Enjoy your spring, everyone! Armed with a few pointed charts fueled by the latest data from HAR, Swamplot’s spreadsheet-wielding correspondent writes in again, this time with comments on March’s residential real-estate market report:

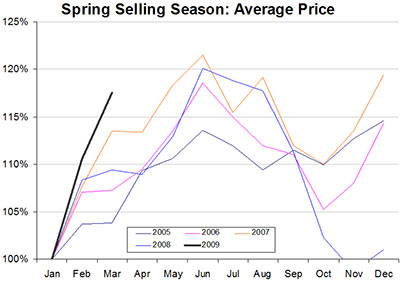

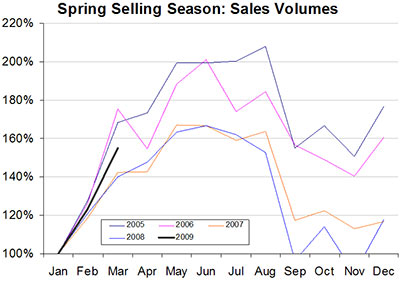

The Realtors always speak breathlessly of the “Spring Selling Season†with an almost religious reverence. Well it shows in the data. Home sales are 60-100% higher in the warm weather months. Prices are 10-20% higher, too. . . .

***

These graphs take the January data (a typical low point) for each year and set it to 100. Then each month’s data is expressed as a % of January. As you can see, on a price and volume basis, the warm weather is bringing out some buyers. Too bad it is from a much smaller set of well capitalized and disciplined savers.

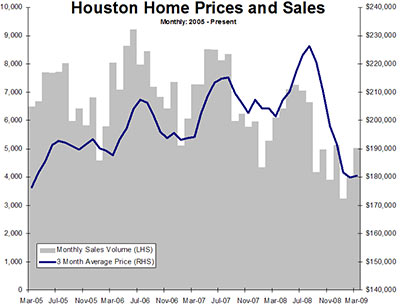

Finally, I added some early 2005 data to the long term sales/prices graph to put the late 2008 cliff dive in perspective. Chances are that anyone who bought a house in Houston in 2006, 2007 or 2008 is under water. Sure, the first instinct is to recoil and say: “not my house!!†“not in West U!†“certainly not in the Heights!!†but the numbers don’t lie.

Alas, the average has returned to early 2005 levels. Go back to 2005, look at what your home was worth then. It is the new reality. Soon it will be 2004 or 2003 levels.

I would like to hear from anyone who argues that Houston “did not have a house bubble†when we are at 2005 levels now and will soon be back at 2003 levels like the rest of the country. We got an almost 2 year late start on our correction. Just because prices rose 9% annually instead of 15% or 20% doesn’t mean that erasing 6 (or more?) years of home equity is going to be any less fun! 3 are gone now.

Home prices in Houston will be supported by the seasonal trend in the next few months, so expect some positive news flow. This will inevitably get spun into talk of a “bottom†or a “floor†by the Realtors, but it is nothing more than the effect of some nice weather, and prices will resume their downward march in September or so.

As a current buyer I can promise you that inner loop properties are still incredibly strong. And it all depends on the price point. I would say generally inner loop below $500K has not experienced much depreciation while houses over $750K have clearly been under considerable pressure.

I’m not saying the reader is necessarily wrong about the “bubble” in general, but statistically there could be more behind the numbers:

1. It’s city wide so just because the average home sales price is down could mean that there are just cheaper houses making up a greater percentage of the sales volume (first time homebuyers get a big tax credit I believe and fewer people are moving into the 200-400K range because I’m guessing a lot of people are “hanging tight” whether it be relocating here, moving due to a new job, moving within the city, etc.)

2. The sales volume is down so any effect of #1 would be magnified.

To say the average house is at its 2005 value or below is not likely to me. If I saw a similar graph for a specific neighborhood (or area) it would hold more weight.

