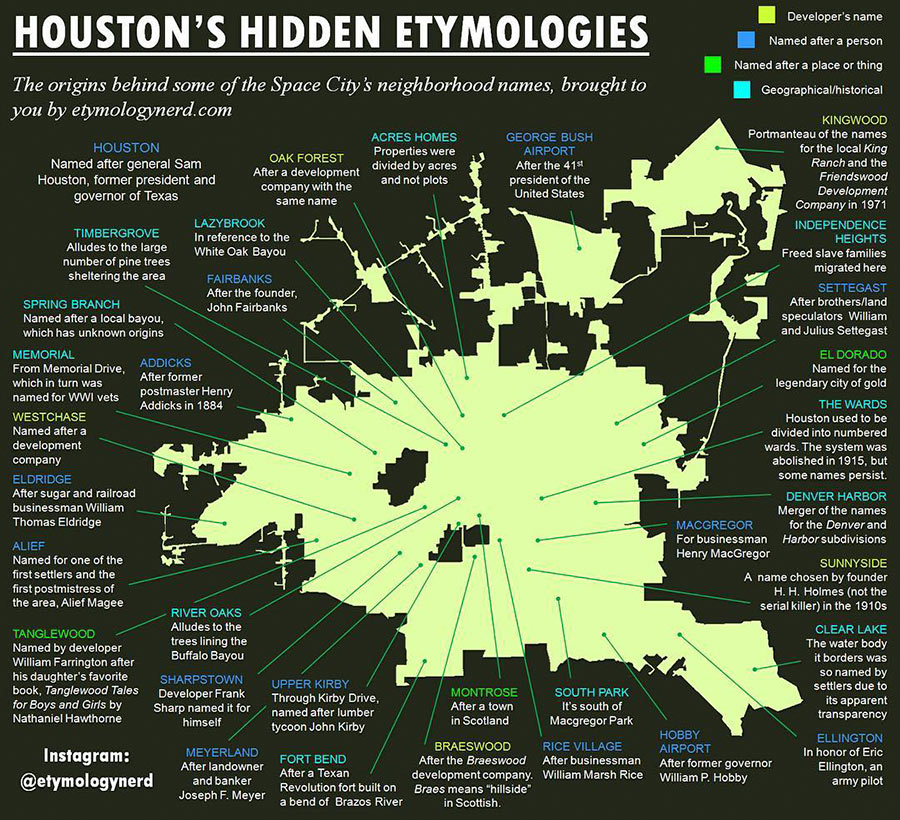

THE 82 SQUARE MILES OF TIRZS SPONGING UP SOME OF THAT REVENUE CAP SPILLOVER  A couple of state senators are mulling over potential reform options for Houston’s ballooning tax increment reinvestment zones, which have more than tripled in area in the past decade according to Mike Morris and Rebecca Elliot’s article in Friday’s Chronicle (which includes a peek-a-boo-style before-and-after slider map for reference).  The zones, shown here on the city’s own map, collected around $109 million dollars of woulda-been property tax money this year for use on development projects inside their boundaries, which (in theory) are supposed to encompass blighted areas in need of an additional redevelopment boost. Morris and Elliot also point out, however, that much of the tax money being collected by TIRZs would be lost altogether if the zones were disbanded at the moment, as the sudden influx would pass Houston’s revenue cap (which limits the amount of cash the city is allowed to collect each year to what was collected in the previous year, scaled up by 4.5% or by inflation and population increases, whichever is less). They also mention that Mayor Turner is pushing for a new vote on the revenue cap in 2017; Turner tells the duo that the city council has stuck with the TIRZ system to make up for some of the potential funds lost by the revenue cap, but notes that “you can only do that for so long without hurting the city as a whole.” [Houston Chronicle; previously on Swamplot] Map of Tax Increment Reinvestment Zones: City of Houston

A couple of state senators are mulling over potential reform options for Houston’s ballooning tax increment reinvestment zones, which have more than tripled in area in the past decade according to Mike Morris and Rebecca Elliot’s article in Friday’s Chronicle (which includes a peek-a-boo-style before-and-after slider map for reference).  The zones, shown here on the city’s own map, collected around $109 million dollars of woulda-been property tax money this year for use on development projects inside their boundaries, which (in theory) are supposed to encompass blighted areas in need of an additional redevelopment boost. Morris and Elliot also point out, however, that much of the tax money being collected by TIRZs would be lost altogether if the zones were disbanded at the moment, as the sudden influx would pass Houston’s revenue cap (which limits the amount of cash the city is allowed to collect each year to what was collected in the previous year, scaled up by 4.5% or by inflation and population increases, whichever is less). They also mention that Mayor Turner is pushing for a new vote on the revenue cap in 2017; Turner tells the duo that the city council has stuck with the TIRZ system to make up for some of the potential funds lost by the revenue cap, but notes that “you can only do that for so long without hurting the city as a whole.” [Houston Chronicle; previously on Swamplot] Map of Tax Increment Reinvestment Zones: City of Houston

Whoa. Talk about a choice of lesser evils:

.

