HERE COME THE HARVEY LOW BALLERS  Outsiders moving into town to buy up homes from distressed owners for pennies on the dollar in the wake of local catastrophe is a proud and longstanding Houston tradition: It keeps the city’s reputation for real-estate shenanigans intact, even as oldtimers mellow. It’s how Sir Allen Stanford got his illustrious start! Plus: Investments that must be recouped can help keep zombie neighborhoods that maybe-shouldn’t-have-been-built-there-or-that-way-in-the-first-place alive. But you don’t have to be a wet-carpetbagger to get in on the fun: Reporter Prashant Gopal heads to the Redneck Country Club on Airport Blvd. in Stafford for a well-attended pep talk by local trashed-home recycler Eddie Gant, then follows local real-estate agent Bryan Schild as he drives through neighborhoods looking for deals: “One of Schild’s prospects is Joseph Hernandez, a disabled U.S. Army veteran married to a housekeeper. The couple are living in a hotel and saving money by eating only two meals a day. Schild has made them a painful offer. If they walk away from their two-bedroom house, worth $127,000 before Hurricane Harvey, Schild will pick up the mortgage payments, paying nothing else. Although he says he sympathizes with the Hernandezes’ plight, he thinks the offer is fair because he figures the home is now worth less than its $65,000 mortgage. Hernandez is in a bind. He didn’t buy flood insurance because his house wasn’t in a high-risk area. He can’t afford to rebuild, and he’s been told he’s eligible for only $23,000 in federal assistance. If he turns over the deed, he’s looking at losing the entire $60,000 in equity he had before the flood. ‘It’s blurry, what’s coming,’ he says. ‘We’ll probably have to sell to an investor, and that’s not good. We were forced out.’†[Bloomberg BusinessWeek] Photo of Hernandez’s home in Bear Creek Village, before it flooded: HAR

Outsiders moving into town to buy up homes from distressed owners for pennies on the dollar in the wake of local catastrophe is a proud and longstanding Houston tradition: It keeps the city’s reputation for real-estate shenanigans intact, even as oldtimers mellow. It’s how Sir Allen Stanford got his illustrious start! Plus: Investments that must be recouped can help keep zombie neighborhoods that maybe-shouldn’t-have-been-built-there-or-that-way-in-the-first-place alive. But you don’t have to be a wet-carpetbagger to get in on the fun: Reporter Prashant Gopal heads to the Redneck Country Club on Airport Blvd. in Stafford for a well-attended pep talk by local trashed-home recycler Eddie Gant, then follows local real-estate agent Bryan Schild as he drives through neighborhoods looking for deals: “One of Schild’s prospects is Joseph Hernandez, a disabled U.S. Army veteran married to a housekeeper. The couple are living in a hotel and saving money by eating only two meals a day. Schild has made them a painful offer. If they walk away from their two-bedroom house, worth $127,000 before Hurricane Harvey, Schild will pick up the mortgage payments, paying nothing else. Although he says he sympathizes with the Hernandezes’ plight, he thinks the offer is fair because he figures the home is now worth less than its $65,000 mortgage. Hernandez is in a bind. He didn’t buy flood insurance because his house wasn’t in a high-risk area. He can’t afford to rebuild, and he’s been told he’s eligible for only $23,000 in federal assistance. If he turns over the deed, he’s looking at losing the entire $60,000 in equity he had before the flood. ‘It’s blurry, what’s coming,’ he says. ‘We’ll probably have to sell to an investor, and that’s not good. We were forced out.’†[Bloomberg BusinessWeek] Photo of Hernandez’s home in Bear Creek Village, before it flooded: HAR

Real Estate Investing

THE MANY DILAPIDATED PROPERTIES OF SCOTT WIZIG  Writer Rachel Monroe catches up on the real estate empire of Scott Wizig, whose extensive operation scoops up properties at tax sales — and lets you know about it by means of those often hand-scrawled bandit signs offering them for seemingly sympathetic terms. Using a scrambled web of LLCs, Monroe explains, the Bellaire resident became the biggest private owner of derelict houses in Baltimore: “Wizig wouldn’t speak with me for months. When he finally agreed to, he didn’t want to discuss how he profits from buying up distressed properties. By the time we spoke, he was trying to rid himself of his Baltimore properties, just as he’d done before in Buffalo. He presented his work as a form of charity: In his view, he helps the city by selling homes and providing financing to people who otherwise couldn’t afford them. (The Houston Press has reported on his company’s sales of legally uninhabitable houses to undocumented immigrants.) He donates to local minority youth groups and hosted a book signing last year for Martin Luther King III and Representative John Lewis. . . . It’s true that in Baltimore, unlike in Buffalo, Wizig focused on selling his properties to other investors rather than renting them out to low-income tenants. But to those who live next to his unmaintained properties, the precise shading of his business model offers little comfort.” [The New Republic] Photo of 5441 Ridge Wind Ln., for sale in Quail Ridge: Wizig’s SWE Homes

