A real-estate firm out of Indianapolis with a keen interest in developing mixed-use projects plans to build a midrise apartment complex on 2 vacant blocks in Midtown, just south of the Pierce Elevated and 4 blocks east of the light rail line running down Main St. Like almost every other recent residential development in the area built before or after the Post Midtown Square about a dozen blocks to the west, though, the Milhaus Midtown won’t include any lease spaces for stores or restaurants. If you’re wondering why not, the company has a detailed explanation ready.

***

In a series of blog posts published last August — about the same time he was working to put together the project in Houston — Milhaus Development founder Tadd Miller walks through the financial ramifications of building 2 different prototypical structures: 3 stories of wood-frame apartments on top of a steel first floor full of commercial lease space, and an all-wood 4-story apartment building. His conclusion: “without free parking, [tax increment financing], tax abatement, or some other subsidy, it is nearly impossible to develop apartments on top of all-commercial space in a mid-market city today.”

Miller may be overstating the conclusion he spells out in a spreadsheet (PDF) comparing the 2 hypothetical options. The all-apartment option simply makes more money for investors:

Since the mixed use building had about $644,000 higher construction loan, there is that much more to pay back. So, the NOI and Cash Flow are similar on the two buildings; but the coverage ratio, expensive construction, lack of sufficient retail rent create a busted pro forma on the mixed-use side. We don’t have to ask our investors which building they want to have their money in: 8.6% versus 26.3% cash returns.

Add in what Miller describes as an additional risk of the mixed-use path — unleased retail space that “undermines the leasing of the residences” — and the firm’s decision is made.

Return on investment isn’t the only consideration everywhere Milhaus operates. “There are actually some cities that require some degree of commercial space at the ground level of every new building,” Miller writes. “To do it in a mid-market city, it requires shrinking the retail space down to a very limited component of the project. . . . The solution in most places is to keep it in all wood construction and provide flexibility in the design so that it can also be residential space or office space or whatever the market brings.”

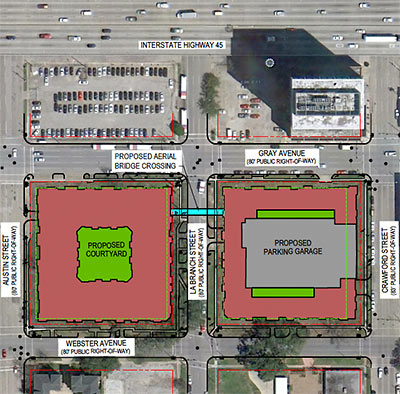

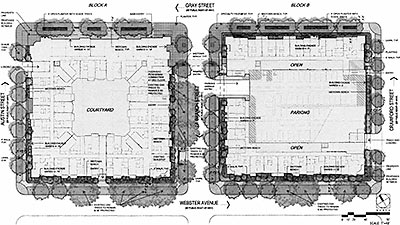

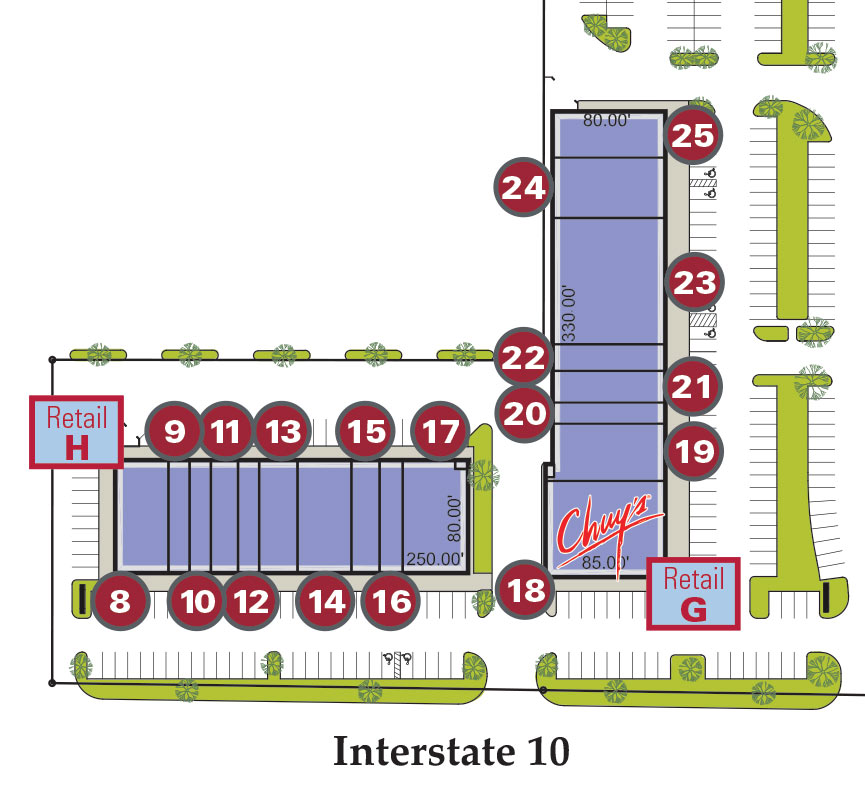

The company’s Houston development will be the first new major Midtown apartment complex east of Main St. and north of Elgin, local blog InnerLooped notes. It’ll sit on the 2 blocks between Crawford, Austin, Webster, and Gray, and — yes — there’ll be plenty of ground-floor residences available. The western block has a central courtyard and is shown 4 stories tall in drawings; the 5-story eastern block, wrapped around a parking garage, is linked by a bridge across La Branch St. Variances that would allow reduced setbacks on all sides will be voted on by the planning commission this Thursday.