1. Remove the revenue cap so that the City could sop up all of the “excess” tax revenue going to the shadowy TIRZs. Downside: the cap is gone so the City could have unlimited revenue. Very Emperor Palpatine of them.

.

2. Keep the revenue cap and the spillover goes to the TIRZs who work on their projects with no coordination and with little oversight. Downside: Money gets wasted with no accountability and nothing really improves.

.

I’ll admit that I was prepared to be against removing the revenue cap when this was first proposed by Mayor Turner. Now, not so much since I think TIRZs operate in too much of the shadows.

The question is why not expand the existing TIRZs that have been essentially redeveloped into those areas needing redevelopment nearby? This would not only ensure funding of future projects in the original TIRZ but also help keep those pesky neighbors in less desirable neighborhoods just outside from using “their” improvements.

An arbitrary cap on revenue on a city that continues to grow is so idiotic, it makes California tax laws almost seem logical. It’s an article of faith that the government wastes money, yet when you actually try to cut spending, we find that the work is poor quality and doesn’t last long. Shocking! Whoda thunk?

.

We keep adding roads and utility infrastructure, and inflation, though low, is still climbing. Yet our cap prevents us from collecting money to reflect that growth. I’m sick of my car being torn apart by cruddy roads downtown, and the stench of backed-up sewage at street corners where it’s not draining from the manholes.

.

Of course, this system of taxing property on perceived market value is regressive, arbitrary, and idiotic, as well. But that’s an argument for another thread.

Wow! This is truly a Kobayashi Maru situation. But if it’s not fixed without losing revenue, the city and many of its neighborhoods are screwed. I wonder if some of the wealthy TIRZs realized this when they asked to be designated. They’re still getting TIRZ money even though the “improvements” have long been completed, while other neighborhoods go wanting. It’s ultimately unsustainable.

So lets see if I understand this. A TIRZ is setup in a “blighted” area, like Montrose or Upper Kirby. A portion of the tax revenues that should be going to the general coffers end up in a special fund that can only be used within those regions. So wealthier and more established areas like Greenspoint have their tax dollars moved to assist in the more problematic and struggling areas like Rice Military.

.

For the life of me I can’t see a problem with this. What am I missing? It’s important that we subsidize the wealthy. If we pump enough dollars up to them some of it will trickle back down to the rest of us. It’s basic gravity people.

before we get too far into the TIRZ bashing, know that of the $109 million, about third goes back to the City through Administration fee or HPD overtime or costs. The remainder, save for about $1 million, goes to debt payment. if we close down the TIRZ, City gets debt obligations. Oh, the one million is Administrative costs to run and manage the TIRZ. That’s about all the City would reclaim at a complete shut-down. That does not take into account the political fallout of every council member saying, “close the others, but not mine!”

Apparently it’s based off the TIF (tax increment financing) scheme which started in California back in the 50’s which Moonbeam Brown shut down (or at least started to) in 2011? And since it has anything to do with tax law it is inherently complex. From my understanding in order to create one it takes 50% of property owners in an area to set one up and go through the bureaucracy of doing such. The city can set one up only if the area is less than 10% residential. Amounts are negotiated as to which party gets what $ between the city and tirz. The improvements in each area are meant to eventually increase tax valuations on properties which fund financing for improvements in that area? So it sounds to me like more and more areas are banding together to keep more of their tax dollars near them instead of never seeing it again once it reaches city hall. The argument against them (tirz) is that the city has less money to spend elsewhere? In theory wouldn’t an increase in tirz’s force the city to focus improvements in areas that are “unincorporated” (non tirz areas)? Instead of a revenue cap, there should be an expenditure cap. Take in as much money as you want, just don’t piss it all away like you’ve been doing.

Turner is a typical tax and spend democrat backed by police and fireman’s unions. The reason he wants to ditch the cap is bc the city is broke paying pensions. Ignorant voters elected him, not knowing that propert taxes threaten the viability of Houston, as a city. Eventually, corporations tap out and move to the burbs – see Detroit. Lee Brown started the destruction, Sylvester aims to finish it.

Some of these TIRZs made sense when they were first implemented, but it’s perhaps useful to remember that people had a different set of concerns twenty years ago and that those concerns have evolved.

.

The Downtown and Uptown TIRZs are good examples. At the time, both of these neighborhoods were on the one hand very large tax bases and by default were very large regional draws for business, conventions, shopping, and tourism…but on the other hand they were sort of unpleasant (or, okay, sometimes kind of severely unpleasant). The theory goes that by sprucing up a targeted high-visibility neighborhood, the City government should expect to create more business within the city limits. That would benefit the financial position of the City government. We can argue whether the particulars of any given TIRZ or TIRZ-funded project are worthwhile, but the logic is sound.

.

