SOUTHMEADOW’S $315 FORECLOSURE FIGHT Why does the West Airport Homeowners Association take up a half page of its newsletter each month with lists of fees for various legal costs associated with policing deed restriction and other violations? Because fee collection and enforcement appears to be a major focus of the organization. An attorney for Southmeadow resident William Castellon claims the HOA — which is operated by a company called Randall Management — has run up $75,000 in legal fees fighting lawsuits over a $315 annual maintenance fee it claims Castellon failed to pay, though Castellon says he did. (A second check sent by Castellon for the same payment was returned.) The HOA filed suit against Castellon, seeking to foreclose on his home near West Airport and South Gessner. Last fall, after Castellon sued back, a jury ruled in his favor and awarded him more than $40,000. But the HOA is now attempting to reverse the decision. Fox 26 reporter Randy Wallace’s calls to the HOA’s law firm, Gammon & Associates, were not returned. [MyFox Houston]

Tag: Foreclosures

“Can’t wait to find a buyer for this condo!” writes real-estate agent Veso Kossev. “Too bad I can’t take [anyone] to see it…..” Huh? Oh, yeah . . . it’s unit E5 at the Park Memorial Condominiums, otherwise known as the 4.85-acre land of limbo just north of Memorial Dr. at Detering. As of a few days ago, you can pick up this 2-bedroom, 2-bath, only partially smashed condo for the low, low price of just $47,000. But you won’t be able to have it inspected — or see it yourself — because the entire complex has been condemned by the city. Where’d these lovely interior photos in the listing come from, then?

“I’m sure there are a 100 foreclosure auctions a day in town,” says a neighbor of this expanded and tarted-up house on 8th 1/2 St., “but this is the only outwardly visible one i’ve seen in the Heights.” Main clue for our tipster that the usual sales process wasn’t working: the Auction.com signs now posted “on every possible surface.” The 3-4 bedroom home is still listed on MLS for $359,000, but bidding will start at $139,000 in Wednesday’s live event at the Intercontinental Hotel near the Galleria. The home — vacant for about a year but painted twice during that time, we’re told — fell into the hands of Fannie Mae in July, and was listed for $369,000 at the beginning of August. Next door: 2 vacant lots that face Studewood, listed for sale the old-fashioned way.

- 739 E. 8th 1/2 St. [Auction.com]

- 739 E. 8 1/2 St. [HAR]

- 821 Studewood St. [HAR]

- Residential Online Auction [Auction.com]

COMMENT OF THE DAY: AN UPDATE FOR POTENTIAL CONDO INVESTORS AT PINE VILLAGE NORTH  “the HOA has financial and legal problems. it’s operating month-2-month; no reserves. even though our assessments are supposed to cover exterior repairs of our units, you may never get your units repaired, unless you do it yourself. many of the units have serious plumbing problems. if the HOA is dissolved, PV may become a free-for-all; it’s almost that now. if you’re willing to risk all of that, then go ahead and buy, otherwise, don’t.” [Marina Sugg, commenting on Pine Village North Open House Welcome] Photo of Pine Village North: HAR

“the HOA has financial and legal problems. it’s operating month-2-month; no reserves. even though our assessments are supposed to cover exterior repairs of our units, you may never get your units repaired, unless you do it yourself. many of the units have serious plumbing problems. if the HOA is dissolved, PV may become a free-for-all; it’s almost that now. if you’re willing to risk all of that, then go ahead and buy, otherwise, don’t.” [Marina Sugg, commenting on Pine Village North Open House Welcome] Photo of Pine Village North: HAR

HOW FAR FROM HOUSTON? David Streitfeld tracks down the foreclosure on a $75,000 Denmark, Maine, house that sparked the recent robo-signing crisis: “Mr. Cox realized almost immediately that Mrs. Bradbury’s foreclosure file did not look right. The documents from the lender, GMAC Mortgage, were approved by an employee whose title was ‘limited signing officer,’ an indication to the lawyer that his knowledge of the case was effectively nonexistent. . . . Fannie Mae and GMAC, which serviced the loan for Fannie, have now most likely spent more to dislodge Mrs. Bradbury than her house is worth. Yet for all their efforts, they are not only losing this case, but also potentially laying the groundwork for foreclosure challenges nationwide.” [NY Times; previously on Swamplot]

Gosh, processing paperwork for foreclosures used to be so easy before the end of last month — when everyone started getting so picky, insisting that agents for the mortgage lenders actually read the documents they were signing. What do they expect? Have you ever tried to wade through all that legalese? And now look what’s come of it: On Friday, Bank of America became the next major lender to call for a time-out, announcing it would halt foreclosures and the sales of foreclosed homes in all 50 states — presumably until the company can figure out its best defense against lawsuits. Yes, that would include all B of A mortgages headed for foreclosure in Texas, where ordinarily courts don’t care whether an agent of the lender has any personal knowledge of the signed documents. Bank of America and its subsidiaries have accounted for 31 percent of all Harris County foreclosures so far this year, according to data dug up by Chronicle reporter Nancy Sarnoff.