Hmmm. Just eyeballying the data, but it looks closer to 5% yearly appreciation for 2005 through mid 2008 rather than 9%. From a trendline of the data looks like about $185k in July 2005 and $215k in July 2008 which yields about a 5% CAGR. Still higher than income growth and inflation, but not crazy appreciation by any means. The slope of the price appreciation looks higher because the scale begins at $140k rather than 0. The basic premise is still good, but I just don’t know that we’ve had this massive amount of appreciation that is going to revert to the mean to quite the degree the post implies.

I just had my house in Sunset Heights appraised a few weeks ago. According to the appraisal, it has appreciated over 13% since I purchased it in December 2005. A small house nearby sold for 22% more than its almost identical neighbor sold for in 2007.

I agree with some of what the writer says, but I also don’t trust all the doomsday talk and fear-mongering when I’ve witnessed my neighborhood doing very well this year.

Statistics can say whatever you want them to say.

Inner loop market is still very strong. Inner loop is no longer a starter home before you have kids. So many couples having kids and staying inner loop now. You analysis should separate inner loop vs suburban housing.

Suburbs have higher traffic, longer commutes, less culture, box-stores chains everywhere, poor infrastruture outside their sub-division, higher taxes if you include the school taxes, and in many areas higher crime because less police presence (i.e Sugarland etc). So why live in the burbs? The “so called sacrifice for good school” and the “bigger house” arguments. Thus the spike in summer buying season before the schools start!

OJ writes: “I just had my house in Sunset Heights appraised a few weeks ago. According to the appraisal, it has appreciated over 13% since I purchased it in December 2005.”

13% appreciation, eh?

Should you wish, or be forced, to sell your house, and assuming that you could sell it at the appraised value, would you really receive, in the end, a 13% return on your original purchase?

I rather doubt it, considering the commission to be paid, moving expenses, upkeep costs paid during your tenure as a homeowner, etc.

Personally, I think that homeownership is for the birds, so to speak. Real estate, over the long term, can seldom be relied upon to offer any sort of real “appreciation” (there is a fine NY Times article dated March 5, 2006 entitled “This Very Old House” on this subject, detailing a 400-year review of housing prices in Amsterdam). It is far better to be a renter and invest the homeowner-renter savings differential.

While I don’t totally disagree with Random Poster on the costs of home ownership I don’t know that I would go as far as to say that their is a savings associated with renting. Tax deductions of mortgage interest (especially in early years of mortgage) generally will at least offset property taxes and then there are other miscellaneous costs such as insurance and upkeep. But, you retain any upside from property appreciation. However, I really don’t understand why if it is a push on buy/rent why anyone would opt to rent, especially when your options are living in your own house vs. an apartment or paying someone else’s mortgage.

Wow, I am shocked that so many are in denial about home prices in Houston. Sure some neighborhoods here and there aren’t yet showing signs of depreciation. Those homes inside the loop are seeing a depreciation of value. All one has to do is drive around the higher priced neighborhoods such as Afton Oaks, River Oaks, Southampton, etc. and see all the for sale signs….the worst is yet to come. I am glad I am not selling my home now. It is definitely a buyers market.

Rachel – All you need to do is look at the houses in these neighborhoods that actually have sold in the last 3 months and the prices and you will be very surprised. No doubt that sales are slower and inventory is higher, but fact is that prices have yet to come down much in these areas – its just a fact. And most people trying to sell in the inner loop are not in distressed situations so unless they really need to come move the property they are not too flexible on price.

SD, the tax deduction argument for homeownership is, in my view, consistently and repeatedly overrated, as it often overlooks that the difference between itemizing and taking the standard deduction is seldom that great. Furthermore, does it not strike anyone that the concept of “spend $1 to get 25 cents back” is a bit perverse?

With regard to the “savings” aspect of renting, the lack of any real committment (which undoubtedly comes with homeownership) is, to some, priceless. Plus, with renting, my wallet is not burdened with upkeep and yard costs, and my time is free from such burdens as well.

Similarly, being able to retain “any upside from property appreciation” is an illusory argument: it is entirely possible that no “upside” would have occured by the time you need to sell your house.

Granted, the calculations between renting and owning are typically property-specific. But in my experience, I’ve come out far ahead by renting.

