COMMENT OF THE DAY: COOL DEVELOPMENTS NEED WACKY BUCKS “There’s plenty of eccentric millionaire money around. I guess they are just more private that they used to be? (My husband’s boss keeps bars of silver in his basement, for example.) Or, they prefer to spend their money on credit default swaps than cooky real estate schemes. C’mon rich people! Do something interesting.” [anon, commenting on Comment of the Day: A Different Kind of Money]

Quicklink

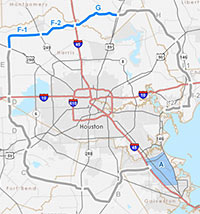

THREE MORE LINKS IN THE GRAND PARKWAY ARE NOW READY TO ROLL  Yesterday the Texas Transportation Commission rubber-stamped TxDOT’s selection of a developer for 3 additional segments of the Grand Parkway — if you count FM1960 and Hwy. 6, Houston’s fourth ring road. Segments F1, F2, and G of State Hwy. 99 will run from Hwy. 290 east to the newly minted I-69 (also known as U.S. 59). Along the way, the new stretch will rub elbows — conveniently — with the new ExxonMobil campus in the former pine forest west of the I-45 intersection and the start of the Hardy Toll Rd. Zachry-Odebrecht Parkway Builders will be in charge of the $1.04 billion project. Construction is expected to start next year, with the toll road opening in 2015. [TxDOT] Map: Tollroads News

Yesterday the Texas Transportation Commission rubber-stamped TxDOT’s selection of a developer for 3 additional segments of the Grand Parkway — if you count FM1960 and Hwy. 6, Houston’s fourth ring road. Segments F1, F2, and G of State Hwy. 99 will run from Hwy. 290 east to the newly minted I-69 (also known as U.S. 59). Along the way, the new stretch will rub elbows — conveniently — with the new ExxonMobil campus in the former pine forest west of the I-45 intersection and the start of the Hardy Toll Rd. Zachry-Odebrecht Parkway Builders will be in charge of the $1.04 billion project. Construction is expected to start next year, with the toll road opening in 2015. [TxDOT] Map: Tollroads News

COMMENT OF THE DAY: A DIFFERENT KIND OF MONEY “Could the banality and sameness of what developers in Houston are constructing be in part to changed lending standards by the banks? Back in the 1970′s Gerald Hines developed very innovative office buildings for the day, employing famous architects for the design. Pennzoil Place is no cookie cutter “international style†box, that’s for sure. But back then, we didn’t have interstate banking either. For those of you born post 1985, that means ALL of our banks were headquartered in Texas. I’d assume Hines went to see Ben Love at Texas Commerce Bank, or the guys at Allied Bank, and they worked out the loans. Today, those loan officers are in New York or Charlotte, and don’t want to risk their bank’s money on something avant garde. Also, developers today rarely keep their portfolios together more than a few years. They ‘flip’ their completed properties to REITs so that they have the capital to build something else. When you need to turn your property over quickly, it’s best to have something the buyers understand, and that didn’t cost so much per square foot that you can’t make a profit selling it in 18 months. A REIT just wants to purchase something with what they feel will be a certain stream of income over a 10 year time horizon. They are oblivious to the fact that it’s not a thrilling design.” [ShadyHeightster, commenting on The Muse Moving in Next to the Post Office in Castle Court]

A DOWNTOWN ART OVERNIGHT  Blogger Robert Boyd is putting on his own art fair to coincide with next month’s Texas Contemporary Art Fair at the GRB. The Pan Art Fair will be housed in a (yet-to-be determined) room in the neighboring Embassy Suites Hotel, across from Discovery Green. Salon des Refusés or after-fair party pad? Maybe a little of both: Individual artists aren’t allowed to set up their own booths at major art fairs — Boyd’s hotel-suite extravaganza has already signed up 2 artists and 2 galleries. “I grew up going to comic book conventions, and art fairs are basically the same thing, except more expensive, more fashionable and less nerdy,” he writes. He’s hoping to drum up more competition: “Renting a suite at the Embassy Suites is not all that expensive. If four artists get together, they could rent a suite for the entire length of TCAF for about $250 apiece.” [The Great God Pan Is Dead] Photo of Embassy Suites, 1515 Dallas St.: Candace Garcia

