COMMENT OF THE DAY: BEWARE OF NEIGHBORHOOD AVERAGES  “Anything zoomed out to the neighborhood scale post-Harvey impact-wise waters down the data so much as to be useless. In the Knollwood-Woodside area where homes are “up ~3%,†it’s a mix of ~$800k newbuilds that mostly didn’t flood and ~$400-500k 1950s houses, some of which flooded and many-most that didn’t. That means any additional newbuild sale immediately skews the pricing average. What has already hit the market lately are mostly original homes that flooded, being sold as-is as teardowns (continuing the trend of the neighborhood), with lot-value on an upswing. I guess I presume all of Knollwood will be new construction in the near future, and almost all of ‘greater Braeswood’ being new construction soon, with everything getting higher elevations . . .” [juancarlos31, commenting on Harvey’s Effect on Housing Prices, Neighborhood by Neighborhood; Houston Press Stops the Presses; Astros Fans Flood Downtown] Photo of house for sale at 8311 Lorrie Dr., Knollwood Village: HAR

“Anything zoomed out to the neighborhood scale post-Harvey impact-wise waters down the data so much as to be useless. In the Knollwood-Woodside area where homes are “up ~3%,†it’s a mix of ~$800k newbuilds that mostly didn’t flood and ~$400-500k 1950s houses, some of which flooded and many-most that didn’t. That means any additional newbuild sale immediately skews the pricing average. What has already hit the market lately are mostly original homes that flooded, being sold as-is as teardowns (continuing the trend of the neighborhood), with lot-value on an upswing. I guess I presume all of Knollwood will be new construction in the near future, and almost all of ‘greater Braeswood’ being new construction soon, with everything getting higher elevations . . .” [juancarlos31, commenting on Harvey’s Effect on Housing Prices, Neighborhood by Neighborhood; Houston Press Stops the Presses; Astros Fans Flood Downtown] Photo of house for sale at 8311 Lorrie Dr., Knollwood Village: HAR

Home Prices

COMMENT OF THE DAY: AFFORDABLE HOMES NEED SMALLER LOTS  “Large houses are not the cause of being priced out of the Heights, they’re the effect. With land values approaching $75/sf at the peak of the market, that’s almost half-a-million dollars for a full-sized lot. If you put a 2000-sq.-ft. house on that lot (at $150/sf construction cost), you’re looking at $800k. Or $400/sf. There’s a very thin market for that size house at that price point.

There are tons of more affordable options in or near the Heights, but they aren’t going to come with 6000 sq. ft. of dirt. The secret to providing more affordable housing is to just build more housing. In the Heights, that’s generally come in the form of replacing one bungalow with two modest two-story houses. In Shady Acres, it’s usually replacing TWO bungalows with SIX townhouses. There are literally hundreds of reasonable-sized houses (2000-2500 s.f.) that have been created this way in the Free Heights over the last decade. Without them, a lot MORE people would have been priced out of the neighborhood.” [Angostura, commenting on Comment of the Day: Aren’t these the Heights Design Guidelines We’ve Been Asking For?] Illustration: Lulu

“Large houses are not the cause of being priced out of the Heights, they’re the effect. With land values approaching $75/sf at the peak of the market, that’s almost half-a-million dollars for a full-sized lot. If you put a 2000-sq.-ft. house on that lot (at $150/sf construction cost), you’re looking at $800k. Or $400/sf. There’s a very thin market for that size house at that price point.

