COMMENT OF THE DAY: NEW URBANIST FLIGHT “Several posters are spot-on about walkable neighborhoods commanding a premium over traditional suburbs, if all else is equal. Unfortunately you can’t have it all in Houston – neighborhood charm, architecturally interesting houses, walkability, safety, good public schooling, AND affordability. Our growing family is being “forced†out of the Heights for several of the above reasons. If a New Urbanist development existed in the Houston area that was priced similarly to the traditional lollipop surburb, we would go there in an instant. Instead, we’re moving to what we see as the best suburban compromise – the Woodlands. Outside observers will no doubt think we are going to the suburbs because of the cul-de-sacs, but the truth is, we are going despite them.” [CV, commenting on Cul de Sac City: Houston’s Ban on New Street Grids]

Tag: Home Prices

Why hasn’t this cute little cottage on South Blvd. in Boulevard Oaks been snapped up yet?

Location: 1930 South Blvd., Boulevard Oaks

Location: 1930 South Blvd., Boulevard Oaks

Details: 5 bedrooms, 6 full and 4 half-baths; 7,863 sq. ft. on a 10,140-sq.-ft. lot

Price: $2,450,000

History: Original home on property torn down in fall of 2007. Listed for $2.6 million during construction; price cut $150K last Halloween.

Our nominator writes in:

I’ve walked through this home. It’s a vacuous monument to the “price per square foot” itch that’s infected so many builders trying to make a buck in fancier neighborhoods. If you can get $300 a square foot for a 3,000 square foot house, why not build a 6,000 square foot house and double the take? And think of the bonus you could get for 7,863!

So the design becomes a ridiculous exercise in racking up square footage for no useful reason. Most of the experience of this house consists of walking down long, built-to-impress but useless hallways. The master bedroom is big enough to skate in.

This place only looks like a great deal on paper. I hope studying this home will make realtors and builders and buyers and appraisers think twice about applying mindless per-square foot pricing formulas.

Because this is what you end up with.

So . . . how should you price it?

COMMENT OF THE DAY: IDYLWOOD APPRAISAL CASE CLOSED “All of you people are batsh!t crazy if you think you can get a house like that in Idylwood for the low $200’s. If houses LESS than 1300 sq ft have been selling for just under $200,000 or $145 to $150+ a foot. Do the math. 500 more sq ft, a second bath that not all of the other sales had and more upgrades for only $10,000 or so more? . . . This house has closed. It sold for $242,000 as well it should.” [Robert, commenting on Idling in Idylwood: Where’s a Friendly Appraiser When You Need One?]

COMMENT OF THE DAY: THE LOW PRICE OF HIGH PROPERTY TAXES “Houston is pretty affordable overall. However, people like to make statements about how affordable the city is and say ‘Prices are low because of __________.’ My point is, property prices are low for a lot of reasons. One of the reasons is that property taxes are high.” [Andrew Burleson, commenting on Houston Home Values: The Property Tax Effect]

FIGHTING THE NEW APPRAISAL RULES A Swamplot reader draws attention to a “rumored email” purporting to show that the National Association of Realtors is gearing up for a campaign against the Housing Valuation Code of Conduct that went into effect at the beginning of May. The HVCC was meant to safeguard the independence of appraisals — in part by prohibiting loan officers, mortgage brokers, and real estate agents from selecting the appraiser for a particular property. The email, posted on a San Fernando Valley real-estate blog, indicates that the NAR is pushing Congress to impose an 18-month moratorium on the new code. Our reader wonders if recent stories of “unfair appraisals” — such as this one — are the result of a larger “orchestrated campaign” against the new rules. [Effective Demand; Swamplot inbox]