Blogger Robert Boyd is putting on his own art fair to coincide with next month’s Texas Contemporary Art Fair at the GRB. The Pan Art Fair will be housed in a (yet-to-be determined) room in the neighboring Embassy Suites Hotel, across from Discovery Green. Salon des Refusés or after-fair party pad? Maybe a little of both: Individual artists aren’t allowed to set up their own booths at major art fairs — Boyd’s hotel-suite extravaganza has already signed up 2 artists and 2 galleries. “I grew up going to comic book conventions, and art fairs are basically the same thing, except more expensive, more fashionable and less nerdy,” he writes. He’s hoping to drum up more competition: “Renting a suite at the Embassy Suites is not all that expensive. If four artists get together, they could rent a suite for the entire length of TCAF for about $250 apiece.” [The Great God Pan Is Dead] Photo of Embassy Suites, 1515 Dallas St.: Candace Garcia

COMMENT OF THE DAY: I’M SMELLING THAT LISTING ALREADY “I love this house . . . and I know exactly how it must smell: a homey mix of old furniture, mothballs, and mildew with a touch of Pine-Sol. I would buy it as is, furnished and everything.” [Miz Brooke Smith, commenting on A Lindale Park Cottage, Much as It Was]

A MEADOWCREEK VILLAGE HELP-YOU-SELL  “SELLER WILL DO NO REPAIRS,” shouts the listing. But . . . um, visitors to this past Sunday’s open house did bring their own period furniture to dress up a brick flat-roofed Modern 4-bedroom in Meadowcreek Village celebrating its 49th birthday — as a foreclosure. That was for Houston Mod’s hastily announced Mod of the Month event. The instant living room arrangement from Heights vintage shop The Mod Pod is gone now, but the 2,558-sq.-ft. vinyl-over-terrazzo home at 2042 Forest Oaks Dr. is still on the market at $99,900. [HAIF; listing] Photo: Mod Pod/Karen Moyers

“SELLER WILL DO NO REPAIRS,” shouts the listing. But . . . um, visitors to this past Sunday’s open house did bring their own period furniture to dress up a brick flat-roofed Modern 4-bedroom in Meadowcreek Village celebrating its 49th birthday — as a foreclosure. That was for Houston Mod’s hastily announced Mod of the Month event. The instant living room arrangement from Heights vintage shop The Mod Pod is gone now, but the 2,558-sq.-ft. vinyl-over-terrazzo home at 2042 Forest Oaks Dr. is still on the market at $99,900. [HAIF; listing] Photo: Mod Pod/Karen Moyers

THE PLAN TO MOVE RICE UNIVERSITY CLOSER TO THE WOODLANDS — OR TRADE IT FOR THE GALLERIA It’s true, and was apparently taken reasonably seriously at the time. From the Rice Thresher in February 1973. [marmer, commenting on Headlines: Calculating Lower Westheimer’s Hip Factor; Westbury Gardens’ Walkable Kitsch]

NEW VOICE OWNERS DUMPING HOUSTON PRESS BACKPAGE ADS  A well-trafficked source of ads for real estate in Houston and the rest of the country — and oh, by the way, escort ads often described as conduits for prostitution and human-trafficking schemes — is separating from the chain of alt weeklies that founded it. A group of Village Voice Media managers headed by company president Scott Tobias is buying out the chain of 13 city weeklies (and websites) that includes the Houston Press, the Village Voice, and LA Weekly. The Voice’s current owners will hold onto Backpage.com, the nation’s top venue for “body rub” ads. [Denver Post]