There are tons of more affordable options in or near the Heights, but they aren’t going to come with 6000 sq. ft. of dirt. The secret to providing more affordable housing is to just build more housing. In the Heights, that’s generally come in the form of replacing one bungalow with two modest two-story houses. In Shady Acres, it’s usually replacing TWO bungalows with SIX townhouses. There are literally hundreds of reasonable-sized houses (2000-2500 s.f.) that have been created this way in the Free Heights over the last decade. Without them, a lot MORE people would have been priced out of the neighborhood.” [Angostura, commenting on Comment of the Day: Aren’t these the Heights Design Guidelines We’ve Been Asking For?] Illustration: Lulu

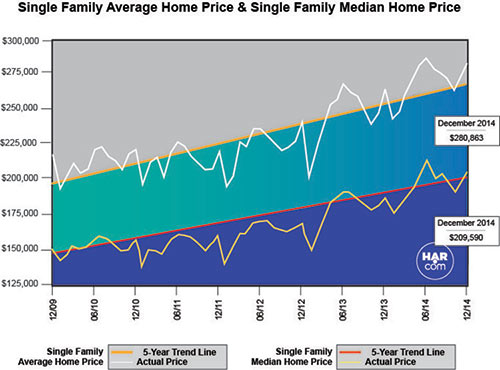

Is this Houston real estate’s Wile E. Coyote off-the-cliff-but-hasn’t-realized-he’s-gonna-fall-yet moment? Or is a new era dawning, in which out-of-state investors new to this whole “Houston is booming” thing swoop in to buy up everything and save the day? A fresh serving of home-sales data from real estate agents is available this morning . . . to support either notion. This past December was a record-breaking month for home sales, the Houston Association of Realtors claims in its latest report. Total property sales were up 11 percent over last December, and the current 2.5-months supply of inventory (a comforting term to those who regularly consider a home to be an off-the-shelf item) is scored as “the lowest level of all time.” Total dollar volume of housing sales for this past month was up a whopping 18.1 percent over December of last year. Both average and median sales prices for single-family homes reached “historic highs for a December in Houston.”

Separately, using her own calculations from MLS data, buyers’ agent Judy Thompson has updated her hand-carved regular roundup of appreciation rates and market conditions for the 21 well-known (and mostly Inner Loop) neighborhoods she’s been tracking on her West U Real Estate website for the past decade. (“In some areas I have had to make value judgments about which sales might have been lot value sales that were not listed that way,” she explains.) Of note: Of the tracked neighborhoods, little old Westbury led the increase in average sales price per sq. ft., rising 22 percent in the last year; the combined average for 2014 was an 11 percent uptick.

- The Houston Real Estate Market Breaks Records in 2014 [HAR]

- Appreciation [West U Real Estate]

Chart: HAR

COMMENT OF THE DAY: HOUSTON REAL ESTATE PROBLEMS, WITH OR WITHOUT CHEAP OIL  “The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

“The Houston market had a few easily identifiable problems even before the drop in oil prices.

1) Older homeowners with paid off or mostly paid off homes are asking unrealistically high prices for fixer uppers or tear downs. That’s slowing down new home purchases and new builds. That was a problem at $100 oil. Well priced homes moved and unrealistically high priced homes sat. People wanting $300K for a total fixer upper inside Beltway 8 or $400K for a lot near the 610 loop are just completely slowing down the revitalization process as those houses/lots sit for months on end while everyone thinks the sky is falling.

2) Near loop new construction is priced exclusively for people making $200K and up. A family of two earners making $50K (teachers, cops, firefighters, non O&G professionals) can only afford to live out west in the burbs, but many are choosing to rent rather than go west. There’s no attempt at affordable housing inside the beltway. When oil goes down, the engineers stop buying in Houston. The aforementioned buyers would be happy with smaller houses they could afford to get into but the developers are chasing the biggest gains possible on each new build.