I had my house in East Sunset Heights appraised two months ago with an appreciation of 62% over when I purchased it in 2002. WOW!

Seriously, WOW!

Alost no homes have sold in the past three months:

http://www.greenwoodking.com/images/pdf/marketreport2.pdf

Look at the one of the 2 homes that actually DID sell in Southampton:

http://harlistings.marketlinx.com/SearchDetail/Scripts/PrtBuyFul/PrtBuyFul.asp?Prp=RES&MlsNumList=7065322&EmailKey=40902382

here is a beautiful home ON SUNSET BLVD selling at 85% of list after 203 days on the market.

Last year it would be 2 days on the market with a bidding war!

Appraisals mean nothing…its not what your home appraises for, but what is sells for that matters. All you get from a higher appraisal is more tax money out of your pocket.

Wait until double-digit inflation kicks in as a result of the trillions of dollars being printed by the Fed. Renters are going to see their rent increase significantly each year while homeowners keep their same monthly payments (provided they have a fixed rate mortgage). Then the argument for owning a home will be a no-brainer.

Irfan,

Your reason for the homes not selling well in the suburbs is preposterous. Most of the concerns you listed are not major concerns of home buyers particularly families. Schools and house size rate much higher than the other elements. A husband will take longer commute to keep his wife happy with her home location or her own commute. I see it all the time with friends and co-workers that live in the suburbs. Also, the b*llsh*t about suburbs lacking culture is pure elitism. I’m not a suburban home owner, but I really hate constant demeaning of suburban homebuyers as lesser citizens. Woodlands has and outdoor concert series performed by the Houston Symphony, Ballet, and Opera!

BK,

You are spot on. If and when (more likely when) inflation kicks in, rents will begin to skyrocket. And Houston is fortunate not to celebrate the bad practice of rent controls. The only hope for renters is that enough inventory is on the market to keep prices competively lower, but since inflation affects pretty much everyone prices should rise together. Faster on properties that are still finance by the owners. Properties that paid off will only have to use rent money for upkeep and taxes. They may fair better.

As a current buyer I can promise you that inner loop properties are still incredibly strong. And it all depends on the price point. I would say generally inner loop below $500K has not experienced much depreciation while houses over $750K have clearly been under considerable pressure.

__________________________________________

I’m sure some are still buying homes in the $500,000 to $1,000,000 range. That doesn’t mean they’re worth the sales price. Only that some are buying them.

As for appraisals, private appraisals at this point are going to be about as reliable as appraisal district appraisals.

A year ago there was the same attitude in Los Angeles. Almost every home in the $5-10 million range, roughly the equivalent of a comparable home here in the $500,000 to $1,000,000 range, has now been sold or is still being marketed for roughly half.

And yes, the realtors like to juggle the MLS figures out there also. They were juggling like crazy a year ago. Prices will remain stable in a market as long as the seller doesn’t have to sell.

Some had to finally sell. And the same thing is happening here. It’s not a buyer’s market here yet. But it will be.

The Houston MLS covers a wide, wide area from Pearland to Cypress to Spring to Rosenberg. Real estate is local, remember location, location, location? E.G., you can be in West U for $300,000–backing up to the RR track. Therefore, while it’s interesting to see broad-based charts, those buying or selling in the next few months need local data, not only about home sales, but also about incoming/outgoing relocation, the Houston job market, and mortgage rates of course. Glass half full or half empty?

And then there is the rental market. I see a new snazzy apartment building in the Heights area offering all kinds of discounts, but the rent on the little cottages is very high by comparison, and they are getting it!

Um, if you drive around River Oaks, you wont see for sale signs. They aren’t allowed. There are currently 9 homes listed as sale pending or option right now in River Oaks, Avalon and Dickie Place. Things are definitely still selling and prices certainly haven’t dropped.

Matt wrote:

I’m sure some are still buying homes in the $500,000 to $1,000,000 range. That doesn’t mean they’re worth the sales price. Only that some are buying them.

