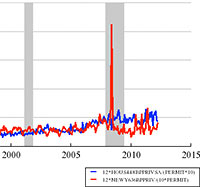

WE’RE BUILDING MORE HOUSES IN HOUSTON  “The New York Metro areas has more than 3 times as many workers as the Houston metro area,” notes UNC professor and Forbes economics blogger Karl Smith after looking at a bunch of graphs, “but can’t keep up with the pace at which Houston is permitting new housing.” One of the several charts Smith assembled from Federal Reserve data shows that the number of construction permits issued in the Houston metro area surged ahead of the number issued in the New York-New Jersey-Long Island area beginning toward the latter end of 2007, just as the recession hit, and has stayed ahead. (The pace of new permitting in both cities accelerated in 2005, but fell off in New York a couple years later, after a big spike.) Over the last couple of years the Houston area has accounted for between 3.5 and 6.5 percent of all newly issued U.S. housing units. [Forbes]

“The New York Metro areas has more than 3 times as many workers as the Houston metro area,” notes UNC professor and Forbes economics blogger Karl Smith after looking at a bunch of graphs, “but can’t keep up with the pace at which Houston is permitting new housing.” One of the several charts Smith assembled from Federal Reserve data shows that the number of construction permits issued in the Houston metro area surged ahead of the number issued in the New York-New Jersey-Long Island area beginning toward the latter end of 2007, just as the recession hit, and has stayed ahead. (The pace of new permitting in both cities accelerated in 2005, but fell off in New York a couple years later, after a big spike.) Over the last couple of years the Houston area has accounted for between 3.5 and 6.5 percent of all newly issued U.S. housing units. [Forbes]

All your permits are belong to us?

My take on Texas Real Estate market is … Americans are trained to buy based on costs of “how much per month” and not so much consider the overall price, since most dont pay off a 30 yr mortgage anyway… Texas has no state income tax but very high property taxes this figures into the “how much can I pay per month”. So it seems our high property taxes created an artificial cap on real estate prices and hence prevented an ensuing crash. As we know Texas was a nation before a state and our constitution places the onus of taxes on the then wealthy landowners, since everyone was a farmer or rancher. Im not in the real estate business like most readers here, but this is my opinion based on a regular guy on outside looking in. Ben