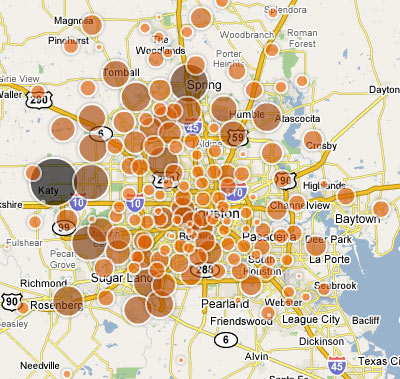

There’s been so much exciting news for dedicated Houston foreclosure gawkers lately. Last month’s HAR redesign added a feature that allows anyone to search current MLS listings for foreclosed properties. And now the Chronicle has put together its own database chronicling foreclosed properties by neighborhood. Plus, the paper includes the handy interactive foreclosure map pictured above, full of dancing bubbles!

A lot of that bubbly makes it look like the foreclosure corks have been popping more frequently in the outside-Beltway-8 neighborhoods, with Katy the big winner. And the map is fun to play with and click on. But don’t miss the more mundane-looking 2007 Neighborhood Foreclosure list, which allows you to sort data on neighborhoods that had 5 or more foreclosures last year, and which spills some fun real-estate secrets . . . like Tremont Tower‘s 97.37 percent foreclosure rate! Bear Creek Meadows‘s 83 foreclosures! And the Memorial Cove Loft Condos’ perfect record: 20 units, 20 foreclosures — in one year! How’d we miss that one?

If you have time to play with these fun tools, and unearth any interesting data, let us know what you find!

- Houston-area foreclosure map by ZIP code [Houston Chronicle]

- 2007 Neighborhood Foreclosures [Houston Chronicle]

- Area foreclosure rate slows, but problems still lurk [Houston Chronicle]

- Thirteen Fun and Obsessive Things To Do on the New HAR.com [Swamplot]

- The Dirty Little Secret Behind the Montrose Foreclosure Hump [Swamplot]

- Bear Creek Meadows Fourclosure Sale! [Swamplot]