—————————–

Matt – I’m not sure I follow your logic. The value of a property is what someone is willing to pay for it. If there are still buyers for properties in the $500K – $1MM range, then those properties are still worth that.

And Random Poster – interesting argument against home ownership. I suppose it depends on the return on your investments. We bought inside the loop 9 years ago and sold our house for more than double what we paid. Our annualized rate of return was over 10%, which given that the stock market has erased the last 12 years of gain, makes my house look like one of the best investments I’ve made yet!

Matt – that comment is absurb. Value is what someone is willing to pay you.

Random Poster – I thought it was obvious that there is potential downside, as in any investment, to real estate. It was mentioned, because obviously as a renter you have no upside.

The other thing houston homebuyers need to consider is the cost of money right now, as other posters have mentioned. Home prices may not be at their low here yet, but it is possible/likely that mortgages rates already saw their low a few weeks ago.

Home ownership and also rental real estate can make incredible investment sense. However, if you do not have good cost effective connections for upkeep, repair, insurance, etc. then things don’t look quite so attractive. Also, if you have the knowledge and skills to do upkeep and/or renovations yourself, then the investment upside becomes even more attractive. I’ve have had a securities license for almost 25 yrs now and I still think residential real estate is a great investment, if you’re prudent and don’t pay retail for everything. But, that same thing can be said for most other investments too. For some people, the carefree lifestyle provided by renting their home may seem to make sense to them. However, to me it’s a waste of money and tax deductions. I don’t even like the thought that I rent an office instead of owning a small building and renting out the part I don’t occupy.

A sure way to find a peak in the RE market is to find a continuing rising price trend and rapidly decreasing sales volume. But to do that, you’d have to look at the data seasonally adjusted. Looking at time-on-market would expand the picture, too.

I’ve peeked into the market recently. I see a lot of overpriced homes and some very affordable ones. There is a large price spread between mostly equivalent homes. My theory is the overpriced ones have unfavorable LTV that the owner can’t afford to sell for less than what is owed for payoff.

To the Original Poster: As a Realtor, I would like to ask you to show us how right you are by pointing me to some properties inside the Loop that could be purchased for 2005 prices. I have buyers. Really ready finance-able buyers. Of course, you had better send me a lot, or my buyers will bid your properties up to a price past 2005 prices in a heartbeat. So, let me at them. I am ready.

I search the market constantly, and would love to present these “2005” deals to my buyers, but I am not seeing them.

Rachel: The house on Sunset was not “A Beautiful Home” by the standards and expectations of its neighborhood. It was a teardown, whose owners had to take less because the builders who would have bought it in minutes last year can not get financing right now. (unlike residential buyers, who can) When you see “Seller to do no repairs”, that is your clue.

Random, your arguments may apply to those willing to rent an apartment, but not to those of us who want to live in a house. The rent for my house would be about the same as my after tax mortgage costs, including taxes and insurance. Ans I would still have to do the yard. I might get a break on repairs. By owning the house, I will eventually not have a house payment, other than taxes and insurance. That will be way cheaper than renting. And when I get old, I’ll have the house to sell to fund my nursing home care.

Comparative value is what I meant by value and comparative value in Houston is pretty much comparative value as determined by HCAD. And yet there are several homes in the Houston area appraised by HCAD at $10 million or more. I doubt any of them would sell for that. Realtors would disagree. But then it’s not in their best interest to admit the comparative value is overvalued value.

It is true that actual value is what someone is willing to pay for it. But I know two women in Los Angeles who are going to have to wait for awhile to find a buyer unless the zoning restrictions are changed and someone decides they want a boutique hotel in Holmby Hills. Suzanne Saperstein will not budge from her $125 million asking price. And Candy Spelling won’t budge from her $150 million asking price. But then they don’t have to sell. A Saudi prince wouldn’t budge from his $35 million asking price here several years ago. He didn’t have to sell. And so the house didn’t sell. But some do have to sell. That hasn’t happened here in sufficient numbers to affect the overall market. But it will. As for prices not dropping in River Oaks, well, sales prices on MLS aren’t always the real sales price are they?

