Back in January of this year, the bankruptcy trustee assigned to colorful imploded homebuilder Royce Homes obtained a $9.3 settlement from Amegy Bank for the bank’s role in what attorneys called a $39 million conspiracy — to swindle creditors by draining the collapsed builder’s bank accounts shortly before Royce shut down and was declared bankrupt, in 2008. A separate settlement with Royce Builders’ founder, Michael Manners, was reached in March. And earlier this month, a jury in federal court returned a $27 million verdict against Royce’s former CEO, John Speer, for his role in the escapade. (Back in March, an earlier jury had ended up deadlocked on a number of charges.)

Back in January of this year, the bankruptcy trustee assigned to colorful imploded homebuilder Royce Homes obtained a $9.3 settlement from Amegy Bank for the bank’s role in what attorneys called a $39 million conspiracy — to swindle creditors by draining the collapsed builder’s bank accounts shortly before Royce shut down and was declared bankrupt, in 2008. A separate settlement with Royce Builders’ founder, Michael Manners, was reached in March. And earlier this month, a jury in federal court returned a $27 million verdict against Royce’s former CEO, John Speer, for his role in the escapade. (Back in March, an earlier jury had ended up deadlocked on a number of charges.)

According to reporting by Law360’s Jeremy Heallen, the charges stemmed from what the attorneys claimed amounted to an off-the-books leveraged buyout of Royce Homes. In 2006, Speer bought Manner’s 50 percent stake in the Royce Homes for $33 million, to give himself complete ownership of the homebuilder. Though the funds used to finance the purchase (including a $20 million personal loan from Amegy Bank) were borrowed in Speer’s own name, Speers, Manners, and Amegy came to an understanding that Royce Homes would ultimately be responsible for paying them off, the suit claimed. The purpose of the scheme, according to the claims, was to keep the loans off of Royce Homes’s financial statements, because doing so would have “wiped out most of the homebuilder’s equity and caused lenders to shut down vital credit lines,” Heallen reports.

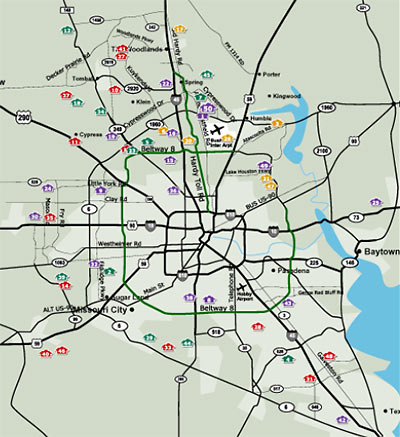

The Bryan farm-lending coop that ended up with 618 acres near Tomball after the collapse of Royce Builders has finally sold the property — to the Caldwell Companies, a land development and investment firm. Royce had planned 1,261 home lots in Cypress Lake Crossing, which is northeast of the intersection of Telge Rd. and Boudreaux and only a couple miles north of the sprawling Cypress home of former Royce president John Speer. (Speer’s Royce-built compound off Telge Rd., pictured above, now serves as the home address of one of his new ventures, Vestalia Homes.) “Bill Heavin, a land broker at Grubb & Ellis Co., says Royce Homes had completed quite a bit of development work on the tract, such as soil and water testing and the establishment of Harris County Municipal Utility District #416.

The Bryan farm-lending coop that ended up with 618 acres near Tomball after the collapse of Royce Builders has finally sold the property — to the Caldwell Companies, a land development and investment firm. Royce had planned 1,261 home lots in Cypress Lake Crossing, which is northeast of the intersection of Telge Rd. and Boudreaux and only a couple miles north of the sprawling Cypress home of former Royce president John Speer. (Speer’s Royce-built compound off Telge Rd., pictured above, now serves as the home address of one of his new ventures, Vestalia Homes.) “Bill Heavin, a land broker at Grubb & Ellis Co., says Royce Homes had completed quite a bit of development work on the tract, such as soil and water testing and the establishment of Harris County Municipal Utility District #416.