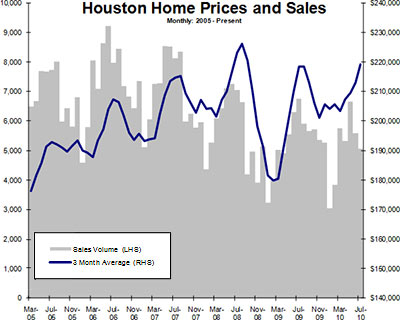

The good news (for homeowners and sellers): home prices haven’t fallen!

Color me impressed (errr…wrong) on pricing trends. Home prices have held up really well in Houston . . . The chart [above] shows this trend. Keep in mind, prices always peak in the summer, so as temperatures cool, so will home prices.

Sales of homes priced between $150K and $250K dropped 35.0 percent. But high-priced home sales suffered too: Sales of homes above $500K dropped 22.7 percent.

These are homes that are NOT really influenced by the $8,000 tax credit. I have been arguing for a long time that the high end market in Houston is actually much worse than the market for moderately priced homes. Builders have been building giant houses for years and they are languishing . . .

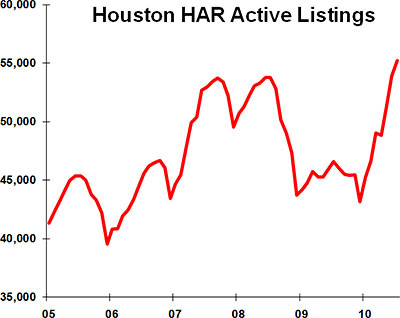

Speaking of which, [here’s a chart showing the] total number of HAR active listings:

***

This 25% reduction in demand — which may last for many months if not years — is going to have to swallow the most bloated inventory in Houston history. I know I sound like a broken record, but home prices are headed lower in the Fat City as price always follows volume.

Lot’s of people in my neighborhood are selling, but nobody is buying–3 houses on the block behind me and 3 houses on my street just sit. Our neighbors just dropped the price to 299 from 325 after only a few weeks active on the market for a 4/3 on a “double” lot, and I don’t see anyone stopping to even pick up the realtor info sheets at any of the homes. I guess people want brand spanking new homes (or their “completely remodeled” equivalent) at bargain basement prices in an established neighborhood of generally well-maintained homes.

Mary – Hopefully you’re not the reason why nobody wants to live there? Kidding. I think the correspondent who wrote this makes many valid points. Though it would be interesting to see further analysis on the $500k and up market (or inside the loop) to further analyze and understand his thesis.

“I guess people want brand spanking new homes (or their “completely remodeled†equivalent) at bargain basement prices in an established neighborhood of generally well-maintained homes.”

Ummmm..who wouldn’t want that?

Do you think that people really want aged, outmoded, and outdated homes at outlandishly high prices in a questionable and delapidated neighborhood of poorly maintained homes?

From Random Poster:

“Do you think that people really want aged, outmoded, and outdated homes at outlandishly high prices in a questionable and delapidated neighborhood of poorly maintained homes?”

——————————————

No, but people want well built, non-leaky, solid homes of the quality you find very rarely in a new home these days. The last home I bought was 35 years old, with nary a piece of particleboard or chinese drywall anywhere. It was spacious, updated in the kitchens and bathrooms where it really counts the most, and $50k less than my neighbors newer home that leaked during Ike. Cheap labor these days can build it, but they have no craftman’s skills or pride.

So…

Sales volumes of lower-priced homes are decreasing at a faster rate than sales volumes of higher-priced homes, and HAR apparently expects for me to be surprised and delighted that the average price has remained fairly stable since the market peaked in 2007.

How very…typical.

Pretty hard for averages to move when there no transactions. Kudos HAR for your uncanny ability to turn lemons into lemonade.

HAR manipulates the figures any way it can to convince everyone that the market is stable and the market is healthy and everyone should go buy a house before prices begin to rise again. The prices no doubt will rise again. But not any time soon. If anything, prices will continue to plummet.

When a house on Friar Tuck sells for less than the HCAD appraisal, much less than the HCAD appraisal, the market has gone down the proverbial drain. That’s the upper end. The lower end isn’t much better.

An HCAD appraised value is not a reliable indicator of market value. Not unlike an HAR press release, HCAD values should never be relied upon for any purpose whatsoever.

From TheNiche:

An HCAD appraised value is not a reliable indicator of market value. Not unlike an HAR press release, HCAD values should never be relied upon for any purpose whatsoever.

______________________________

Then HAR values should not be considered a realiable indicator of market value since HCAD uses HAR values as the basis of their valuations.

Not everyone is stupid. Which explains why so many are NOT buying real estate at the moment.

I have found that HAR sales prices and dates are fairly reliable but that inputs describing properties (like square-footage, which are most frequently sourced from HCAD) are ****.

Since HAR is only looking at two variables (price and date) for its PR analysis, I trust that their data is good. And to the extent that there are transpositional errors or that sort of thing, those tend to average out in aggregate, making for a good macro indicator. My problem with HAR is that their analysis is abominable.

Same thing with HCAD, except that HCAD is required to make adjustments for all kinds of factors on just a handful of recent sales comps–on every single property–and they suck at it. It doesn’t matter if HCAD’s sales comps are complete, valid, and reliable if their analysis is not.