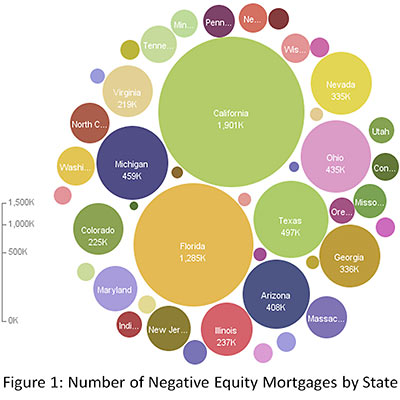

HOUSTON-AREA MORTGAGE STORM SURGE: NOW A QUARTER UNDER WATER Another few months, another one of those studies from research firm First American CoreLogic — this one using data from the end of June. By that date, the firm says, 26.15 percent of all Houston-Sugar Land- Baytown-area mortgages were in a “negative equity” position. Add in the “up to their eyeballs” crowd of mortgage-holders who are within 5 percentage points of owing more than their homes are worth, and the figure rises to 33.86 percent. That’s a marked increase from the figures in the firm’s March study, which used data from September 2008. [First American CoreLogic; previously on Swamplot]

Tag: Negative Equity

Sure is nice for us Houston didn’t get caught up in that big price run-up housing markets in the rest of the country fell for! That’s why in Houston real estate is in much better shape than it is everywhere else, right?

Not according to a study released yesterday by First American CoreLogic. The research firm estimates that 18.3 percent of all mortgaged properties in the Houston-Sugar Land-Baytown region are in a “negative equity position,” and another 6.7 percent are within just 5 percentage points of being there. “Negative equity,” AKA “I’ve fallen down and I can’t get up,” means a mortgage holder owes more than the underlying property is worth.

In other words, 1 in every 4 Houston-area mortgages is already in deep doo-doo.

But hey, all it’ll take to recover is for prices to rise a little! And the rest of the country is doing much worse, right?