COMMENT OF THE DAY: INNER LOOP REUNION OF THE EX-PRESIDENTS’ HEADS “I wish someone would get all of the presidents back together! They are very sad now. A kind donor, say perhaps the magnanimous Landed Gent who always boasts of his splendor here on Swamplot, should cut a deal for the Wilshire Village property and foster the development of a Presidential Park. I’m sure it’s like a buy 20 get one free sort of deal, so maybe we could get that nifty telephone too.” [Bobby Hadley, commenting on Pearland Heads Cut Off: The WaterLight District’s Giant Presidential Bust]

Tag: Lancaster Place

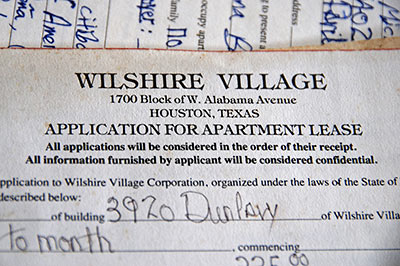

About 100 people showed up to that Saturday protest on the former site of the Wilshire Village Apartments, organized by a group calling itself the Montrose Land Defense Coalition. Organizers had originally expressed a desire to have the 7.68-acre site at the southwest corner of West Alabama and Dunlavy be turned into a park. Protesters told reporters they wanted the property’s trees preserved. But the organization’s website now features this clarification:

The aim of our campaign is not to alienate or place our Coalition in direct opposition to any one entity seeking to develop the land. We are concerned with the degree to which communities have a say in the development of land directly adjacent to their places of residence.

Specifically, organizer Maria-Elisa Heg tells Swamplot,

We are still fighting for a green space, a public commons, and we need to show HEB that they need to be mindful of smart urban planning.

And . . . uh, they have some plans for the site to present — shown to them by an unnamed “group of architects”:

HOW CERTAIN IS THAT MONTROSE H-E-B? “H-E-B’s plans [to build a new store on the former site of the Wilshire Village apartments] may not be as sure as some think. Cyndy Garza Roberts, the chain’s public-affairs director, tells Hair Balls that plans ‘are still in the very, very early stages.’ That includes not just rudimentary things like due diligence on title and legalities, but even a feasibility study to determine whether a store at the location would be economically viable.” [Hair Balls; previously on Swamplot]

LOOKS LIKE THAT PUBLICITY CAMPAIGN FOR THE NEW MONTROSE H-E-B HAS ALREADY BEGUN If H-E-B can figure out a way to keep this sort of thing going even after the new store is built, that Fiesta won’t have a chance: “The Montrose Land Defense Coalition will hold a rally this weekend at Menil Park to raise awareness of H-E-B’s plans to build a new store on the site of the long-gone Wilshire Village apartment complex. The group will walk from the park to the property at the southwest corner of West Alabama and Dunlavy on Saturday around 1:30 p.m. Last week, H-E-B confirmed that it’s under contract to buy the nearly eight-acre site across from a strip center anchored by a Fiesta. Resident Maria-Elisa Heg recently formed the Montrose Land Defense Coalition to call attention to the property and attract investors who might be interested in buying it with the city of Houston for use as a public space.” [Prime Property; previously on Swamplot]

COMMENT OF THE DAY: THE WILSHIRE VILLAGE CURSE “. . . I think we can officially call this site cursed as everyone who has anything to do with it seems to begin making insane decisions about what to do with it. A grocery store?? Really?!?” [mstark, commenting on H-E-B: Yes, We’re Buying the Wilshire Village Site]

A representative of H-E-B confirms to the River Oaks Examiner‘s Mike Reed that the grocery company is buying the 7.68-acre site on West Alabama in Montrose — across Dunlavy from Fiesta — where the Wilshire Village Apartments once stood:

H-E-B spokeswoman Cyndy Garza-Roberts said she could not disclose a proposed purchase price.

“Right now, we are doing our due diligence,†she said. “We are in the very early stages.â€

One part of Swamplot’s due diligence, of course, might be figuring out who H-E-B is actually buying the property from. Some sort of transaction related to the property appears to have already taken place. We’ll have more details on that later.

Update: A few details from the Chronicle.

- H-E-B confirms effort to buy Wilshire Village property [River Oaks Examiner]

- Wilshire Village coverage [Swamplot]

Photo of Wilshire Village Site from Dunlavy St., South of West Alabama: Carl Guderian [license]

The demolished Wilshire Village Apartments appear to have been rescued from threatened foreclosure. A source tells Swamplot that the $13 million the owners owed to Wedge Real Estate Finance has been paid off in full — within days of a scheduled trustee sale. Where’d all that money come from?

