MITT ROMNEY’S MISSOURI CITY MORTGAGE Among those who answered the clarion call to invest in Houston-area real estate back in the early eighties, just a few years before its big crash: Presidential candidate Mitt Romney. Long before he earned billions at the helm of Bain Capital, Romney bought 5 rent-to-own houses in suburban areas of Houston — “without putting up any of his own money,” according to Mike McIntire’s report. Romney got stuck renting out the houses until the late 1990s, when he unloaded 4 of them, “mostly at a loss.” The tenants of the fifth house wanted to buy their 1,836-sq.-ft. 3-bedroom home (at 1350 Gentle Bend Dr. in Missouri City’s Hunters Glen neighborhood) but couldn’t qualify for a mortgage. So Romney became their bank. Tim and Betty Stamps have been making out $600 checks to Romney every month for 15 years. They refinanced the property with him this June. [NY Times]

Tag: Mortgages

A decade-long scheme of systemic fraud by Houston-based Allied Home Mortgage Capital Corp. cost taxpayers $834 million in insurance claims on defaulted loans and forced thousands of the company’s customers to lose their homes through mortgages that were “doomed to fail,” according to a lawsuit filed by a former branch manager of the company and which the U.S. government officially joined yesterday. Allied Home, which is based in offices at 6110 Pinemont Dr. (above) off the Northwest Fwy. not far from Houston’s new FBI HQ, claims to be the largest privately held mortgage company in the country (99 percent of the company is owned by founder Jim Hodge), with 200 branches, down from a high of 600. Separately, the company has now been suspended from issuing any FHA-backed loans or GNMA-backed mortgage securities.

HOW FAR FROM HOUSTON? David Streitfeld tracks down the foreclosure on a $75,000 Denmark, Maine, house that sparked the recent robo-signing crisis: “Mr. Cox realized almost immediately that Mrs. Bradbury’s foreclosure file did not look right. The documents from the lender, GMAC Mortgage, were approved by an employee whose title was ‘limited signing officer,’ an indication to the lawyer that his knowledge of the case was effectively nonexistent. . . . Fannie Mae and GMAC, which serviced the loan for Fannie, have now most likely spent more to dislodge Mrs. Bradbury than her house is worth. Yet for all their efforts, they are not only losing this case, but also potentially laying the groundwork for foreclosure challenges nationwide.” [NY Times; previously on Swamplot]

Gosh, processing paperwork for foreclosures used to be so easy before the end of last month — when everyone started getting so picky, insisting that agents for the mortgage lenders actually read the documents they were signing. What do they expect? Have you ever tried to wade through all that legalese? And now look what’s come of it: On Friday, Bank of America became the next major lender to call for a time-out, announcing it would halt foreclosures and the sales of foreclosed homes in all 50 states — presumably until the company can figure out its best defense against lawsuits. Yes, that would include all B of A mortgages headed for foreclosure in Texas, where ordinarily courts don’t care whether an agent of the lender has any personal knowledge of the signed documents. Bank of America and its subsidiaries have accounted for 31 percent of all Harris County foreclosures so far this year, according to data dug up by Chronicle reporter Nancy Sarnoff.

Also getting in on the break: Litton Loan Processing Services, a division of Goldman Sachs. The Houston company announced Friday it would also stop pushing through foreclosure paperwork — though only in “certain cases.” Next to be held up in the paperwork traffic pile-up: title insurers. A statement released by the company tries to spin it in a different direction, but the AP reported Friday that an internal memo issued by Houston’s Stewart Title would “make it difficult” for the company’s agents to issue insurance policies for properties foreclosed on by Bank of America and other quick-signing lenders: JP Morgan Chase, OneWest Bank and the GMAC Mortgage unit of Ally Financial.