- Milhaus in Midtown [InnerLooped]

- Does Mixed Use Really Work? Part One, Does Mixed Use Really Work? (Part Two), and Making Mixed Use Work Financially (Part Three) [Milhaus Development]

Images: Kimley-Horn and Associates, via HAIF

well, may not be what we want w/out the retail, but it’s better than a vacant block & I’m glad something nice is going up there!

What’s a mid-market city?

It’s nice to see a actual real estate development being discussed on this blog. I hope this gets built even without the ground floor retail it will still be nice to see some development.

He probably doesn’t want to say it, but a retail component spooks a lot of multifamily operators that lack retail experience. To a lot of them, it is a white elephant, and that can affect the offer prices that they are willing to pay.

@ dom: Any decent-sized city other than NYC, Boston, Chicago, or San Francisco.

If you dig a bit deeper into the Milhaus proformas, what the developer is REALLY saying is that there won’t be retail because:

1. lenders don’t like it;

2. buyers don’t like it;

3. adding retail reduces my return on cost somewhat; AND

4. mostly because of #1 and #2, it kills my numbers.

If you look at the overall return on cost (NOI/cost) you get 7.7% return on cost with retail vs 8.7% return on cost without retail. That’s a substantial difference, but not eye popping. If the Midtown TIRZ really wanted some retail in the deal, they could easily toss Millhaus a bone and bridge this 100 basis point gap with ease.

The real problem, at least according to Millhaus (not that I disagree), is that the lenders and buyers treat mixed use differently.

In the example comparison, Millhaus assumes the non-retail deal gets a permanent loan underwrittien to 1.25 DSC vs 1.30 DSC for the with-retail deal. This means a larger permanent loan upon completion for the no-retail deal(more cash in Millhaus pocket). He’s assuming lenders will get more aggressive on a apartments-only deal.

He also thinks his eventual buyer will prefer a non-retail deal. He calculates the as-completed value using a 7.00% cap rate for the non-retail project, but uses a 7.25% cap rate for apartments+retail project.

What he’s really saying is, “Don’t blame me for not including retail in my development. Blame the lenders and buyers.”

So, the clowns in the City of Houston’s economic development office go running after Walmart and Kroger with 380 tax deals for mega stores with huge parkinglots but won’t offer a penny to help develop midtown into a walkable urban area? Take the handouts to Kroger and Walmart and give them to these guys to do something good for midtown.

To add insult to injury, there is actually a bridge connecting the two buildings, guaranteeing the deadness of streetlife. You would think this city had rivers of toxic chemicals running over its sidewalks, the way developers and their clientele are so afraid of them.

One of my favorite things about Swamplot are the tongue-in-cheek pun headlines. This one actually made me laugh out loud.

Just out of curiosity, why does the first floor need to be metal construction for first floor commercial but just wood construction for all-apartments?

As a neighbor of this place, I’m actually fine with not having retail (I already have options nearby). I care more about getting residents in the area who feel safe and secure. They will be walking to Baldwin Park, Pappas BBQ, or six blocks to the Toyota Center to play basketball out front. There are also strip centers on neighboring blocks that might get different tenants who cater to the new residents (think Buffalo Wild Wings/Coffee Groundz/Ponzos/Ibiza/etc. like on the West side Midtown).

Also, that part of La Branch is a busy street and a bridge across it is actually probably a necessity. Commuters take it to Webster (another road that borders this development) and turn left on Webster to get to the freeway entrance a couple blocks away.

It’s like the opposite of the Houston Pavilions decision, where they removed the residential component. Starts with both, but eliminates one.

In this case, adding residential is better, but still would rather have both.

I buy the argument that lenders are skeptical about the idea of ground floor retail and apartments above, but i’m not sure that it’s that big of an issue for renters. At least not in midtown. if it was in West U or Meyerland i could see it but not in an area that could be easily made walkable and urban. There’s a demand in that area and it seems like there’s a supply shortage.

This will be good for Midtown even if it doesn’t include retail. I agree that development is better than empty land. This should help meet the rental demand for downtown workers.

If there was a real demand for retail in this area then retail would be built. Of course it would be nice to have a urban walk able midtown with ground floor retail but there just doesn’t seem to be a demand for it. Hopefully if the midtown population increases more mixed use developments will be built.

Can we rename Midtown Midrisetown now?