Writer Rachel Monroe catches up on the real estate empire of Scott Wizig, whose extensive operation scoops up properties at tax sales — and lets you know about it by means of those often hand-scrawled bandit signs offering them for seemingly sympathetic terms. Using a scrambled web of LLCs, Monroe explains, the Bellaire resident became the biggest private owner of derelict houses in Baltimore: “Wizig wouldn’t speak with me for months. When he finally agreed to, he didn’t want to discuss how he profits from buying up distressed properties. By the time we spoke, he was trying to rid himself of his Baltimore properties, just as he’d done before in Buffalo. He presented his work as a form of charity: In his view, he helps the city by selling homes and providing financing to people who otherwise couldn’t afford them. (The Houston Press has reported on his company’s sales of legally uninhabitable houses to undocumented immigrants.) He donates to local minority youth groups and hosted a book signing last year for Martin Luther King III and Representative John Lewis. . . . It’s true that in Baltimore, unlike in Buffalo, Wizig focused on selling his properties to other investors rather than renting them out to low-income tenants. But to those who live next to his unmaintained properties, the precise shading of his business model offers little comfort.” [The New Republic] Photo of 5441 Ridge Wind Ln., for sale in Quail Ridge: Wizig’s SWE Homes

TAKARA-SO COMPLEX BACK ON THE MARKET, THIS TIME WITH NEW UTH UPGRADE  If you were thinking its purchase by a SoCal investment firm almost exactly 1 year ago meant the pseudo-Japanesee 1962 apartment complex at 1919 W. Main St. would be shielded from the evict-and-redevelop cycle for a few years, think again. Apartment Income Investors has put the Takara-So Apartments, which sit on most of the block surrounded by Hazard, W. Main, Colquitt, and McDuffie, back on the market — with a twist. Though on-site signs have not been changed, the complex is described as the Takara South Apartments in a sleek set of marketing materials produced by Newmark Grubb Knight Frank, the firm that’s marketing the 77-unit, 10-building, 1.22-acre property once owned by Allen Stanford. Why unload the storied complex now? So much has happened in a Montrose year: There’s that $2.05 million jump in the property’s tax appraisal. And maybe some profits to be made: Though no asking price is listed, included comps indicate the sellers are likely aiming for offers between $8 and $10.8 million. The purchase price was listed on company documents as $5.51 million. [LoopNet; previously on Swamplot]Â Photo: Newmark Grubb Knight Frank

If you were thinking its purchase by a SoCal investment firm almost exactly 1 year ago meant the pseudo-Japanesee 1962 apartment complex at 1919 W. Main St. would be shielded from the evict-and-redevelop cycle for a few years, think again. Apartment Income Investors has put the Takara-So Apartments, which sit on most of the block surrounded by Hazard, W. Main, Colquitt, and McDuffie, back on the market — with a twist. Though on-site signs have not been changed, the complex is described as the Takara South Apartments in a sleek set of marketing materials produced by Newmark Grubb Knight Frank, the firm that’s marketing the 77-unit, 10-building, 1.22-acre property once owned by Allen Stanford. Why unload the storied complex now? So much has happened in a Montrose year: There’s that $2.05 million jump in the property’s tax appraisal. And maybe some profits to be made: Though no asking price is listed, included comps indicate the sellers are likely aiming for offers between $8 and $10.8 million. The purchase price was listed on company documents as $5.51 million. [LoopNet; previously on Swamplot]Â Photo: Newmark Grubb Knight Frank