- Ally’s mortgage documentation problems could extend beyond 23 states [Washington Post]

- Bank of America puts sales on hold [Houston Chronicle]

Photo of Bank of America Center: Erin Ferguson

NO MONEY DOWN — FOR DOCTORS Who’s still able to get jumbo mortgages from banks with no down payment required? Why, borrowers in “lucrative professions” of course, explains Nancy Sarnoff. She profiles a CPA and a tax attorney who were recently offered a million-dollar loan with no money down and no mortgage insurance requirement — from BBVA Compass — to help them purchase their West University home. Among the more prized groups for such “professional mortgages”: doctors and dentists. Such programs are often targeted toward cash-poor graduates just out of medical school, and don’t take student loan payments into account.” [Houston Chronicle]

THE CASE OF THE UNUSUALLY HELPFUL CONTRACTOR Melvin Lendall Brown, owner of a local unincorporated business he called Brownstone Construction, provided an unusually complete range of services to his clients. The Justice Dept. announced his guilty plea — to a single count of wire fraud — earlier this week: “Brown and others recruited and solicited individuals with good credit to act as borrowers in applications for residential mortgage loans to purchase one or more of those properties, even though the borrowers had no intention of making payments on the mortgage loans. Brown, aided and abetted by at least one other person, made representations to each borrower, including that he would buy the home in the borrower’s name, make any monthly mortgage payments, find others to live in the home and pay monthly rent, take the home out of the borrower’s name after a period of time as well as compensate the borrower. Brown and others caused Uniform Residential Loan Applications to be made in the names of the borrowers that overstated their employment income and other assets, understated or omitted their debts and other liabilities, falsely represented that the borrowers leased the homes in which they resided and received income from the rent, and falsely claimed that the borrowers intended to occupy the newly purchased homes. Because of the fraudulent information, the lenders made decisions to approve the applications and fund the loans. In support of those fraudulent loan applications, false and fraudulent documents were submitted, including sham lease agreements and bogus employment information. Brown also provided funds to the borrowers to use for deposits toward the purchases of those homes and for closing fees, and he often appeared with the borrowers at the closings.” [FBI Houston, via InSite]

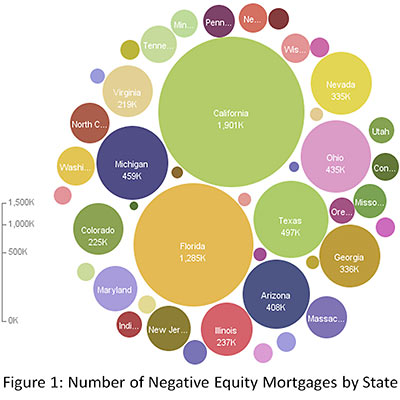

HOUSTON-AREA MORTGAGE STORM SURGE: NOW A QUARTER UNDER WATER Another few months, another one of those studies from research firm First American CoreLogic — this one using data from the end of June. By that date, the firm says, 26.15 percent of all Houston-Sugar Land- Baytown-area mortgages were in a “negative equity” position. Add in the “up to their eyeballs” crowd of mortgage-holders who are within 5 percentage points of owing more than their homes are worth, and the figure rises to 33.86 percent. That’s a marked increase from the figures in the firm’s March study, which used data from September 2008. [First American CoreLogic; previously on Swamplot]

Sure is nice for us Houston didn’t get caught up in that big price run-up housing markets in the rest of the country fell for! That’s why in Houston real estate is in much better shape than it is everywhere else, right?

Not according to a study released yesterday by First American CoreLogic. The research firm estimates that 18.3 percent of all mortgaged properties in the Houston-Sugar Land-Baytown region are in a “negative equity position,” and another 6.7 percent are within just 5 percentage points of being there. “Negative equity,” AKA “I’ve fallen down and I can’t get up,” means a mortgage holder owes more than the underlying property is worth.

In other words, 1 in every 4 Houston-area mortgages is already in deep doo-doo.

But hey, all it’ll take to recover is for prices to rise a little! And the rest of the country is doing much worse, right?