Totally unscientific, but when I drive around Austin ( a city that claims to love new urbanism) I see lots of vacant space in the mixed use apartments that have gone up there in the past few years. Specifically on West 6th and South Congress, both areas that have a pedestrian component. Many have never filled in the retail with a tenant, and others have had tenants come and go. If Austin can’t embrace mixed-use, I question whether Houston will be able to except in small pockets like upper Kirby.

Why aren’t there any high rise developments or at least any proposals for midtown ? Especially since the land is so valuable.

He mentioned the real reason retail isn’t done; it’s not required here as in other cities. If it was required in areas like Midtown, then no developer/investor would be at a disadvantage. Requiring it would first require a PLAN for urban/commercial/retail/livable districts. Since brainwashed Houstonians equate planning with big scary zoning, we don’t have a plan for anything – except the size of parking lots. So, Midtown continues to be developed as if it were the suburbs. What’s new?

@John- that’s just it. Valuable = expensive land. Why not move east or north where land is up and coming *and* less expensive?

Smart Growth: Being smart enough to see that a ground floor full of empty retail is just dumb.

Three blocks from the downtown bus station. Nice! Not. I think I know why they’re limiting street-level access by omitting the ground floor retail and adding a pedestrian bridge to connect the buildings.

Post Oak’s development with wildly successful ground floor retail is six blocks from the bus station. Is three blocks really the difference between ground floor retail and another apartment midrise box? There is definitely a market for ground floor retail in mixed use residential developments. The problem is that the market for a midrise residential only box is just a bit more profitable and less risky in the short run than the same project with ground floor retail. The result is economic efficiency on the micro level leading to inefficiency on the macro level. Midtown will always be an odd transitional “neighborhood” if everything is either going to be a strip mall or midrise residential. If developers went for mixed use developments that made the area more desirable (imagine block after block of Post Oak-esque development), then that would truly maximize the value of the land. But it will never happen because each development individually does just a bit better economically for the investors as a residential only. It is too bad. Midtown could be a really great place with the new arts center coming soon.

After traveling around Europe and seeing plenty of rundown drug stores and graffiti covered ground-floor retail… I’m actually happy with how Midtown is turning out. Mixed-use is awesome (and I’m all for it)… but too much empty retail (or rundown corner stores underneath) will make the neighborhood look blighted.

@ Northside girl but what I don’t understand is since the land in midtown is expensive why don’t developers build high rises instead of these mid rises in order to make more of a profit ? I mean where this development is going its taking up two empty full city blocks. One with 5 levels of apartments in a mid rise and the other a parking garage surrounded by 4 levels of apartments. Two high rises could go on these blocks with residential units above parking garages similar to one park place, 2727 Kirby, and mosaic.

@ Jon: It’s not just that other cities level the playing field between developers by making them all build ground-level retail. It’s that they level the playing field between sellers of land. When a glut of non-performing retail that apartment operators don’t want gets factored into what they’re all willing to pay for land, suddenly the land isn’t worth as much as it had been, and neither is anything that is allowed to be built there. And that may seem esoteric to someone that isn’t a commercial real estate investor, but it isn’t so esoteric to taxing entities like the City, TIRZs, or Management Districts…and they make the rules.

I think “MiToo” for midtown makes more sense than EaDo.

It is great to see so much interest in Midtown. This is exactly the reason Milhaus wants to be a part of the transformation here. Also, I’m glad you found the comparison I posted on http://www.thinkmixeduse.com did last summer on another project in Indianapolis. I think this site in Midtown deserves a different analysis…..

There is no retail market right now for retail/office on this site, and therefore, it doesn’t matter how cheap you can build it or what you try to force to happen, doing retail could potentially be a very negative to the entire neighborhood, as it would likely end up as more empty space, leaving the wrong impression of the project/neighborhood. There is substantial retail vacancy in the market, including on the first floor of Post Midtown and others. We are very hopeful that bring +/1 500 residents to the neighborhood will help stimulate activity that will allow for some future development that does include retail (which hopefully Milhaus will be able to make happen). This project should be looked at as a stepping stone to that end, not as the final project that settles the issues.

We appreciate all the support that Milhaus has seen on these blogs, and hope that this can become a successful and positive next step in the continued development of Midtown

The arguement being made for leaving retail spaces out of these urban apartment communities is an unfortunate trend in business today. I respect the developers right to earn a profit. We as a community also need to realize this company is building on land that is valued much higher than the property Post built on. The real grinch who stole the ability for developers to build more properties like Post may really be property owners who hold city blocks hostage until they are worth millions. There would be no need for the restoration of Houston’s Urban Center if the current owner’s of decayed buildings had cared for the buildings. It would be nice to see some of our less than beautiful blocks of Houston returned to responsible use. Maybe some of these land owners could try to partner with the companies who do actually build because it takes more than a logo to be a real real estate developer. The lack of retail adds to the addtional problem we are creating with these dense residential developments which is gridlock traffic on streets never designed for such high volume.