The real estate market will ultimately be fine for people who didn’t overpay but it would be nice to see changes that reflect reality now that oil is not at $100.” [Houstonian, commenting on Tanking Oil Prices Place Houston Second on Fitch’s Overvalued Housing Market List] Illustration: Lulu

TANKING OIL PRICES PLACE HOUSTON SECOND ON FITCH’S OVERVALUED HOUSING MARKET LIST  With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

With homes selling on average 19 percent above their value, Houston trails only Austin as an overheated U.S. market, says mortgage securities group Fitch Ratings. “What we’re most worried about is speculative buying and selling,” says Fitch analyst Stefan Hilts. “People aren’t buying houses because they need to; it’s because they can. That’s causing a big market distortion.” Sub-$60 oil gets much of the blame, but there are several other factors at play: student debt, rising home prices, the tendency of the millennial generation to delay home ownership, and high apartment rents hampering the ability of would-be homeowners to save for a down payment. [Houston Business Journal] Photo of Gary Sweeney sign at Art Guys World Headquarters: Shawna Mouser

COMMENT OF THE DAY: WE’RE NOWHERE NEAR PEAK MONTROSE  “I don’t think we’re anywhere close to the peak of property values in Montrose. You can still get an older 1,500 square foot townhome in the area for under $250,000. The average price for a bigger (~2,500sf) recent construction townhome is probably around $600,000. Those prices would be laughably low in comparable neighborhoods in most cities. Gentrification doesn’t really stop halfway like that barring a major economic downturn — once the ball starts rolling like this it just keeps going until the whole neighborhood is gleaming and wealthy. If you think Montrose has reached that point yet, you’re wrong. A fully gentrified urban neighborhood doesn’t have horrible apartment complexes like Takara So or vacant lots and skeazy strip centers on its main commercial street. Gentrification isn’t going to stop in Montrose until you can’t get a new townhome for less than a million or an apartment for less than $1,400.” [Christian, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

“I don’t think we’re anywhere close to the peak of property values in Montrose. You can still get an older 1,500 square foot townhome in the area for under $250,000. The average price for a bigger (~2,500sf) recent construction townhome is probably around $600,000. Those prices would be laughably low in comparable neighborhoods in most cities. Gentrification doesn’t really stop halfway like that barring a major economic downturn — once the ball starts rolling like this it just keeps going until the whole neighborhood is gleaming and wealthy. If you think Montrose has reached that point yet, you’re wrong. A fully gentrified urban neighborhood doesn’t have horrible apartment complexes like Takara So or vacant lots and skeazy strip centers on its main commercial street. Gentrification isn’t going to stop in Montrose until you can’t get a new townhome for less than a million or an apartment for less than $1,400.” [Christian, commenting on Gibbs Boats on West Gray and Montrose Is Selling Everything Now] Illustration: Lulu

A DIRE WARNING FOR HOUSTON, 1965: IN CASE OF NUCLEAR ATTACK, PROPERTY VALUES MAY RISE  Nuclear historian Alex Wellerstein, creator of the online Nukemap nuclear-blast simulator, finds the following charming nugget in a September 1965 report issued by the nonprofit Institute for Defense Analyses, which wad been hired by the U.S. Army’s Office of Civil Defense to calculate the effects of the use of a nuclear weapon on an American city — using Houston as an example: “For single surface bursts of 3- and 10-Mt, about 64 percent and 46 percent of the property values survive, while only 32 and 18 percent of the unsheltered population survives. In a macabre sense, the surviving population would be individually ‘wealthier’ than before the attack. For a single 10-Mt weapon, surviving property value per capita nearly doubles from a preattack value of about $9,000 to slightly more than $16,000 and, as the weight of the attack increases, the greater the per capita gain in ‘wealth’ of the survivors. For a 100-Mt surface burst, the surviving population is nearly four times wealthier than pre-attack ($34,000). However, any joy among the surviving population may be quite shortlived; none of these gross estimates of the effects of nuclear attack indicate whether or not the immediate metropolitan area is viable, either by itself or with the assistance of the rest of the country.” [Lawyers, Guns, and Money; report (PDF)] Simulated image of 10-megaton mushroom cloud over Houston: Nukemap 3D

