COMMENT OF THE DAY: BEWARE OF NEIGHBORHOOD AVERAGES  “Anything zoomed out to the neighborhood scale post-Harvey impact-wise waters down the data so much as to be useless. In the Knollwood-Woodside area where homes are “up ~3%,†it’s a mix of ~$800k newbuilds that mostly didn’t flood and ~$400-500k 1950s houses, some of which flooded and many-most that didn’t. That means any additional newbuild sale immediately skews the pricing average. What has already hit the market lately are mostly original homes that flooded, being sold as-is as teardowns (continuing the trend of the neighborhood), with lot-value on an upswing. I guess I presume all of Knollwood will be new construction in the near future, and almost all of ‘greater Braeswood’ being new construction soon, with everything getting higher elevations . . .” [juancarlos31, commenting on Harvey’s Effect on Housing Prices, Neighborhood by Neighborhood; Houston Press Stops the Presses; Astros Fans Flood Downtown] Photo of house for sale at 8311 Lorrie Dr., Knollwood Village: HAR

“Anything zoomed out to the neighborhood scale post-Harvey impact-wise waters down the data so much as to be useless. In the Knollwood-Woodside area where homes are “up ~3%,†it’s a mix of ~$800k newbuilds that mostly didn’t flood and ~$400-500k 1950s houses, some of which flooded and many-most that didn’t. That means any additional newbuild sale immediately skews the pricing average. What has already hit the market lately are mostly original homes that flooded, being sold as-is as teardowns (continuing the trend of the neighborhood), with lot-value on an upswing. I guess I presume all of Knollwood will be new construction in the near future, and almost all of ‘greater Braeswood’ being new construction soon, with everything getting higher elevations . . .” [juancarlos31, commenting on Harvey’s Effect on Housing Prices, Neighborhood by Neighborhood; Houston Press Stops the Presses; Astros Fans Flood Downtown] Photo of house for sale at 8311 Lorrie Dr., Knollwood Village: HAR

Tag: Housing Prices

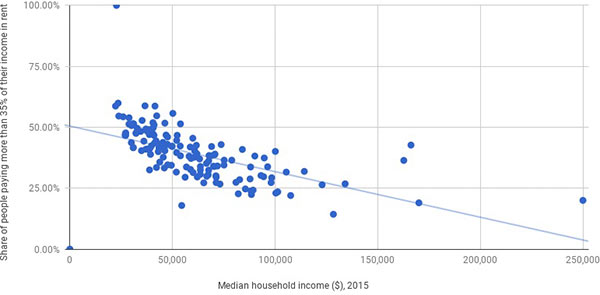

THE RENT IS TOO DAMN HIGH WHERE THE INCOME IS TOO DAMN LOW  Inspired by a report from Harvard’s Joint Center on Housing Studies that compares household income to the percentage of income used to pay rent for various income levels, Chronicle biz reporter Lydia DePillis charts similar stats for Harris County. “Houston is slightly less cost burdened than the national average,” she concludes, “with 46.7 percent of its renter households paying more than a third of their income on rent.” According to her analysis of Harris County data from the Census Bureau’s American Community Survey, “the disparity between high and low-income areas is still present: In the third of ZIP codes with the highest median household incomes, 31 percent of renters pay more than 35 percent of their income on housing. In the bottom third of ZIP codes, the share is 49 percent.” Her graph, shown above, plots median household income (on the X-axis) against the percentage of people paying more than 35 percent of their incomes on rent — for every Harris County Zip Code. [Houston Chronicle] Image: Houston Chronicle/Lydia DePillis

Inspired by a report from Harvard’s Joint Center on Housing Studies that compares household income to the percentage of income used to pay rent for various income levels, Chronicle biz reporter Lydia DePillis charts similar stats for Harris County. “Houston is slightly less cost burdened than the national average,” she concludes, “with 46.7 percent of its renter households paying more than a third of their income on rent.” According to her analysis of Harris County data from the Census Bureau’s American Community Survey, “the disparity between high and low-income areas is still present: In the third of ZIP codes with the highest median household incomes, 31 percent of renters pay more than 35 percent of their income on housing. In the bottom third of ZIP codes, the share is 49 percent.” Her graph, shown above, plots median household income (on the X-axis) against the percentage of people paying more than 35 percent of their incomes on rent — for every Harris County Zip Code. [Houston Chronicle] Image: Houston Chronicle/Lydia DePillis

COMMENT OF THE DAY: AFFORDABLE HOMES NEED SMALLER LOTS  “Large houses are not the cause of being priced out of the Heights, they’re the effect. With land values approaching $75/sf at the peak of the market, that’s almost half-a-million dollars for a full-sized lot. If you put a 2000-sq.-ft. house on that lot (at $150/sf construction cost), you’re looking at $800k. Or $400/sf. There’s a very thin market for that size house at that price point.

