COMMENT OF THE DAY: YOU SHOULD GET FLOOD INSURANCE EVEN IF YOU LIVE OUTSIDE ANY DESIGNATED FLOODPLAIN  “Consider the following:

1.) Houston as a whole is a low-lying area.

2.) FEMA Flood Maps are outdated; this is not a new revelation following Harvey.

3.) Flood insurance for Zone X is cheap (I pay $425/year for $200k building/$80k contents coverage)

4.) Your house is outside of both the 1% and 0.2% flood plains (i.e. Zone X).

Given those four conditions alone, buying flood insurance should be a no brainer for anyone that owns property in Houston, particularly if you’re even *near* a 100- or 500-year line. And after this event, which has made it quite clear that the models that determine what a 0.2% and 1% event is are inadequate, not getting flood insurance wherever you are in this town makes no sense at all. Heck, it doesn’t even take a Harvey to flood your ‘never been flooded house’ – all it takes is a blocked storm drain, a collapsed drainage ditch, poor lot grading, or any number of other non-“biblical†localized catastrophic events. Hopefully more people will realize this now, but it’s very sad that so many didn’t until 40-50 in. of rain fell over the entire county in less than 48 hours. [meh, commenting on Suing the Army Corps for Reservoir Releases; A City App for Debris Removal; 30 Years of the GRB] Illustration: Lulu

“Consider the following:

1.) Houston as a whole is a low-lying area.

2.) FEMA Flood Maps are outdated; this is not a new revelation following Harvey.

3.) Flood insurance for Zone X is cheap (I pay $425/year for $200k building/$80k contents coverage)

4.) Your house is outside of both the 1% and 0.2% flood plains (i.e. Zone X).

Given those four conditions alone, buying flood insurance should be a no brainer for anyone that owns property in Houston, particularly if you’re even *near* a 100- or 500-year line. And after this event, which has made it quite clear that the models that determine what a 0.2% and 1% event is are inadequate, not getting flood insurance wherever you are in this town makes no sense at all. Heck, it doesn’t even take a Harvey to flood your ‘never been flooded house’ – all it takes is a blocked storm drain, a collapsed drainage ditch, poor lot grading, or any number of other non-“biblical†localized catastrophic events. Hopefully more people will realize this now, but it’s very sad that so many didn’t until 40-50 in. of rain fell over the entire county in less than 48 hours. [meh, commenting on Suing the Army Corps for Reservoir Releases; A City App for Debris Removal; 30 Years of the GRB] Illustration: Lulu

Tag: Flood Insurance

COMMENT OF THE DAY RUNNER-UP: ABANDONED NEIGHBORHOODS MAKE GREAT DETENTION PONDS  “I grew up off Fairbanks/West Little York area. TS Allison was the third time Creekside Estates and Woodland Trails West II had flooded which meant those homes wouldn’t be insured for future floods. Both of those neighborhoods are almost completely gone now, mainly just streets people use to cut through. Even with all the new construction/neighborhoods built near Breen Rd, nothing around has flooded since. The south side of WTW where Gulf Bank runs through flooded twice in late ’90s, along with Philippine St. in Jersey Village. Neither of those areas have had a third flood event; not Ike, Memorial Day flood, Tax Day flood or Harvey could flood them. A huge reason why has got to be because old Creekside Estates and WTW II hold so much of the water that would’ve flooded them out that costly third time years ago. Sometimes you have to cut loose some fat for the overall good and I know it sounds heartless but I’ve seen it work. These very flood prone neighborhoods just have to be made into retention areas because it works.” [mas, commenting on How About We Don’t Sell People Homes in Areas That Keep Flooding, and Other Crazy Ideas for Houstonians To Discuss Amongst Themselves] Illustration: Lulu

“I grew up off Fairbanks/West Little York area. TS Allison was the third time Creekside Estates and Woodland Trails West II had flooded which meant those homes wouldn’t be insured for future floods. Both of those neighborhoods are almost completely gone now, mainly just streets people use to cut through. Even with all the new construction/neighborhoods built near Breen Rd, nothing around has flooded since. The south side of WTW where Gulf Bank runs through flooded twice in late ’90s, along with Philippine St. in Jersey Village. Neither of those areas have had a third flood event; not Ike, Memorial Day flood, Tax Day flood or Harvey could flood them. A huge reason why has got to be because old Creekside Estates and WTW II hold so much of the water that would’ve flooded them out that costly third time years ago. Sometimes you have to cut loose some fat for the overall good and I know it sounds heartless but I’ve seen it work. These very flood prone neighborhoods just have to be made into retention areas because it works.” [mas, commenting on How About We Don’t Sell People Homes in Areas That Keep Flooding, and Other Crazy Ideas for Houstonians To Discuss Amongst Themselves] Illustration: Lulu