If this Wilshire Village rescued owner-in-distress situation sounds familiar to you, you aren’t alone. Jay Cohen, the longtime sole owner of the apartments that stood at the corner of West Alabama and Dunlavy until last summer, faced foreclosure on the property back in 2002, according to a Houston Business Journal article written at the time by Nancy Sarnoff. Details of what happened next have never been published, but within a few years the 7.68-acre property had a new ownership structure, and apartment developer and former director of real estate for Landry’s Restaurants Matthew Dilick was its general partner. (Jay Cohen is likely a limited partner.)

So . . . who’s Dilicking Dilick, now that his own rescue efforts have flopped? Does the Wilshire Village site have a new owner?

Did Matthew Dilick, managing partner of the partnership that owns the 7.68-acre site of the former Wilshire Village Apartments, really refer to the long-term tenants of the long-neglected property at the corner of West Alabama and Dunlavy — many of whom had lived in their apartments and paid rent for decades before they were evicted last year — as “squatters”?

In a February 1st affidavit he provided to the 133rd District Court in hopes it might help forestall Wedge Real Estate Finance from foreclosing on the property, Dilick states that “the Plaintiff [Alabama & Dunlavy Ltd., of which Dilick is the general partner] expended considerable time and expense in evicting squatters on the Property.” This just a page or so after declaring his qualifications: “The Plaintiff and/or limited partners of the Plaintiff have owned this Property for over 50 years.”

Gosh, maybe there’s a bit of confusion here? Maybe the “squatters” Dilick is referring to weren’t the actual long-term rent-paying Wilshire Village residents, but some other people he found hiding out in the complex who didn’t have authorization to be there from “the Plaintiff and/or limited partners of the Plaintiff”?

Uh . . . no. By “squatters,” Dilick clearly means Wilshire Village’s long-term residents. The ones he sent eviction notices to; the ones he addressed as “reported occupants” in the release forms he asked them to sign. Otherwise, why should it have taken “considerable time and expense” for Dilick to evict them? How about just . . . “shoo!”?

Neatly left out of the affidavit: The apparent ongoing conflicts Dilick had with Jay Cohen, the sole owner of the property for the bulk of those 50 years. Until they were evicted, the tenants paid their rent to him every month. What’s Cohen’s role?

A person familiar with the situation writes in:

COMMENT OF THE DAY: COLQUITTERS, IT’S YOUR OWN DAMN ASPHALT “What is it about Colquitt? I have seen other streets in your same zipcode surfaced twice in the last dozen years, while certain blocks of Colquitt (the high teens) look like Beyond Thunderdome. I am not so naive as to be ignorant of why some streets get better attention than others, but who did you Colquitters piss off?” [Harold Mandell, commenting on Steve Radack’s Next Little Idea]

COMMENT OF THE DAY: THE WILSHIRE VILLAGE CAPER “Cohen is a limited partner and Dilick is the general partner. That helps explain why last February Dilick was telling people they were evicted and Cohen was telling them they could stay. Dilick is the GP and gets to call the shots. Who knows how or for how much Dilick became the GP (remember the rumors of tax delinquencies and Cohen seeking a bailout a few years back?) but I do recall Dilick surfacing in 2006 with his plan for putting a high rise there. That’s also the same time he started taking out loans on the property. So, my theory is that Dilick acquires his position as part of deal to help Cohen pay his taxes while maintaining partial ownership, uses the property as a piggy bank, comes to realize his development plans are going nowhere and he can’t find a buyer, can’t pay his loans because he couldn’t sell the property or make it profitable enough to cover his loans, defaults on his $13 million in loans, and tries every trick in the book to find a buyer and avoid foreclosure (including taking affirmative steps toward marketing the property, such as demolition, in an effort to satisfy lenders that money is on the way).” [Cap’n McBarnacle, commenting on Comment of the Day: The Ghost of Wilshire Village]

COMMENT OF THE DAY: THE GHOST OF WILSHIRE VILLAGE “Where is Jay Cohen in all of this? Supposedly he sold the property and yet continued to collect rent from the ‘squatters’ as they are referred to by Dilick. Did he, does he, still own an interest in the property?” [Matt Mystery, commenting on Wilshire Village Owners Try To Hold Off the Bank]

River Oaks Examiner reporter Mike Reed makes a valiant stab at deciphering the latest twists in the ongoing legal battle between the owner of the 7.68-acre site at the corner of West Alabama and Dunlavy where the Wilshire Village Apartments stood until last summer and Wedge Real Estate Finance, the lender that’s been trying since then to foreclose on the property. All that time, Matthew Dilick, the managing partner of property owner Alabama & Dunlavy Ltd., has been using a portfolio of delaying tactics to forestall foreclosure — hoping to sell or refinance the property before it’s taken from him and “two unnamed limited partners.”

