COMMENT OF THE DAY: WHAT ROYCE BUILDERS SOLD ME “I bought a home from them in oct 2007 and got riped off. First I am still trying to figure out how I even got financed based on my income. I was making about $1200.00 a month and my notes where almost $900.00 a month. Then I have an adjustable rate morgage which would go up every 6 months. I thought about it after the fact (I had to give up my home) that they must have messed with the figures to get me in the home at the first place. I couldn’t get them to come fix things that come with the home warranty. If anyone knows what kind if any lawsuit is out on them would you please let me know.” [monmon, commenting on No-Charity Case: Royce Builders Education in Bankruptcy]

Tag: Lawsuits

COMMENT OF THE DAY RUNNER-UP: MAKING OLDER HOMES SAFER “Ironically, all of the lawsuit-limiting legislation passed at the request of the home-building industry makes Texas one of the few states where a pre-existing home is a more secure investment than a new home. When the market begins to reflect this, which it will eventually, new home builders will regret it.” [jlawrence, commenting on The $58 Million Perry Home]

Did Matthew Dilick, managing partner of the partnership that owns the 7.68-acre site of the former Wilshire Village Apartments, really refer to the long-term tenants of the long-neglected property at the corner of West Alabama and Dunlavy — many of whom had lived in their apartments and paid rent for decades before they were evicted last year — as “squatters”?

In a February 1st affidavit he provided to the 133rd District Court in hopes it might help forestall Wedge Real Estate Finance from foreclosing on the property, Dilick states that “the Plaintiff [Alabama & Dunlavy Ltd., of which Dilick is the general partner] expended considerable time and expense in evicting squatters on the Property.” This just a page or so after declaring his qualifications: “The Plaintiff and/or limited partners of the Plaintiff have owned this Property for over 50 years.”

Gosh, maybe there’s a bit of confusion here? Maybe the “squatters” Dilick is referring to weren’t the actual long-term rent-paying Wilshire Village residents, but some other people he found hiding out in the complex who didn’t have authorization to be there from “the Plaintiff and/or limited partners of the Plaintiff”?

Uh . . . no. By “squatters,” Dilick clearly means Wilshire Village’s long-term residents. The ones he sent eviction notices to; the ones he addressed as “reported occupants” in the release forms he asked them to sign. Otherwise, why should it have taken “considerable time and expense” for Dilick to evict them? How about just . . . “shoo!”?

Neatly left out of the affidavit: The apparent ongoing conflicts Dilick had with Jay Cohen, the sole owner of the property for the bulk of those 50 years. Until they were evicted, the tenants paid their rent to him every month. What’s Cohen’s role?

A person familiar with the situation writes in:

Swamplot has been covering the whole sorry Wilshire Village debacle since longtime tenants of the decrepit 1940 garden apartment complex at the corner of West Alabama and Dunlavy received a rather curious eviction notice early last year. You can find all our posts on the topic — in reverse order — starting here. But even Swamplot readers haven’t heard the full story of Wilshire Village. It’s now become apparent that — as compelling and absurd a plot as the whole soap opera has seemed to follow — a whole ’nother equally gripping drama was taking place behind the scenes.

Since our last post on the subject earlier this week, a whole bunch of new documents have appeared covering what appears to be an ongoing legal battle over the property between Matthew Dilick and Wedge Real Estate Finance. And they’re all available online here. (Click on the “documents” button to see them — but you’ll need to sign up for a free account to get access.) Frankly, we need your help to sift through all the paperwork and figure out what really happened. There’s a lot to look through, but we’ve already discovered some rather startling details, which we’ll be reporting on soon.

If you’ve got legal training, or just fancy yourself an armchair courthouse sleuth, we’re happy to receive any document summaries or commentary you can send us. But what we’d really like to assemble is a definitive timeline of events. And that’s the format we’d prefer to receive your submissions in: A date, an event, and a specific reference to the document that confirms it.

What’ll it all add up to? Maybe a better picture of the secret real-estate history of one large Inner Loop site in Houston. Maybe — more. Who knows? But we can’t see what the jigsaw puzzle shows until we find all the pieces and fit them together. Can you help?