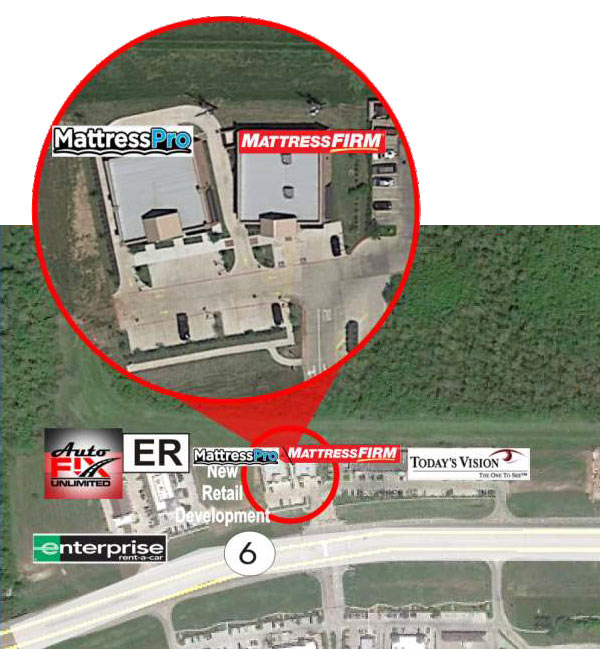

If you thought it was kinda adorable how those 2 same-owner mattress stores are snuggling up right next to each other at the corner of Westheimer and Montrose Blvd. in Montrose, you’re sure to be enthralled by the suburban version of the same like-kind pair-up down about Sienna Plantation, what with their separate, straight-laced façades and separate showrooms. Mattress Firm has been open for a couple years already at 8741 Hwy. 6 South in Missouri City; the same company’s slightly larger Mattress Pro just opened up next door at 8735 last month. Better yet, the buildings are for sale, together!

If you thought it was kinda adorable how those 2 same-owner mattress stores are snuggling up right next to each other at the corner of Westheimer and Montrose Blvd. in Montrose, you’re sure to be enthralled by the suburban version of the same like-kind pair-up down about Sienna Plantation, what with their separate, straight-laced façades and separate showrooms. Mattress Firm has been open for a couple years already at 8741 Hwy. 6 South in Missouri City; the same company’s slightly larger Mattress Pro just opened up next door at 8735 last month. Better yet, the buildings are for sale, together!

YOU’RE NOT FROM TEXAS, BUT TEXAS WANTS YOUR MONEY ANYWAY  Wondering why a bunch of out-of-towners are afoot hunting down $214,000 homes (such as the Lakewood Forest number pictured here) to buy as investments in Houston — just as locals start to feel a bit jittery about the possibility of coming oil-price-drop aftershocks? The sudden outsider enthusiasm may stem in part from a roundup of “Best Buy Cities” published last month by Forbes, which purports to tell folks with extra cash on their hands Where To Invest In Housing In 2015. Number 3 on the list, which magazine writers in concert with a firm called Local Market Monitor came up with after exploring data on job opportunities and population increases — is Houston. But all 5 major Texas cities make it to the Top Ten. What, oil prices are falling? That just means you shouldn’t buy a home in Midland, declares the quoted expert, whose first name and credentials the article doesn’t bother to identify. (It’s Ingo Winzer, Local Market Monitor’s founder, who lives in North Carolina.) The list is revised annually, though between those efforts Forbes is generally busy producing a steady stream of clickbait ranking cities on various other criteria. [Forbes] Photo of 11711 Cedar Point Ct.: HAR

Wondering why a bunch of out-of-towners are afoot hunting down $214,000 homes (such as the Lakewood Forest number pictured here) to buy as investments in Houston — just as locals start to feel a bit jittery about the possibility of coming oil-price-drop aftershocks? The sudden outsider enthusiasm may stem in part from a roundup of “Best Buy Cities” published last month by Forbes, which purports to tell folks with extra cash on their hands Where To Invest In Housing In 2015. Number 3 on the list, which magazine writers in concert with a firm called Local Market Monitor came up with after exploring data on job opportunities and population increases — is Houston. But all 5 major Texas cities make it to the Top Ten. What, oil prices are falling? That just means you shouldn’t buy a home in Midland, declares the quoted expert, whose first name and credentials the article doesn’t bother to identify. (It’s Ingo Winzer, Local Market Monitor’s founder, who lives in North Carolina.) The list is revised annually, though between those efforts Forbes is generally busy producing a steady stream of clickbait ranking cities on various other criteria. [Forbes] Photo of 11711 Cedar Point Ct.: HAR

OIL PRICE PLUNGE LEADS TO STOCK DOWNGRADE FOR NEW GREENWAY PLAZA OWNERS  Last year Atlanta-based Cousins Properties splashed out big in the Houston office market, purchasing all 4.4 million sq.-ft. of Greenway Plaza for $950m in October, 8 months after they snapped up the $233m Post Oak Central complex, making Houston the dominant market in the CUZ portfolio. Which might have seemed a great idea in October 2013, when crude was going for about $100 a barrel, but now? A security analyst from Bank of America and Stifel have both downgraded Cousins Properties shares from “buy” to “hold,” citing falling oil prices and the company’s exposure to Houston. [Realty News Report] Photo of lightning over Greenway Plaza: Russell Hancock via Swamplot Flickr Pool