There are tons of more affordable options in or near the Heights, but they aren’t going to come with 6000 sq. ft. of dirt. The secret to providing more affordable housing is to just build more housing. In the Heights, that’s generally come in the form of replacing one bungalow with two modest two-story houses. In Shady Acres, it’s usually replacing TWO bungalows with SIX townhouses. There are literally hundreds of reasonable-sized houses (2000-2500 s.f.) that have been created this way in the Free Heights over the last decade. Without them, a lot MORE people would have been priced out of the neighborhood.” [Angostura, commenting on Comment of the Day: Aren’t these the Heights Design Guidelines We’ve Been Asking For?] Illustration: Lulu

“Large houses are not the cause of being priced out of the Heights, they’re the effect. With land values approaching $75/sf at the peak of the market, that’s almost half-a-million dollars for a full-sized lot. If you put a 2000-sq.-ft. house on that lot (at $150/sf construction cost), you’re looking at $800k. Or $400/sf. There’s a very thin market for that size house at that price point.

There are tons of more affordable options in or near the Heights, but they aren’t going to come with 6000 sq. ft. of dirt. The secret to providing more affordable housing is to just build more housing. In the Heights, that’s generally come in the form of replacing one bungalow with two modest two-story houses. In Shady Acres, it’s usually replacing TWO bungalows with SIX townhouses. There are literally hundreds of reasonable-sized houses (2000-2500 s.f.) that have been created this way in the Free Heights over the last decade. Without them, a lot MORE people would have been priced out of the neighborhood.” [Angostura, commenting on Comment of the Day: Aren’t these the Heights Design Guidelines We’ve Been Asking For?] Illustration: Lulu

COMMENT OF THE DAY: THE REAL DIFFERENCE NOT HAVING ZONING MAKES  “For a city without zoning, development in Houston isn’t much different that it would be if we DID have zoning. Most retail development happens on major commercial thoroughfares, and most industrial sites are either along railway lines or otherwise clustered together. And development still has to comply with our (idiotic) setback requirements and parking minimums.

The main difference Houston has over other cities with stricter land use regulation, is the ability to increase residential density in a fairly timely manner. This has helped keep housing costs from rising higher than they otherwise would have. The kinds of land use regulation in cities like New York, Washington and San Francisco generally benefit wealthy landowners at the expense of younger, poorer new-comers. Even current middle-class homeowners don’t really benefit: you can’t bank the appreciation until you sell, at which point you still have to live somewhere, and in the meantime, your property tax bill is higher.” [Angostura, commenting on Medistar’s Planned Webster Sprawl Plaza; The Most Congested Roads in Texas; Free Metro Rides] Illustration: Lulu

“For a city without zoning, development in Houston isn’t much different that it would be if we DID have zoning. Most retail development happens on major commercial thoroughfares, and most industrial sites are either along railway lines or otherwise clustered together. And development still has to comply with our (idiotic) setback requirements and parking minimums.

The main difference Houston has over other cities with stricter land use regulation, is the ability to increase residential density in a fairly timely manner. This has helped keep housing costs from rising higher than they otherwise would have. The kinds of land use regulation in cities like New York, Washington and San Francisco generally benefit wealthy landowners at the expense of younger, poorer new-comers. Even current middle-class homeowners don’t really benefit: you can’t bank the appreciation until you sell, at which point you still have to live somewhere, and in the meantime, your property tax bill is higher.” [Angostura, commenting on Medistar’s Planned Webster Sprawl Plaza; The Most Congested Roads in Texas; Free Metro Rides] Illustration: Lulu

TANKING OIL PRICES PLACE HOUSTON SECOND ON FITCH’S OVERVALUED HOUSING MARKET LIST  With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

