Sure is nice for us Houston didn’t get caught up in that big price run-up housing markets in the rest of the country fell for! That’s why in Houston real estate is in much better shape than it is everywhere else, right?

Not according to a study released yesterday by First American CoreLogic. The research firm estimates that 18.3 percent of all mortgaged properties in the Houston-Sugar Land-Baytown region are in a “negative equity position,” and another 6.7 percent are within just 5 percentage points of being there. “Negative equity,” AKA “I’ve fallen down and I can’t get up,” means a mortgage holder owes more than the underlying property is worth.

In other words, 1 in every 4 Houston-area mortgages is already in deep doo-doo.

But hey, all it’ll take to recover is for prices to rise a little! And the rest of the country is doing much worse, right?

***

In some areas, sure. (More than half of all mortgages are now upside-down in Nevada, for example.) But Houston’s 25-percent-of-mortgages-are-waterlogged figure is right at the national average. First American CoreLogic estimates 20 percent of mortgages nationwide are already underwater; back in September the country-wide average was 18 percent — just about where this region is today.

Which means that if Houston really is the last car on the real-estate roller coaster, it should be pretty clear which direction we’re headed.

- New Data Shows One-Fifth of all Mortgages Underwater [First American CoreLogic]

- Housing plan’s effect in Houston area? Hard to tell [Houston Chronicle]

- Study: Texas negative equity at 18 percent [Houston Business Journal]

- Report: 20% of Home Mortgages Were Underwater in December [Wall Street Journal]

- Previously in Swamplot: Houston Real Estate Sales Volume: Off the Charts!

Image: First American CoreLogic

“Which means that if Houston really is the last car on the real-estate rollercoaster, it should be pretty clear which direction we’re headed.”

That’s the good news.

I have some questions about the study that I’ll have to read to see if they answer it.

How many were 100% mortgages? Those were the ones easy to be upside down in because there was no down payment to protect you from up to a 20% downturn.

How many were 100%+ mortgages? Those you already start underwater.

If you are not intent on moving anytime soon, this stuff actually means nothing to you. The rough part is if you have to move because of work and need to sell the house.

@kjb434: Good question. Unfortunately, the report itself doesn’t appear to be posted online, but the national numbers in it made big news yesterday, so you might be able to get more details by googling to find some of the coverage. The number of 100% mortgages in the mix doesn’t appear to be something they quantified as part of this report, but the company might have that info separately. We’re hoping to get some more detailed data from them in a week or so.

@kjb434: We were just sent a link to the actual report, so we’ve updated the post. Try the first link listed at the bottom of the story.

Thanks Gus!

Keep up the good work!

As I was told over and over again in my college math and engineering class:

“Statistics is how you win an argument without real facts.”

It’s a little different than the common state about lies and statistics.

Hey,

At the bottom of the report is goes over methodology.

It looks pretty solid. It doesn’t answer my question, but it does look like a pretty simple yet good analysis.

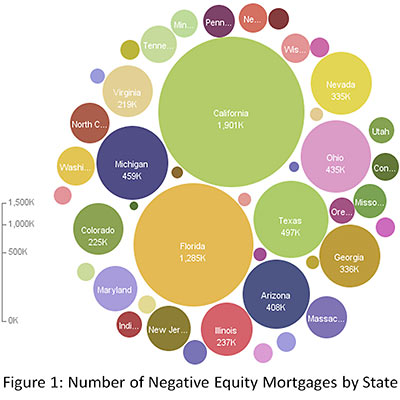

I do like the bubble graphic to show the relative amount of mortgages compared to other states.

@kjb434: Yeah, I like that graphic too. So it’s at the top of the story now.

That 18% of mortgages are in negative territory is by no means positive. But in order for us to make a realistic assessment of the situation, we would need to know the percentage of negative equity in these homes. If the average underwaterness is 20%+ of the homes’ value (like Nevada for instance) than the statistic is staggering. If most of the negative equity mortgages are $95k loans on a property that’s worth $92k, then that will easily be remediated in the upturn.

