Swamplot readers have a few things to say about Greenwood King’s latest fancy-neighborhood market report, which came out yesterday! Our regular GK watcher notes that the separate breakdowns for new construction and existing home sales introduced in last month’s edition have been abandoned. Still:

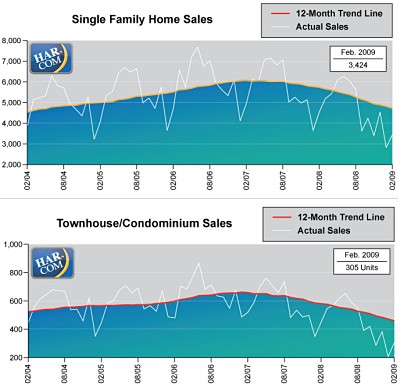

The news is relatively bad. Sales volumes are down sharply all over town. 17% more high end listings than last year . . . River Oaks, Tanglewood, Boulevard Oaks, and Memorial Close In are all over 12 months of inventory. . . .

The 17% higher inventory is reflective of a market of motivated sellers. By definition, a high end homeowner should not “have to†sell unless there has been a life change (divorce, death, job interruption). Everyone knows the housing market is weak in 2009, so…. the only class of sellers on the market are those having cash flow problems or those who have to sell due to a life change. There are almost no trade up sellers right now.

Memorial has 19.1 months of inventory

. . . as big $3-5 million white elephants sit there waiting for the landscapers to come and cut the lawn for the week. It takes a good $20,000 a month to live in one of those monsters. I guess the supply of willing millionaires just isn’t going to match the number of mega mansions. It will take some time, but they will soon move onto bank balance sheets and then to the auction block.