A well-trafficked source of ads for real estate in Houston and the rest of the country — and oh, by the way, escort ads often described as conduits for prostitution and human-trafficking schemes — is separating from the chain of alt weeklies that founded it. A group of Village Voice Media managers headed by company president Scott Tobias is buying out the chain of 13 city weeklies (and websites) that includes the Houston Press, the Village Voice, and LA Weekly. The Voice’s current owners will hold onto Backpage.com, the nation’s top venue for “body rub” ads. [Denver Post]

COMMENT OF THE DAY: WHY WE REALLY NEED THE EARLY MORNING CONCRETE CURE “It’s partly due to traffic, but the main reason you pour concrete in the extreme early hours is due to temperature. Concrete is actually a substance undergoing a chemical reaction and continues to get warmer. In the south, it’s not uncommon to pour concrete in the early morning hours before it gets too hot. If the concrete gets too warm it becomes brittle really fast. There are ways of dealing with heat such as adding ice to the mix, but it is not the preferred way to go. This is also the reason why in west Texas you don’t see to many concrete roads. It’s really hard to maintain the temperature during a large placement. So yes, there is some concern with traffic, but it has to do more with heat. Now, some of you may say that the slab of your house was placed in the heat of the day. Yes, but the strength lost in the heat for your house is not enough to effect the overall structure. Bridges, highways, highrises, and large placements where high loads are experienced can get susceptible to the heat and weaken the overall structure. . . .” [kjb434, commenting on About Those “Early Morning†Concrete Pours]

COMMENT OF THE DAY RUNNER-UP: TAKING A FENCE “Having lived in a number of other cities around the country, I am continuously shocked by what contractors in this city get away with at construction sites. No fences around construction sites (the smaller ones, anyway), complete destruction of the public sidewalks until project completion, lack of protection for street trees, work taking place at 5:30 in the morning in residential neighborhoods, etc. A new home is being built in my neighborhood, and they broke some part of the water main across the street from their site and failed to fix it for a month while we had standing water in the middle of the sidewalk. This just seems to be part of Houston’s any-construction-is-better-than-no-construction-no-matter-what mentality. This type of behavior is disrespectful to neighbors and simply not tolerated in other cities.” [tracy, commenting on About Those “Early Morning†Concrete Pours]

ABOUT THOSE “EARLY MORNING” CONCRETE POURS  A neighbor of the Park Memorial construction site in Rice Military writes: “Just a question on Houston city ordinances. Are there any restrictions on construction in the middle of the night? I was awakened at 3 am this morning by a massive concrete pour. The site has been lit up with floodlights and there are multiple trucks with back up signals, machinery noise and yelling workers. I found some general noise ordinances but wondered if there are any other rules? This is as bad as any nightclub or worse.” [Swamplot inbox; previously on Swamplot]

A neighbor of the Park Memorial construction site in Rice Military writes: “Just a question on Houston city ordinances. Are there any restrictions on construction in the middle of the night? I was awakened at 3 am this morning by a massive concrete pour. The site has been lit up with floodlights and there are multiple trucks with back up signals, machinery noise and yelling workers. I found some general noise ordinances but wondered if there are any other rules? This is as bad as any nightclub or worse.” [Swamplot inbox; previously on Swamplot]

COMMENT OF THE DAY: A CITYCENTRE IN THE CITY’S CENTER WOULD’VE MADE THE GRADE “. . . The Ainbinder/Orr/San J Stone sites represent over 30 acres of land being developed with only 280 residential units going up on the old Sons of Hermann site. About the same number of apartments were demo-ed for Ainbinder’s strip mall. That means 30 plus acres of land being developed with no net increase in housing or office space in an area that should be booming with that kind of development. There are no other 30 plus acre tracts west of Downtown that have the same development potential as this site did. It may be one step forward to replace vacant land with strip malls. But it is two steps back when you consider what a City Centre style mixed use development would have done for the area. It would have generated way more in tax revenue and made property values in the immediate west end neighborhood shoot through the roof. Instead, we are getting the lowest possible tax revenue generating development that will cost six million in future tax revenues. It is like being happy when your kid gets a C minus in school. It is better than getting an F and graduating is better than dropping out. But if your kid has the potential to do A plus work, then the C minus should be a huge disappointment. Those thirty plus acres had the potential to be one of the most significant developments in Houston. Instead, it is going to be the same development that gets put in on cheap land in the burbs when a new housing development goes in. If my tax dollars are going to be thrown at wealthy developers, I want to get every dollar’s worth and will not be happy with anything other than the most productive use of the land. Developers who will not deliver that can pay their own way.” [Old School, commenting on Shops Replacing San Jacinto Stone, Just North of the South-of-the-Heights Walmart]