Yes, I like how the story very clearly points out how many mortgage are at least 95% LTV (nearly underwater), but they don’t point out how many of the underwater loans are 100 to 105% LTV (nearly above water). It’s not the end of the world if you bought a $200k home with no money down and now it’s only worth $190k. Just keep making the payments as promised and enjoy all the utility a home provides.

It also doesn’t breakdown how many of those homes are investor owned vs. owner occupied. No sympathy for the investors. All investments have risk.

@Erion Shehaj & Bernard: The press release doesn’t provide that data, but this info included about the national numbers may shed some light:

“More than 2.2 million, or 5.3 percent, of all mortgaged properties are in a severe negative equity position with LTVs of 125 percent or more . . . More than 70 percent of these mortgages are in five states: California (723,000), Florida (432,000), Nevada (170,000), Michigan (128,000), and Arizona (122,000).”

Then, the company’s predictions: “Future changes in the negative equity shares will be driven by two components, the distribution of equity and home price declines. Going forward, the largest increases in the share of negative equity will most likely occur in states that have not yet experienced deep declines. The reason: the boom/bust states already have very high negative equity shares and incremental declines in home prices will result in smaller negative equity share increases relative to other states given the same decline in prices. This means that as prices continue to decline in 2009, the rise in the negative equity share of states outside the boom/bust regions will begin to accelerate more quickly relative to the boom/bust states.”

If loans and insurance did not exist, we would have none of this mess.

That’s probably true. But then we would be Zimbabwe.

In my opinion, the problem wasn’t that there were loans and insurance involved but that the products that were offered completely disregarded financial principles. It was one big party and as it often happens during parties, principles are out the door, herd mentality rules, and all end up with a huge hangover.

Gosh you could get a mortgage for 100%+ LTV a few years ago (and even today), so why is anyone surprised to be upside down if that is where you started from. The news media wants to keep the eyeballs, so they restyled our homes into “investments” to be tracked daily with commentary. It’s housing and lifestyle, and if you get some of your money back in thirty years that’s a good thing.

Wish my 401K had performed as well as Houston RE. When pension funds start defaulting and 401K are wiped out, its going to get nasty. My suggestion is go to work for governmnet: growth industry, job security, little work, lots of holidays, good insurance and wonderful pension.

Current events much? We’re turning into Zimbabwe at a breathtaking rate. I heard the President of the United (Socialist?) States of America point out 451,000,000 jobs have been lost since this recession began, as justification for his “We need to do something BIG, NOW, even if it’s WRONG” program– which includes the second largest redistribution of wealth the world has seen.

My family has worked very hard, saved, paid cash for everything we’ve bought–cars, homes, and airplanes. We have bought only what we could afford to buy, to maintain and enjoy, and afford to lose. Life has been simpler that way, without loans or insurance (except the minima required by law)(ever wonder why the lawyers require insurance?). I wonder if my children, or grandchildren will be able to live the way we have, or just what they will be reduced to.

Finance and insurance industries inflate the cost and make needlessly complex every commercial transaction. What value do they add? They are the destruction of the health care industry, of_________… They are the entropic yin to the plaintiff bar’s yang. So much greed has led us to this fix we are in. Feel that poverty trickling up, comrades.

Eric,

So because you personally pay cash for stuff you think the entire financial system is redundant? Do you conduct all of your transactions only within some closed gold-and-barter bubble? How do you think your family’s airplane got built, or invented in the first place?

BTW, I don’t like the graphic. It’s hard to tease out the effect of state size on total negative equity numbers. So you can tell NV and AZ are doing relatively badly, and NY must be doing relatively well, but only with some effort.

I’m not normally such a curmudgeon…

jt

Redundant, yes, and failed. All of the aircraft manufacturers are bankrupt, or nearly. I use currency– we’ll see how much longer that holds up.

> Current events much? We’re turning into Zimbabwe at a breathtaking rate.

Not even close. If Zimbabwe woke up tomorrow to 8% unemployment and 3% inflation, they would declare it a national holiday and people would be dancing on the street.

