As you were, mate. Way back when.

Photo of Space Shuttle Endeavour over Houston: NASA

COMMENT OF THE DAY: A CITYCENTRE IN THE CITY’S CENTER WOULD’VE MADE THE GRADE “. . . The Ainbinder/Orr/San J Stone sites represent over 30 acres of land being developed with only 280 residential units going up on the old Sons of Hermann site. About the same number of apartments were demo-ed for Ainbinder’s strip mall. That means 30 plus acres of land being developed with no net increase in housing or office space in an area that should be booming with that kind of development. There are no other 30 plus acre tracts west of Downtown that have the same development potential as this site did. It may be one step forward to replace vacant land with strip malls. But it is two steps back when you consider what a City Centre style mixed use development would have done for the area. It would have generated way more in tax revenue and made property values in the immediate west end neighborhood shoot through the roof. Instead, we are getting the lowest possible tax revenue generating development that will cost six million in future tax revenues. It is like being happy when your kid gets a C minus in school. It is better than getting an F and graduating is better than dropping out. But if your kid has the potential to do A plus work, then the C minus should be a huge disappointment. Those thirty plus acres had the potential to be one of the most significant developments in Houston. Instead, it is going to be the same development that gets put in on cheap land in the burbs when a new housing development goes in. If my tax dollars are going to be thrown at wealthy developers, I want to get every dollar’s worth and will not be happy with anything other than the most productive use of the land. Developers who will not deliver that can pay their own way.” [Old School, commenting on Shops Replacing San Jacinto Stone, Just North of the South-of-the-Heights Walmart]

Construction of the complex’s overall expansion isn’t quite finished yet, but a new section of the resale shop at the Memorial Assistance Ministries in Spring Branch will open officially for the first time this weekend anyway. And oh, by the way, says the group’s marketing manager, in advance of that the shop at 1625 Blalock Rd. north of Long Point is actually open already. The new section adds 4,000 sq. ft. of retail space to showcase more of the used clothing and household stuff people keep donating. Another 4,200 sq. ft. was also added to the warehouse area to sort through it all. New totals: 14,000 sq. ft. for the store, plus 8,400 sq. ft. in the warehouse. The program’s executive director says the store typically generates enough income to fund MAM adult education programs and other assistance for more than 800 families.

The new store space, designed by Kirksey, is at the northern end of the complex’s original building (in the front at right in this new photo):

Note: Story updated below.

Note: Story updated below.

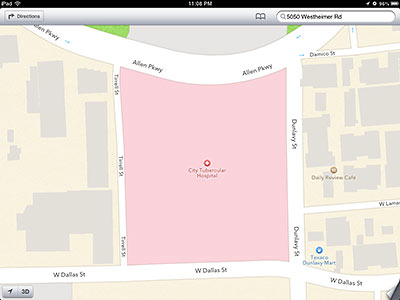

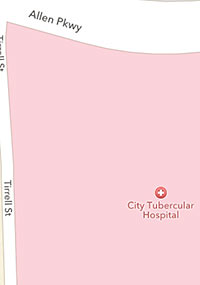

Yesterday, Apple released a new version of its operating system for late-model iPhones, iPads, and iPod Touches, just 2 days in advance of the scheduled appearance of the company’s new flagship, the iPhone 5. A Swamplot reader who took the plunge immediately and upgraded his iPad to iOS6 has been enjoying tours of Houston within the included brand-new built-in Maps application, which in the updated operating system is built by Apple instead of Google. “Notice anything odd about these maps?” the reader asks.

Just a few things so far, the reader answers for us. F’rinstance, a mysterious “City Tubercular Hospital” appears to have alighted on the vacant block west of Dunlavy off Allen Parkway where a portion of the Allen House Apartments used to stand. A large chunk of the Regent Square mixed-use development has been planned for that location since 2008.