Inner Loop is going to see less devaluation because it is more desireable. But as people in Los Angeles discovered, desireable isn’t a protection against devaluation. And it is happening here. Despite the MLS figures. Including the sales figures. Which aren’t always really the actual sales figures.

The “inner loop” is more desirable, or that WestU or River Oaks are more desirable are those same bogus arguments made about other locations. Look at the San Francisco market for a good comparison. First, the suburbs had price depreciation of 30-50%, and everyone said, “but the inner city of San Francisco is so desirable, so it is an exception.” I just came back from San Francisco looking for a summer home. Prices inside the city are free-falling. New construction has virtually stopped. Inventory numbers have been creeping up, so it was only time when prices would have to fall. Simple economics. If you consider the massive price appreciation in the inner loop the last few years, it is a bubble–and it will pop.

Historically, prices are driven by the labor market. Many employers are downsizing and no offering raises to their employees. There are hiring freezes at many of the area’s largest employers. So who is going to buy these expensive homes?

Guess your glass is half empty, Mr. Matt. Again, real estate is local. Texas is not California. Houston is not Los Angeles. Grind your ax all you want, but I believe Mr. Mandell is correct for his market. At the same time, some areas of Pearland are in deep distress due to foreclosures bringing the prices down and deep discounts by builders with excess inventory. If Mr. Matt believes certain sales figures state in the Houston MLS are not true, he should contact the Houston Association of Realtors and see about filing a complaint. If an exchange of funds is not stated on the closing statement, that’s illegal. The MLS now includes amounts when closing costs or repairs have been credited to buyers.

In terms of the inflation picture, one risk to home prices is if the Fed increases interest rates to fight off potential inflation. Keep in mind this is one of the main objectives of the Fed and they will almost certainly do this. Now they may somewhat miss the mark, and we will stil have some inflation. But to control inflation, they will raise interest rates, effectively making the cost of homeownership higher. Right now, the cost of homeownership is artificially high, since interest rates are at unsustainable low levels. When interests rates go up, that same monthly payments buys a much cheaper house. Therefore, home prices may come down.

There has already been significant price depreciation at the top of the market in these areas. Do you really think River Oaks, West U, etc is going to collapse? There are not going to be many forced sales in these areas and plenty of people are still buying homes here.

As long as we all agree that inner-loop homes are holding value better than those in far-flung exurban areas, then I’ve got no quibble with the posters’ broad analysis.

However, the regional numbers are only interesting from the macro view. North

Katy has very little in common with North Boulevard.

I strongly believe that solid, close-in

properties will suffer only a small dip

and a rebound as the recession runs its course. I also believe that Houston will suffer only a fraction of the damage that we see/will continue to see in the wildly overbuilt regions.

Inside-The-Loop-Houston has some of the best fundamentals in the country, bar none (no giant $ runup, OK economy w/giant health care segment, low home cost as % of personal income, high % of properties NOT financed w/liar, etc. loans, consolidation of energy staffing to Houston, vibrant port and more).

Almost without exception, close-in Houston homeowners are among the most fortunate in the nation – possibly the world – as we all muddle through the real estate bubble.

Do you really think River Oaks, West U, etc is going to collapse? There are not going to be many forced sales in these areas and plenty of people are still buying homes here.

—-

Saying any area is immune for downturn is a sure way to place a losing bet. Ever heard of a “sure thing”? I don’t have the history; can somene help out? Were these… or ANY… areas of HOUTX immune from the local real estate downturn in the 80s?

The HOUTX market shows many indicators of a peaking market. It’s naive to believe that the local market will remain in a vacuum of a deteriorating economy, and widely declining RE marketplace. This is just the leading edge. Any decline or collapse is just gathering momentum. Buckle up!

Name the person who can predict the peak or bottom of any market and I’ll gladly hand over my investments to them.

People can watch trends and predict something is near or past, but rarely has anyone predicted the peak or bottom.

Historically, it takes about 2 years for most markets to recover from a housing bottom, but that isn’t set in stone. Some markets rotted away (Detroit) and some markets just flattened out (one prediction for Houston).