COMMENT OF THE DAY: WHAT FLOOD INSURANCE FLOWS FROM  “The NFIP is a creation of Congress meant to insure against a peril which the private insurance industry refuses to insure against. The reason private insurance refuses is because there is no actuarially sound method to do so. Effectively, federal flood insurance is not pure risk insurance but actually a type of social insurance. To move the conversation forward on flood insurance reform, that fact has to be acknowledged first. By properly characterizing it as social insurance, we can start talking about how much more people in flood prone areas should pay.” [Jardinero1, commenting on The Limits of Mapping Flood Risk; Original Beaver’s Takes a Summer Vacation] Illustration: Lulu

“The NFIP is a creation of Congress meant to insure against a peril which the private insurance industry refuses to insure against. The reason private insurance refuses is because there is no actuarially sound method to do so. Effectively, federal flood insurance is not pure risk insurance but actually a type of social insurance. To move the conversation forward on flood insurance reform, that fact has to be acknowledged first. By properly characterizing it as social insurance, we can start talking about how much more people in flood prone areas should pay.” [Jardinero1, commenting on The Limits of Mapping Flood Risk; Original Beaver’s Takes a Summer Vacation] Illustration: Lulu

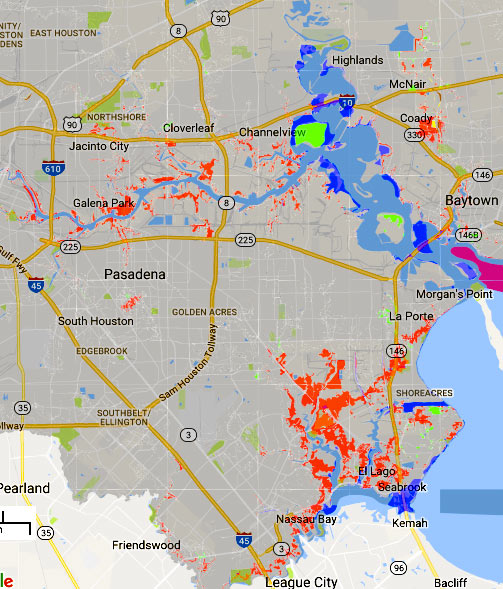

COMMENT OF THE DAY: FURTHER READING INTO YOUR HOUSTON FLOOD AND FIRE CHANCES  “Every home is susceptible to flooding. There are not ANY non-flood areas. There are only homes that are more likely to flood and homes that are less likely to flood. The likelihood is expressed, on flood maps, by the single-year probability of being flooded (with some other factors). This does not properly describe the likelihood of being flooded during the course of a longer time period — of, say, a 30-year mortgage. Homes eligible for NFIP preferred flood rates can have up to just less than a 1 percent chance of flooding annually. These ‘preferred areas’ are what the public thinks of, euphemistically, as non-flood areas. Assuming a .009 probability (just less than 1 percent), a home has a 20 percent chance of flooding, at least once, over the course of a 30-year mortgage (look up binomial probability). An alternative way to think about it is that 1 in 5 homes, in preferred flood zones, will flood over the course of a 30-year mortgage. [In that case,] you are actually more likely to experience a flood than a house fire in a ‘preferred flood area.'” [Jardinero1, commenting on Where Houston Floods Outside the Flood Zones] Image of recent flood map revisions: FEMA RiskMap6

“Every home is susceptible to flooding. There are not ANY non-flood areas. There are only homes that are more likely to flood and homes that are less likely to flood. The likelihood is expressed, on flood maps, by the single-year probability of being flooded (with some other factors). This does not properly describe the likelihood of being flooded during the course of a longer time period — of, say, a 30-year mortgage. Homes eligible for NFIP preferred flood rates can have up to just less than a 1 percent chance of flooding annually. These ‘preferred areas’ are what the public thinks of, euphemistically, as non-flood areas. Assuming a .009 probability (just less than 1 percent), a home has a 20 percent chance of flooding, at least once, over the course of a 30-year mortgage (look up binomial probability). An alternative way to think about it is that 1 in 5 homes, in preferred flood zones, will flood over the course of a 30-year mortgage. [In that case,] you are actually more likely to experience a flood than a house fire in a ‘preferred flood area.'” [Jardinero1, commenting on Where Houston Floods Outside the Flood Zones] Image of recent flood map revisions: FEMA RiskMap6