HOUSTON HOME VALUES: THE PROPERTY TAX EFFECT A few of Andrew Burleson’s conclusions from a comparison of property taxes in Houston, Chicago, L.A., and New York: “When a person buys a $200,000 home in Houston they’re actually making payments worth $273,000 including taxes. When a person in Los Angeles buys a house for $200,000 they’re making payments worth $235,000. It costs the person in LA the equivalent of $37,000 less to obtain the same loan. . . . The greatest irony here is how this plays out at the high end of the market. Because our taxes are so high, the cost to own valuable property becomes significantly higher here. . . . What you can see in the chart is how the actual cost to own a property is much higher than the real value of the property, and how this gap becomes larger as a property increases in value. For instance, if you have enough cash flow to make payments worth $200,000, you can only actually afford about a $150,000 home in Houston. As you look up the scale the difference becomes more ridiculous. $750,000 worth of cash flow actually gets you $550,000 worth of property in Houston – that’s $200,000 in value lost to property taxes. Therefore, if you’re rich, and you’re planning on buying a mansion, you’re better off living in Los Angeles or New York.” [NeoHouston]

Is this house on W. Alabama in First Montrose Commons priced . . . too low?

Location: 409 W. Alabama St., First Montrose Commons

Location: 409 W. Alabama St., First Montrose Commons

Details: 3-4 bedrooms, 4 1/2 baths; 2,558 sq. ft. on a 7,812-sq.-ft. lot

Price: $449,900

History: On the market for a month and a half. Price cut $50K a month ago.

“Why should this house be listed for more?” asks a Swamplot reader:

Because it is really large in square footage (2,558) and lot size (7,812 sf) and in addition to the main house, there is a nice carriage house in back that could be a home office, in-law quarters, rental apartment, or given that it’s Montrose, a nightclub or tattoo parlor (kidding). Although it’s been 10 years since it was updated, I think the updates have held up and stayed fairly current with today’s design trends as evidenced by the kitchen’s under-mount, double stainless sink, cooking island, granite, tile floors and tile backsplash with custom dark wood cabinetry and upgraded appliances included (looks to me). Master bath has tile and granite; one of the secondary baths looks like it could use some serious updating.

Custom paint throughout, looks like big closets, nice hardwood floors (some look better than others), lots of French doors and a bright and sunny interior make this home, in my opinion, the quintessential (non-bungalow) Montrose residence. And then there’s the added bonus of a wrought iron fenced and gated (not cheap) property on a very eclectic street. Who needs TV when you live on W. Alabama? Just sit on the porch and watch the street life. Nice landscaping, too.

What would be a better price?

THE SECRET SALES PRICE SECRET Over the past 2 years, the practice of omitting sales price information from Multiple Listing Service sales forms has increased, possibly skewing reported median home price data, reports Steve Brown in the Dallas Morning News. In several high-end Dallas neighborhoods, transactions with a “Z” in the price column now account for the majority of sales: “Because of the way the MLS database is structured, it’s hard to find out how prevalent the practice is. . . . Jim Gaines, an economist with Texas A&M University’s Real Estate Center, wonders how withheld prices affect the data his center releases to the public each month. ‘Of course, if these are systematically at lower prices, then our averages and medians are overstated to the extent they are not showing lower-priced property sales,’ Gaines said.” Texas is one of only 5 states that doesn’t require public disclosure of home sales prices. [Dallas Morning News]

The Chronicle’s Nancy Sarnoff says low appraisals are becoming the “newest threat” to Houston’s housing market. Her example? The story of the redone bungalow at 6707 Fairfield St. in Idylwood, where the sellers accepted a full-price offer less than a week after the property was listed.

But the appraisal on the 1,780-square-foot home came in at just $206,000. The buyer couldn’t come up with enough cash to make up the difference and [co-owner Derrick] DeCristofaro wasn’t willing to drop the price, so the deal fell through.

Why can’t the appraiser buy that $242,900 asking price?