Similar arguments could be made for other targeted neighborhoods, for example strips of land fronting linear parks, in order to finance the development and maintenance of the parks themselves. If those parks are a regional draw, benefiting residents throughout the City of Houston and making the City a more attractive place to live, work, visit, and do business, then a broad set of constituents are served and the City’s tax base is improved. Build the tax base and then, even with a revenue cap, that means that you can cut the tax rate. Cut the tax rate, and you bump your commercial property values directly and all other property values indirectly over time. If its managed well then there’s something in it for just about everyone.

.

The use of Management Districts, on the other hand, provides parts of the city (and the region, more generally) with the opportunity to levy a larger tax on themselves in order to go above and beyond what the existing local government can provide for local people. If some random wealthy neighborhood wants to dramatically improve its neighborhood parks and that isn’t going to benefit the City as a whole in any strategic sense, then that’s where Management Districts are very useful. But the very same thing can be said about poor neighborhoods, or any neighborhoods at all. Effective use of Management Districts can result in an improvement in their constituents’ quality of life, which will correspond to an increase in property values in general — but only within their communities and not beyond them.

.

Obviously though, its a lot *easier* for wealthy neighborhoods and disproportionately commercial neighborhoods to leverage the use of Management Districts. If there’s going to be a policy focus on wealth transfer, it needs to be more regional or even state-wide in scope. Wealth transfer within a single municipality has the potential to distort how and where people of various socioeconomic classes live, pushing one group out or pulling one group in; and a City will always have a financial incentive to try and push out the poor and pull in the wealthy. (One can look to the City of Dallas to see how *that* gets done.)

I say just get rid of them all and start over. You can’t polish a TIRZ.

Lets just turn the land currently called the COH into a series of TIRZ’s!

We are already kinda powerless to the bureaucrats, developers and monied interests so lets just go full meta.

Create different TIRZs to cover every part of the area currently not part of a TIRZ.

Dissolve the COH and turn all inter-TIRZ functions over to the County. The County then charges each TIRZ based on some formula of size and population.

The name could be Greater Houston instead of the COH, or better yet, Greater Heights since the Heights now seems to encompass the area bounded by Allen Parkway, I45, the Beltway and Memorial Park.

And EaDo would be the EaDoTirz. Creative TIRZ managers could sell the naming rights.

Talk about changing the paradigm of urban development forever!

“The use of Management Districts, on the other hand, provides parts of the city (and the region, more generally) with the opportunity to levy a larger tax on themselves in order to go above and beyond what the existing local government can provide for local people. If some random wealthy neighborhood wants to dramatically improve its neighborhood parks and that isn’t going to benefit the City as a whole in any strategic sense, then that’s where Management Districts are very useful”

–

Except in Montrose, a few people got together and formed a management district. And it only taxes commercial property is its not fairly assessed. And even when an overwhelmingly large % of people signed to get rid of the district, they went right on working.

–

The Montrose district has been taken to court to get rid of them. They still hang around. Ironically their legal fees are paid by the very people trying to get rid of them.

I dont mind the TIRZ. I think they just need to be tweaked to build it some ways to hold those in leadership accountable. Sounds good in theory, but I dont know how to do that in practice because it doesnt seem like ANYONE in public leadership is held accountable in Houston/Harris… even those who are supposed to be accountable by design.

@ Cody: Yes, you’re absolutely right regarding your concerns that these special districts should be more transparent and accountable to the public. It also makes no sense at all to me that homeowners shouldn’t share in the burden (and furthermore it doesn’t make any sense that somebody with a three-plex is residential and a four-plex or more is commercial or in general that multifamily *housing* is taxed as commercial property). And I agree that there are substantial risks posed by the way that they are governed. The devil is in the details. That’s true of many other government entities as well; but it doesn’t mean that there’s no plausible justification for them.

1. Get rid of TRIZs. They have not been used as promised(gee another govt program gone awry). The money from it does not evaporate. It instead stays with the TRIZ residents who usually are just the rich ones in the nice neighborhoods, the money goes back to them. They can invest in their neighborhoods themselves. Central Park, the most visited city park in the country, is a public park but managed by a conservancy group that contributes to the budget of the park. Memorial Park residents(or residents near any park) can do the same thing

2. We DO NOT HAVE A REVENUE PROBLEM. WE HAVE A SPENDING PROBLEM. City govt needs to realize there is so much that can be cut fron the budget. The tax cap exception for cops and firefighters barely hired any new cops/firemen. Most of it, I’m sure, went to bureaucrats instead. We need to get better bang for our buck to compete for residents and businesses with the suburbs(well some of them no longer should be called suburbs but rather cities since they have grown so quickly).

3. Instead of a tax cap, let’s have a spending cap. It would be hard for officials to justify taxing like crazy if we actually kept expenses at a reasonable rate. And if our population grows like crazy, the excess money can be used to pay debt. By not addressing the spending problem, we do not tackle our debt because politicians are just gonna say let’s keep spending to the same level as taxes. Swiss voters instituted a national spending cap, and since then the national debt has gone down as they tackled the real problem of spending rather than revenues.