Last year Atlanta-based Cousins Properties splashed out big in the Houston office market, purchasing all 4.4 million sq.-ft. of Greenway Plaza for $950m in October, 8 months after they snapped up the $233m Post Oak Central complex, making Houston the dominant market in the CUZ portfolio. Which might have seemed a great idea in October 2013, when crude was going for about $100 a barrel, but now? A security analyst from Bank of America and Stifel have both downgraded Cousins Properties shares from “buy” to “hold,” citing falling oil prices and the company’s exposure to Houston. [Realty News Report] Photo of lightning over Greenway Plaza: Russell Hancock via Swamplot Flickr Pool

ONE MAN’S THRIVING GAYBORHOOD IS ANOTHER’S MONTROSE VALUE-ADD PORTFOLIO  What is the Montrose Value-Add Portfolio? “48 apartment-units, 13 townhomes, 1 quadraplex and 5 rental homes with 8-units that include 2 garage apartments; for a total of 73 units, 67,960 rentable square feet, with a land tract of 2.09 acres.” Writes a reader who came across the listing: “This is where I live. I love the phrase ‘The Montrose Value Add Portfolio,’ it practically screams ‘knock it down!’ So much for my old gayborhood!” The properties are all within walking distance of the MVAP’s listed address: 409 Stratford St., a stone’s throw from the always-hopping cluster of bars and clubs on Pacific St. to the north and but a little farther from Numbers and Indika to the south. No asking price is indicated in the marketing materials. [Loopnet; brochure (PDF)] Photo: Transwestern.

What is the Montrose Value-Add Portfolio? “48 apartment-units, 13 townhomes, 1 quadraplex and 5 rental homes with 8-units that include 2 garage apartments; for a total of 73 units, 67,960 rentable square feet, with a land tract of 2.09 acres.” Writes a reader who came across the listing: “This is where I live. I love the phrase ‘The Montrose Value Add Portfolio,’ it practically screams ‘knock it down!’ So much for my old gayborhood!” The properties are all within walking distance of the MVAP’s listed address: 409 Stratford St., a stone’s throw from the always-hopping cluster of bars and clubs on Pacific St. to the north and but a little farther from Numbers and Indika to the south. No asking price is indicated in the marketing materials. [Loopnet; brochure (PDF)] Photo: Transwestern.

Last week, after a vote of the State Securities Board, Texas became the lucky 13th state to allow equity crowdfunding. Jumping the gun on nationwide rules authorized in 2012 but still not put in place by the SEC, the new statewide setup will allow companies to raise up to $1 million a year through approved “portals,” or crowdfunding websites. Any Texan will be able to invest up to $5,000 per company, but qualified investors (individuals with assets of more than $1 million — minus their home — and $200K in annual net income) will be able to invest any amount.

Last week, after a vote of the State Securities Board, Texas became the lucky 13th state to allow equity crowdfunding. Jumping the gun on nationwide rules authorized in 2012 but still not put in place by the SEC, the new statewide setup will allow companies to raise up to $1 million a year through approved “portals,” or crowdfunding websites. Any Texan will be able to invest up to $5,000 per company, but qualified investors (individuals with assets of more than $1 million — minus their home — and $200K in annual net income) will be able to invest any amount.

Unlike donation-based crowdfunding efforts popularized on sites such as Indiegogo and Kickstarter, portals operating under the new rules will turn subscribers into owners of the projects they invest in. The rules, which go into effect next month, apply to any type of company investment, from restaurants to local businesses to real estate — as long as the investors are Texas residents, the companies are Texas companies, and the crowdfunding website is based here. A Houston beta site hoping to begin offering stakes in “corporate backed single tenant leased properties” — such as the dummy McDonald’s Net Lease portrayed in the image above — has already been announced.