COMMENT OF THE DAY: THAT HIGH HORSE WON’T KEEP YOUR FLOORS DRY  “Wonder how many areas will sue to get out of the high risk zones, only to get flooded years later, have no insurance, and cry foul. Note to those who are able to sue or survey themselves out of a flood zone… buy the insurance anyway! If you are [put] in a high risk zone, right or wrong, you are close enough to warrant the protection.” [Rex, commenting on A Quick Tour of Spots Where FEMA Will Expand Its Flood Hazard Zone In January] Illustration: Lulu

“Wonder how many areas will sue to get out of the high risk zones, only to get flooded years later, have no insurance, and cry foul. Note to those who are able to sue or survey themselves out of a flood zone… buy the insurance anyway! If you are [put] in a high risk zone, right or wrong, you are close enough to warrant the protection.” [Rex, commenting on A Quick Tour of Spots Where FEMA Will Expand Its Flood Hazard Zone In January] Illustration: Lulu

The areas in red above mark some of the new additions to the legally-gotta-buy-flood-insurance zones on FEMA’s recently revised flood maps. The agency’s interactive online viewer lets you mix-and-match a few data sets for Harris County (as well as Galveston, Fort Bend, and Wharton), compare the old mapped flood zone boundaries to proposed new ones, or look only at what would change — a FEMA spokesperson told Houston Public Media that about 8,000 properties have been added to the list in Harris County, while only about 400 were dropped.

Those acid-green highlights are areas that have been removed from the special flood hazard zone by the updated map (while blue shows areas that have just changed floodplain classification some other way. Bits of brown and yellow in other areas of the map show places added or removed (respectively) from the floodway. The updates above to the mandatory flood insurance zone (legally called the Special Flood Hazard Area) are set to go into effect in January, as shown above. Buffalo Bayou and its tributaries are pretty marked up:

A set of 4 new FEMA disaster recovery centers opened yesterday, sprinkled around the north and west sides of Houston hit hardest by the Tax Day flooding. The locations include a Greenspoint office building right across Greens Bayou from some of the apartment complexes evacuated during the flooding (including Arbor Court). The other centers opened Monday in Meyerland, Cypress, and Spring, and additional temporary help centers might get set up elsewhere around town.

As of yesterday night, FEMA had already received nearly 12,000 applications for post-flood assistance. Harris County reported last week that more than twice as many homes were damaged by the April floods as reported during last year’s Memorial Day flooding. Farmers Insurance agent Peter Zografos told the Houston Press last week that many of the same houses have filed claims a second time: “Some of these homeowners may have to be insured directly with the National Flood Insurance Program due to repetitive claims, [and] basically will be charged more for too many flood claims.â€

- Disaster Recovery Centers Open in Harris County [Houston Office of Emergency Management]

- Another Flooding Pain-in-the-Rump: More Expensive Insurance [Houston Press]

- Previously on Swamplot: Videos: What S. Braeswood Looks Like Fully Submerged, and Other Aquatified Aerial Houston Scenes; Where Houston Flooded and Where It Didn’t on Memorial Day

Map of FEMA disaster recovery centers: City of Houston

COMMENT OF THE DAY: WHERE HOUSTON STAYED UNDERWATER AFTER THE MEMORIAL DAY FLOOD  “Was there ever any kind of press writeup on why so many homes in Meyerland did not come back from this last flood? I’m saddened by all the vacant lots, and on some streets off Endicott, there are clusters of teardowns. Was insurance plus flood insurance essentially useless for all of those homeowners? Or was it the new city building requirements? Genuine questions, because I’ve been in the area 30 years and this [flooding] seems to have been so much more devastating than Allison (and Ike).” [Heather, commenting on Daily Demolition Report: As Is, Where Is] Illustration: Lulu

“Was there ever any kind of press writeup on why so many homes in Meyerland did not come back from this last flood? I’m saddened by all the vacant lots, and on some streets off Endicott, there are clusters of teardowns. Was insurance plus flood insurance essentially useless for all of those homeowners? Or was it the new city building requirements? Genuine questions, because I’ve been in the area 30 years and this [flooding] seems to have been so much more devastating than Allison (and Ike).” [Heather, commenting on Daily Demolition Report: As Is, Where Is] Illustration: Lulu