According to Wedge, a Feb. 2 foreclosure sale marked the fourth month in a row such a sale had been scheduled, only to be halted by court actions.

Conspicuous among the court documents was a check for $1 million from Tour Partners Ltd., of Spring, Texas, to Wedge, dated Jan. 29 with “Alabama Dunlavy funding†written on it. The address on the check matches that of the Augusta Pines Golf Club.

The president of Tour Funding, Dennis Wilkerson, who signed the check, did not return calls from the Examiner. Neither did attorneys for either party in the lawsuit and foreclosure proceedings.

However, a few pieces of the puzzle were available through court documents:

Negotiation to lease the property for use as an H-E-B grocery store have been conducted by a “purchaser†identified as R.H. Abercrombie.

- Wilshire Village fate: Legal moves, H-E-B overtures [River Oaks Examiner]

- Wilshire Village coverage [Swamplot]

Photo: Swamplot inbox

Swamplot has been covering the whole sorry Wilshire Village debacle since longtime tenants of the decrepit 1940 garden apartment complex at the corner of West Alabama and Dunlavy received a rather curious eviction notice early last year. You can find all our posts on the topic — in reverse order — starting here. But even Swamplot readers haven’t heard the full story of Wilshire Village. It’s now become apparent that — as compelling and absurd a plot as the whole soap opera has seemed to follow — a whole ’nother equally gripping drama was taking place behind the scenes.

Since our last post on the subject earlier this week, a whole bunch of new documents have appeared covering what appears to be an ongoing legal battle over the property between Matthew Dilick and Wedge Real Estate Finance. And they’re all available online here. (Click on the “documents” button to see them — but you’ll need to sign up for a free account to get access.) Frankly, we need your help to sift through all the paperwork and figure out what really happened. There’s a lot to look through, but we’ve already discovered some rather startling details, which we’ll be reporting on soon.

If you’ve got legal training, or just fancy yourself an armchair courthouse sleuth, we’re happy to receive any document summaries or commentary you can send us. But what we’d really like to assemble is a definitive timeline of events. And that’s the format we’d prefer to receive your submissions in: A date, an event, and a specific reference to the document that confirms it.

What’ll it all add up to? Maybe a better picture of the secret real-estate history of one large Inner Loop site in Houston. Maybe — more. Who knows? But we can’t see what the jigsaw puzzle shows until we find all the pieces and fit them together. Can you help?

Photo of apartment at Wilshire Village (now demolished): Katharine Shilcutt

WILSHIRE VILLAGE OWNERS SAY NEVERMIND ABOUT THAT LAWSUIT Those plot twists just keep twisting! The owners of the former Wilshire Village Apartments at the corner of West Alabama and Dunlavy have dropped the lawsuit they filed at the beginning of this month — the one that claimed their about-to-foreclose lender, Wedge Real Estate Finance, interfered with the owners’ attempts to sell the now-vacant 7.68-acre property. Why? Explains a source: “Whether that is because the claim became moot, or was settled, is unknown.” Of course, they can always refile later! [Swamplot inbox; previously on Swamplot]

Wilshire Village rubberneckers: Pull on over; you are in for quite a treat! The gift that keeps on giving — the tragicomedy of real estate errors at the corner of West Alabama and Dunlavy in Montrose — has come through with another rich round of jaw-dropping twists. It’s up to us to recount and gawk.

We’re still combing through documents filed in the recent lawsuit for more goodies. But a reader who’s a few steps ahead of us has dug into them already and found these gems:

The property has been appraised at $26.8 million. Alabama & Dunlavy (“the partnershipâ€) claim that they were jerked around by Wedge [Real Estate Finance, LLC] as follows:

At the instruction of Wedge, the partnership demolished the buildings on the property. They did this in an effort to prepare the site for development and increase its value by “millions of dollars.†Wedge demanded that this be done because Wedge purchased the Amegy $10 million loan, held the $3 million Wedge loan, and wanted to foreclose. Wedge allegedly stated that if the partnership demolished the buildings and increased the value of the property, Wedge would work with the partnership to avoid foreclosure.

So, the partnership – at great expense – “evicted squatters†and demolished the buildings. But, alas, Wedge decided to foreclose on the partnership and also seize $1,000,000 the partnership held in an amegy account that the partnership planned to use to help fund development.

Among the juicy tidbits…

What? There’s more!?