COMMENT OF THE DAY: WE’RE NOWHERE NEAR PEAK MONTROSE  “I don’t think we’re anywhere close to the peak of property values in Montrose. You can still get an older 1,500 square foot townhome in the area for under $250,000. The average price for a bigger (~2,500sf) recent construction townhome is probably around $600,000. Those prices would be laughably low in comparable neighborhoods in most cities. Gentrification doesn’t really stop halfway like that barring a major economic downturn — once the ball starts rolling like this it just keeps going until the whole neighborhood is gleaming and wealthy. If you think Montrose has reached that point yet, you’re wrong. A fully gentrified urban neighborhood doesn’t have horrible apartment complexes like Takara So or vacant lots and skeazy strip centers on its main commercial street. Gentrification isn’t going to stop in Montrose until you can’t get a new townhome for less than a million or an apartment for less than $1,400.” [Christian, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

“I don’t think we’re anywhere close to the peak of property values in Montrose. You can still get an older 1,500 square foot townhome in the area for under $250,000. The average price for a bigger (~2,500sf) recent construction townhome is probably around $600,000. Those prices would be laughably low in comparable neighborhoods in most cities. Gentrification doesn’t really stop halfway like that barring a major economic downturn — once the ball starts rolling like this it just keeps going until the whole neighborhood is gleaming and wealthy. If you think Montrose has reached that point yet, you’re wrong. A fully gentrified urban neighborhood doesn’t have horrible apartment complexes like Takara So or vacant lots and skeazy strip centers on its main commercial street. Gentrification isn’t going to stop in Montrose until you can’t get a new townhome for less than a million or an apartment for less than $1,400.” [Christian, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

COMMENT OF THE DAY: SCREWING THE HAVES  “Message to the cool kids: If you are really cool, move to a cheaper part of town. The squares who are pricing you out of Montrose will be punished by living exclusively among squares, and the cheaper part of town will be cool. However, if you move and none of that happens then you probably weren’t that cool.” [Memebag, commenting on New Owners to Montrose Apartment Dwellers: Everybody Out by the End of August, We’re Tearing These Places Down] Illustration: Lulu

“Message to the cool kids: If you are really cool, move to a cheaper part of town. The squares who are pricing you out of Montrose will be punished by living exclusively among squares, and the cheaper part of town will be cool. However, if you move and none of that happens then you probably weren’t that cool.” [Memebag, commenting on New Owners to Montrose Apartment Dwellers: Everybody Out by the End of August, We’re Tearing These Places Down] Illustration: Lulu

COMMENT OF THE DAY: THE BOOM IN SPRING BRANCH  “This part of Spring Branch has seen the median listing price go up from ~$150k to ~$250k over the past two years. Listings all over SB get multiple cash offers on the first day; a $400k listing will get bid up well into half-mil territory by week’s end. If this ball keeps rolling, we could start to see the first teardowns north of Long Point before the end of the year. Decision, decisions . . . best to buy now, or sit tight and wait for the pop?” [Rodrigo, commenting on Daily Demolition Report: Auto Air] Illustration: Lulu

“This part of Spring Branch has seen the median listing price go up from ~$150k to ~$250k over the past two years. Listings all over SB get multiple cash offers on the first day; a $400k listing will get bid up well into half-mil territory by week’s end. If this ball keeps rolling, we could start to see the first teardowns north of Long Point before the end of the year. Decision, decisions . . . best to buy now, or sit tight and wait for the pop?” [Rodrigo, commenting on Daily Demolition Report: Auto Air] Illustration: Lulu

COMMENT OF THE DAY: INNER LOOP HOME PRICES CAN’T KEEP RISING LIKE THEY HAVE  “. . . Our current population boom was due to an unexpected resurgence in the gulf of mexico oil market and hit our housing supply by complete surprise. However, the housing market will be going full steam for the next few years to catch up on supply and entire new subdivisions are going to be created that are well outside of the property value inflation we’re seeing in town. The vast majority of new residents are already buying well outside of the 610 Loop. Even the snottiest of inner loopers such as myself would eventually consider buying a mansion in the ‘burbs for the same price as a cluttered townhome in the Loop.