Also getting in on the break: Litton Loan Processing Services, a division of Goldman Sachs. The Houston company announced Friday it would also stop pushing through foreclosure paperwork — though only in “certain cases.” Next to be held up in the paperwork traffic pile-up: title insurers. A statement released by the company tries to spin it in a different direction, but the AP reported Friday that an internal memo issued by Houston’s Stewart Title would “make it difficult” for the company’s agents to issue insurance policies for properties foreclosed on by Bank of America and other quick-signing lenders: JP Morgan Chase, OneWest Bank and the GMAC Mortgage unit of Ally Financial.

- Ally’s mortgage documentation problems could extend beyond 23 states [Washington Post]

- Bank of America puts sales on hold [Houston Chronicle]

Photo of Bank of America Center: Erin Ferguson

The new owner of the 2 “infamous” Skylane apartment complexes on West Alabama is already at work making changes. Montrose apartment investor and real-estate agent Cody Lutsch picked up the 2 foreclosed and red-tagged properties from Enterprise Bank earlier this month. For the 25-unit building at 502 West Alabama (on the corner of Garrott), Lutsch has plans to replace the window units with small ductless split A/C systems, fix some structural issues, switch to monthly instead of weekly rentals, and change the name. Also: He’d like to reduce the crime associated with the property, by adding gates, lights, security cameras, larger trash bins, and maintaining the landscaping.

Lutsch has fewer changes planned for the 32-unit Skylane across the street from Spur 527 at 219 West Alabama (above): He says he’s already begun addressing criminal and safety issues at the property, but otherwise plans to let it run “as it’s been running,” as a pay-by-the-week complex. Lutsch says he hadn’t planned to buy that property originally, but decided the property’s land size, rental income, and location might make it attractive to other investors later on.

SCHOOL-DISTRICT MANIFEST DESTINY Cinco Ranch — recently named the fastest-growing residential community in the country by a real-estate consulting firm — will keep expanding west. Newland Communities just purchased 492 acres west of neighboring Pine Mill Ranch, way out near Firethorne between FM 1463 and Katy-Flewellen Road; the company plans to have new Cinco Ranch-branded homesites available there within a couple of years. Further west, there’s even more land available for cheap: the 742-acre Tamarron Lakes subdivision was foreclosed on in April. Kirk Laguarta of Land Advisors Organization, who’s marketing that property for $19K an acre, tells the Houston Business Journal that the property that Newland just bought is considered more valuable that that, in part because it’s zoned to Katy ISD. But Newland may not be interested in expanding Cinco Ranch into Tamarron Lakes — that development belongs to the Lamar Consolidated ISD. [Houston Business Journal]

This home in Lakeside Place, one block north of Briar Forest between Wilcrest and Kirkwood, was until recently the location of Briar Oaks Home Care, an assisted-living facility. What a nice place to live for a while with a little assistance, no? But not for too long: The facility was foreclosed on, and just went up for sale earlier this week.

The listing counts 6 bedrooms, but that may include the converted dining room. Also on its way to living-space status: a drywalled but unfinished garage.

GREENSPOINT APARTMENT TAKEOVER A Houston firm that took over management of 3 foreclosed Greenspoint-area apartment complexes last month says it’s working with the HPD to open a police substation in one of them. Kaplan Management Co. VP Michelle Rhone tells reporter Jennifer Duell Popovec that the complexes — City View Place Apartments, Cambridge at City View, and Springfield at City View — became “a haven for criminals” during the 5 years the properties were owned by New York’s GFI Capital. The substation would be located at City View Place, at 16818 City View Place, east of Greenspoint Mall next to Greens Bayou. “Moreover, the company has created a plan to establish a number of civic programs to serve the City Place assets including a wellness clinic, tutoring from Houston Independent School District, vocational training and YMCA swimming lessons. Additionally, Kaplan will work with CW Capital to address deferred maintenance issues, Rhone says. The lender has already invested $100,000 to address immediate maintenance needs at the properties, she adds.” [Globe St.]

WHERE THE ROYCE LAND WENT  The Bryan farm-lending coop that ended up with 618 acres near Tomball after the collapse of Royce Builders has finally sold the property — to the Caldwell Companies, a land development and investment firm. Royce had planned 1,261 home lots in Cypress Lake Crossing, which is northeast of the intersection of Telge Rd. and Boudreaux and only a couple miles north of the sprawling Cypress home of former Royce president John Speer. (Speer’s Royce-built compound off Telge Rd., pictured above, now serves as the home address of one of his new ventures, Vestalia Homes.) “Bill Heavin, a land broker at Grubb & Ellis Co., says Royce Homes had completed quite a bit of development work on the tract, such as soil and water testing and the establishment of Harris County Municipal Utility District #416.