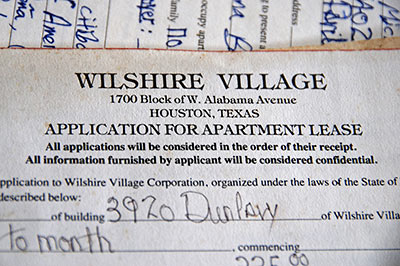

Photo of apartment at Wilshire Village (now demolished): Katharine Shilcutt

ASHBY HIGHRISE LAWSUIT: IT’S ON! Gee, who’da thunk it would come to this? “The developers of the Ashby high-rise sued the city of Houston today seeking more than $40 million in compensation after repeated denials of their permit application. ‘The city must learn that it cannot misapply the law to please a select few or to achieve de facto zoning regulations that our community has consistently rejected,’ said Kevin Kirton, the chief executive of Buckhead Investment Partners Inc., the company that sought to build the 23-story tower at 1717 Bissonnet near Rice University.” [Houston Chronicle; previously on Swamplot]

WILSHIRE VILLAGE OWNERS SAY NEVERMIND ABOUT THAT LAWSUIT Those plot twists just keep twisting! The owners of the former Wilshire Village Apartments at the corner of West Alabama and Dunlavy have dropped the lawsuit they filed at the beginning of this month — the one that claimed their about-to-foreclose lender, Wedge Real Estate Finance, interfered with the owners’ attempts to sell the now-vacant 7.68-acre property. Why? Explains a source: “Whether that is because the claim became moot, or was settled, is unknown.” Of course, they can always refile later! [Swamplot inbox; previously on Swamplot]

Wilshire Village rubberneckers: Pull on over; you are in for quite a treat! The gift that keeps on giving — the tragicomedy of real estate errors at the corner of West Alabama and Dunlavy in Montrose — has come through with another rich round of jaw-dropping twists. It’s up to us to recount and gawk.

We’re still combing through documents filed in the recent lawsuit for more goodies. But a reader who’s a few steps ahead of us has dug into them already and found these gems:

The property has been appraised at $26.8 million. Alabama & Dunlavy (“the partnershipâ€) claim that they were jerked around by Wedge [Real Estate Finance, LLC] as follows:

At the instruction of Wedge, the partnership demolished the buildings on the property. They did this in an effort to prepare the site for development and increase its value by “millions of dollars.†Wedge demanded that this be done because Wedge purchased the Amegy $10 million loan, held the $3 million Wedge loan, and wanted to foreclose. Wedge allegedly stated that if the partnership demolished the buildings and increased the value of the property, Wedge would work with the partnership to avoid foreclosure.

So, the partnership – at great expense – “evicted squatters†and demolished the buildings. But, alas, Wedge decided to foreclose on the partnership and also seize $1,000,000 the partnership held in an amegy account that the partnership planned to use to help fund development.

Among the juicy tidbits…

What? There’s more!?

Swamplot is hearing a couple of unconfirmed items about Wilshire Village, the 7.68-acre site at the corner of West Alabama and Dunlavy that’s sat vacant since the 70-year-old yellow-brick garden apartment buildings long left to decay on the site were cleared of their pesky tenants and torn down last year.

First comes a source telling us that on February 2nd the property was somehow foreclosed on — despite the fact that the the owner of the property, an entity called Alabama & Dunlavy Ltd., declared bankruptcy back in November for the apparent express purpose of avoiding such an event.

The next item is even more fun: There’s a lawsuit!

A loyal Swamplot tipster alerts us to a copy of a letter that appeared on a neighborhood email list late last week. The letter is signed by Mark Thuesen, president of the condominium association at the 2520 Robinhood at Kirby condos. Loyal Swamplot readers, of course, will recognize that name — Thuesen is one of 3 condo residents named in a lawsuit by the owners of Hans’ Bier Haus, the little outdoorish bar that’s next door to the 16-story Rice Village residential tower. The lawsuit claims that Theusen and 2 others attacked patrons at the bar several times, throwing beer cans, bottles, and eggs at them from above, as well as spraying performing musicians with water.

A loyal Swamplot tipster alerts us to a copy of a letter that appeared on a neighborhood email list late last week. The letter is signed by Mark Thuesen, president of the condominium association at the 2520 Robinhood at Kirby condos. Loyal Swamplot readers, of course, will recognize that name — Thuesen is one of 3 condo residents named in a lawsuit by the owners of Hans’ Bier Haus, the little outdoorish bar that’s next door to the 16-story Rice Village residential tower. The lawsuit claims that Theusen and 2 others attacked patrons at the bar several times, throwing beer cans, bottles, and eggs at them from above, as well as spraying performing musicians with water.