Nuclear historian Alex Wellerstein, creator of the online Nukemap nuclear-blast simulator, finds the following charming nugget in a September 1965 report issued by the nonprofit Institute for Defense Analyses, which wad been hired by the U.S. Army’s Office of Civil Defense to calculate the effects of the use of a nuclear weapon on an American city — using Houston as an example: “For single surface bursts of 3- and 10-Mt, about 64 percent and 46 percent of the property values survive, while only 32 and 18 percent of the unsheltered population survives. In a macabre sense, the surviving population would be individually ‘wealthier’ than before the attack. For a single 10-Mt weapon, surviving property value per capita nearly doubles from a preattack value of about $9,000 to slightly more than $16,000 and, as the weight of the attack increases, the greater the per capita gain in ‘wealth’ of the survivors. For a 100-Mt surface burst, the surviving population is nearly four times wealthier than pre-attack ($34,000). However, any joy among the surviving population may be quite shortlived; none of these gross estimates of the effects of nuclear attack indicate whether or not the immediate metropolitan area is viable, either by itself or with the assistance of the rest of the country.” [Lawyers, Guns, and Money; report (PDF)] Simulated image of 10-megaton mushroom cloud over Houston: Nukemap 3D

COMMENT OF THE DAY: GETTING THE MAXIMUM PRICE ON A MINIMUM LOT SIZE  “All things being equal, restricted property is worth less than un-restricted property. However, property for which NEIGHBORING properties are restricted can be MORE valuable. Property owners accept MLS [minimum lot size] restrictions on their own property in return for MLS restrictions on their neighbors’ property. If the value they give up by accepting the restriction on their own property is less than the value they gain by ensuring they won’t end up living next to a townhouse cluster, then it can be in their interest to accept the restriction.

If you own a tear-down, MLS restrictions will (probably) reduce the value of your home. If you own a valuable structure on a block with one or more tear-downs, MLS restrictions will probably INCREASE the value of your home.” [Angostura, commenting on Flyer Sent to Very Near Northside Warns of Dangers of Minimum Lot Size Designation] Illustration: Lulu

“All things being equal, restricted property is worth less than un-restricted property. However, property for which NEIGHBORING properties are restricted can be MORE valuable. Property owners accept MLS [minimum lot size] restrictions on their own property in return for MLS restrictions on their neighbors’ property. If the value they give up by accepting the restriction on their own property is less than the value they gain by ensuring they won’t end up living next to a townhouse cluster, then it can be in their interest to accept the restriction.

If you own a tear-down, MLS restrictions will (probably) reduce the value of your home. If you own a valuable structure on a block with one or more tear-downs, MLS restrictions will probably INCREASE the value of your home.” [Angostura, commenting on Flyer Sent to Very Near Northside Warns of Dangers of Minimum Lot Size Designation] Illustration: Lulu

HAVE HOME PRICES IN LINDALE PARK REALLY JUMPED THAT MUCH, THAT FAST?  “I’d be curious to know what your more knowledgeable readers think about the rising prices in Lindale Park,” a reader writes. “Just today I saw this listing — for north of $400k! Over the past couple of months there have been a number of homes listed, and quickly pending, for around $300k. Most (all?) of these appear to have been flipped.

I bought my (not updated, in need of work, but a not-bad 3-2) house in Lindale Park for around $150k in 2010. There were a number of factors to picking Lindale Park, but the biggest was that we could get a decent-sized house in a close-in neighborhood that seemed to be on the up-and-up without breaking the bank. (The rail was a big reason too.) But when I saw this home — big and updated but right on 610 — for more than $400k . . . my jaw dropped.” [Swamplot inbox] Photo of 511 Kelley St.: HAR

“I’d be curious to know what your more knowledgeable readers think about the rising prices in Lindale Park,” a reader writes. “Just today I saw this listing — for north of $400k! Over the past couple of months there have been a number of homes listed, and quickly pending, for around $300k. Most (all?) of these appear to have been flipped.