Royce Homes began seeking an investor or joint venture partner on the large tract in late 2006 or early 2007. . . . the asking price was $30,000 an acre, or $18.5 million.†[Houston Business Journal; previously on Swamplot]

The Bryan farm-lending coop that ended up with 618 acres near Tomball after the collapse of Royce Builders has finally sold the property — to the Caldwell Companies, a land development and investment firm. Royce had planned 1,261 home lots in Cypress Lake Crossing, which is northeast of the intersection of Telge Rd. and Boudreaux and only a couple miles north of the sprawling Cypress home of former Royce president John Speer. (Speer’s Royce-built compound off Telge Rd., pictured above, now serves as the home address of one of his new ventures, Vestalia Homes.) “Bill Heavin, a land broker at Grubb & Ellis Co., says Royce Homes had completed quite a bit of development work on the tract, such as soil and water testing and the establishment of Harris County Municipal Utility District #416.

Royce Homes began seeking an investor or joint venture partner on the large tract in late 2006 or early 2007. . . . the asking price was $30,000 an acre, or $18.5 million.†[Houston Business Journal; previously on Swamplot]

COMMENT OF THE DAY: WHY THE BANK WON’T FINISH BUILDING THOSE TOWNHOUSES “. . . the bank would rather take the loss than become builders. The law in Texas puts certain long term responsibilities on the builder and the banks don’t want to get into it. I’ve talked to a few banks about finishing, or at least drying in, some of them and for them it’s cheaper to let them rot and write them off than to prolong the process and get financially deeper into a project that will probably never turn a profit. That money is making them +5.5% profit now if they invest it elsewhere, which over a very short amount of time, more than makes up for the loss. Bankers care about money not urban blight.” [SCD, commenting on Swamplot Price Adjuster: Some Unfinished EaDo Business]

The Swamplot Price Adjuster runs on your nominations! Found a property you think is poorly priced? Send an email to Swamplot, and be sure to include a link to the listing or photos. Tell us about the property, and explain why you think it deserves a price adjustment. Then tell us what you think a better price would be. Unless requested otherwise, all submissions to the Swamplot Price Adjuster will be kept anonymous.

Location: 2312 Sperber Ln., East Downtown

Details: 3 bedroom, 3 1/2-bath, 2,006-sq.-ft. unfinished townhome on a 1,400-sq.-ft. lot

Price: $151,700

History: Current listing up since mid-April

For your consideration: this special property, just over the tracks from EaDo. Submitted by a reader, who comments:

Here’s another one from the Waterhill debacle. There’s a set of 3 townhouses in the corner of this EaDo neighborhood that all appear to be in tear down condition. HAR description states “Great opportunity for investor or builder to purchase 3 partially completed townhomes, never lived in.†HA! I beg to differ! I bet homeless people have been living there off and on for the last 2 years! HAR lists this stand-alone unit for $151,700. Is it really worth that?

Then . . . well, what is it worth?

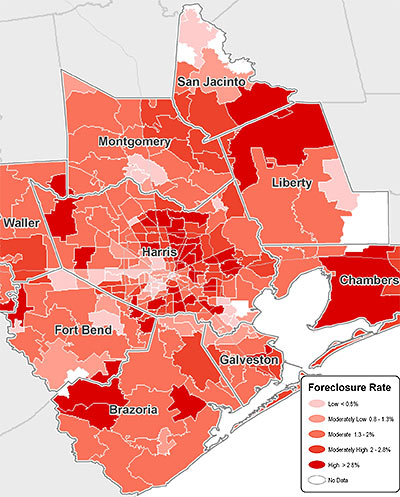

The foreclosure rate for the Houston-Sugar Land-Baytown area keeps rising, but it’s still well below the national average. As of May, 1.64 percent of all area mortgages were in some stage of foreclosure, according to data firm CoreLogic. That’s the highest level in quite a while, and a little more than half a percentage point higher than the rate last May. The national figure is 3.15 percent.

Also in CoreLogic’s latest report: 6.03 percent of area mortgage loans were 90 days or more delinquent in May, almost a point and a half higher than the same period last year, but down a bit from a peak in January. The nationwide rate is up to 8.22 percent.

- Foreclosure Rates in Houston-Sugar Land-Baytown Increase [CoreLogic]

- Previously on Swamplot: Where the Action Was: Houston Summer Foreclosure Map

Map: CoreLogic

In a streaming-video event broadcast last night, hip-hop star Chamillionaire tried to explain the circumstances surrounding the foreclosure of his Woodlands mansion. He claims his decision to give the 7,583-sq.-ft. property in Carlton Woods back to the bank was part of an attempt to lower out-of-control expenses in light of 2 recent life-changing events: the birth of his son and learning from his mother that she has cancer:

She’s doing fine . . . and I was like . . . whatever you need, I want you to ask me. And my mom won’t ask me because she sees me with all these expenses, and . . . she doesn’t want to say anything. She wants me to live my life and have fun and buy all these cars and all this stuff and doesn’t want to burden me . . . I wasn’t cool with that. . . .

I know I spend all this money a month. You don’t know what the feeling is, spending $300 thousand . . . quick, just seeing it come out of your account. I don’t care how much money you got — you gonna be like, dang, that’s $300 thousand!

Yes: Dang!

I’m paying all kinds of stuff: multiple businesses, stuff for other people, etc. etc. So I told her, you know what, don’t worry about it. Whatever bills may come, you let me know. I’m gonna keep my bills the same. I’m just gonna cut some slack.

Next: It’s budget-cutting time in Carlton Woods!