Unsurprisingly, Thuesen does not specifically mention those allegations in his letter, which we presume is meant for fellow condo residents. But he is kind enough to include a copy of the temporary injunction handed down by Judge Patricia Hancock last week, which specifically prohibits Theusen [sic], 2 codefendants, and all residents of 2520 Robinhood from “throwing any sort of object whatsoever” or “intentionally running or pouring water or any other liquid upon” Hans’ Bier Haus.

Thuesen does, however, draw attention to the now-famous incident on December 13th of last year, in which Hans’ Bier Haus co-owner Bill Cave stormed into the condo lobby and dragged the concierge by his tie into an elevator — on a quest to turn off the water that was spraying onto bar patrons and musicians from a hose connected to the patio of an upper-story condo resident:

When will the ongoing feud between Hans’ Bier Haus and the 2520 Robinhood at Kirby condos be optioned for television? Fortunately for the scriptwriters among you busy preparing your treatments, the tale of the little open-air bar in the Rice Village and the residents of the 16-story condo tower next door who like to pour water and heave beer cans, bottles, eggs onto its patrons isn’t just a simple melodrama. It’s a simple melodrama with a rich lineup of stock supporting characters. Reporter Angela Grant introduces a few of them in her report on yesterday’s court hearing:

The helpful concierge. Reggie McGowan, the condo-building concierge Bill Cave dragged by the necktie into the elevator on the night of December 13th, had no idea what was happening, and feared the angry and shouting Bier Haus co-owner was going to bring him up to the roof and throw him off:

When the pair exited the elevator onto the 4th floor, McGowan said he heard Cave say that water was spraying the bar and he wanted to turn it off.

“I said oh, I understand. I can take care of that,†McGowan said. “I had already picked up the hose Wednesday morning of that week.â€

The disgruntled former employee. Condo management company employee Alton Smith was fired on December 15th, after a confrontation with 2 of the 3 condo residents the lawsuit claims had been throwing items at the bar. Conveniently, both of those men — Mark Theusen and Richard Booker — “happen to serve on the condo association’s board of directors, which is responsible for firing decisions,” writes Grant.

The water that rained down on partygoers at Hans’ Bier Haus two nights earlier came from a hose that was connected to a spigot on a patio belonging to Robert Souders, the lawsuit’s 3rd defendant. But Smith told the court he had seen the hose in the same Bier-Haus-soaking configuration at least 2 times before that night. Writes Grant:

“Angry about his firing, Smith approached the Hans’ Bier Haus owners, told them what he knew about the incidents and he named the three defendants as the perpetrators.”

More bit parts that may soon be available:

The long-simmering feud between Rice Village bocce bastion Hans’ Bier Haus and some residents of the 2520 Robinhood condo tower next door has reached the courts. The condo association and residents are now subject to a restraining order that forbids them from tossing “produce, water, or anything” onto the bar patrons below. Hans’ Bier Haus’s owners are seeking a permanent injunction and compensation for the damage and lost business caused by projectiles coming their way from the 16-story condos. And 3 Robinhood residents have apparently been planning their own civil lawsuit against the bar owners.

The long-simmering feud between Rice Village bocce bastion Hans’ Bier Haus and some residents of the 2520 Robinhood condo tower next door has reached the courts. The condo association and residents are now subject to a restraining order that forbids them from tossing “produce, water, or anything” onto the bar patrons below. Hans’ Bier Haus’s owners are seeking a permanent injunction and compensation for the damage and lost business caused by projectiles coming their way from the 16-story condos. And 3 Robinhood residents have apparently been planning their own civil lawsuit against the bar owners.

But as of today, the battle’s obviously become much more serious, as the story has found its way into . . . the newspaper! Writing in the Chronicle, Mary Flood adds a colorful account of a few details bar co-owner Bill Cave appears to have glossed over in the description he gave to the Houston Press — namely, how he wound up with a misdemeanor assault charge after a scuttled gig on that fateful December 13th:

The Chronicle’s Nancy Sarnoff, after a tour of 2727 Kirby:

Developer Jerry Brown said 20 units are occupied in the 78-unit building.

