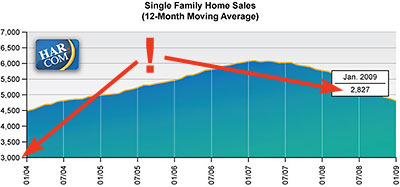

Houston’s housing market will slow, UH economist Barton Smith told homebuilders, real-estate agents, and a Chronicle reporter at his annual spring symposium:

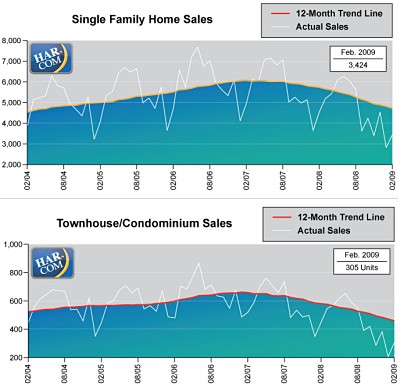

Smith cautioned builders that this area is not immune to the national housing market correction just because housing remains affordable and fixed-rate mortgages are still low.

A national crackdown on subprime loans because of increasing foreclosures will significantly shrink the number of households that qualify for homeownership.

Combined with interest rates that are slightly higher today than two years ago, Smith estimates that the reduction in subprime lending will eliminate nearly 100,000 Houston households from the owner-occupied home market.

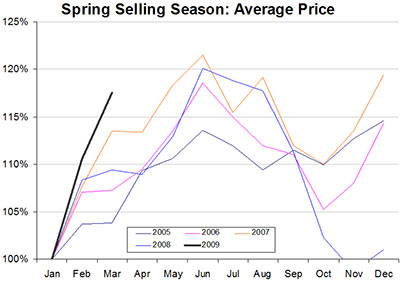

On the other hand, real estate experts have seen an uptick in sales of higher-priced homes.

“You’re just seeing the high end of the market going wild,” said Mark Woodroof of Prudential Gary Greene, Realtors.

More than ever before, builders are creating homes valued in excess of $500,000 in places other than the silk-stocking neighborhoods where they’re traditionally found.

“Today, they’re in The Woodlands, Fort Bend, and it’s not because prices are skyrocketing, but because we’re building bigger, more luxurious homes,” Smith said.

Of course, it’s difficult to compare last year’s prices to this year’s—because the house that sold last year is in the landfill, and the new one that replaced it is three times the size. In Houston, that’s your growth in the residential market. So maybe Dr. Smith’s just calling for a little less Foyer.