- Texas Approves Equity-Based Crowdfunding Rules [Silicon Hills]

- Texas Intrastate Crowdfunding [Texas State Securities Board]

- InvestPeer Launches Equity Based Crowdfunding Beta Website in Texas [InvestPeer]

Photo: Investpeer

COMMENT OF THE DAY RUNNER-UP: HOW TO POSITION YOUR INNER LOOP INVESTMENT BUSINESS FOR THE COMING DOWNTURN  “Cody, yeah I agree with you. If this isn’t the top of a market cycle, it’s damn close. If you bought low, now is the time to sell high. And do it without regret because you’ll never go broke by profit-taking. But even more than your Montrose assets, sell the stuff that you’ve got that is further east. In a downturn, there will be a flight to asset quality both on the part of capital markets and tenants. Montrose values will go down, but Greater Third Ward be much more volatile.

Use some of the proceeds to short high-yield bonds, use the remainder to reposition your outfit as an apartment management company. No matter how bad things get, there will always be a need for management companies, and this gives you a way to maintain the continuity of your career and to keep your ear to the ground. Then, in the worst of the down-cycle, while most everybody else is paralyzed and some are distressed sellers, you’ll have cash (hopefully a LOT of cash if that short position plays out for you the way I think that it might), a company, and a resume.

And when my prediction pans out and you’re fantastically successful, don’t forget whose crystal ball made it possible. I might need a job by then.” [TheNiche, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

“Cody, yeah I agree with you. If this isn’t the top of a market cycle, it’s damn close. If you bought low, now is the time to sell high. And do it without regret because you’ll never go broke by profit-taking. But even more than your Montrose assets, sell the stuff that you’ve got that is further east. In a downturn, there will be a flight to asset quality both on the part of capital markets and tenants. Montrose values will go down, but Greater Third Ward be much more volatile.

Use some of the proceeds to short high-yield bonds, use the remainder to reposition your outfit as an apartment management company. No matter how bad things get, there will always be a need for management companies, and this gives you a way to maintain the continuity of your career and to keep your ear to the ground. Then, in the worst of the down-cycle, while most everybody else is paralyzed and some are distressed sellers, you’ll have cash (hopefully a LOT of cash if that short position plays out for you the way I think that it might), a company, and a resume.

And when my prediction pans out and you’re fantastically successful, don’t forget whose crystal ball made it possible. I might need a job by then.” [TheNiche, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

HOW TO DO RIVERSIDE TERRACE ON $647.32 A DAY  This 1930 brick and half-timbered 4-bedroom home on Riverside Dr. in Riverside Terrace sold for $205,000 on January 14th. With no apparent updates, the unrenovated property, which sits on a 12,560-sq.-ft. lot, sold again at the end of August — for $350,000. [HAR]

This 1930 brick and half-timbered 4-bedroom home on Riverside Dr. in Riverside Terrace sold for $205,000 on January 14th. With no apparent updates, the unrenovated property, which sits on a 12,560-sq.-ft. lot, sold again at the end of August — for $350,000. [HAR]

THE TAKARA-SO APARTMENTS WON’T BE GOING AWAY JUST YET  Inner Loop property watchers: As other Montrose apartment complexes are knocked down and redeveloped left and right, do your thoughts turn occasionally to the Takara-So? If so, you are not alone: The 77-unit 2-story apartments at 1919 W. Main St., occupying the entire 1.22-acre block also bounded by McDuffie, Hazard, and Colquitt, was sold back in May in an off-market transaction. The complex that once belonged in the portfolio of swindler Allen Stanford is now the property of a group headed by Southern California firm Apartment Income Investors. A cached version of a memo for the investment posted online in advance of the sale envisioned renting out and holding the property for 3 to 5 years before selling it to investors or a developer, and identifies the price as $5.51 million. Photo: Takara-So Apartments

Inner Loop property watchers: As other Montrose apartment complexes are knocked down and redeveloped left and right, do your thoughts turn occasionally to the Takara-So? If so, you are not alone: The 77-unit 2-story apartments at 1919 W. Main St., occupying the entire 1.22-acre block also bounded by McDuffie, Hazard, and Colquitt, was sold back in May in an off-market transaction. The complex that once belonged in the portfolio of swindler Allen Stanford is now the property of a group headed by Southern California firm Apartment Income Investors. A cached version of a memo for the investment posted online in advance of the sale envisioned renting out and holding the property for 3 to 5 years before selling it to investors or a developer, and identifies the price as $5.51 million. Photo: Takara-So Apartments

Investor Steve Moore, who’s made a name for himself by buying up, moving into, establishing unusual rules in, cleaning up, and lowering crime rates at some of the roughest apartment complexes in Houston neighborhoods such as Greenspoint and Westwood, has a new investment (and new address) — in Sharpstown. Working with an investment group, the owner of more than 5,000 apartment units has purchased a majority interest in the Gardens at Bissonnet condos at 7400 Bissonnet St., the 200-unit complex near Fondren Rd. known as the Le Promenade condos when it was home to the La Primera gang. Moore was sought out for the purchase by the Greater Sharpstown Management District after the condo complex was put into receivership last year; a series of security measures, which included changing the property’s name, were instituted as part of a legal settlement between the county and the property’s previous owners.