. . . Not to say we’re in a bubble right now, but beyond doubt there will be a lot of downward pressure on home prices in the Houston area moving forward unless we see employment start accelerating again. That definitely is not going to be likely no matter how well the gulf market holds up. So I think people claiming there is or isn’t a bubble are being a bit premature, we all have to wait and see. I believe the general expectation is that although values have shot up, there should be enough demand to hold the prices up moving forward. So yes, odds are probably against a bubble, but I would expect that this burst of demand has pulled property valuations forward quite a bit and that folks shouldn’t expect to see gains on home prices for the next 5 years or so as a glut of new apartments and homes come onto the market. There’s still plenty of land to be redeveloped and no shortage of opportunities for increased density in the inner Loop and that’s even before we start really gentrifying the 3rd and 5th wards. For me, i’ll hold off on Inner Loop property until the boomers start dwindling down.” [joel, commenting on Mirroring the Features of a Simple $310K Studewood St. Duplex] Illustration: Lulu

“. . . Our current population boom was due to an unexpected resurgence in the gulf of mexico oil market and hit our housing supply by complete surprise. However, the housing market will be going full steam for the next few years to catch up on supply and entire new subdivisions are going to be created that are well outside of the property value inflation we’re seeing in town. The vast majority of new residents are already buying well outside of the 610 Loop. Even the snottiest of inner loopers such as myself would eventually consider buying a mansion in the ‘burbs for the same price as a cluttered townhome in the Loop.

. . . Not to say we’re in a bubble right now, but beyond doubt there will be a lot of downward pressure on home prices in the Houston area moving forward unless we see employment start accelerating again. That definitely is not going to be likely no matter how well the gulf market holds up. So I think people claiming there is or isn’t a bubble are being a bit premature, we all have to wait and see. I believe the general expectation is that although values have shot up, there should be enough demand to hold the prices up moving forward. So yes, odds are probably against a bubble, but I would expect that this burst of demand has pulled property valuations forward quite a bit and that folks shouldn’t expect to see gains on home prices for the next 5 years or so as a glut of new apartments and homes come onto the market. There’s still plenty of land to be redeveloped and no shortage of opportunities for increased density in the inner Loop and that’s even before we start really gentrifying the 3rd and 5th wards. For me, i’ll hold off on Inner Loop property until the boomers start dwindling down.” [joel, commenting on Mirroring the Features of a Simple $310K Studewood St. Duplex] Illustration: Lulu

COMMENT OF THE DAY: ENERGY DEPENDENCE  “The current Houston economic boom isn’t connected to nation-wide anything. It’s connected to energy-sector activity. If, how and when energy activity slows will determine if the Houston economy, and the Houston real estate market by extension, also slows or busts. If all drilling were to stop tomorrow, our boom would be a bubble that popped. If energy activity continues at this pace for 100 years, they won’t be able to call it a bubble. They’ll just call it growth.” [Densify, commenting on Comment of the Day: Bursting Your Housing Bubble Bubble] Illustration: Lulu

“The current Houston economic boom isn’t connected to nation-wide anything. It’s connected to energy-sector activity. If, how and when energy activity slows will determine if the Houston economy, and the Houston real estate market by extension, also slows or busts. If all drilling were to stop tomorrow, our boom would be a bubble that popped. If energy activity continues at this pace for 100 years, they won’t be able to call it a bubble. They’ll just call it growth.” [Densify, commenting on Comment of the Day: Bursting Your Housing Bubble Bubble] Illustration: Lulu

COMMENT OF THE DAY: BURSTING YOUR HOUSING BUBBLE BUBBLE  “Your fears of a bubble being caused in this manner are unfounded. The sales of older homes (by Houston standards at least — still less than 10 years) have shot up in just the last 9 months. Sure, we always need to guard against bubbles, but I don’t think an EaDo-specific bubble is occurring, and certainly not because there aren’t existing single-family homes.

Teardowns of existing, livable (leaving out the shotgun shacks) single-family homes have started (here, for instance). In the place of the teardowns are multiple townhomes.

There are some examples of irrational exuberance on the part of the developers, like the $500,000 asking price for the townhomes bounded by Nagle/Capitol/Delano/Rusk, but the recent high appreciation occurring is not out of line and has only been occurring for a few years, whereas places like the Heights and Rice Military have seen prices increases for many years, all without any neighborhood-specific bubble. Midtown, too, has avoided a bubble-then-crash and they have an even smaller stock of single-family homes yards than EaDo.” [eiioi, commenting on Comment of the Day: East Downtown, Brought to You by Montrose] Illustration: Lulu

“Your fears of a bubble being caused in this manner are unfounded. The sales of older homes (by Houston standards at least — still less than 10 years) have shot up in just the last 9 months. Sure, we always need to guard against bubbles, but I don’t think an EaDo-specific bubble is occurring, and certainly not because there aren’t existing single-family homes.