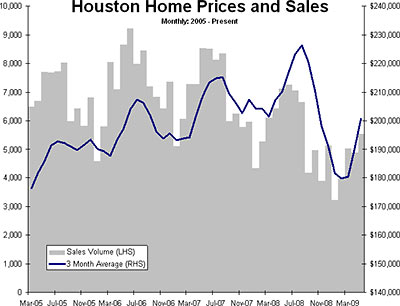

The May home numbers are in and they’re . . . not so bad, says Swamplot’s chart-wielding commentator:

The “spring selling season†is going well as average home prices are up 21.6% since the beginning of the year. Errrr…ummm….that is a big move and it underscores that there is a strong seasonal trend at work. The big bounce brought us up to slightly above May of last year on a median basis. Positives included record low interest rates and foreclosures were “only†20% of the total.

Fewer foreclosures is better, right?

A reduction in foreclosure sales is a change in “product mix†and doesn’t reflect on the price of a given home. In prior reports we were encouraged to ignore them, now the lower # of foreclosures is embraced and is cited as “price gains.†The strong seasonal trend is powerful enough to keep the housing “bears†like me silent for a few months. May also featured some of the lowest interest rates in a long time, so buyers were poised to move and lock in lower rates.

A Swamplot reader thinks this 1959 ranch at the corner of Bellefontaine and Morningside in Braeswood is priced too high — even though the property is listed as “Pending Continue To Show”!

Here’s the scoop:

Location: 2401 Bellefontaine Blvd., Braeswood

Details: 4-5 bedrooms, 4 1/2 baths; 3,748 sq. ft. on a 14,436-sq.-ft. lot

Price: $700,000

History: Currently under contract. Listed as “Pending Continue to Show.”

Our nominator writes:

I was thinking about this property three ways.

It could be sold as a remodel (which would probably require $100K or more just to update surfaces – a little birdie told me, for example, about the bright purple shag carpet in the entire bedroom wing of the house) – if it was an updated large ranch on this prime corner it could probably get close to 800K on a resale IMO. So what would a “flipper” pay for that? I’m guessing in the 500’s.

It could be sold as a teardown. The land value here is good and probably won’t ever collapse, but it will not be generating any income for a couple of years at best. There is way too much inventory in the neighborhood right now (big houses, old houses, new houses, empty lots) for more building to make much sense.

It could be sold as a rental. I’m currently living in . . . a big beautiful ranch house that hasn’t been touched in 50 years. In some ways that’s neat, but in other ways (plumbing, electrical) it is not. So I’d guess the rental income here will be about $2700/month. What would be the math on that for a purchase? I think that would depend on how much cash you put into the house and if you were landbanking it. I’d still end up in the 500s.

So . . . you got a better number?

Are you getting the sense that some properties on the market in the greater Houston area are priced a little . . . inappropriately? Then you’ll enjoy the brand new feature Swamplot is trying out. We’re calling it the Swamplot Price Adjuster.

Which properties will Price Adjuster feature? Ones you send in!

Here’s how it works: Send your nominations to Swamplot in an email. Make sure to include a link to the listing or photos. Tell us about the property, and explain why you think it’s worthy of a price adjustment. Then tell us what you think a better price would be. (Unless you request otherwise, all submissions will be anonymous.)

Swamplot Price Adjuster will feature the best submissions, and allow readers to comment on and quibble with the property’s pricing.

Does this sound like an interesting idea? Good, because we’ve already received our first Swamplot Price Adjuster submission, and it’s waiting for your proposed adjustments:

Texas boasts six of the top 12 residential real-estate markets in the country, says Money magazine. Houston is ranked number 12, behind San Antonio, Dallas, Fort Worth/Arlington (yeah, they broke them out), El Paso, and that southern juggernaut McAllen. They predict a 3.2 percent increase in home prices here over the next year.

Money’s handy chart gently reminds readers of the 9.6% drop between 1984 and ’85, but it includes another statistic that suggests any downturn here won’t be as catastrophic as it might in Los Angeles, for example: the median mortgage here is only 15 percent of a homeowner’s income. In L.A., that figure is 57 percent.

- Forecast: 100 Biggest Markets [Money]