Investor Steve Moore, who’s made a name for himself by buying up, moving into, establishing unusual rules in, cleaning up, and lowering crime rates at some of the roughest apartment complexes in Houston neighborhoods such as Greenspoint and Westwood, has a new investment (and new address) — in Sharpstown. Working with an investment group, the owner of more than 5,000 apartment units has purchased a majority interest in the Gardens at Bissonnet condos at 7400 Bissonnet St., the 200-unit complex near Fondren Rd. known as the Le Promenade condos when it was home to the La Primera gang. Moore was sought out for the purchase by the Greater Sharpstown Management District after the condo complex was put into receivership last year; a series of security measures, which included changing the property’s name, were instituted as part of a legal settlement between the county and the property’s previous owners.

The photo above — sent to Swamplot by a HAIF user who goes by the handle SkylineView — is our best view yet of the project themed-condo developer Randall Davis has been working on for more than 5 years: convincing the Galleria McDonald’s to scooch over just a smidge and sell him part of the fast-food restaurant’s parking lot so he could build a 30-story highrise on it with all the benefits and cachet of drive-thru adjacency. Davis’s $70 million Astoria (portrayed in more glamorous circumstances at left) is being funded in part by the immigration dreams of 29 well-to-do foreigners, who have ponied up $1 million a piece to gain themselves status as U.S. residents, a path to citizenship, and a piece of whatever action the investment brings.

The photo above — sent to Swamplot by a HAIF user who goes by the handle SkylineView — is our best view yet of the project themed-condo developer Randall Davis has been working on for more than 5 years: convincing the Galleria McDonald’s to scooch over just a smidge and sell him part of the fast-food restaurant’s parking lot so he could build a 30-story highrise on it with all the benefits and cachet of drive-thru adjacency. Davis’s $70 million Astoria (portrayed in more glamorous circumstances at left) is being funded in part by the immigration dreams of 29 well-to-do foreigners, who have ponied up $1 million a piece to gain themselves status as U.S. residents, a path to citizenship, and a piece of whatever action the investment brings.

COMMENT OF THE DAY: HOW DID HOUSTON CHANGE FROM TOWNHOMES TO APARTMENTS?  “Before the financial crash in 2008, developers were giddy to get large lots such as these and develop them into townhomes or high-end single family residential. See, for example, the townhomes that sit up against the railroad tracks on Center Street that now have a view of the Wal Mart parking lot. Or the gated community at Washington Ave. and Memorial Heights.

Since then, I’m seeing more of these parcels developed into mid rise apartments, or shopping centers. Did something change in regards to bank financing or is this a response to more out of town money investing in Houston because it’s a ‘hot market’? Does anyone here know the answer?” [ShadyHeightster, commenting on A Second Midrise Alexan Planned Right Beside the First One on Yale] Illustration: Lulu

“Before the financial crash in 2008, developers were giddy to get large lots such as these and develop them into townhomes or high-end single family residential. See, for example, the townhomes that sit up against the railroad tracks on Center Street that now have a view of the Wal Mart parking lot. Or the gated community at Washington Ave. and Memorial Heights.

Since then, I’m seeing more of these parcels developed into mid rise apartments, or shopping centers. Did something change in regards to bank financing or is this a response to more out of town money investing in Houston because it’s a ‘hot market’? Does anyone here know the answer?” [ShadyHeightster, commenting on A Second Midrise Alexan Planned Right Beside the First One on Yale] Illustration: Lulu

COMMENT OF THE DAY: WHY THEY AREN’T BUILDING ON THE VACANT LOTS “Spoonman hit the nail on the head. Speculators jack up the price of open land so far that it pushes developers to buy existing buildings. This is also why you don’t see a rush of new construction immediately adjacent to light rail lines. My advice to the owners who haven’t already sold: do what the speculators do; hold out for more money. If Hines wants your house bad enough, they’ll pay it. I usually don’t advocate for this kind of thing, but if everyone did it, it might help push development back to open land.” [ZAW, commenting on Hines Buying Up Museum District Property To Build Highrise Apartments]