Here’s what you wanted to see: nice fuzzy photos of the 7,583-sq.-ft. mansion in a gated neighborhood in The Woodlands recently repossessed from rap star Chamillionaire. Talking to TMZ reporter and comedian Adam Glyn yesterday in front of the W Hotel near New York’s Times Square, the Houston native says he gave the house in Carlton Woods back to the bank because he “just didn’t feel like it was a good business investment to keep paying that much mortgage for a house that I’m never at.”

This house actually was my most expensive mortgage. And I decided to let that house go because the house ended up being worth nothing. When the market went down, the house went down too and it was just worth nothing. . . . I paid close to 2 million dollars for the house and I decided to just let it go, give it back to the bank. It wasn’t a situation where they came and took it from me. I felt like I didn’t want to pay that much money a month for a house that I’m never at. I was never at the house, I was always on the road touring . . .

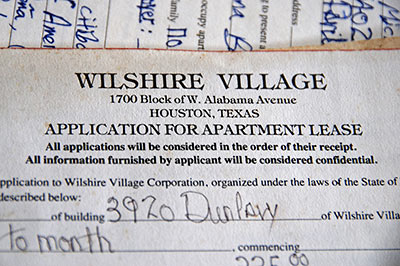

The rap star, who bought the home under the name Hakeem Seriki Millionaire Mindframe Trust (Hakeem Seriki is his real name), actually paid $2.125 million for the property in 2006. TMZ reports the home was foreclosed on after the owner failed to make several payments. The 5-bedroom, 5 1/2-bath house on an acre-plus corner lot may have been “worth nothing” to him, but the bank will likely be able to squeeze a fair bit of money out of it:

Earlier this month Cameron Management lost the

Earlier this month Cameron Management lost the