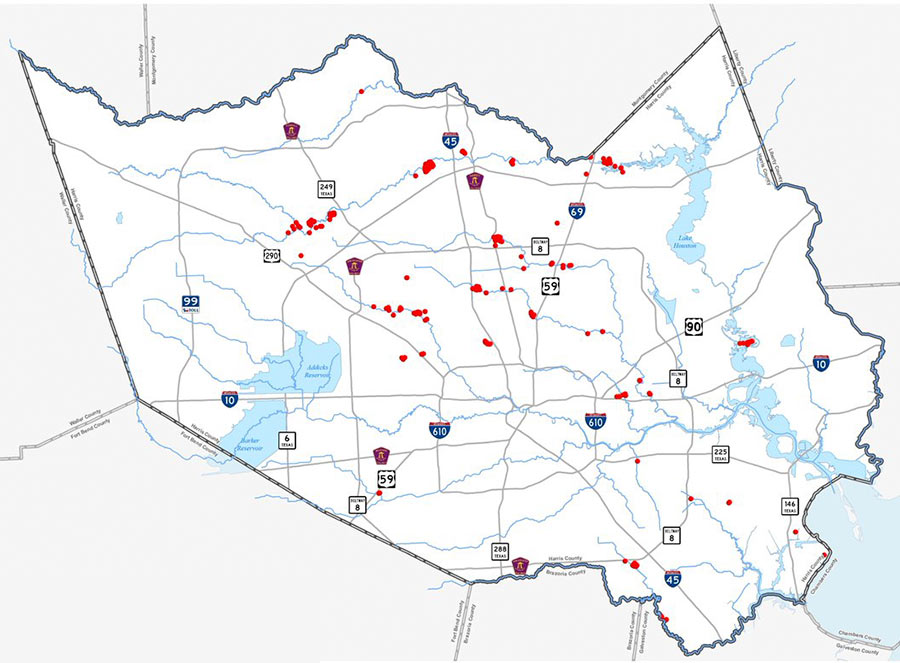

Now that a second, $51 million round of FEMA funding for home buyouts has come through, here’s the map of where the latest government snatch-ups are planned, 294 total. As indicated by the red dots above, they’re all outside the Loop — with a good portion grouped in 3 distinct clusters along Cypress Creek (which drowned out previous flooding records along nearly its entire length during Harvey). Other hotspots include several along White Oak Bayou, as well as a Greens-Bayou-adjacent bunch off Beltway 8 just north of Aldine and a San Jacinto River-side group south of Hwy. 90, near Highlands.

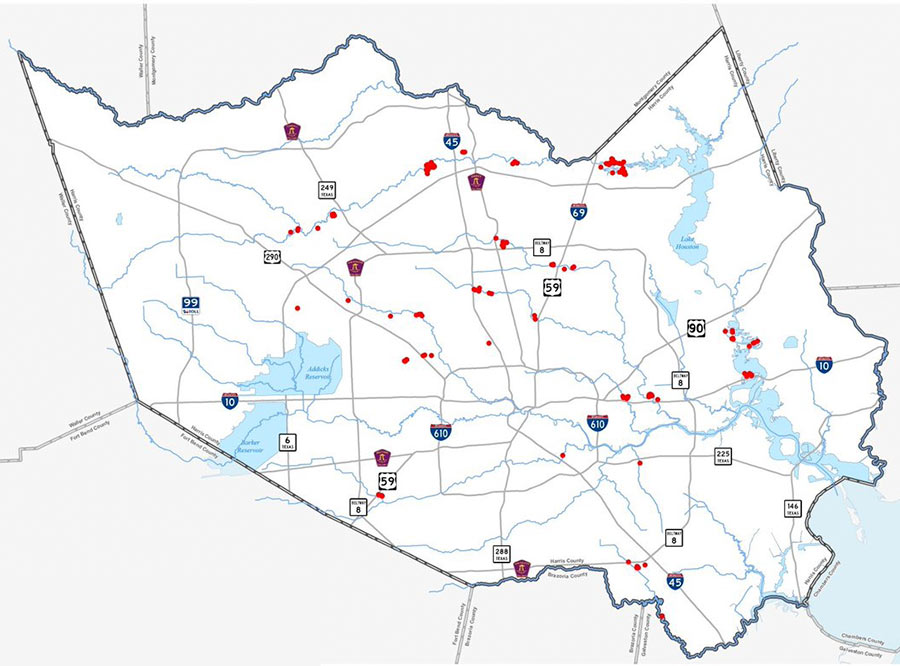

The money Harris County Flood Control District expects to receive for these purchases supplements an earlier $25.6 million FEMA committed to it on June 4. That previous check (along with an $8.6 million match the Harris County Commissioners okayed in order to get it) will be spent on about 169 buyouts, mapped out below:

***

Among them: a whole lot more along Cypress Creek, this time mainly clustered around Humble — as well as one lucky inner-loop home on Brays Bayou, east of I-45.