Houston having a flat market for a while is not necessarily a bad then. It could be a prolonged bottom.

Summer weather is simply a correlation. The real reason sales boom is due to families relocating while kids are out of school during the summer. The sharp drop off in closings at the end of summer is due to school returning to session. Very nice analysis though.

If Mr. Matt believes certain sales figures state in the Houston MLS are not true, he should contact the Houston Association of Realtors and see about filing a complaint. If an exchange of funds is not stated on the closing statement, that’s illegal. The MLS now includes amounts when closing costs or repairs have been credited to buyers.

___________________________________________

Unless something has changed, the MLS figure is the figure reported to MLS. Not verified by MLS. You figure it out.

There has already been significant price depreciation at the top of the market in these areas. Do you really think River Oaks, West U, etc is going to collapse? There are not going to be many forced sales in these areas and plenty of people are still buying homes here.

__________________________________________

Not all homes in River Oaks are sold on the open market through the friendly neighborhood Realtor. Some are sold by the friendly family attorney. And there have been some “pre-foreclosures” sold already there and in Tanglewood and Memorial. If you have a $2 million loan you need to cover on a $3 million home and have a “willing buyer” a friend introduced you to who has $2 million in cash, you are going to sell the home – your loan is paid off, your credit is intact and best of all you didn’t have to cough up $120,000 in commission to a Realtor out of your dwindling capital. Pity the poor person who finds out they paid $3.5 million for their house and the next door neighbor only paid $2 million even though it’s bigger. It is happening here.

As for other markets not having any relevance to the market here, the effect of the collapsing economy is merely being seen first in other markets. A number of homes in these other markets, Los Angeles and New York in particular, have been sold through “pocket listings” which means the listing broker brings the buyer and if the broker wants to co-op the sale, the broker pays the other broker out of his commission which usually doesn’t happen because there is no MLS and no advertisement allowed. Word of mouth or your own customers only. Some simply don’t want just anyone schlepping through their living rooms with the Picassos on the walls but some simply don’t want anyone to know they’re selling and wondering if they’re selling because they need to. Which most are. Rumor is some brokers here have begun to take “pocket listings” despite their always having refused to. Until now. The “pocket listings” tend to bring a better price but in this market if the house is priced for a “willing buyer” rather than the market itself it sits there. Along with everything else. There has been devaluation in our market. Some refuse to accept that. Including many of the friendly neighborhood Realtors.

The difference between a $500,000 house and a $750,000 house is $15,000 in commission. If you’re a good agent and tend to sell your own listings, you are going to try to make that extra $15,000. If and when you sell the $500,000 house for $750,000.

People have been paying too much for their homes in our city the past five to ten years. The Realtors loved it. As did HCAD. Reality is reality. And eventually reality will hit the Inner Loop although to a degree it already has. It just hasn’t hit the Realtors or their sellers who can’t figure out why their house is still sitting there in this market that’s still so wonderful according to their Realtors.

Bellaire may not be Bel-Air but the reality is the same. And the reality is it ain’t worth what is was worth a year ago. Just as the $7,500,000 home in Bel-Air ain’t worth it, the $750,000 home in Bellaire ain’t worth it. Unless you find a fool who doesn’t know better.

My past experiences with licensed real estate agents have been honest and professional. When one has an ax to grind, though, anyone can use unsubtantiated rumor and hyperbole in lieu of facts, a la Fox ‘News’, to support his or her weltenshung.

“anyone can use unsubtantiated rumor and hyperbole in lieu of facts, a la Fox ‘News’, to support his or her weltenshung.”

You actually believe that? To me, all three cable news channels are quite a load of crap with MSNBC being the worst. Obviously newspapers are worthless. The best coverage of any US news is coming from the UK papers (not BBC though).

Anyway as with all information from any source, blanket trust should never be used. The MLS, although comprehensive, can have errors because humans are behind it. Now, it doesn’t mean that every entry is flawed to push some kind of misinformation. If it was, that would break as a story eventually.