It didn’t garner much local attention, but a certain local condo building — along with a few close friends — made a star appearance in last week’s big mortgage-scam announcement by the FBI. More than 400 people were charged in 144 separate mortgage fraud cases nationwide over the last 3 months as part of the agency’s “Operation Malicious Mortgage.” Six of those arrests were in Houston:

This indictment charges Houston-area residents Frankthea Annette Williams, Ishmael Boyd Laryea, Charles Joseph-DeShawn Wilson, Kristen Anne Way and Robert Wilfred Stanley, and Tasha Rene Bellow, of Burbank, Calif., with engaging in a scheme to defraud by providing false and fraudulent information to residential lenders to induce the lenders to fund the purchase of single family homes and condominium units.

11 News reporter Allison Triarsi describes how the scams worked:

The suspects would find a home for sale, let’s say $200,000.

They would then get a phony appraisal that would almost double the home’s actual value. In that case, $400,000.

The culprits would then look for an investor. That’s someone to actually put the house in their name using their good credit for the closing and title.

A bank would then loan the money for the house, which has the phony appraisal value. The crooks would then pay the seller the $200,000 asking price and pocket the other $200,000.

Here’s a question. If you were trying to run this scam, where would you find properties you could get appraised for as much as twice their actual value? Sure, Houston had some price runups . . . and yes, appraisals can be played. But why fake something you don’t have to?

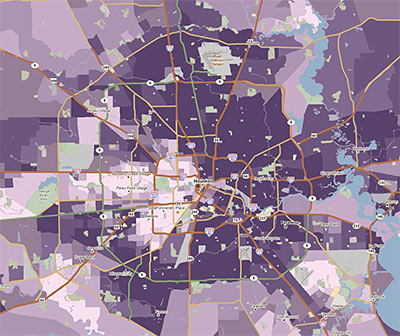

Here’s a tool likely to be useful to armchair developers interested in the lay of the land. PolicyMap is a new GIS website that allows you to view a range of local market and demographic data for Houston or any area of the country. You can see how local crime statistics, an interesting array of mortgage categories (such as the percentage of piggyback, subprime, and refi loans), income distributions, and even donations to presidential candidates look on a map. (Big surprise: Pearland and the Energy Corridor really like John McCain!)

PolicyMap is a project of The Reinvestment Fund, a non-profit community-development financial institution from Philadelphia. Some of the advanced features require a subscription, but there’s plenty to play around with for free.

The quick map above shows what Houston areas took out the most subprime loans in 2006. (The darkest purple means more than 50% of all mortgages funded that year.) If you discover more interesting neighborhood stories demonstrated nicely in PolicyMap maps, share your finds in the comments.

It’s not just a burgeoning problem that’s destroying neighborhoods and creating havoc in the real-estate market: Mortgage fraud is now also the target of over-the-top TV-show parodies. Yes, “FSI: Fraud Scheme Investigation” is . . . a training video for bored mortgage professionals — or anyone who’s suspicious (or wants to be) that he may be surrounded by unlawful real-estate hijinx.

But really, “FSI” is so much more than that. Designed for “maximum employee learning retention,” the DVD has been a runaway hit for Interthinx, a company that ordinarily provides risk mitigation and compliance tools for the financial-services industry, but occasionally breaks out of that mold to film comedy-dramas like this or its predecessor, “Desperate House Lies.”

But wait, there’s more!

[youtube:http://www.youtube.com/watch?v=iLqkHr77N0U 400 330]

So the actors aren’t likely to win any awards, but this new video posted to YouTube by Tremont Tower owner-victim-gadfly Heather Mickelson is notable for it’s uh . . . stirring illustration of the connection between construction-quality complaints and foreclosure train wrecks.