I bought my (not updated, in need of work, but a not-bad 3-2) house in Lindale Park for around $150k in 2010. There were a number of factors to picking Lindale Park, but the biggest was that we could get a decent-sized house in a close-in neighborhood that seemed to be on the up-and-up without breaking the bank. (The rail was a big reason too.) But when I saw this home — big and updated but right on 610 — for more than $400k . . . my jaw dropped.” [Swamplot inbox] Photo of 511 Kelley St.: HAR

COMMENT OF THE DAY: INNER LOOP HOME PRICES CAN’T KEEP RISING LIKE THEY HAVE  “. . . Our current population boom was due to an unexpected resurgence in the gulf of mexico oil market and hit our housing supply by complete surprise. However, the housing market will be going full steam for the next few years to catch up on supply and entire new subdivisions are going to be created that are well outside of the property value inflation we’re seeing in town. The vast majority of new residents are already buying well outside of the 610 Loop. Even the snottiest of inner loopers such as myself would eventually consider buying a mansion in the ‘burbs for the same price as a cluttered townhome in the Loop.

. . . Not to say we’re in a bubble right now, but beyond doubt there will be a lot of downward pressure on home prices in the Houston area moving forward unless we see employment start accelerating again. That definitely is not going to be likely no matter how well the gulf market holds up. So I think people claiming there is or isn’t a bubble are being a bit premature, we all have to wait and see. I believe the general expectation is that although values have shot up, there should be enough demand to hold the prices up moving forward. So yes, odds are probably against a bubble, but I would expect that this burst of demand has pulled property valuations forward quite a bit and that folks shouldn’t expect to see gains on home prices for the next 5 years or so as a glut of new apartments and homes come onto the market. There’s still plenty of land to be redeveloped and no shortage of opportunities for increased density in the inner Loop and that’s even before we start really gentrifying the 3rd and 5th wards. For me, i’ll hold off on Inner Loop property until the boomers start dwindling down.” [joel, commenting on Mirroring the Features of a Simple $310K Studewood St. Duplex] Illustration: Lulu

“. . . Our current population boom was due to an unexpected resurgence in the gulf of mexico oil market and hit our housing supply by complete surprise. However, the housing market will be going full steam for the next few years to catch up on supply and entire new subdivisions are going to be created that are well outside of the property value inflation we’re seeing in town. The vast majority of new residents are already buying well outside of the 610 Loop. Even the snottiest of inner loopers such as myself would eventually consider buying a mansion in the ‘burbs for the same price as a cluttered townhome in the Loop.

. . . Not to say we’re in a bubble right now, but beyond doubt there will be a lot of downward pressure on home prices in the Houston area moving forward unless we see employment start accelerating again. That definitely is not going to be likely no matter how well the gulf market holds up. So I think people claiming there is or isn’t a bubble are being a bit premature, we all have to wait and see. I believe the general expectation is that although values have shot up, there should be enough demand to hold the prices up moving forward. So yes, odds are probably against a bubble, but I would expect that this burst of demand has pulled property valuations forward quite a bit and that folks shouldn’t expect to see gains on home prices for the next 5 years or so as a glut of new apartments and homes come onto the market. There’s still plenty of land to be redeveloped and no shortage of opportunities for increased density in the inner Loop and that’s even before we start really gentrifying the 3rd and 5th wards. For me, i’ll hold off on Inner Loop property until the boomers start dwindling down.” [joel, commenting on Mirroring the Features of a Simple $310K Studewood St. Duplex] Illustration: Lulu

GAINING IN HOUSTON’S GAYBORHOODS  So home prices are rising in urban areas — no surprise there. But nowhere are those prices rising faster than in so-called “gayborhoods.” That’s according to Jed Kolko, crunching the numbers for Trulia: “Neighborhoods where same-sex male couples account for more than 1% of all households (that’s three times the national average) had price increases, on average, of 13.8%. In neighborhoods where same-sex female couples account for more than 1% of all households, prices increased by 16.5% –– more than one-and-a-half times the national increase.” Prime Property’s Nancy Sarnoff adds that in Houston in Rosedale prices are up 16 percent and 14 percent in Hyde Park, where the 1920s Jackson Blvd. bungalow shown here is for sale for $425,000. [Trulia Trends; Prime Property] Photo of 1223 Jackson: HAR