Teardowns of existing, livable (leaving out the shotgun shacks) single-family homes have started (here, for instance). In the place of the teardowns are multiple townhomes.

There are some examples of irrational exuberance on the part of the developers, like the $500,000 asking price for the townhomes bounded by Nagle/Capitol/Delano/Rusk, but the recent high appreciation occurring is not out of line and has only been occurring for a few years, whereas places like the Heights and Rice Military have seen prices increases for many years, all without any neighborhood-specific bubble. Midtown, too, has avoided a bubble-then-crash and they have an even smaller stock of single-family homes yards than EaDo.” [eiioi, commenting on Comment of the Day: East Downtown, Brought to You by Montrose] Illustration: Lulu

The only difference between this 1981 West University property’s new listing and a previous one in mid-March appears to be the $110,000 escalation in price since its sale in mid-April, for $525,000. The current photos are a bit grainy and bleak, but they document how the unoccupied interior and lot-filling pool and deck have been faring as prices rise:

COMMENT OF THE DAY RUNNER-UP: WHO’S RESPONSIBLE FOR THE WORKERS “As a contractor who does both commercial and residential projects, I can tell you that the worker pay is dictated by the buyer, as is the safety, and as is everything. I can’t advertise that I pay my subs more, that I have a safer work environment, and that I’m more fair than my competitors, so YOU should pay more for my product. Especially if it is essentially the same product. I think I do pay my guys more, and I do have a safer work site, but I still cringe at some of the things that go on and I wish 5 guys didn’t have to live together to make a living. I just make less than my competitors and sleep better at night. If people were REALLY concerned about that we would have union laws like New York and California, and we would regulate the safety aspect more heavily.” [SCD, commenting on Headlines: Financing Williams Tower Purchase; Proposing a Safe-Passing Law for Houston]

TODAY IN MAJOR MEDIA MARKET LINKBAIT  The marketing folks at real estate brokerage Movoto have drummed up this pointless factoid: If the White House were located in Houston, it would cost $20 million — far less than it would if it were in any of the 6 other major markets they ran the spreadsheet calculation for. (Costs would probably be even lower in suburban Waco, but they’d have generated too few pageviews from calculating that figure to make it worthwhile.) Next least expensive of the calculated cities: Miami, with an imaginary White House worth $39 million. Most expensive: New York, at $387 million. No, this isn’t the cost to build another White House, it’s how much it would cost to buy it, if it were for sale, in a city where it doesn’t exist. [Movoto] Graphic: Movoto

The marketing folks at real estate brokerage Movoto have drummed up this pointless factoid: If the White House were located in Houston, it would cost $20 million — far less than it would if it were in any of the 6 other major markets they ran the spreadsheet calculation for. (Costs would probably be even lower in suburban Waco, but they’d have generated too few pageviews from calculating that figure to make it worthwhile.) Next least expensive of the calculated cities: Miami, with an imaginary White House worth $39 million. Most expensive: New York, at $387 million. No, this isn’t the cost to build another White House, it’s how much it would cost to buy it, if it were for sale, in a city where it doesn’t exist. [Movoto] Graphic: Movoto

COMMENT OF THE DAY: THE HIGH COST OF BEAUTY “. . . admittedly, i’d love to live in a much more beautiful city such as san francisco, paris, nyc, or any number of the hundreds of small quaint towns dotting the american landscape. however, i don’t want to spend 50% of my budget on housing and i want access to plenty of jobs. i choose to live in houston fully knowing that my living expenses support nothing more than a cheap, ugly and easy city to live in. i love houston because it provides an alternative. i can understand other peoples viewpoint, but me and tons of others don’t want to pay exorbitant living expenses just so you all can have better views on your way home from work or while you walk your dog in my yard, there’s tons of other cities that can provide that to you. this will all change as the city becomes richer, just wait and you’ll get your day, but for now let’s just accept the city we all choose to live in for what it is and revel in the benefits it provides now.” [joel, commenting on Comment of the Day: We’ll Do It Our Way]