COMMENT OF THE DAY: WHAT YOU REALLY MADE ON YOUR HOUSE “. . . Most people say ‘I bought it for x and sold it for y, so I made an (y-x)/x return on my house’ which really isn’t the case. That formula can tell you your total appreciation in market value, but that is not the same as your ROI. To get closer to calculating an accurate nominal return, you need deduct the following from y: total in real estate taxes you paid while you owned the home, total expenses for repairs and maintenance, total amount of insurance premiums, the total interest and fees you paid to a lender before paying off your mortgage, and any commissions you paid to a realtor. You can then add back any income tax benefit you got for deducting your interest payments as well as any income you got from renting out all or part of your property. If you wanted to take things to the next level you could discount these cash flows and also convert nominal dollars to real, but I think even with just doing the above exercise most people will find that they didn’t really make as much money on their house as they think they did, and unless you manage to time your purchase, sale, and hold period just right, home values really have to appreciate significantly each year for the regular homeowner to just break even on it as a pure investment. That said, I think there are a lot of other very good arguments in favor of home ownership, including some financial ones. My point is just that if you bought a house for $100K and sold it 10 years later for $200K, you didn’t actually get a 10% annual return unless your property was tax exempt, you paid cash (and had a separate account set up to hedge inflation and compensate you for the cost of that capital being tied up for ten years), sold it yourself, didn’t buy homeowner’s or flood insurance, and never made any repairs.” [You Didn’t Earn That, commenting on Comment of the Day: What You Inner Loopers Got Wrong]

COMMENT OF THE DAY: WHAT YOU INNER LOOPERS GOT WRONG “. . . You could have bought a 3,000 sqft home in the burbs for $250,000 and put the $500,000 you saved in an investment that has a return that is better than 3%. Not to mention the money you had to spend putting a couple of kids through private school. The idea that residential real estate is a good investment is not supported by the data during a time of record low interest rates. Once the fed starts to raise rates again you are going to have trouble selling those homes that sit on expensive land for what you have in them. The only people that made off like bandits in the last decade in Houston were those who bought a single family home on a 7,000 sqft lot and replaced it with several single family townhomes.” [Dave Swank, commenting on Shops Replacing San Jacinto Stone, Just North of the South-of-the-Heights Walmart]

COMMENT OF THE DAY: MIDCENTURY STYLING WAS THE PSEUDO TUSCAN OF ITS DAY “. . . But let’s be honest with ourselves, if we can step out of our trendy mid-century loving selves for a moment . . . just because something was original doesn’t mean it was good, or desirable. Let’s not fall into that elitist trap. Honestly, I’m not crying over replacing that gawdawful carpet with anythingbutthatgawdafulcarpet. Yes, a lot of the updates are generic “what’s popular/mainstream right now†sort of stuff. But what they’re replacing is the exact same sort of mainstream styling, just with a healthy dose of nostalgia wrapped around it. Let’s not kid ourselves . . . as much as I personally like midcentury style, most of these houses were just as generic as the pseudo Tuscan places going up all over the area. They simply have the benefit of being fewer in number these days. There is nothing inherently better about one era’s overused style elements than another. Novelty is not the same thing as absolute superiority.” [JB, commenting on Fixed That for You: A Memorial Hollowed Modern, Corrected]