Photo of Endeavour over Astrodome yesterday: National Weather Service

COMMENT OF THE DAY: WHAT YOU REALLY MADE ON YOUR HOUSE “. . . Most people say ‘I bought it for x and sold it for y, so I made an (y-x)/x return on my house’ which really isn’t the case. That formula can tell you your total appreciation in market value, but that is not the same as your ROI. To get closer to calculating an accurate nominal return, you need deduct the following from y: total in real estate taxes you paid while you owned the home, total expenses for repairs and maintenance, total amount of insurance premiums, the total interest and fees you paid to a lender before paying off your mortgage, and any commissions you paid to a realtor. You can then add back any income tax benefit you got for deducting your interest payments as well as any income you got from renting out all or part of your property. If you wanted to take things to the next level you could discount these cash flows and also convert nominal dollars to real, but I think even with just doing the above exercise most people will find that they didn’t really make as much money on their house as they think they did, and unless you manage to time your purchase, sale, and hold period just right, home values really have to appreciate significantly each year for the regular homeowner to just break even on it as a pure investment. That said, I think there are a lot of other very good arguments in favor of home ownership, including some financial ones. My point is just that if you bought a house for $100K and sold it 10 years later for $200K, you didn’t actually get a 10% annual return unless your property was tax exempt, you paid cash (and had a separate account set up to hedge inflation and compensate you for the cost of that capital being tied up for ten years), sold it yourself, didn’t buy homeowner’s or flood insurance, and never made any repairs.” [You Didn’t Earn That, commenting on Comment of the Day: What You Inner Loopers Got Wrong]

There’s a changing of the guard at the strip-center endcap at 10705 Westheimer in Westchase. Workers have been taking down the signs; the Smashburger in that location closed for good on Monday. A reader claims that the burger joint, on a small strip directly adjacent to the McDonald’s at the corner of Wallingford Rd., was the chain’s worst-performing store. And: that the location has already been reserved for Dunkin’ Donuts. A franchise group plans to open 16 new Dunkin’ Donuts stores in Houston over the next 6 years.

There’s a changing of the guard at the strip-center endcap at 10705 Westheimer in Westchase. Workers have been taking down the signs; the Smashburger in that location closed for good on Monday. A reader claims that the burger joint, on a small strip directly adjacent to the McDonald’s at the corner of Wallingford Rd., was the chain’s worst-performing store. And: that the location has already been reserved for Dunkin’ Donuts. A franchise group plans to open 16 new Dunkin’ Donuts stores in Houston over the next 6 years.

Photos: Swamplot inbox

Upgrading the Oak-to-home ratio Avenue of Oaks. And Ford unbuilt. Tough.

Upgrading the Oak-to-home ratio Avenue of Oaks. And Ford unbuilt. Tough.

Photo of Hermann Park: elnina999 via Swamplot Flickr Pool

COMMENT OF THE DAY: WHAT YOU INNER LOOPERS GOT WRONG “. . . You could have bought a 3,000 sqft home in the burbs for $250,000 and put the $500,000 you saved in an investment that has a return that is better than 3%. Not to mention the money you had to spend putting a couple of kids through private school. The idea that residential real estate is a good investment is not supported by the data during a time of record low interest rates. Once the fed starts to raise rates again you are going to have trouble selling those homes that sit on expensive land for what you have in them. The only people that made off like bandits in the last decade in Houston were those who bought a single family home on a 7,000 sqft lot and replaced it with several single family townhomes.” [Dave Swank, commenting on Shops Replacing San Jacinto Stone, Just North of the South-of-the-Heights Walmart]

Here’s a parking-lot view — what you’d see from Yale St. — of a 125,000-sq.-ft. strip development planned for the site of San Jacinto Stone, immediately north of the Washington Heights Walmart going up just south of I-10. San Jacinto Stone measures its stoneyard at 4 acres; the proposed 8-acre development taking over for it appears to include a few adjacent properties to the north, including frontage along the new I-10 feeder road and White Oak Bayou.