The flood control overlords are still waiting on FEMA’s answer to the rest of the $163.5 million they applied for in total, enough to buy about 1,000 floody houses.

- HCFCD to Receive First Allocation of Funding to Support Voluntary Home Buyouts in Response to Hurricane Harvey [Harris County Flood Control District]

- FEMA awards $51 million for Harris County property acquisition [FEMA]

- Previously on Swamplot: Every Spot Where Bayou Flooding Broke a Record During Harvey, Mapped

Maps: Harris County Flood Control District via Travis Bubenik

Using the above purchase results, if the proposed $2.5 BILLION bond were used to repurchase homes in the 100 year flood plain then over 14,400 houses could be permanently removed. With additional money that has been coming from the federal government that would increase by thousands more and replaced by parks. Why is this not being promoted? I guess some palms need to be greased.

WR: Totally agree. If the government is going to spend this kind of $, then do so to get rid of the homes that are prone to flood and make them green space. The only counter argument I can see is a ton of new greenspace has a lot of upkeep required by the government that leaving them in homeowner hands does not. Also, you remove homes from the tax roles as well.

.

Ideally the government would just stay out of it and not spend the billions. If someone wants to build a home 10 feet under ground and get flooded each time it sprinkles, that’s on them (and whoever they can get to insure). The government should focus on making sure buyers have good data about where their properties are wrt flooding and then let them make their own decision.

I think that the Green’s Bayou portion of the bond includes ~$95MM with on average $120k buyout per home. It will be interesting to see how this land is re-purposed. Hopefully parks.

There is a community close to 290 and Windfern, on Cole Creek Dr. Another near Fairbanks and Hollister on Woodland West. Deep in the flood neighborhoods that were bought back by Harris County flood a while ago. All of the roads, utilities and everything are there. Just no homes or home owners. Made a great place to take a post lunch car nap, when I worked close by.

I agree with Cody on that last part. The government could save a lot of money if they just stop insuring land in the 100 year floodplain (and increase the cost of flood insurance in the 500). Then to keep developers from selling flood-prone houses to suckers, introduce some better disclosure requirements.

I wonder how much of Ponderosa Forest will be left after all this. They’ve been hit so badly the last 3 years. Removing more affluent households from that area also won’t help its neighborhood economy, which already had challenges.

Cody,

While I agree with the sentiment that the government shouldn’t be buying other people’s mistakes, the infrastructure for those mistakes can be problematic if the owners fail to maintain and instead abandon the structures, letting the electrical and sewer fail and the house fall into disrepair. Better in some cases to nip it in the bud, take a one time hit and properly return areas to nature (assuming that’s what the city/county actually does) and preserve the connected infrastructure for the neighboring areas. Also, start adding a cradle to grave cost of utility connections charged to developers to further drive home the cost to the city. (Kind of like how oil and gas wells are charged a plug and abandon fee on to every well to preserve the financial incentive to properly eliminate the well when it’s no longer economic)

How would that work (the government suddenly stopping to subsidize flood insurance)? All of the people who bought property that relies on flood insurance to be viable would eat the loss? Wouldn’t that be a big hit to the economy?

memebag,

.

I’d assume a stop of insurace would come at the same time as a buyout offer.

.

we’re offering to buy your home, you can take the money, or you can stay. if you stay, you lose all flood insurance.

.

so people who are still in a mortgage from a bank that requires flood insurance, they’d have to sell, if you own it outright, that’s your choice, stay without insurance, or go.

.

the probability is though that someone would offer insurance to these people at really high rates.

Exactly, toasty.

@toasty: Buying out properties takes them off the market and gets rid of the insurance, doesn’t it? I think mjohns is advocating killing flood insurance subsidies without buying out the properties.