The Tremont is colorfully renamed “LemonTree Tower” in the video reenactment. If you’re new to the story, you’ll find better introductions to the sordid Montrose condo tale elsewhere. But if you’ve ever wondered why foreclosures seem to gather like flies around new developments that feature questionable levels of quality (and, say, water-tightness), this will make pretty good internet theater. No, the mortgage defaults aren’t the work of the millions of mold spores and the grim reaper, who together make cameo appearances in the video; they’re the ultimate result of the surefire sales techniques employed for undesirable properties — made so much easier, of course, by the subprime-mortgage boom.

Here’s the formula: Building with bad enclosure + poor disclosure = lots of foreclosure. Or just watch the video. At just over seven minutes, it’s still a lot shorter than Glengarry Glen Ross.

- LemonTree Tower [YouTube]

- Ownership Wrongs [Houston Press]

- The Dirty Little Secret Behind the Montrose Foreclosure Hump [Swamplot]

- The Collapse of 1342 Rutland [Swamplot]

Washington Mutual may not be closing all of its home-loan centers nationwide, but it sure is getting out of Houston in a hurry. From the Houston Business Journal this morning:

WaMu intends to close five of six home loan centers in the Houston area, affecting 25 employees, a company spokeswoman said Tuesday.

The six centers are:

- Northline Mall, 4400 North Fwy Suite 300 77022

- Gulfgate Mall, 745 Gulfgate Center Mall 77087

- Little York, 121 Little York 77076

- N. Houston II, 14340 Torrey Chase Blvd. Suite 200 77014

- Sugar Land, 16111 Kensington Dr. 77479

- South Houston, 17225 El Camino Real Suite 110 77058

Which will remain?

WaMu is now out of the subprime loan business entirely.

- WaMu’s mortgage woes prompt office closings, layoffs [Houston Business Journal]

[youtube:http://www.youtube.com/watch?v=SJ_qK4g6ntM 400 330]

If you can spare nine minutes and want a lucid explanation of what’s been going on in the mortgage markets, British comedians John Bird and John Fortune explain it all in this video.

- The Long Johns – The Last Laugh – George Parr – Subprime [YouTube; via Paul Kedrosky’s Infectious Greed]

Some individual investors who’ve been using IRA money to invest in mortgages have been cheering as foreclosures have become more common, reports the Wall Street Journal:

No one tracks IRA loan defaults, but experienced individual lenders say it has happened rarely — though they are bracing for an uptick, given the shaky state of the housing market in many areas.

“You don’t want them to pay you,” says Charlie Adams, a Houston investor who has made about 20 mortgage loans through his and his mother’s IRAs in the past 10 years, typically charging 15% interest for one-year loans. “What’s the worst thing that can happen — you wind up owning a house at 70% of its cost?” He lends no more than 70% of a property’s value and charges interest-only payments. More conservative lenders will go no higher than 50%.

With the one foreclosure he’s done, his mother had lent $40,000 to a renovator to refurbish a house worth $85,000. The borrower made 12 months of interest payments, then stopped, and did not make the balloon payment due. Mr. Adams foreclosed on the house, his mother’s IRA spent $14,000 to finish fixing it up, and they sold it in three months for $85,000, he says, adding that he helped his mother’s IRA increase in value to $140,000 from $50,000 in five years.

Great, but you’ll need to make sure you have enough IRA money in reserve to handle this kind of “good fortune”:

For investors, one risk in foreclosing on a house is racking up so many expenses — from legal fees to repair bills — that the IRA runs out of money. If that happens, the IRA owner faces a difficult choice: Get a loan, or close out your IRA and pay any taxes or penalties.

Using a self-directed IRA to fund mortgage or real estate investments can make sense: for a lot of people, an IRA is the largest pool of money available. Self-directed individual-retirement-account companies Entrust, Pensco Trust, and Guidant Financial have seen a dramatic increase in real-estate lending activity within their IRAs, the article reports.

- Investors Use Their IRAs To Make Home Loans [Wall Street Journal]