So home prices are rising in urban areas — no surprise there. But nowhere are those prices rising faster than in so-called “gayborhoods.” That’s according to Jed Kolko, crunching the numbers for Trulia: “Neighborhoods where same-sex male couples account for more than 1% of all households (that’s three times the national average) had price increases, on average, of 13.8%. In neighborhoods where same-sex female couples account for more than 1% of all households, prices increased by 16.5% –– more than one-and-a-half times the national increase.” Prime Property’s Nancy Sarnoff adds that in Houston in Rosedale prices are up 16 percent and 14 percent in Hyde Park, where the 1920s Jackson Blvd. bungalow shown here is for sale for $425,000. [Trulia Trends; Prime Property] Photo of 1223 Jackson: HAR

COMMENT OF THE DAY: WHAT DO I HEAR FOR AN ORIGINAL TANGLEWOOD RANCH? “serious question . . . as the number of 1 story ranch houses in tanglewood dwindles to what is now only about 20% of the market, does this type of product ever carry in ITSELF a premium for being a certain ‘historic’ structure? or is the value of these houses always going to be simply a function of their dirt value? and if they are renovated enough for entry level tanglewood families (like mine) to live in, is there a value to be established there? the answer is probably as suggested. i realize that ultimately these houses are saddled with 8′ ceilings and outdated wiring/plumbing, but it’s still a 1:4 coverage ratio housing product, where you want to be, surrounded by the schools you want to send your kids to, and spending $1.25 to buy it and $250,000 to renovate it (to the studs)” [HTX REZ, commenting on Daily Demolition Report: School of Hard Knocks]

Seem familiar? This 1952 mod appeared in the HBO boob-job exposé Breast Men, starring David Schwimmer as Houston’s early-’60s boob pioneer Dr. Kevin Saunders. Or maybe that two-faced fireplace sparks your memory: Last July, the 4-bedroom, 3,558-sq.-ft. home was listed for sale at $1.1 million. (It was the one with the bomb shelter underneath the patio?) Well, in December it was sold for an even $1 million. And it showed up in today’s Daily Demolition Report.

Why not take one last peek, before it goes?

If Beyoncé still wants this deeply discounted Piney Point Village mansion for her mother, she might have to bring back Sasha Fierce and grab a paddle: It’s going up on February 19 for auction. The 21,640-sq.-ft., 4-kitchen rental property near Briar Forest was listed as recently as January 3 at $5.9 million — and, says the website of California-based auction house Premier Estates, that’s just where bids will start.

TODAY IN MAJOR MEDIA MARKET LINKBAIT  The marketing folks at real estate brokerage Movoto have drummed up this pointless factoid: If the White House were located in Houston, it would cost $20 million — far less than it would if it were in any of the 6 other major markets they ran the spreadsheet calculation for. (Costs would probably be even lower in suburban Waco, but they’d have generated too few pageviews from calculating that figure to make it worthwhile.) Next least expensive of the calculated cities: Miami, with an imaginary White House worth $39 million. Most expensive: New York, at $387 million. No, this isn’t the cost to build another White House, it’s how much it would cost to buy it, if it were for sale, in a city where it doesn’t exist. [Movoto] Graphic: Movoto

The marketing folks at real estate brokerage Movoto have drummed up this pointless factoid: If the White House were located in Houston, it would cost $20 million — far less than it would if it were in any of the 6 other major markets they ran the spreadsheet calculation for. (Costs would probably be even lower in suburban Waco, but they’d have generated too few pageviews from calculating that figure to make it worthwhile.) Next least expensive of the calculated cities: Miami, with an imaginary White House worth $39 million. Most expensive: New York, at $387 million. No, this isn’t the cost to build another White House, it’s how much it would cost to buy it, if it were for sale, in a city where it doesn’t exist. [Movoto] Graphic: Movoto