COMMENT OF THE DAY: MOVIN’ ON UP! “The Upper East Side of Manhattan was once all single family mansions and townhouses (after it was farmland). Most of them are now gone, replaced with highrises; some of the most expensive on Earth. I’m sure most people in West U, Southampton, Broad Acres, etc . can’t imagine Bissonnet, North, South, or Sunset being lined with highrises some day, but I’m equally sure that the residents of Fifth, Park, and Madison didn’t imagine it either.” [John, commenting on Ashby Highrise: The 9th Is the Time for Charm]

Tag: Forecasts

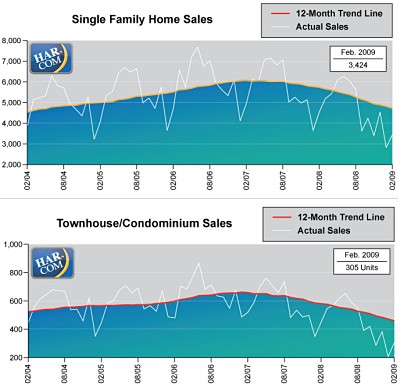

Looks like HAR has responded to some Swamplot reader criticism and added a bit of needed real estate to the bottom of the charts in its latest report — as well as a thin white line to indicate actual, non-adjusted values. The changes and the addition of the latest numbers show a market that doesn’t seem quite so steady as last month’s HAR report made it seem.

There were 25.9 percent fewer property sales this February than last, according to the report. But our reader’s 3-month-moving average chart doesn’t look any worse than last month:

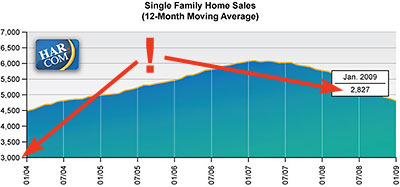

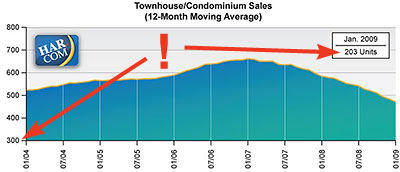

A reader writes in to poke fun at a few “awfully massaged” charts included in last week’s monthly MLS report from the Houston Association of Realtors, calling them “the unintended consequences of crazy average-it-all-together-to-create-a-veneer-of-stability reporting”:

….the latest monthly sales numbers for single family and condo/townhomes are ACTUALLY OFF THE BOTTOM OF THE CHARTS!!

HAR’s sales-volume charts show 12-month moving averages, but even that isn’t enough to keep the latest numbers from dropping through the floor:

The unintentional comedy arises from the fact that the latest values very prominently highlighted in the boxes (2,827 & 203) are well below the scale on either of these sales volume graphs. . . .

It also reveals WAAY TO MUCH data smoothing on their part which calls into question their credibility. Their charts convey almost no information -on purpose.

Okay, but if you’ve got any actual information to share, break it to us gently, please:

THE COMING FORECLOSURE FLOOD “Harris County foreclosures totaled 11,837 in 2008, up 0.6 percent from 11,766 during the prior year, according to The Woodlands-based Foreclosure Information & Listing Service. The figures represent foreclosed homes up for sale on the first Tuesday of each month at the courthouse. The next auction won’t be until January. . . . Foreclosures had made double-digit percentage gains in the prior two years. But they began to moderate toward the end of 2008 because the now government-controlled mortgage finance giants Fannie Mae and Freddie Mac halted foreclosure sales between Nov. 26 and Jan. 9. Also, earlier in the year, the U.S. Department of Housing and Urban Development put a 90-day moratorium on foreclosures in areas affected by Hurricane Ike. Additionally, lenders typically hold off on foreclosures during the Christmas season, adding to the slowdown, said Michael Weaster, an agent who specializes in selling foreclosed properties for banks. ‘Nobody wants to look like ogres during the holidays,’ Weaster said. ‘So what we’ve got in the pipelines is significant.’†[Houston Chronicle]

LAS VEGAS TO HOUSTON: WHAT ARE THE ODDS? A Swamplot reader requests a long hard look at the Houston housing market crystal ball: “Do any ‘experts’ lurking among Swamplot’s readership have any thoughts on long-term residential price trends in Houston? Me and the missus were trying to sell our home in Vegas (good house, great neighborhood, bad timing). Now we will be holding on to it until the Vegas market starts coming back — whenever that is. I’m trying to get an idea on what prices could look like when we finally have the funds to buy locally (6 months – 1 year, depending). Any info or sites that might help us answer those questions would be greatly appreciated.” [Swamplot inbox]

HURRICANE IKE: GREAT FOR HOUSTON REAL ESTATE! “. . . the storm, which might have left about 50,000 homes uninhabitable in the Houston-Galveston-Brazoria metro area, could actually give a boost to the housing market, University of Houston Professor Barton Smith told me today. The local job market, which has remained robust thanks to the booming energy sector, has helped to fuel the need for housing. The storm has created a shortage of homes, some of which will likely never be rebuilt, Smith said. And new home starts could drop as builders turn their attention to repairing damaged homes, he added. ‘This is probably going to create a strengthening of the housing market,’ Smith said.” [Hot Property]

Houston’s housing market will slow, UH economist Barton Smith told homebuilders, real-estate agents, and a Chronicle reporter at his annual spring symposium:

Smith cautioned builders that this area is not immune to the national housing market correction just because housing remains affordable and fixed-rate mortgages are still low.

A national crackdown on subprime loans because of increasing foreclosures will significantly shrink the number of households that qualify for homeownership.

Combined with interest rates that are slightly higher today than two years ago, Smith estimates that the reduction in subprime lending will eliminate nearly 100,000 Houston households from the owner-occupied home market.

On the other hand, real estate experts have seen an uptick in sales of higher-priced homes.

“You’re just seeing the high end of the market going wild,” said Mark Woodroof of Prudential Gary Greene, Realtors.

More than ever before, builders are creating homes valued in excess of $500,000 in places other than the silk-stocking neighborhoods where they’re traditionally found.

“Today, they’re in The Woodlands, Fort Bend, and it’s not because prices are skyrocketing, but because we’re building bigger, more luxurious homes,” Smith said.

Of course, it’s difficult to compare last year’s prices to this year’s—because the house that sold last year is in the landfill, and the new one that replaced it is three times the size. In Houston, that’s your growth in the residential market. So maybe Dr. Smith’s just calling for a little less Foyer.

- Future of real estate here depends greatly on health of energy market [Houston Chronicle]

- 2007 Spring Real Estate Symposium [Institute for Regional Forecasting]