> My family has worked very hard, saved, paid cash for everything we’ve bought–cars, homes, and airplanes. We have bought only what we could afford to buy, to maintain and enjoy, and afford to lose. Life has been simpler that way, without loans or insurance.

Agreed. Agreed. And Agreed.

But to say that the reason we’re in this mess is because there is such a thing as mortgages and insurance is at best a freakish overreaction. That’s like saying:

“All accidents are caused from people in cars, so we should get rid of them and go back to horses”

If common sense financial principles are applied and enforced (operative word) we would not be in this mess either.

My advice: Turn off the news. Watch something else: A movie, a ballgame, hell even Poker on TV if that’s your thing. Participating in the current 24 hr cycle of “the world is going to hell in a handbasket” also known as CNN is a waste of time, at best.

Thanks Erion. I would include Fox News (in fact put it in front of the list) with the world going to hell in a handbasket waste of time.

Wait, get rid of cars, or the people in them? Just kidding. My point: If all accidents are caused by cars that are exploding left and right and with increasing frequency, then, yes, let’s hitch up to old Bessie. Anything built on financing is a house of cards.

EMME grows weary of all the name and label calling and wishes for a world where people can live harmoniously, whether they agree on political philosophy or not.

Houston’s economy has diversified since the 80’s, but we’re still largely an oil & gas town. High energy prices ($145/barrel last summer) kept a lot of cash pumping into the Houston economy and cushioned us from much of the RE downturn faced by the rest of the country. At the same time, plant expansions and engineering contracts (refineries, chem plants, etc) were also experiencing record upswings and that boom has dropped significantly over the last 6 mos. The big cushion factors to our local RE market, oil/gas/petrochem have all dwindled down significantly, and that drop has occurred only recently. I seriously doubt the impact of those downturns underpinning our local economy has been priced into the Houston RE market to any significant extent. RE problems will not be limited to subprime loans by any stretch IMO.

@mook

I think your point is absolutely valid. Lower oil prices have already affected the local economy as demonstrated by the higher unemployment numbers that just got released as well as the drop in prices caused by the heavier weight that foreclosures carried in home sales. But in my opinion oil prices have been on an upward trend heading into the summer. Not to mention that OPEC cannot afford oil at these prices for much longer so more supply cuts are sure to come. I truly believe we will see oil between 60-70 dollars per barrel by the end of the summer. And this time, those petroleum underpinnings will not only shield us from pain but fuel our turnaround as well.

I think Mook’s got it right. You can see the collapse happening in West U. Noticed what I thought were an unusually high number of for sale/for rent signs there in late January, so started keeping an eye on the number of listings. (There’s an easy link on the chron.com site and then you can click on a neighborhood.)

At the beginning of Feb. there were 297 residences listed. It has climbed more or less steadily over the past 6 weeks and stood at 353 today. A drive down Edloe from Westpark towards Holcombe is almost scary. There is a combination of developers finishing the last of the giant McMansions for this cycle and likely reseting of adjustable rate mortgages and job losses. There will probably be a cascading effect as very expensive places that can’t be sold get reduced and put pressure on prices of smaller places that have to be cut in turn.

I disagree with Erion’s sentiments about oil prices. Over the past year, we have seen the beginnings of deflation in all asset categories. Oil has been at historically high levels over the past 5 years coinciding with the growth of the debt bubble. See this chart:

http://www.wtrg.com/oil_graphs/oilprice1947.gif

While there were many dire predictions about “peak oil” and $200/barrel oil last summer, oil is simply doing what everything else, e.g. real estate and milk, is, returning to historically normal prices that were in effect back around 2003, or $30-40/barrel for oil. Of course, the price will bounce around because of speculation, but OPEC has little control over prices. If they had, there wouldn’t have been a bubble last summer and there wouldn’t have been a collapse in prices following the bubble.

oil prices are already going up. i see gas priced over $2.00 a gallon. sure i know supply and all that, but oil is on its way back up.

gee i am sorry for the dr doom followers on here who seem to love gory stories, oil is going up. deal with it.

Looks like I called this just right 3 months ago and with a few weeks to spare :-)