The least expensive floor is priced at $575 per square foot, he said, and the average unit is about $2 million.

Maintenance fees are 65 cents per square foot.

While Brown said he’s seeing more traffic these days, there have been some snags.

I recently came across some lawsuits against the developer filed by buyers who canceled their contracts, but didn’t receive their earnest money back like they were promised.

“If they’re entitled to their money, they’ll get their money,” Brown said.

- A look inside 2727 Kirby [Prime Property]

- Previously on Swamplot: Condo Spies in the Night: Investigating Sales at 2727 Kirby, Studying Those Sales Reports for 2727 Kirby

Photo of 2727 Kirby: Ziegler Cooper

REDEVELOPMENT BRAWL AT THE SHARPSTOWN MALL Developer and former Sugar Land mayor David Wallace now says his firm’s $350 million proposal to redevelop the Sharpstown Mall — approved in early July by the Southwest Houston TIRZ over the objections of the mall’s owner and manager — isn’t likely to happen: “R.D. Tanner, a partner in the firm, resigned from the TIRZ board the day his company [Wallace Bajjali Development Partners] submitted its vision for the mall. The board voted to support his firm’s bid that same day. The board is tasked with overseeing the site’s redevelopment and distributing up to $20 million of public money to assist in that effort. The mall’s owner and manager — whose own redevelopment plan was rejected by the authority in May — filed suit last week, alleging that Tanner and the TIRZ board’s subsequent requests for information were “a subterfuge†to obtain “confidential, proprietary information†they could use to make their own bid. The allegations highlight a widespread problem in Houston: that developers on TIRZ boards are often able to make decisions about tax abatements — and the use of public dollars for economic development — that ultimately benefit themselves or their projects, according to Craig McDonald, director of Texans for Public Justice, an advocacy organization that promotes openness and accountability in government.” [Houston Chronicle]

Regular Swamplot readers will remember all the fun surrounding the collapse and shutdown of Royce Builders last year. What’s happened since? Chapter 7 bankruptcy! Plus now, says the Chronicle‘s Nancy Sarnoff:

Regular Swamplot readers will remember all the fun surrounding the collapse and shutdown of Royce Builders last year. What’s happened since? Chapter 7 bankruptcy! Plus now, says the Chronicle‘s Nancy Sarnoff:

Wisenbaker Builder Services, Suncoast Post Tension, Builders Mechanical and Luxury Baths by Arrow are collectively seeking to recover more than $1.1 million from the builder, according to the petition filed last month in U.S. Bankruptcy Court for the Southern District of Texas.

Thousands of home- owners could also have claims against the company.

Attorney David Jones, who is representing Royce in the bankruptcy, is compiling names of potential creditors that lists more than 12,000 people.

“Homeowners are the biggest portion,†said Jones, a partner with Porter & Hedges.

Oh, but there’s more! In a separate legal action, an educational charity that Royce owner John Speer used to promote his businesses and solicit contributions from customers is claiming that Royce failed to deliver funds raised on its behalf. A struggling charity that renamed itself the Royce Homes Foundation for Youth in 2003 — after Speer apparently promised to deliver several hundred thousand dollars a year in support — says Royce still owes it about $400K:

Just how did a group of Israeli investors get stuck with 114 condo units in this quaint converted apartment complex in League City? And why are they now suing the project’s developer and property manager?

Just how did a group of Israeli investors get stuck with 114 condo units in this quaint converted apartment complex in League City? And why are they now suing the project’s developer and property manager?

The Galveston County Daily News‘s Laura Elder explains:

The investors never intended to live in the units but instead were seeking to generate income by renting them to others, according to the lawsuit. Through agreements, the units owned by the investors were put in a rental pool managed by the defendants, according to the lawsuit.

But while Westcorp Management Group, of which Roni Amid is vice chairman, had been collecting rent from tenants, it failed to pay proceeds to the mortgage company or the investors for some units, according to the lawsuit.

Without rental income, some of the investors are unable to pay their mortgages, leading lenders to begin foreclosure proceedings on at least 30 units in the complex, said Danny Sheena, a Houston attorney representing investors.

The suit also claims the defendants used the investors’ units at the Fairways at South Shore as collateral for a $23 million loan from Deutsche Bank obtained behind their backs last August. Which means, the suit claims, the investors can’t sell their units.

And that Israeli connection? Looks like it’s all in the family: